Pv Annuity Chart 2024 provides a comprehensive guide to understanding the present value of annuities, a crucial concept in finance and investment. Annuities are a series of equal payments made over a specified period, and their present value represents the current worth of those future payments.

This chart explores the factors influencing PV annuity values, analyzes key trends in 2024, and provides practical examples to illustrate the concept.

An annuity is a financial product that provides a stream of regular payments over a set period of time. You can learn more about how it works in 2024 by visiting Annuity How It Works 2024.

Understanding PV annuities is essential for making informed financial decisions, whether you’re planning for retirement, investing in a property, or evaluating loan options. This chart serves as a valuable resource for individuals and businesses alike, offering insights into the dynamics of present value calculations and their implications for financial planning.

Understanding the meaning of an annuity is essential before making any investment decisions. Visit Annuity Is Meaning 2024 to learn more.

Contents List

Understanding PV Annuities

A present value (PV) annuity is a financial concept that represents the current value of a series of future payments, assuming a specific discount rate. It is a crucial tool for evaluating investments, loans, and other financial instruments that involve regular cash flows.

Components of a PV Annuity

A PV annuity comprises several key components:

- Payment Amount (PMT):The amount of each regular payment in the annuity.

- Discount Rate (r):The rate of return used to discount future payments to their present value.

- Number of Periods (n):The total number of payment periods in the annuity.

Discounting and Its Role

Discounting is the process of reducing the value of future cash flows to their present value. It accounts for the time value of money, recognizing that money received today is worth more than the same amount received in the future due to the potential for investment and earning interest.

If you’re looking for the Hindi meaning of “annuity,” you can find it on Annuity Ka Hindi Meaning 2024.

Factors Influencing PV Annuity Values

Several factors can influence the present value of an annuity:

- Discount Rate:A higher discount rate leads to a lower PV annuity value, as future payments are discounted more heavily.

- Number of Periods:As the number of periods increases, the PV annuity value also increases, as more future payments are included in the calculation.

- Payment Amount:A higher payment amount results in a higher PV annuity value.

PV Annuity Chart 2024: Key Considerations

In 2024, several key trends and factors will likely influence PV annuity calculations.

Annuity can be a valuable tool for retirement planning. Learn more about how it can be used as a voluntary retirement vehicle at Annuity Is A Voluntary Retirement Vehicle 2024.

Interest Rate Changes

Fluctuations in interest rates can significantly impact PV annuity values. Rising interest rates generally lead to lower PV annuities, as the discount rate used in the calculation increases. Conversely, falling interest rates can result in higher PV annuities.

Annuity can be integrated with a 401k plan to provide retirement income. Find out more about this at Annuity 401k Plan 2024.

Inflation

Inflation erodes the purchasing power of money over time. When calculating PV annuities, it’s crucial to consider inflation, as it can affect the real value of future payments. Adjusting for inflation can provide a more accurate picture of the present value.

Annuity is a versatile financial product that can be used in a variety of ways. Learn more about its uses at Annuity Is Used In 2024.

Types of PV Annuities: Pv Annuity Chart 2024

PV annuities can be categorized into different types based on the timing of payments and other characteristics.

There are different ways to purchase an annuity, and understanding the process is crucial. Head over to Annuity Is Purchased 2024 for insights.

Ordinary Annuity

An ordinary annuity involves payments made at the end of each period. For example, a mortgage payment is typically an ordinary annuity, with payments made at the end of each month.

For those who speak Tamil, understanding the concept of an annuity is important. Visit Annuity Meaning In Tamil 2024 to learn more.

Annuity Due

An annuity due involves payments made at the beginning of each period. For instance, rent payments are often made at the beginning of each month, making them an annuity due.

Perpetuity

A perpetuity is an annuity that continues indefinitely, with payments made forever. It is often used to value assets that generate a perpetual stream of income, such as preferred stocks or real estate.

Calculating PV Annuities

Formula

PV = PMT

- [1

- (1 + r)^-n] / r

Where:

- PV = Present Value

- PMT = Payment Amount

- r = Discount Rate

- n = Number of Periods

Step-by-Step Calculation, Pv Annuity Chart 2024

- Identify the payment amount (PMT), discount rate (r), and number of periods (n).

- Plug these values into the formula above.

- Calculate the present value (PV) using a calculator or spreadsheet software.

Example

Let’s say you are considering an investment that promises to pay you $1,000 per year for 5 years. The discount rate is 5%. To calculate the PV annuity, you would use the following formula:

PV = $1,000

Annuity options can be tailored to different ages, including those over 85. Visit Annuity 85 Years Old 2024 to learn more.

- [1

- (1 + 0.05)^-5] / 0.05

The PV annuity in this case would be approximately $4,329.48.

Applications of PV Annuities

Finance and Investment

PV annuities are widely used in finance and investment to evaluate various financial instruments and decisions, such as:

- Investment Analysis:PV annuities help assess the present value of future cash flows from investments, allowing investors to compare different options.

- Loan Amortization:PV annuities are used to calculate the monthly payments required to repay a loan over a specific period.

- Bond Valuation:PV annuities are crucial in valuing bonds, as they represent the present value of future coupon payments and the principal repayment.

Retirement Planning

PV annuities play a vital role in retirement planning. They help individuals estimate the present value of their future retirement income, allowing them to make informed decisions about saving and investing for their golden years.

