Calculating Annuity Due On BA II Plus 2024, a powerful financial calculator, empowers you to solve complex annuity due problems with ease. Whether you’re a finance professional, student, or simply looking to manage your finances effectively, understanding how to calculate annuity due is crucial.

It’s easy to get confused about the similarities and differences between annuities and IRAs. Is Annuity The Same As Ira 2024 provides a clear explanation of these two popular retirement savings options.

This guide provides a comprehensive overview of the concept of annuity due, the functionalities of the BA II Plus 2024 calculator, and a step-by-step approach to performing various annuity due calculations.

Planning for the future involves ensuring your loved ones are taken care of. Annuity Beneficiary Is A Trust 2024 can help you understand how to establish a trust as a beneficiary for your annuity.

From understanding the key characteristics of annuity due to mastering the calculator’s features, this guide equips you with the knowledge and skills to confidently navigate the world of annuity due calculations. We’ll delve into real-world scenarios, provide practical examples, and offer valuable tips and tricks to optimize your use of the BA II Plus 2024 calculator.

Contingent annuities are a specific type of annuity with unique features. For a deeper understanding of these, you can visit Annuity Contingent Is 2024 and explore their intricacies.

Contents List

- 1 Understanding Annuity Due

- 2 The BA II Plus 2024 Calculator

- 3 Inputting Data for Annuity Due Calculations

- 4 Calculating Annuity Due on the BA II Plus 2024

- 5 Applications of Annuity Due Calculations: Calculating Annuity Due On Ba Ii Plus 2024

- 6 Tips and Tricks for Using the BA II Plus 2024

- 7 Final Summary

- 8 FAQ Corner

Understanding Annuity Due

An annuity due is a series of equal payments made at the beginning of each period. This differs from an ordinary annuity, where payments are made at the end of each period. The key characteristic of an annuity due is that the first payment occurs immediately, while subsequent payments are made at the start of each subsequent period.

Annuity investments can be a bit complex, so understanding the future value of your investment is crucial. Check out this resource on Annuity Is Future Value 2024 to gain insight into how your annuity will grow over time.

Differentiating Annuity Due from Ordinary Annuity

The main difference between annuity due and ordinary annuity lies in the timing of the payments. Annuity due payments are made at the beginning of each period, while ordinary annuity payments are made at the end of each period. This difference in timing affects the calculation of present value and future value.

If you’re in the UK and considering an annuity, you’ll want to compare quotes from different providers. Annuity Quotes Uk 2024 provides a starting point for finding the best deals.

- Annuity due: Payments made at the beginning of each period.

- Ordinary annuity: Payments made at the end of each period.

Real-World Scenarios of Annuity Due

Annuity due is applicable in various real-world scenarios, including:

- Rent payments:Renters typically pay rent at the beginning of each month, making it an example of an annuity due.

- Insurance premiums:Insurance premiums are often paid at the beginning of the policy period, making them an annuity due.

- Lease payments:Lease payments for vehicles or equipment are often made at the beginning of each lease period, making them an annuity due.

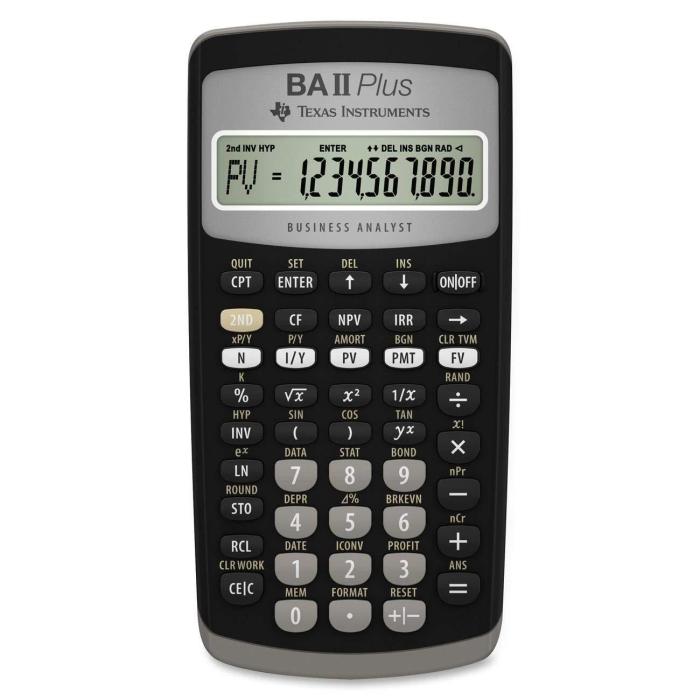

The BA II Plus 2024 Calculator

The BA II Plus 2024 calculator is a powerful financial calculator that can handle various financial calculations, including annuity due calculations. It features a user-friendly interface and dedicated keys for different financial functions, making it ideal for both students and professionals.

Tax implications are always a factor when considering financial products. Is Annuity Interest Taxable 2024 will help you understand the taxability of annuity interest.

