Calculate Annuity Due Future Value 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a world of financial planning and investment strategies. Understanding the concept of annuity due, its key characteristics, and the factors that influence its future value is essential for individuals and businesses alike.

An annuity due is a type of annuity where payments are made at the beginning of each period. Annuity Due Is 2024 differs from an ordinary annuity, where payments are made at the end of each period. This distinction can affect the overall value of the annuity.

This guide delves into the intricacies of annuity due calculations, equipping you with the knowledge to make informed financial decisions.

An annuity due is a series of equal payments made at the beginning of each period, unlike an ordinary annuity where payments are made at the end. This distinction is crucial as it affects the timing of interest accrual and ultimately the future value of the investment.

By understanding the formula for calculating the future value of an annuity due, you can gain insights into the potential growth of your investments over time.

Contents List

Understanding Annuity Due

An annuity due is a series of equal payments made at the beginning of each period. This distinguishes it from an ordinary annuity, where payments are made at the end of each period. Understanding the concept of an annuity due is crucial in various financial planning scenarios, including retirement planning, loan repayment, and investment strategies.

Key Characteristics of Annuity Due

The defining characteristic of an annuity due is the timing of payments. Payments are made at the beginning of each period, meaning the first payment is made immediately upon the initiation of the annuity. This timing difference has significant implications for the future value of the annuity, as each payment has an extra period to accumulate interest.

Annuity is primarily used to provide a steady stream of income for retirement. An Annuity Is Primarily Used To Provide 2024 can be a valuable tool for ensuring financial security in later years.

- Equal Payments:Each payment within an annuity due is identical in amount, ensuring consistency over the annuity’s duration.

- Regular Intervals:Payments are made at fixed intervals, such as monthly, quarterly, or annually, providing a predictable cash flow.

- Predetermined Period:The annuity has a defined duration, specifying the number of periods over which payments are made.

Real-World Examples of Annuity Due

- Rent Payments:Rent payments are typically made at the beginning of each month, making them a classic example of an annuity due.

- Insurance Premiums:Insurance premiums are often paid at the beginning of the coverage period, reflecting the principle of annuity due.

- Lease Payments:Lease payments for vehicles or equipment are generally made at the start of each lease period, aligning with the concept of an annuity due.

Formula for Annuity Due Future Value

The future value of an annuity due represents the total accumulated value of the annuity at the end of its term. It considers the compounded interest earned on each payment, taking into account the earlier payment timing. The formula for calculating the future value of an annuity due is:

FV = P

While not technically insurance, an annuity can be considered a type of insurance product. Is Annuity Insurance 2024 provides a guaranteed income stream, similar to how insurance policies provide coverage for unexpected events.

- [(1 + r)^n

- 1] / r

- (1 + r)

Where:

- FV = Future Value

- P = Payment Amount

- r = Interest Rate per Period

- n = Number of Periods

Step-by-Step Example

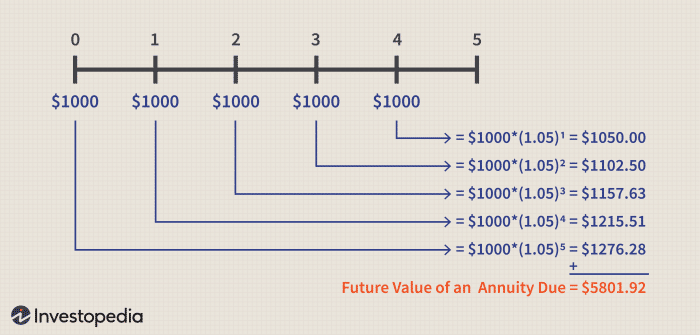

Let’s assume you invest $1,000 at the beginning of each year for 5 years, earning an annual interest rate of 5%. To calculate the future value of this annuity due:

- Identify the variables:P = $1,000, r = 5% (0.05), n = 5 years.

- Plug the values into the formula:FV = $1,000

- [(1 + 0.05)^5

- 1] / 0.05

- (1 + 0.05).

