Calculate Annuity Discount Factor 2024: A Guide to Present Value is your comprehensive guide to understanding and calculating annuity discount factors. This crucial concept in finance helps determine the present value of future cash flows, enabling informed decisions about investments, loans, and financial planning.

We’ll delve into the fundamental principles of annuity discount factors, exploring how interest rates, time periods, and payment frequencies influence their calculation. You’ll gain practical insights into how these factors are applied in real-world scenarios, such as loan amortization, asset valuation, and retirement planning.

Finding the right annuity for retirement can feel overwhelming, but it doesn’t have to be. What Annuity Is The Best For Retirement 2024 provides insights into various annuity types, allowing you to make an informed decision about your retirement savings.

Contents List

- 1 Understanding Annuity Discount Factors

- 2 Factors Affecting Annuity Discount Factors

- 3 Calculating Annuity Discount Factors

- 4 Applications of Annuity Discount Factors

- 5 Tools and Resources for Annuity Discount Factor Calculations

- 6 Concluding Remarks

- 7 Question & Answer Hub: Calculate Annuity Discount Factor 2024

Understanding Annuity Discount Factors

Annuity discount factors are essential tools in finance, especially when dealing with cash flows occurring over time. Understanding how these factors work is crucial for making informed financial decisions.

Defining Annuity Discount Factors

An annuity discount factor represents the present value of a stream of equal payments made over a specific period. It essentially tells you how much a series of future payments is worth today, taking into account the time value of money.

Annuity M, a popular annuity product, offers a variety of features designed to meet different financial needs. Annuity M 2024 provides a detailed overview of this annuity, explaining its benefits and potential drawbacks.

Role of Discount Factors in Present Value Calculations

Discount factors are central to present value calculations. The present value of a future cash flow is determined by discounting it back to the present using the appropriate discount factor. This process is vital for comparing investments with different cash flow patterns and making sound financial decisions.

Examples of Annuity Discount Factor Applications

- Loan Amortization:Discount factors are used to calculate the monthly payments required to repay a loan over a set period. By factoring in the interest rate and loan term, the discount factor determines the present value of the future loan payments.

There are many types of annuities available, each with its own features and benefits. Annuity Options 2024 provides a comprehensive overview of the different types of annuities, allowing you to choose the one that best aligns with your goals.

- Investment Analysis:Investors use discount factors to evaluate the profitability of different investment opportunities. By discounting future cash flows from investments, they can compare their present values and choose the most attractive option.

- Retirement Planning:Annuity discount factors are used to calculate the present value of future retirement income streams. This helps individuals determine how much they need to save today to achieve their desired retirement lifestyle.

Factors Affecting Annuity Discount Factors

Several factors influence the magnitude of annuity discount factors. Understanding these factors is crucial for accurately calculating present values.

Annuity contracts can be confusing, especially when you’re trying to figure out if an annuity is the same as an IRA. Is Annuity Same As Ira 2024 explores the differences between these two retirement savings options, helping you understand which might be better for your needs.

Interest Rates and Discount Factors

The interest rate is directly proportional to the discount factor. As interest rates increase, the discount factor decreases, reflecting the higher opportunity cost of money. Conversely, lower interest rates result in higher discount factors.

When evaluating annuities, using a calculator can be a helpful tool. Annuity Calculator Bmo 2024 offers a convenient way to estimate potential payouts and understand the long-term impact of your annuity investment.

Time Period and Discount Factors

The longer the time period over which payments are made, the lower the discount factor. This is because the time value of money becomes more significant over longer periods. Future payments are discounted more heavily when they occur further in the future.

Annuity products are often categorized into series, each with its own features and investment options. Annuity Is Series 2024 explores the concept of annuity series, helping you understand the different types available and their implications for your retirement planning.

Payment Frequency and Discount Factors

The frequency of payments also affects the discount factor. More frequent payments lead to higher discount factors, as the present value of each individual payment is greater due to the shorter time period between payments.

Calculating Annuity Discount Factors

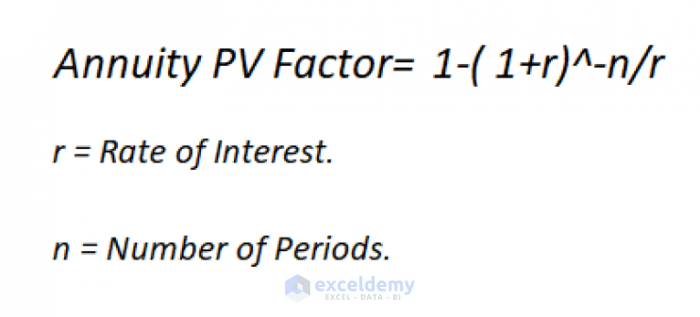

Calculating annuity discount factors involves using a specific formula that considers the interest rate, time period, and payment frequency.