Functionalities for Annuity Calculations

The BA II Plus 2024 calculator offers a range of functionalities relevant to annuity calculations, including:

- Present value (PV):Calculates the present value of an annuity, representing the current worth of future payments.

- Future value (FV):Calculates the future value of an annuity, representing the accumulated value of payments at a specific point in time.

- Payment amount (PMT):Calculates the regular payment amount required to achieve a specific present or future value.

- Interest rate (I/Y):Inputs the annual interest rate used for calculating the annuity.

- Number of periods (N):Inputs the total number of payment periods for the annuity.

Accessing the Annuity Due Mode, Calculating Annuity Due On Ba Ii Plus 2024

To access the annuity due mode on the BA II Plus 2024 calculator, follow these steps:

- Press the 2ndkey.

- Press the BGNkey.

- The calculator will display BGNon the screen, indicating that the annuity due mode is activated.

Inputting Data for Annuity Due Calculations

To perform annuity due calculations on the BA II Plus 2024 calculator, you need to input the following variables correctly:

Input Variables

- Present value (PV):The current worth of future payments. Input a negative value if you are receiving payments (e.g., a loan) and a positive value if you are making payments (e.g., an investment).

- Payment amount (PMT):The regular payment amount for each period. Input a negative value if you are making payments and a positive value if you are receiving payments.

- Interest rate (I/Y):The annual interest rate used for calculating the annuity. Enter the rate as a percentage (e.g., 5% would be entered as 5).

- Number of periods (N):The total number of payment periods for the annuity.

- Future value (FV):The accumulated value of payments at a specific point in time. Input a negative value if you are receiving payments (e.g., a loan) and a positive value if you are making payments (e.g., an investment).

Inputting Data Examples

Here are examples of how to input data for annuity due calculations:

- Example 1:Calculating the present value of a $1,000 annuity due with a 5% annual interest rate for 10 years.

- PV: ? (unknown)

- PMT: -1000

- I/Y: 5

- N: 10

- FV: 0

- Example 2:Determining the future value of a $500 annuity due with a 4% annual interest rate for 5 years.

- PV: 0

- PMT: -500

- I/Y: 4

- N: 5

- FV: ? (unknown)

Calculating Annuity Due on the BA II Plus 2024

The BA II Plus 2024 calculator simplifies annuity due calculations by providing dedicated keys for each variable. To calculate the present value, future value, or payment amount of an annuity due, follow these steps:

Calculating Present Value

- Enter the known values for PMT, I/Y, N, and FV.

- Press the CPTkey.

- Press the PVkey to calculate the present value.

Calculating Future Value

- Enter the known values for PV, PMT, I/Y, and N.

- Press the CPTkey.

- Press the FVkey to calculate the future value.

Calculating Payment Amount

- Enter the known values for PV, I/Y, N, and FV.

- Press the CPTkey.

- Press the PMTkey to calculate the payment amount.

Examples of Annuity Due Calculations

Here are examples of common annuity due calculations:

- Calculating the present value of an annuity due with a known payment amount:

- You want to know the present value of a $1,000 annuity due with a 5% annual interest rate for 10 years. You would input the following values: PMT = -1000, I/Y = 5, N = 10, FV = 0.

Khan Academy offers a great deal of free educational content, including information on annuities. You can find a comprehensive explanation of annuities and their various applications by exploring Annuity Khan Academy 2024.

After pressing CPT and PV, you would get the present value of the annuity due.

- You want to know the present value of a $1,000 annuity due with a 5% annual interest rate for 10 years. You would input the following values: PMT = -1000, I/Y = 5, N = 10, FV = 0.

- Determining the future value of an annuity due with a given present value:

- You want to know the future value of a $5,000 annuity due with a 4% annual interest rate for 5 years. You would input the following values: PV = 5000, PMT = -500, I/Y = 4, N = 5.

There are different types of annuities, each with unique characteristics. For a detailed explanation of “X-share annuities,” X Share Annuity 2024 provides a helpful resource.

After pressing CPT and FV, you would get the future value of the annuity due.

- You want to know the future value of a $5,000 annuity due with a 4% annual interest rate for 5 years. You would input the following values: PV = 5000, PMT = -500, I/Y = 4, N = 5.

- Finding the payment amount required for an annuity due with a specific future value:

- You want to know the payment amount required to accumulate $10,000 in 7 years with a 3% annual interest rate. You would input the following values: PV = 0, I/Y = 3, N = 7, FV = 10000.

Annuity investments are a popular choice for retirement planning, but it’s natural to wonder about their safety. Is Annuity Safe 2024 provides valuable insights into the security of annuities.

After pressing CPT and PMT, you would get the payment amount required for the annuity due.

- You want to know the payment amount required to accumulate $10,000 in 7 years with a 3% annual interest rate. You would input the following values: PV = 0, I/Y = 3, N = 7, FV = 10000.

Applications of Annuity Due Calculations: Calculating Annuity Due On Ba Ii Plus 2024

Annuity due calculations have wide-ranging applications in various fields, including finance, real estate, and insurance.

