Pv Annuity Example 2024: Understanding Present Value delves into the crucial concept of discounting future cash flows to their present value, a fundamental tool for financial planning and investment decisions. Imagine you’re offered a choice: receive $10,000 today or $10,000 in five years.

Annuity payments can be used for various purposes, including financing a home. Annuity Home Loan 2024 might discuss how annuity payments can be utilized for home loans and the potential benefits.

Which would you choose? The answer likely lies in the time value of money, a concept that underscores the importance of understanding present value annuities.

Annuity is a powerful financial tool, but it’s not always the same as a pension plan. Annuity Is Pension Plan 2024 can help you understand the key differences and whether an annuity might be a suitable option for you.

This guide explores the mechanics of PV annuities, including the key factors that influence their calculation, the different types of annuities, and real-world applications in areas such as retirement planning, mortgage calculations, and loan analysis. We’ll also provide practical resources and tools to help you calculate PV annuities effectively.

Contents List

What is a PV Annuity?

A PV Annuity, or Present Value Annuity, is a financial concept that helps you understand the current worth of a series of future payments. It’s essentially a way to calculate the value today of a stream of money you’ll receive in the future, taking into account the time value of money.

Think of it as the “discount” you apply to future payments to reflect the fact that money today is worth more than money tomorrow.

Discounting Future Cash Flows to Present Value

The core idea behind PV Annuity is discounting future cash flows to their present value. This means that you’re taking into account the fact that money can earn interest over time. If you receive $100 today and invest it at a 5% interest rate, it will be worth $105 next year.

Regular statements are essential for keeping track of your annuity. Annuity Statement Is 2024 might explain what information is typically included in an annuity statement and how to interpret it.

Conversely, if you’re promised $100 in one year, its present value is less than $100 because you could invest money today and have more than $100 in a year.

Index annuities are a popular type, offering potential growth linked to a market index. Index Annuity Is What 2024 can help you understand the mechanics of index annuities and how they work.

Real-World Example

Imagine you win a lottery and have the option of receiving a lump sum payment of $100,000 today or receiving $10,000 per year for the next 15 years. To make an informed decision, you need to calculate the present value of the annuity (the stream of $10,000 payments).

A large sum of money can be a good starting point for an annuity. Annuity 3 Million 2024 might shed light on how a substantial amount can translate into a steady income stream.

If the present value of the annuity is greater than $100,000, it would be more beneficial to choose the annuity option.

Planning for the future together? A joint life option could be a great fit. Annuity Joint Life Option 2024 ensures payments continue even if one spouse passes away. This provides peace of mind and financial stability for the surviving partner.

Factors Affecting PV Annuity Calculation

The calculation of a PV Annuity is influenced by several key factors that determine the present value of the future cash flows. Understanding these factors is crucial for making accurate financial decisions.

Interest Rates

Interest rates play a significant role in PV Annuity calculations. Higher interest rates mean a higher discount rate, which reduces the present value of future cash flows. This is because if interest rates are high, you can earn more by investing your money today, making future payments less valuable in today’s terms.

Annuity Period (Number of Payments), Pv Annuity Example 2024

The number of payments in an annuity also affects the present value. A longer annuity period generally results in a higher present value because you’re receiving more payments.

Want to estimate your potential annuity payments? An online calculator can help. Annuity Calculator By Age 2024 can provide personalized estimates based on your age and other factors.

PV Annuity Formula and Calculation

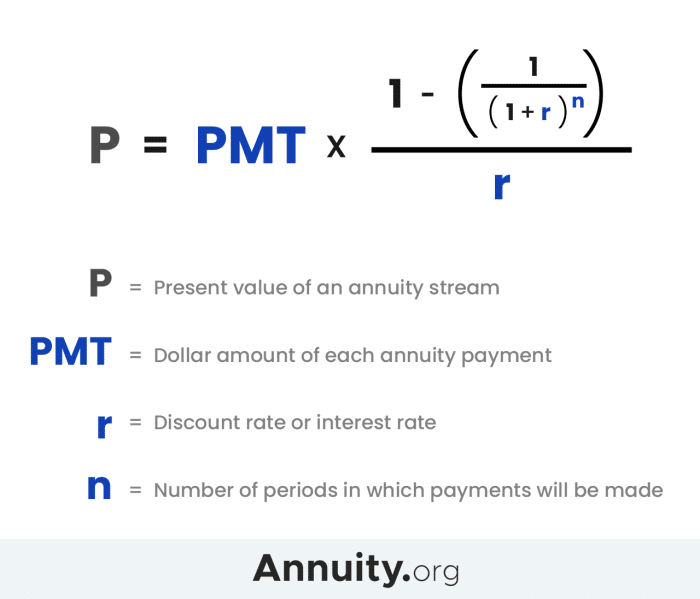

The PV Annuity formula is used to calculate the present value of a stream of future payments. The formula takes into account the payment amount, the interest rate, and the number of payments.

Retirement planning often involves transitioning funds from a 401k to an annuity. Annuity 401k Rollover 2024 might provide guidance on how to roll over your 401k into an annuity.

PV Annuity Formula

PV = PMT- [1 – (1 + r)^-n] / r

Where:

- PV = Present Value of the Annuity

- PMT = Payment Amount

- r = Interest Rate (discount rate)

- n = Number of Payments

Step-by-Step Calculation

Let’s say you’re promised $5,000 per year for the next 10 years, and the interest rate is 4%. Here’s how to calculate the PV Annuity:

- Identify the variables:PMT = $5,000, r = 0.04, n = 10

- Plug the values into the formula:PV = $5,000

- [1

- (1 + 0.04)^-10] / 0.04

- Calculate:PV = $5,000

- [1

- (1.04)^-10] / 0.04 = $39,196.41

Therefore, the present value of this annuity is $39,196.41.

