Calculate Annuity Example 2024: A Step-by-Step Guide is a comprehensive guide that will walk you through the process of calculating the future value of an annuity. We will explore the fundamentals of annuities, delve into the formula used for calculation, and provide a practical example to illustrate the process.

You’ll learn how to apply this knowledge to your own financial planning, whether it’s for retirement savings, investment strategies, or income generation.

If you’re considering an annuity, it’s a good idea to use an annuity calculator to estimate your potential payments. BMO offers a helpful annuity calculator that can help you compare different annuity options.

Understanding annuities is crucial for anyone looking to plan for their financial future. Annuities are a type of financial product that provides a stream of regular payments over a set period of time. They can be used for various purposes, including retirement savings, investment strategies, and income generation.

This guide will provide you with the knowledge and tools you need to make informed decisions about annuities.

Contents List

Understanding Annuities: Calculate Annuity Example 2024

An annuity is a financial product that provides a series of regular payments over a set period of time. It’s like a stream of income that you can rely on, often used for retirement planning or to cover expenses. Let’s break down the key components of an annuity and explore its different types.

Components of an Annuity

- Principal:The initial amount of money you invest in the annuity. This is the starting point for your annuity.

- Interest Rate:The rate of return you earn on your principal. This rate can be fixed or variable, depending on the type of annuity.

- Payment Period:The frequency of payments you receive. This could be monthly, quarterly, annually, or based on a different schedule.

- Term:The duration of the annuity, meaning the length of time you’ll receive payments.

Types of Annuities

There are various types of annuities, each with unique features and benefits. Here’s a breakdown of some common ones:

- Ordinary Annuity:Payments are made at the end of each period. This is the most common type of annuity.

- Annuity Due:Payments are made at the beginning of each period. This type often provides slightly higher returns due to the earlier payment timing.

- Fixed Annuity:Offers a guaranteed interest rate for a set period, providing predictable income payments. This type is ideal for those seeking stability and security.

- Variable Annuity:The interest rate and payments fluctuate based on the performance of the underlying investments. This type offers the potential for higher returns but comes with greater risk.

Real-World Example

Imagine you’re planning for retirement. You decide to invest in a fixed annuity with a principal of $100,000, a 3% annual interest rate, and a term of 20 years. This annuity will provide you with a steady stream of income for your retirement years, giving you financial security and peace of mind.

The annuity market is constantly evolving, so it’s important to stay up-to-date on the latest trends. You can find news and information about annuities at this link. This can help you make informed decisions about your annuity investments.

Annuity Calculation Formula

To calculate the future value of an annuity, you can use a formula that considers the principal, interest rate, payment period, and term. This formula helps you understand the potential growth of your annuity over time.

Future Value of an Annuity Formula

FV = P

Annuity payments can be structured in various ways. For example, you might be interested in an annuity that pays out $2,000 per month for a certain period of time. Or, you might want an annuity that provides a guaranteed return of 4% per year.

- (((1 + r)^n

- 1) / r)

Where:

- FV = Future Value of the annuity

- P = Principal amount

- r = Interest rate per period

- n = Number of periods

Step-by-Step Guide

- Determine the variables:Identify the principal, interest rate, payment period, and term of the annuity.

- Calculate the interest rate per period:Divide the annual interest rate by the number of periods per year.

- Calculate the number of periods:Multiply the term of the annuity by the number of periods per year.

- Plug the values into the formula:Substitute the calculated values into the formula for FV.

- Solve the equation:Calculate the future value of the annuity.

Annuity Calculation Example (2024)

Let’s say you invest $50,000 in an ordinary annuity with a 4% annual interest rate, compounded monthly. You plan to make monthly payments for 10 years.

Scenario:

- Principal (P) = $50,000

- Interest rate (r) = 4% per year = 0.04/12 = 0.00333 per month

- Payment period = Monthly

- Term = 10 years = 10 – 12 = 120 months

Calculation:

FV = 50000

Annuity products can vary widely. For example, you might be interested in a X-share annuity , which allows you to invest in a specific set of stocks or bonds. It’s crucial to understand the different types of annuities available and choose the one that aligns with your financial goals and risk tolerance.

- (((1 + 0.00333)^120

- 1) / 0.00333)

FV ≈ $73,465.75

If you’re living in the UK, you might be interested in learning about the annuity options available to you. You can find more information about UK annuities at this link.

Therefore, the future value of this annuity after 10 years would be approximately $73,465.75.

One of the main advantages of annuities is that they can provide a guaranteed income stream for life. But it’s important to note that annuities are not always tax-free. It’s worth exploring whether your annuity payments will be subject to taxes.

You can learn more about the tax implications of annuities at this link.

Factors Affecting Annuity Value

Several factors influence the future value of an annuity. Understanding these factors can help you make informed decisions about your annuity investments.

In simple terms, an annuity is a financial product that provides a series of payments over a period of time. You can find a detailed explanation of annuities at this link. Understanding the basics of annuities can help you make informed decisions about your financial future.

Interest Rates

Higher interest rates generally lead to a higher future value of an annuity. This is because your principal earns more interest over time. Conversely, lower interest rates result in a lower future value.

Payment Period

The frequency of payments also impacts the future value. More frequent payments, such as monthly payments, typically lead to higher future values compared to less frequent payments, such as annual payments. This is due to the compounding effect of interest.

Term of the Annuity, Calculate Annuity Example 2024

A longer term for the annuity generally results in a higher future value. This is because your principal has more time to grow with interest. The longer the term, the greater the potential for compounding and a higher final value.