- Calculate the future value:FV = $1,000

- [1.27628

- 1] / 0.05

- 1.05 = $5,525.63.

Therefore, the future value of this annuity due after 5 years would be $5,525.63.

Income from an immediate annuity is generally taxable. Is Immediate Annuity Income Taxable 2024 However, the tax implications can vary depending on the specific type of annuity and the individual’s tax situation.

Factors Influencing Annuity Due Future Value

Several factors can influence the future value of an annuity due, impacting the total amount accumulated over time. Understanding these factors is essential for making informed financial decisions and maximizing returns on annuity investments.

Understanding the basics of annuities can help you make informed decisions about your retirement planning. Annuity Questions And Answers 2024 provides a comprehensive overview of common questions and answers related to annuities.

Impact of Interest Rates

Higher interest rates lead to greater future values for annuities due. As interest rates increase, the compounded interest earned on each payment grows exponentially, resulting in a larger final accumulation.

When deciding on a retirement strategy, individuals often weigh the pros and cons of an annuity versus a drawdown. Annuity Or Drawdown 2024 involves a careful consideration of risk tolerance, income needs, and investment goals.

Impact of Payment Amounts

Larger payment amounts naturally result in higher future values. Increasing the amount of each payment directly contributes to a greater total accumulation at the end of the annuity’s term.

The Calculating Annuity Ba Ii Plus 2024 involves using a financial calculator to determine the present value, future value, or payment amount of an annuity. This calculator is a helpful tool for financial professionals and individuals alike.

Impact of Investment Periods

Longer investment periods allow for more compounding periods, leading to greater future values. The longer the annuity runs, the more time interest has to accrue on both the principal payments and the accumulated interest.

Calculating annuity payments involves determining the amount of each regular payment based on factors such as the principal amount, interest rate, and time period. Calculating Annuity Payments 2024 can be done using various formulas and financial calculators.

Comparison Table, Calculate Annuity Due Future Value 2024

| Scenario | Interest Rate | Payment Amount | Investment Period | Future Value |

|---|---|---|---|---|

| Scenario 1 | 5% | $1,000 | 5 years | $5,525.63 |

| Scenario 2 | 7% | $1,000 | 5 years | $6,077.53 |

| Scenario 3 | 5% | $1,200 | 5 years | $6,630.76 |

| Scenario 4 | 5% | $1,000 | 10 years | $12,577.89 |

This table demonstrates the impact of changes in interest rates, payment amounts, and investment periods on the future value of an annuity due. As you can see, higher interest rates, larger payments, and longer investment periods all contribute to a larger future value.

While annuities can be a valuable financial tool, it’s important to be aware of potential issues. Annuity Issues 2024 include factors such as surrender charges, interest rate risk, and potential limitations on withdrawals.

Practical Applications of Annuity Due Calculations

Annuity due calculations have wide-ranging applications in various financial contexts, aiding individuals and businesses in making informed decisions about savings, investments, and debt management.

Financial Planning

Annuity due calculations help individuals plan for future financial goals, such as retirement, education, or major purchases. By determining the future value of a regular savings plan, individuals can assess their progress toward their objectives and make adjustments as needed.

A qualified annuity is a type of annuity that meets certain requirements for tax benefits. Annuity Is Qualified 2024 can provide tax advantages for retirement savings and income.

Retirement Planning

Annuity due calculations are fundamental to retirement planning. By projecting the future value of retirement savings, individuals can estimate their potential income stream during retirement and make informed decisions about their savings and investment strategies.

Understanding the Annuity Loan Formula 2024 is crucial for calculating loan payments and interest accrued. This formula helps determine the amount of each payment and the total cost of borrowing.

Investment Strategies

Annuity due calculations are used to evaluate the profitability of various investment options. By comparing the future values of different investments, individuals can identify the most promising opportunities for maximizing returns.

Real-World Case Studies

- Retirement Savings:A person planning for retirement might use annuity due calculations to determine the future value of their 401(k) contributions, considering factors like interest rates and investment period.