Manual Calculation of Annuity Discount Factors, Calculate Annuity Discount Factor 2024

- Determine the Interest Rate (r):This is the rate of return used to discount future cash flows.

- Identify the Number of Periods (n):This is the total number of payment periods over which the annuity is paid.

- Apply the Discount Factor Formula:The formula for calculating the annuity discount factor is:

Discount Factor = (1- (1 + r)^-n) / r

Annuity products are often associated with insurance, but their purpose is distinct. Is Annuity Insurance 2024 clarifies the relationship between annuities and insurance, helping you differentiate between these financial tools.

- Calculate the Discount Factor:Substitute the values for ‘r’ and ‘n’ into the formula and solve for the discount factor.

Examples of Annuity Types and Formulas

| Annuity Type | Formula |

|---|---|

| Ordinary Annuity | (1

An annuity contract is a legally binding agreement between you and an insurance company. Annuity Contract Is 2024 explains the key elements of an annuity contract, ensuring you understand your rights and obligations.

|

| Annuity Due | ((1

|

| Perpetuity | 1 / r |

Applications of Annuity Discount Factors

Annuity discount factors have numerous applications in various financial contexts.

With $50,000 to invest, you might consider an annuity as a potential retirement savings option. Annuity 50k 2024 explores the feasibility of using an annuity for a $50,000 investment, helping you determine if it aligns with your financial goals.

Loan Amortization Calculations

Discount factors are crucial for calculating loan amortization schedules. They help determine the amount of principal and interest paid in each payment period. By using the discount factor, lenders can ensure that the loan is repaid fully over the specified term.

Valuing Financial Assets

Discount factors are essential for valuing financial assets such as stocks, bonds, and real estate. By discounting future cash flows from these assets, investors can determine their present value and make informed investment decisions.

A $400,000 annuity can provide a significant source of income during retirement. Annuity $400 000 2024 delves into the potential benefits of a $400,000 annuity, helping you understand its value in retirement planning.

Retirement Planning and Investment Analysis

Annuity discount factors play a vital role in retirement planning. They are used to calculate the present value of future retirement income streams, helping individuals determine how much they need to save today to achieve their desired retirement goals.

An annuity fund is a dedicated investment vehicle that helps you grow your savings for retirement. Annuity Fund Is 2024 provides insights into how annuity funds work, helping you understand the investment process.

Tools and Resources for Annuity Discount Factor Calculations

Various tools and resources are available to assist in calculating annuity discount factors.

The health care industry is always growing, and annuities can play a role in supporting your financial well-being. Annuity Health Careers 2024 explores the connection between annuities and health care careers, highlighting opportunities for professionals in this field.

Financial Calculators

Financial calculators are designed to perform complex financial calculations, including annuity discount factors. These calculators often have built-in functions for calculating present values, future values, and other financial metrics.

Understanding the basics of annuities is crucial for making informed financial decisions. 1 An Annuity Is 2024 offers a simple explanation of what an annuity is, clarifying its role in retirement planning.

Online Resources and Websites

Several websites offer online calculators and tools for calculating annuity discount factors. These resources often provide a user-friendly interface and allow users to input different variables to obtain the desired discount factor.

Spreadsheet Software Features

Spreadsheet software such as Microsoft Excel and Google Sheets have built-in functions for calculating annuity discount factors. These functions allow users to easily input the necessary parameters and obtain the desired results. They also offer flexibility in creating custom calculations and scenarios.

Sarasota is known for its beautiful beaches and vibrant culture, but it also has a strong financial services industry. Annuity King Sarasota 2024 highlights the top annuity providers in the area, helping you find a reliable partner for your retirement planning.

Concluding Remarks

By understanding the mechanics of annuity discount factors, you can gain a deeper appreciation for the time value of money and make sound financial decisions. Whether you’re a seasoned investor or just starting your financial journey, this guide equips you with the knowledge to navigate the complexities of present value calculations and optimize your financial outcomes.

Question & Answer Hub: Calculate Annuity Discount Factor 2024

What is the significance of the year 2024 in the title?

If you’ve inherited an annuity, you’ll need to understand how it’s taxed. How Is Inherited Annuity Taxed 2024 delves into the tax implications of inherited annuities, helping you navigate the financial landscape.

The year 2024 is included in the title to indicate that the information provided is relevant to the current year and can be applied to calculations for 2024.

How do I choose the appropriate discount rate for my calculations?

The appropriate discount rate depends on the specific investment or project you are analyzing. It should reflect the risk associated with the investment and the opportunity cost of investing in an alternative project.

Can I use a spreadsheet program to calculate annuity discount factors?

Yes, spreadsheet programs like Microsoft Excel or Google Sheets offer built-in functions for calculating annuity discount factors. These programs can save you time and effort compared to manual calculations.