Calculating Annuity Due Payment 2024 is a crucial aspect of financial planning, particularly for individuals seeking to maximize their investment returns or manage debt effectively. Annuity due payments, unlike ordinary annuities, involve payments made at the beginning of each period, leading to a slightly higher future value.

Sometimes, an annuity can be a good way to potentially increase your income in retirement. You can potentially win a jackpot by investing in a particular annuity. If you’re interested in learning more about the possibility of winning an annuity jackpot in 2024, you can find information on this website: Annuity Jackpot 2024.

Understanding the nuances of annuity due calculations allows individuals to make informed decisions regarding retirement savings, loan amortization, and other financial goals.

When considering an annuity, it’s important to choose the right option for your needs. There are many different types of annuities available, each with its own benefits and drawbacks. If you want to explore different annuity options in 2024, you can find helpful information here: Annuity Options 2024.

This guide delves into the intricacies of annuity due payments, providing a comprehensive understanding of the concept, the formula used for calculation, and the various factors influencing the final amount. We’ll explore practical applications, demonstrate calculations through real-world examples, and discuss the advantages and disadvantages of utilizing annuity due payments in financial planning.

Annuity is a financial product that provides a stream of regular payments for a set period of time. It can be a valuable tool for retirement planning, but it’s important to understand the different types of annuities available and how they work.

To learn more about the meaning of annuity in 2024, check out this article: Annuity Is Meaning 2024.

Contents List

- 1 Understanding Annuity Due Payments

- 2 Formula for Calculating Annuity Due Payments

- 3 Factors Affecting Annuity Due Payments: Calculating Annuity Due Payment 2024

- 4 Examples and Applications of Annuity Due Calculations

- 5 Using Financial Calculators and Software

- 6 Practical Considerations and Tips

- 7 Concluding Remarks

- 8 Top FAQs

Understanding Annuity Due Payments

An annuity due payment is a type of financial arrangement where payments are made at the beginning of each period, rather than at the end. This structure differs from ordinary annuities, where payments occur at the end of each period.

Annuity can be a complex financial product. Before you decide to invest in an annuity, it’s important to consider whether it’s the right choice for you. If you’re wondering whether an annuity is a good idea in 2024, you can find more information on this website: Annuity Is It A Good Idea 2024.

Understanding the nuances of annuity due payments is crucial for effective financial planning, especially when dealing with investments, loans, and retirement savings.

Annuity payments can vary depending on the terms of the contract. If you’re considering an annuity that pays out $30,000 per year, it’s important to understand how this amount is calculated and what factors can affect it. To learn more about $30,000 annuities in 2024, you can check out this website: Annuity 30k 2024.

Key Features of Annuity Due

- Payment Timing:The defining characteristic of annuity due is the upfront payment at the beginning of each period. This means the first payment is made immediately upon entering the agreement.

- Interest Accrual:Because payments are made at the beginning of the period, interest starts accruing on the principal immediately, leading to potentially higher returns compared to ordinary annuities.

- Compounding:Interest earned on annuity due payments is compounded over a longer period, as interest is earned on the principal and accumulated interest from the previous period.

Real-World Examples

- Rent Payments:Rent is typically paid at the beginning of each month, making it an example of an annuity due payment.

- Insurance Premiums:Many insurance premiums are paid upfront, signifying an annuity due structure.

- Mortgage Payments:While mortgages are usually structured as ordinary annuities, some lenders offer options where the first payment is due upfront, creating an annuity due arrangement.

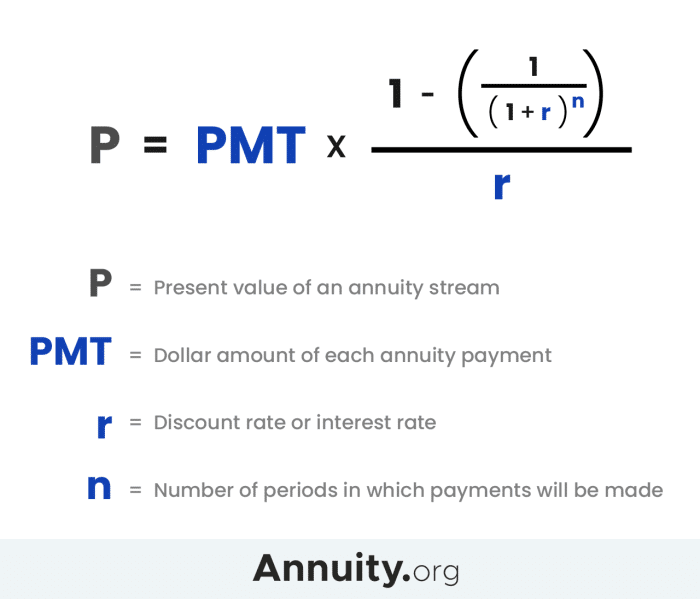

Formula for Calculating Annuity Due Payments

The formula for calculating annuity due payments considers the future value of the annuity, the interest rate, and the number of payment periods. The formula is as follows:

Annuity Due Payment = (Future Value

Annuity contracts often have a surrender period. This means that you can’t withdraw your money without penalty for a certain period of time. If you’re wondering what to do if your annuity is out of surrender in 2024, you can find more information on this website: My Annuity Is Out Of Surrender 2024.

- Interest Rate) / (1

- (1 + Interest Rate)^(-Number of Payments))

Variables in the Formula

- Future Value:The desired amount to be accumulated at the end of the annuity period.

- Interest Rate:The annual interest rate applied to the annuity.

- Number of Payments:The total number of payments to be made over the annuity period.

Step-by-Step Breakdown

- Calculate the discount factor:This involves subtracting 1 from the sum of 1 and the interest rate, raised to the power of the negative number of payments.

- Divide the future value by the discount factor:This step yields the present value of the annuity.

- Multiply the present value by the interest rate:This final step provides the annuity due payment amount.

Factors Affecting Annuity Due Payments: Calculating Annuity Due Payment 2024

Several factors influence the calculation of annuity due payments. Understanding these factors is essential for making informed financial decisions.

Understanding how annuity payments are calculated can help you make informed financial decisions. There are different formulas and factors that go into calculating annuity payments. If you’re interested in learning more about calculating annuity payments in 2024, you can find information on this website: Calculating Annuity Payments 2024.

Interest Rates

- Higher interest rates:Lead to higher annuity due payments, as interest accrues faster and the future value grows more quickly.

- Lower interest rates:Result in lower annuity due payments, as interest accrues at a slower pace and the future value grows more gradually.

Payment Period (Frequency)

- More frequent payments:Result in higher annuity due payments, as interest is compounded more often, leading to greater growth in the future value.

- Less frequent payments:Lead to lower annuity due payments, as interest is compounded less frequently, resulting in slower growth in the future value.

Number of Payments

- More payments:Increase the total amount paid over the annuity period, leading to a higher future value.

- Fewer payments:Decrease the total amount paid over the annuity period, resulting in a lower future value.

Examples and Applications of Annuity Due Calculations

Annuity due calculations find practical applications in various financial scenarios, including retirement planning, loan amortization, and investment strategies.

Annuity can be a useful financial tool, but it’s important to understand how they work. One common type of annuity is a single payment annuity. This means that you make a single payment upfront, and then receive regular payments in return.

If you want to learn more about single payment annuities in 2024, you can check out this website: Annuity Is Single Payment 2024.

Scenario Table

| Scenario | Interest Rate | Payment Period | Number of Payments | Annuity Due Payment |

|---|---|---|---|---|

| Scenario 1 | 5% | Monthly | 120 | $1,000 |

| Scenario 2 | 7% | Quarterly | 40 | $2,500 |

| Scenario 3 | 3% | Annually | 20 | $5,000 |

Financial Planning Applications

- Retirement Savings:Annuity due calculations help determine the required monthly contributions to achieve a desired retirement nest egg.

- Loan Amortization:Understanding annuity due payments can assist in calculating loan payments and the total interest paid over the loan term.

- Investment Strategies:Annuity due calculations are used to evaluate the growth potential of various investment options, such as fixed deposits or mutual funds.

Benefits and Drawbacks

- Benefits:Annuity due payments can lead to higher returns due to early interest compounding. They also provide flexibility in payment scheduling, allowing for immediate interest accrual.

- Drawbacks:Annuity due payments may require a larger upfront investment, which can be a challenge for individuals with limited financial resources. The complexity of calculations may require specialized financial knowledge or software.

Using Financial Calculators and Software

Financial calculators and spreadsheet software offer convenient tools for calculating annuity due payments, eliminating the need for manual calculations.

Calculating annuity payments can be done using different methods, including spreadsheets. Microsoft Excel is a popular tool for financial calculations, and it can be used to calculate annuity payments. If you’re interested in learning how to calculate an annuity in Excel in 2024, you can find helpful information here: Calculating An Annuity In Excel 2024.

Financial Calculators

- Dedicated financial calculators:These calculators are specifically designed for financial calculations, including annuity due payments. They often feature pre-programmed formulas and functions, simplifying the process.