If you’re curious about the Hindi translation for “annuity,” Annuity Ka Hindi Meaning 2024 is a great place to start. This can be helpful for understanding financial concepts in a different language.

Finance

Annuity due calculations are essential in finance for:

- Loan amortization:Calculating the monthly payments required to repay a loan, taking into account the interest rate and loan term.

- Investment planning:Determining the future value of an investment, considering the regular contributions and interest rate.

- Retirement planning:Estimating the amount of savings required for retirement, based on expected expenses and investment returns.

Real Estate

Annuity due calculations are used in real estate for:

- Mortgage calculations:Determining the monthly mortgage payments, considering the loan amount, interest rate, and loan term.

- Lease payments:Calculating the monthly lease payments for commercial or residential properties, based on the lease term and interest rate.

Insurance

Annuity due calculations are utilized in insurance for:

- Premium calculations:Determining the monthly premium payments for insurance policies, considering the coverage amount, risk factors, and interest rate.

- Annuity contracts:Calculating the periodic payments an individual will receive from an annuity contract, based on the initial investment and interest rate.

Tips and Tricks for Using the BA II Plus 2024

Here are some tips and tricks to maximize the functionality of the BA II Plus 2024 calculator when performing annuity due calculations:

Tips

- Double-check your inputs:Ensure that you have entered all the variables correctly, including the signs for PV, PMT, and FV.

- Use the memory functions:Store frequently used values in the calculator’s memory to save time and reduce errors.

- Take advantage of the calculator’s built-in functions:Explore the various financial functions available on the calculator to simplify complex calculations.

Common Errors and Pitfalls

- Incorrectly setting the annuity due mode:Ensure that the BGN mode is activated before performing annuity due calculations.

- Mixing up signs for PV, PMT, and FV:Remember to use the correct signs for these variables based on whether you are making or receiving payments.

- Using the wrong interest rate:Ensure that you are using the annual interest rate (I/Y) and not the monthly or quarterly rate.

Additional Learning Resources

For further exploration of annuity due calculations and the BA II Plus 2024 calculator, consider the following resources:

- The BA II Plus 2024 User Manual:Provides comprehensive information on all the calculator’s features and functions.

- Online tutorials and videos:Numerous online resources offer step-by-step guides and tutorials on using the BA II Plus 2024 for annuity calculations.

- Financial textbooks and courses:Explore textbooks and courses on finance and investment to gain a deeper understanding of annuity concepts and their applications.

Final Summary

Armed with the knowledge of annuity due and the proficiency to use the BA II Plus 2024 calculator, you’re ready to tackle a wide range of financial challenges. Whether it’s planning for retirement, understanding loan amortization, or analyzing investment options, the ability to calculate annuity due gives you a powerful tool for making informed financial decisions.

Remember, practice is key to mastering any skill, so don’t hesitate to explore various annuity due scenarios and experiment with the calculator to solidify your understanding. As you delve deeper into the world of finance, the BA II Plus 2024 calculator will become an indispensable companion, helping you achieve your financial goals with confidence.

FAQ Corner

What are the benefits of using the BA II Plus 2024 calculator for annuity due calculations?

Thinking about moving your 401(k) into an annuity? You might be interested in learning more about Annuity 401k Rollover 2024. This could be a good strategy for those seeking guaranteed income in retirement, but it’s important to understand the potential benefits and drawbacks.

The BA II Plus 2024 calculator offers several benefits for annuity due calculations, including its user-friendly interface, comprehensive functionalities, and accuracy. Its dedicated keys for annuity due calculations simplify the process, reducing the risk of errors and saving time. Additionally, the calculator’s ability to handle complex scenarios with multiple variables makes it a versatile tool for various financial applications.

Can I use the BA II Plus 2024 calculator for other financial calculations besides annuity due?

Yes, the BA II Plus 2024 calculator is a versatile tool that can be used for a wide range of financial calculations, including present value, future value, loan amortization, bond pricing, and more. Its comprehensive functionalities make it a valuable asset for finance professionals, students, and individuals seeking to manage their finances effectively.

Where can I find additional resources for learning about annuity due and the BA II Plus 2024 calculator?

There are numerous resources available online and in libraries for learning about annuity due and the BA II Plus 2024 calculator. You can find tutorials, articles, and videos that provide detailed explanations and practical examples. Additionally, financial textbooks and courses often cover annuity due calculations and the use of financial calculators.

Annuity payments are often structured as a series of regular payments. To understand how these payments work, you can explore An Annuity Is A Series Of 2024 for more information.

The relationship between annuities and insurance can be a bit confusing. Is Annuity Insurance 2024 clarifies the connection between these two financial concepts.

Understanding how mortality tables are used in annuity calculations can be valuable. Annuity 2000 Mortality Table 2024 provides information about these tables and their relevance to annuity calculations.

There are various types of annuities available, each with its own advantages and disadvantages. Annuity Kinds 2024 offers a comprehensive overview of the different types of annuities you can choose from.