Some annuities allow for a share of the investment growth to be distributed to the annuitant. X Share Annuity 2024 might offer a way to potentially increase your annuity income based on market performance.

PV Annuity for Different Interest Rates and Periods

| Interest Rate (r) | Number of Payments (n) | PV Annuity |

|---|---|---|

| 2% | 5 | $23,601.29 |

| 4% | 5 | $22,117.42 |

| 6% | 5 | $20,673.33 |

| 2% | 10 | $44,502.96 |

| 4% | 10 | $39,196.41 |

| 6% | 10 | $34,351.91 |

Types of PV Annuities

PV Annuities can be categorized based on the frequency of payments. Understanding these different types is important because they affect the calculation and application of the present value.

Ordinary Annuity

An ordinary annuity is a series of equal payments made at the end of each period. This is the most common type of annuity. For example, a mortgage payment is typically an ordinary annuity, where you make equal payments at the end of each month.

Annuity options are diverse, catering to different needs and ages. For instance, if you’re a 60-year-old man looking for a reliable income stream, you might want to explore Annuity 60 Year Old Man 2024. These plans can provide a guaranteed monthly payment for life, offering financial security in your golden years.

Annuity Due

An annuity due is a series of equal payments made at the beginning of each period. This means that the first payment is made immediately. For example, a lease payment is often structured as an annuity due, where you pay the first month’s rent upfront.

Applications of PV Annuity in 2024: Pv Annuity Example 2024

PV Annuity is a versatile tool used in various financial planning and investment decisions. Its applications extend across personal finance, business, and investment analysis.

Tax implications are important to consider when investing in an annuity. Is Annuity Income Taxable In India 2024 might address the taxability of annuity income in India, offering insights into relevant tax regulations.

Retirement Planning

PV Annuity is crucial in retirement planning to determine the present value of future retirement income streams. This helps individuals understand how much they need to save today to achieve their desired retirement lifestyle.

Mortgage Calculations

When applying for a mortgage, lenders use PV Annuity to calculate the present value of your future mortgage payments. This helps them determine the loan amount you can afford based on your income and repayment capacity.

Loan Analysis

PV Annuity is also used in loan analysis to evaluate the present value of loan repayments. This helps borrowers compare different loan options and make informed decisions based on the total cost of borrowing.

Annuity is a financial product, but it can be confusing. Annuity What Is It Definition 2024 provides a straightforward explanation of what an annuity is and how it works.

Hypothetical Scenario

Let’s say you’re considering two investment options: a lump sum investment that promises a 6% annual return for 10 years or an annuity that pays $5,000 per year for 10 years with a 4% annual return. Using PV Annuity, you can calculate the present value of each option to determine which one is more beneficial.

Investment Option 1: Lump Sum Investment

Present Value (PV) = Future Value (FV) / (1 + r)^n

PV = $5,000 / (1 + 0.06)^10 = $2,790.82

Investment Option 2: Annuity

Annuity policies often have specific numbers associated with them. Understanding these numbers can be crucial. Annuity Number Lic 2024 might provide insight into the unique identifier or policy number for a particular annuity contract.

PV = PMT – [1 – (1 + r)^-n] / r

PV = $5,000 – [1 – (1 + 0.04)^-10] / 0.04 = $39,196.41

While annuities are often used for retirement income, they can sometimes be tax-advantaged. Is Annuity Exempt From Tax 2024 might explore whether certain annuity types offer tax exemptions or advantages.

Based on the calculations, the annuity option has a significantly higher present value, making it a more favorable investment choice in this scenario.

One of the most appealing aspects of annuities is their potential to provide income for life. Is Annuity For Life 2024 can help you understand the various annuity types and their longevity guarantees.

Tools and Resources for PV Annuity Calculation

There are numerous online calculators and software tools available to help you calculate PV Annuities. These tools can simplify the process and ensure accuracy.

Online Calculators

- Investopedia:Provides a user-friendly PV Annuity calculator that allows you to input different variables and get instant results.

- Calculator.net:Offers a comprehensive calculator that includes various annuity options, including ordinary annuities and annuities due.

- Financial Calculators:Many financial websites and calculators offer PV Annuity calculations, providing a convenient way to estimate present values.

Software Tools

- Microsoft Excel:Excel has built-in financial functions, including PV, which can be used to calculate PV Annuities. You can use the PV function with the appropriate variables.

- Financial Planning Software:Several financial planning software programs, such as Quicken and Mint, offer PV Annuity calculations as part of their budgeting and investment tools.

Using a Specific Tool

To use a PV Annuity calculator, you typically need to input the following information:

- Payment Amount (PMT)

- Interest Rate (r)

- Number of Payments (n)

- Payment Frequency (e.g., monthly, annually)

Once you’ve entered the necessary data, the calculator will automatically calculate the present value of the annuity.

Conclusion

Understanding PV annuities empowers you to make informed financial decisions, whether you’re planning for retirement, managing debt, or investing for the future. By grasping the concept of discounting future cash flows to their present value, you gain a valuable tool for evaluating investment opportunities, assessing the true cost of borrowing, and making strategic financial choices that align with your goals.

Question Bank

What is the difference between an ordinary annuity and an annuity due?

An ordinary annuity makes payments at the end of each period, while an annuity due makes payments at the beginning of each period. This difference in timing affects the present value calculation.

How can I use PV annuity calculations in my personal finances?

You can use PV annuity calculations to evaluate the true cost of a loan, compare different investment options, and determine how much you need to save for retirement.

Are there any online tools that can help me calculate PV annuities?

Yes, several online calculators and software tools are available to calculate PV annuities. These tools can save you time and effort, allowing you to quickly determine the present value of an annuity based on your specific circumstances.