Calculating the rate of return on an annuity is important for understanding its potential. You can find guidance on this topic at Calculating An Annuity Rate 2024.

Loan Amortization

PV annuities are used to calculate the regular payments required to repay a loan over time. The loan amortization schedule, which details the principal and interest payments for each period, is based on PV annuity calculations.

PV Annuity Chart 2024: Data Analysis

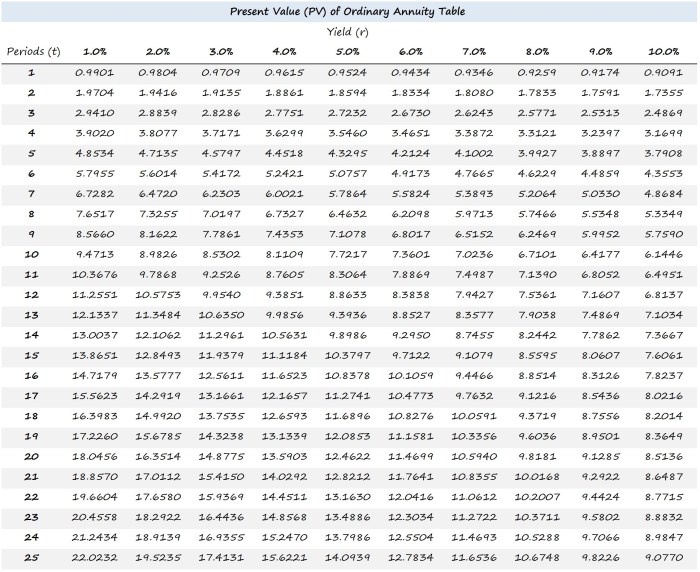

Table of PV Annuity Values

| Interest Rate | 1 Year | 5 Years | 10 Years | 20 Years |

|---|---|---|---|---|

| 1% | 0.990 | 4.853 | 9.471 | 18.046 |

| 2% | 0.980 | 4.713 | 9.057 | 17.159 |

| 3% | 0.971 | 4.579 | 8.654 | 16.351 |

| 4% | 0.962 | 4.450 | 8.264 | 15.617 |

| 5% | 0.952 | 4.329 | 7.890 | 14.917 |

The table above illustrates the PV annuity values for different interest rates and time periods, assuming a payment amount of $1. As the interest rate increases, the PV annuity value decreases, reflecting the increased discounting of future payments. Similarly, as the time period lengthens, the PV annuity value increases, as more future payments are included in the calculation.

New Zealand has its own specific regulations and options for annuities. Visit Annuity Nz 2024 for more information.

Trends and Patterns

The data in the table reveals several key trends:

- Inverse Relationship with Interest Rates:Higher interest rates lead to lower PV annuity values.

- Direct Relationship with Time Periods:Longer time periods result in higher PV annuity values.

- Diminishing Returns:The increase in PV annuity value with each additional period becomes smaller as the time period extends.

Implications for Financial Decision-Making

The data analysis highlights the importance of considering both interest rates and time periods when evaluating PV annuities. For instance, if you are planning for retirement, understanding how interest rate changes and the length of your investment horizon will impact the present value of your future income is crucial for making informed financial decisions.

PV Annuity Chart 2024: Visualization

Chart Design

A chart visualizing the relationship between PV annuity values, interest rates, and time periods can provide a clear and intuitive representation of these concepts. The chart could use a line graph with interest rates on the x-axis, time periods on the y-axis, and PV annuity values represented by the line itself.

The key characteristic of an annuity is the series of equal periodic payments. Learn more about this aspect at An Annuity Is A Series Of Equal Periodic Payments 2024.

Key Insights

The visualization would clearly demonstrate the inverse relationship between interest rates and PV annuity values, as the line would slope downwards as interest rates increase. Additionally, the chart would show the direct relationship between time periods and PV annuity values, as the line would rise as the time period lengthens.

Importance of Visualization

Visual representations of PV annuities are essential for understanding the complex interplay between different factors. Charts and graphs provide a clear and concise way to illustrate these relationships, making it easier for individuals to grasp the concepts and make informed financial decisions.

If you’re interested in Kathy’s experience with an annuity, you can read about it on Kathy’s Annuity Is Currently Experiencing 2024.

Closing Notes

The Pv Annuity Chart 2024 provides a comprehensive overview of present value annuities, encompassing their definition, calculation, and applications. By understanding the factors influencing PV annuity values and analyzing the data presented in the chart, individuals and businesses can make informed financial decisions, optimize their investment strategies, and navigate the complexities of financial planning in the ever-evolving economic landscape.

Wondering how much you could receive from a $75,000 annuity in 2024? Check out Annuity 75000 2024 for more information.

Detailed FAQs

How does interest rate affect PV annuity values?

Higher interest rates generally result in lower PV annuity values, as the future payments are discounted at a higher rate. Conversely, lower interest rates lead to higher PV annuity values.

Considering a $500,000 annuity? You’ll find helpful information on this topic at Annuity 500k 2024.

What is the difference between an ordinary annuity and an annuity due?

An ordinary annuity has payments made at the end of each period, while an annuity due has payments made at the beginning of each period. This difference in timing affects the PV annuity calculation.

How can I use the Pv Annuity Chart 2024 for retirement planning?

The chart can help you estimate the present value of your future retirement income, allowing you to assess the adequacy of your savings and adjust your retirement planning accordingly.