Fv Annuity Excel 2024 empowers you to understand and calculate the future value of a series of payments, also known as an annuity. Whether you’re planning for retirement, analyzing investment opportunities, or managing loans, understanding the concept of Fv Annuity is essential.

To determine the value of your annuity, you need to understand its present value. You can learn more about calculating annuity present value in 2024 online, but remember, these calculations can be complex and may require professional guidance.

This guide will equip you with the knowledge and tools to navigate the complexities of Fv Annuity calculations using the powerful capabilities of Microsoft Excel 2024.

We’ll delve into the fundamentals of Fv Annuity, exploring its key characteristics, factors influencing its calculation, and its applications in various financial scenarios. You’ll learn how to utilize Excel’s FV function, create spreadsheet templates for efficient calculations, and understand the impact of interest rates, time periods, and payment amounts on the future value of your annuity.

Need help calculating your annuity based on your age? There are online tools that can help. You can find more information about annuity calculators by age in 2024 , but remember, these calculators are just tools, and you should always consult with a financial advisor for personalized advice.

By mastering these concepts, you’ll gain valuable insights into the potential growth of your savings or investments over time.

Planning for retirement often involves considering annuities that provide income for many years. You can find information about annuities that last for 30 years in 2024 , but remember, these plans can have different features and limitations.

Contents List

Understanding Fv Annuity

An Fv Annuity, or future value of an annuity, represents the total accumulated value of a series of regular payments at a future point in time, considering the effect of compound interest. It’s a crucial concept in financial planning, as it helps individuals and organizations understand the potential growth of their savings or investments over time.

An annuity is essentially a stream of payments over a specific period. You can find more information about what an annuity is in 2024 , but remember, there are different types of annuities, each with its own features and benefits.

Key Characteristics of Fv Annuity

Fv Annuities are characterized by:

- Regular Payments: A series of equal payments made at regular intervals (e.g., monthly, quarterly, annually).

- Compound Interest: The interest earned on the principal amount and any accumulated interest over time.

- Time Period: The duration of the annuity, typically expressed in years or months.

- Interest Rate: The rate at which the principal amount and accrued interest grow.

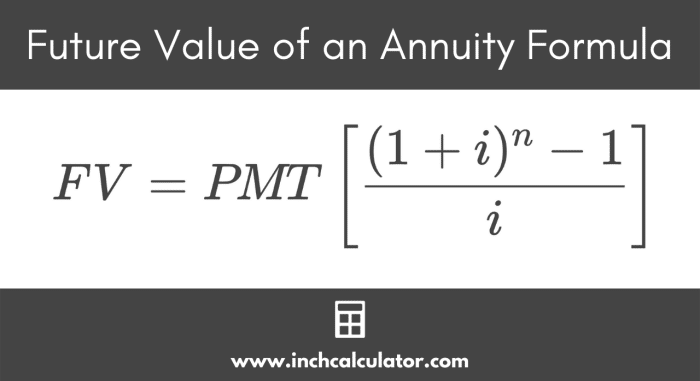

Future Value (FV) and Annuities

The future value (FV) represents the total value of an investment or a series of payments at a specific future date. In the context of annuities, Fv Annuity focuses on calculating the future value of a series of regular payments, considering the impact of compound interest.

This concept is crucial for assessing the long-term growth of savings, investments, or loan repayments.

Factors Influencing Fv Annuity Calculation

Several factors significantly impact the calculation of Fv Annuity:

- Payment Amount: The larger the payment amount, the higher the Fv Annuity.

- Interest Rate: A higher interest rate leads to a greater Fv Annuity.

- Time Period: The longer the annuity period, the higher the Fv Annuity.

- Frequency of Payments: More frequent payments (e.g., monthly vs. annually) generally result in a higher Fv Annuity due to more frequent compounding.

Calculating Fv Annuity in Excel 2024

Excel 2024 provides a powerful and convenient way to calculate Fv Annuity using its built-in functions. Here’s a step-by-step guide:

Using the FV Function

The FV function in Excel is designed specifically for calculating the future value of an investment or annuity. Its syntax is as follows:

=FV(rate, nper, pmt, [pv], [type])

- rate: The interest rate per period.

- nper: The total number of payment periods.

- pmt: The payment made each period.

- pv: The present value (optional). This represents any initial investment or loan amount. If omitted, it is assumed to be 0.

- type: (optional) Specifies when payments are due. 0 (default) for payments at the end of each period, 1 for payments at the beginning of each period.

Creating a Spreadsheet Template

To streamline Fv Annuity calculations, you can create a simple spreadsheet template:

- Label the columns: “Interest Rate,” “Number of Periods,” “Payment Amount,” “Present Value,” “Type,” and “Fv Annuity.”

- Enter the relevant data in the corresponding cells.

- In the “Fv Annuity” column, use the FV function to calculate the future value for each row:

- Copy the formula down to calculate the Fv Annuity for all rows.

=FV(A2, B2, C2, D2, E2)

Understanding the unit of an annuity is important for calculating your payments. You can find more information about annuity units in 2024 , but remember, these units can vary depending on the type of annuity and the terms of the plan.

Applications of Fv Annuity: Fv Annuity Excel 2024

Fv Annuity has wide-ranging applications in financial planning, providing valuable insights into the potential growth of savings, investments, and loan repayments.

One common question about annuities is whether the income they generate is taxable. You can find information about whether immediate annuity income is taxable in 2024 , but it’s always best to consult with a tax professional for personalized advice.

Retirement Planning

Fv Annuity calculations can help individuals determine the future value of their retirement savings, considering regular contributions and expected investment returns. This information is essential for planning a comfortable retirement and ensuring sufficient funds to meet future expenses.