- Smartphone apps:Many financial calculator apps are available for smartphones, providing easy access to annuity due calculations on the go.

Spreadsheet Software

- Microsoft Excel:Excel offers built-in functions for annuity due calculations, allowing users to input variables and generate results with ease.

- Google Sheets:Google Sheets provides similar functionality to Excel, enabling users to perform annuity due calculations online without installing any software.

Advantages and Limitations

- Advantages:Financial calculators and spreadsheet software streamline calculations, reducing the risk of errors. They provide flexibility in exploring different scenarios by adjusting variables.

- Limitations:Users must have basic understanding of financial concepts and formulas to effectively utilize these tools. The accuracy of calculations depends on the input data and the software’s functionality.

Practical Considerations and Tips

When choosing an annuity due payment plan, it’s crucial to consider several practical aspects and seek expert advice if needed.

Some annuities offer tax benefits, but these benefits can be complex. One important factor to consider is the annuity exclusion ratio. This ratio determines how much of your annuity payments are considered taxable income. If you’re interested in learning more about the annuity exclusion ratio in 2024, you can find information on this website: Annuity Exclusion Ratio 2024.

Choosing the Right Plan

- Financial Goals:Align the annuity due plan with specific financial objectives, such as retirement savings or loan repayment.

- Risk Tolerance:Consider your risk tolerance and choose an annuity due plan with an appropriate interest rate and payment period.

- Financial Resources:Evaluate your financial resources and ensure that the upfront payments are manageable.

Understanding Terms and Conditions, Calculating Annuity Due Payment 2024

- Interest Rate:Understand the interest rate offered by the annuity due provider and compare it with other options.

- Payment Period:Clarify the payment frequency and ensure it aligns with your financial capabilities.

- Fees and Charges:Inquire about any fees or charges associated with the annuity due plan.

Evaluating Suitability

- Financial Advisor Consultation:Seek advice from a qualified financial advisor to determine the suitability of annuity due payments for your specific circumstances.

- Comparison Shopping:Explore different annuity due providers and compare their terms and conditions to find the most favorable option.

Concluding Remarks

As you navigate the complexities of financial planning, mastering the concept of annuity due payments can be a valuable asset. By understanding the formula, analyzing the factors influencing the calculation, and utilizing available tools and resources, individuals can make informed decisions regarding their financial future.

Whether you’re seeking to maximize retirement savings, manage debt effectively, or simply understand the intricacies of financial planning, the knowledge gained from this guide will empower you to make informed decisions and achieve your financial goals.

Top FAQs

What is the difference between an annuity due and an ordinary annuity?

An annuity due involves payments made at the beginning of each period, while an ordinary annuity involves payments made at the end of each period. This difference in timing affects the future value of the annuity, with annuity due payments generally resulting in a higher future value.

How can I use annuity due calculations in real-world scenarios?

Annuity due calculations are commonly used in retirement planning, where individuals seek to maximize their savings by making regular contributions at the beginning of each period. They are also used in loan amortization, where the borrower makes payments at the beginning of each period, reducing the principal balance more quickly.

What are the advantages and disadvantages of using annuity due payments?

The primary advantage of annuity due payments is the higher future value they generate due to the earlier payment timing. However, a disadvantage is that the initial payment is required at the beginning of the period, which may not be feasible for all individuals.

Annuity contracts often specify an interest rate. This rate can affect the amount of your annuity payments. If you’re interested in learning more about annuities with an 8 percent interest rate in 2024, you can find information on this website: Annuity 8 Percent 2024.

Annuity payments can be considered earned income for tax purposes. However, there are different rules and regulations that apply to annuities. If you’re wondering whether annuity payments are considered earned income in 2024, you can find more information on this website: Is Annuity Earned Income 2024.

Annuity contracts can be issued by different insurance companies. If you’re considering an annuity from LIC (Life Insurance Corporation of India), you may want to learn more about the specific features and terms of these contracts. To find out more about LIC annuities in 2024, you can check out this website: Is Annuity Lic 2024.

Annuity is a versatile financial product that can be used for various purposes. One common use of annuities is to provide a steady stream of income during retirement. If you want to learn more about how annuities are primarily used to provide income in 2024, you can check out this website: Annuity Is Primarily Used To Provide 2024.

Annuity payments can be subject to taxation. The taxability of annuity payments can depend on various factors, including the type of annuity and the issuing company. If you’re wondering whether annuity payments from LIC are taxable in 2024, you can find more information on this website: Is Annuity From Lic Taxable 2024.