When it comes to annuities, there are many factors to consider, such as the type of annuity, the interest rate, and the payment schedule. If you’re looking for an annuity that provides a guaranteed income stream, you might be interested in a variable annuity.

But if you’re looking for an annuity that allows you to customize your payments, you might consider a fixed annuity.

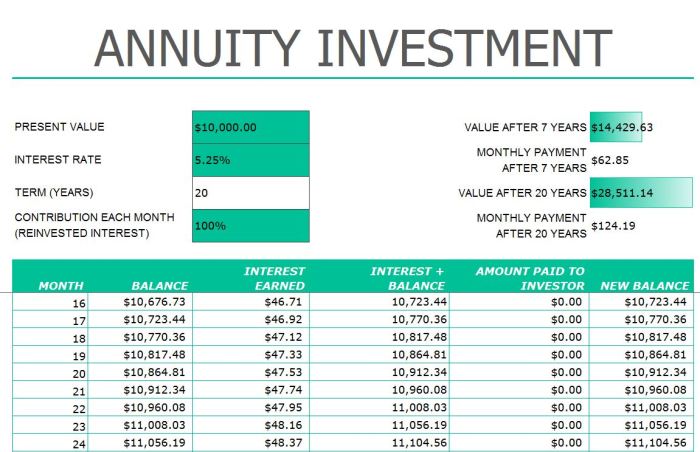

Annuity Calculator Tools

Online annuity calculators can be incredibly helpful for estimating the future value of an annuity. These tools automate the calculation process, saving you time and effort. They also provide a clear visualization of how your annuity might grow over time.

List of Online Annuity Calculators

- Bankrate:[https://www.bankrate.com/calculators/retirement/annuity-calculator.aspx](https://www.bankrate.com/calculators/retirement/annuity-calculator.aspx)

- Investopedia:[https://www.investopedia.com/calculator/annuity-calculator.aspx](https://www.investopedia.com/calculator/annuity-calculator.aspx)

- Calculator.net:[https://www.calculator.net/annuity-calculator.html](https://www.calculator.net/annuity-calculator.html)

Features and Benefits

- Ease of use:Annuity calculators are designed to be user-friendly, with simple interfaces and clear instructions.

- Accuracy:These calculators utilize accurate formulas to provide reliable estimates of future values.

- Customization:Most calculators allow you to adjust variables like the principal, interest rate, payment period, and term to suit your specific scenario.

- Visualization:Many calculators provide charts and graphs to illustrate the growth of your annuity over time, making it easier to understand its potential.

Using an Annuity Calculator

To use an annuity calculator, simply input the required information, such as the principal, interest rate, payment period, and term. The calculator will then calculate the future value of the annuity based on the provided data. You can experiment with different variables to see how they affect the outcome.

Annuity Applications

Annuities have various applications in personal finance, serving as valuable tools for achieving financial goals and securing your future.

Retirement Planning

Annuities are a popular choice for retirement planning, providing a steady stream of income during your golden years. By investing in an annuity, you can ensure a reliable source of funds to cover your living expenses, travel, and other retirement activities.

Investment Strategies

Annuities can also be incorporated into investment strategies. They can provide a guaranteed return on your investment, offering stability and protection against market fluctuations. Annuities can serve as a cornerstone of a diversified investment portfolio.

Annuity payments can be structured in various ways. For example, you might be interested in an annuity that allows you to withdraw a certain percentage of your principal each year. You can find more information about 72t annuities at this link.

Income Generation

Annuities can be used to generate income, particularly for individuals who are retired or seeking supplemental income. By drawing on the principal and accrued interest, you can create a regular stream of payments to meet your financial needs.

Annuity calculations can be tricky, but there are tools available to help. For example, you can use Excel to calculate the present value of an annuity due. This can be helpful when determining the amount of money you need to invest in an annuity to reach your financial goals.

Real-Life Examples

- Retirement Income:A retiree may purchase a fixed annuity to receive monthly payments for life, ensuring a consistent income stream to cover their living expenses.

- Investment Portfolio Diversification:An investor may allocate a portion of their portfolio to a variable annuity, seeking potential growth while diversifying their investments.

- Estate Planning:An individual may use an annuity to provide income for their beneficiaries after their passing, ensuring their loved ones are financially supported.

Last Recap

By understanding the fundamentals of annuities, the formula used for calculation, and the factors that affect annuity value, you can make informed decisions about your financial future. Whether you’re looking to save for retirement, invest your savings, or generate income, annuities can be a valuable tool.

Are you thinking about purchasing an annuity in 2024? It’s important to understand the different types of annuities available, such as owner annuities , contingent annuities , and deferred annuities. It’s also essential to consider the pros and cons of each type to determine which one is best for your individual needs.

Use the information and resources provided in this guide to explore the potential of annuities and how they can help you achieve your financial goals.

Quick FAQs

What are the benefits of using an annuity?

Annuities offer a guaranteed stream of income, which can be beneficial for retirement planning or income generation. They also provide protection against market volatility, as the payments are not subject to fluctuations in stock prices or other investments.

What are the risks associated with annuities?

Annuities can be complex financial products, and there are certain risks associated with them. For example, some annuities may have high fees or surrender charges, which can impact your returns. It’s important to carefully research and understand the terms of any annuity contract before investing.

How do I choose the right annuity for my needs?

The best annuity for you will depend on your individual financial goals, risk tolerance, and time horizon. It’s important to consult with a financial advisor to discuss your specific needs and determine which type of annuity is right for you.