Understanding how your annuity payments will be calculated is crucial. You can learn more about calculating annuity annual payment in 2024 , but remember, these calculations can vary depending on the type of annuity and the terms of the plan.

Investment Analysis

Fv Annuity can be used to compare the potential returns of different investment options. By calculating the Fv Annuity for each investment, individuals can assess which option is likely to generate the highest future value and make informed investment decisions.

Loan Calculations

Fv Annuity is crucial for understanding the total amount repaid on a loan, including principal and interest. This information is helpful for determining loan affordability and making informed borrowing decisions.

Assessing Future Value of Savings

Fv Annuity calculations can be used to assess the future value of savings or investments, considering the impact of compound interest over time. This helps individuals understand the potential growth of their savings and plan for future financial goals.

Wondering if your annuity payments will be considered earned income in 2024? That’s a common question. You can find some information about whether annuity is earned income in 2024 online, but it’s always best to check with a tax professional for personalized guidance.

Fv Annuity Variations

Fv Annuity calculations can be adapted for different types of annuities, each with its own unique characteristics and calculation method.

Looking to invest $50,000 in an annuity in 2024? There are many options available, but it’s important to do your research. You can find information about annuity with 50k in 2024 online, but it’s always best to consult with a financial advisor who can guide you through the process.

Ordinary Annuities

Ordinary annuities involve payments made at the end of each period. The Fv Annuity calculation for ordinary annuities is the most common and straightforward.

Annuities Due

Annuities due involve payments made at the beginning of each period. This results in an additional period of interest accumulation, leading to a higher Fv Annuity compared to ordinary annuities.

Annuity loans can be a way to finance your home purchase. You can find more information about annuity home loans in 2024 , but remember, these loans may have different terms and conditions compared to traditional mortgages.

Perpetuities

Perpetuities are annuities that continue indefinitely. The Fv Annuity for a perpetuity is calculated as the present value divided by the discount rate.

The 72t rule is a specific type of annuity that allows for early withdrawals. You can find more information about annuity 72t in 2024 , but remember, this type of annuity comes with specific requirements and limitations.

Factors Affecting Fv Annuity

Several factors can influence the Fv Annuity, significantly impacting the future value of an annuity.

Interest Rates

A higher interest rate leads to a greater Fv Annuity. This is because the principal amount and accumulated interest grow at a faster rate with a higher interest rate.

Time Periods

The longer the annuity period, the higher the Fv Annuity. This is because there is more time for the principal amount and accumulated interest to grow through compounding.

Fixed annuities can offer a sense of stability in uncertain times. If you’re interested in exploring the options for 4 fixed annuity in 2024 , make sure to carefully compare different plans and understand their terms and conditions.

Payment Amounts

The larger the payment amount, the higher the Fv Annuity. This is because more money is being invested or saved, leading to a greater future value.

Compounding

Compounding refers to the process of earning interest on both the principal amount and any accumulated interest. The more frequent the compounding (e.g., monthly vs. annually), the higher the Fv Annuity.

Fv Annuity in Financial Decision Making

Fv Annuity calculations play a vital role in informed financial decision making, helping individuals and organizations evaluate investment options, plan for future expenses, and determine loan affordability.

New Zealand offers a variety of annuity options. You can find more information about annuities in New Zealand in 2024 online, but it’s always best to consult with a financial advisor who can guide you through the process.

Evaluating Investment Options

Fv Annuity calculations can be used to compare the potential returns of different investment options. By calculating the Fv Annuity for each investment, individuals can assess which option is likely to generate the highest future value and make informed investment decisions.

Figuring out how much annuity you can get with $80,000 in 2024? It’s a good question! You can find some insights on how much annuity for 80000 2024 , but remember, individual situations vary, so it’s always best to consult with a financial advisor.

Planning for Future Expenses, Fv Annuity Excel 2024

Fv Annuity calculations can help individuals plan for significant future expenses, such as a down payment on a house, college tuition, or retirement. By determining the future value of their savings or investments, they can assess whether they will have sufficient funds to meet their financial goals.

Determining Loan Affordability

Fv Annuity calculations can help individuals determine the total amount repaid on a loan, including principal and interest. This information is helpful for determining loan affordability and making informed borrowing decisions.

Comparing Financial Scenarios

Fv Annuity calculations can be used to compare different financial scenarios, such as the impact of different interest rates, time periods, or payment amounts on the future value of an annuity. This information can help individuals make informed financial decisions that align with their goals and risk tolerance.

Conclusion

Mastering Fv Annuity calculations with Excel 2024 empowers you to make informed financial decisions, evaluate investment options, and plan for your future with confidence. Whether you’re a seasoned investor or just starting your financial journey, understanding the power of Fv Annuity is crucial.

This guide has provided you with the necessary tools and knowledge to embark on your journey towards achieving your financial goals.

For many, the idea of having an income stream that lasts a lifetime is appealing. You can learn more about whether an annuity is for life in 2024 , but it’s important to remember that these plans can have different features and limitations.

FAQ

What are the different types of annuities?

Annuities can be categorized as ordinary annuities, annuities due, and perpetuities. An ordinary annuity involves payments made at the end of each period, while an annuity due involves payments made at the beginning of each period. A perpetuity is an annuity that continues indefinitely.

How does compounding affect Fv Annuity calculations?

Compounding refers to the process of earning interest on both the principal amount and accumulated interest. The more frequently interest is compounded, the higher the Fv Annuity will be. This is because the interest earned in each period is added to the principal, generating even more interest in the following periods.