- Loan Repayment:A borrower can use annuity due calculations to assess the total amount they will repay on a loan, considering factors like interest rates and loan term.

- Investment Portfolio:An investor might use annuity due calculations to compare the potential returns of different investment options, such as stocks, bonds, or mutual funds.

Tools and Resources for Annuity Due Calculations

Various online calculators and software programs are available to assist with annuity due calculations, simplifying the process and providing accurate results. These tools can be valuable for individuals and businesses looking to streamline their financial planning and investment analysis.

A joint and survivor annuity provides income to two individuals, typically a married couple. Annuity Joint And Survivor 2024 ensures that income continues even after the death of one spouse. This type of annuity is often used for estate planning and retirement income protection.

Online Calculators

Numerous websites offer free annuity due calculators, allowing users to input variables like payment amount, interest rate, and investment period to quickly calculate the future value. These calculators are user-friendly and convenient for quick estimations.

Software Programs

Specialized financial software programs provide more comprehensive features for annuity due calculations, often including advanced functionalities like scenario analysis and sensitivity testing. These programs can be beneficial for complex financial planning and investment management.

Benefits of Using Tools

- Accuracy:Calculators and software programs use precise formulas and algorithms to ensure accurate calculations, minimizing the risk of errors.

- Efficiency:These tools automate the calculation process, saving time and effort compared to manual calculations.

- Flexibility:Many tools allow users to adjust variables and explore different scenarios, providing insights into the impact of changes on future values.

Limitations of Using Tools

- Limited Customization:Some calculators may have limited customization options, restricting the ability to account for specific financial situations.

- Dependence on Input:The accuracy of the results depends on the accuracy of the input data. Incorrect inputs can lead to misleading outcomes.

- Overreliance:It’s crucial to understand the underlying concepts and not solely rely on tools for decision-making.

Selecting Appropriate Tools

When selecting annuity due calculation tools, consider factors such as:

- Functionality:Choose a tool that provides the necessary features for your specific needs.

- Ease of Use:Select a tool with a user-friendly interface and clear instructions.

- Reliability:Opt for tools from reputable sources and with a proven track record.

Concluding Remarks

As we conclude our exploration of annuity due calculations, we’ve uncovered a powerful tool for financial planning and investment strategies. Whether you’re saving for retirement, planning for a major purchase, or managing a business, understanding the principles of annuity due can help you make informed decisions that align with your financial goals.

Annuity, sometimes called the flip side of a loan, is a financial product that provides a stream of regular payments over a set period. An Annuity Is Sometimes Called The Flip Side Of 2024 can be a valuable tool for retirement planning, as it provides a guaranteed income stream.

By utilizing the formulas and resources discussed in this guide, you can navigate the complexities of financial planning with confidence and achieve your desired outcomes.

FAQs: Calculate Annuity Due Future Value 2024

What is the difference between an annuity due and an ordinary annuity?

An annuity due has payments made at the beginning of each period, while an ordinary annuity has payments made at the end of each period. This difference in timing impacts the interest earned and the future value of the annuity.

An annuity can be a valuable investment tool for those seeking guaranteed income. Is Annuity Compound Interest 2024 ? While not always structured as compound interest, annuities can benefit from growth over time due to the accumulation of interest.

How does interest rate affect the future value of an annuity due?

Higher interest rates generally result in a higher future value for an annuity due. This is because the interest earned on each payment is compounded over a longer period.

What are some examples of real-world scenarios where annuity due calculations are used?

Annuity due calculations are used in various financial planning scenarios, such as retirement planning, mortgage payments, and loan amortization.

A career in the annuity industry offers a variety of opportunities for those interested in finance and helping others. Annuity Health Careers 2024 involves working with clients to understand their financial needs and providing personalized solutions.

Are there any online tools available to help with annuity due calculations?

Yes, several online calculators and software programs can assist with annuity due calculations. These tools can simplify the process and provide accurate results.