How Calculate Annuity 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Annuity calculations are a fundamental aspect of financial planning, particularly for retirement and long-term financial goals.

Looking for information on a specific type of annuity? This article focuses on a particular annuity, providing detailed insights into its features and potential benefits.

This guide delves into the world of annuities, providing a comprehensive understanding of their types, calculation methods, and applications. We’ll explore how to calculate the present and future value of annuities, taking into account factors such as interest rates, time periods, and payment frequencies.

Annuity sounds complicated, but it’s not as daunting as it seems. This guide provides a straightforward explanation of how annuities work, their benefits, and different types available.

Whether you’re planning for retirement, funding education expenses, or seeking a steady stream of income, understanding annuity calculations is essential.

By grasping the nuances of annuity calculations, individuals can make informed decisions regarding their financial future. This guide will empower you with the knowledge to navigate the complexities of annuities and leverage their potential to achieve your financial aspirations.

Annuity jokes? They do exist! Check out this collection for a lighthearted take on the world of annuities.

Contents List

Understanding Annuities

An annuity is a financial product that provides a series of regular payments over a specified period of time. These payments can be used to provide a steady stream of income, especially during retirement, or to cover expenses like education or long-term care.

For those seeking a loan with regular payments, an annuity loan might be an option. This calculator can help you understand the structure of an annuity loan and estimate your monthly payments.

Annuities are often purchased with a lump sum of money, which is then invested and used to generate the regular payments. The payments can be fixed or variable, depending on the type of annuity chosen.

Deciding if an annuity is the right choice for you requires careful consideration. This article explores the pros and cons of annuities, helping you weigh if they align with your financial goals.

Types of Annuities

Annuities come in various forms, each designed to meet specific financial needs. Here’s a breakdown of some common types:

- Fixed Annuities:These provide guaranteed payments for a set period, regardless of market fluctuations. The interest rate is fixed, ensuring predictable income.

- Variable Annuities:The payments fluctuate based on the performance of the underlying investments. They offer the potential for higher returns but also carry greater risk.

- Immediate Annuities:Payments begin immediately after the purchase of the annuity. This is suitable for those seeking immediate income.

- Deferred Annuities:Payments are delayed until a future date, allowing for potential growth of the invested funds.

Key Features of Annuities

- Payment Structure:Annuities can offer various payment options, including monthly, quarterly, or annually. The payment structure can be customized based on individual needs.

- Interest Rates:The interest rate applied to an annuity determines the growth of the invested funds and the amount of the regular payments. Interest rates can be fixed or variable, depending on the annuity type.

- Guarantees:Some annuities offer guarantees, such as a minimum return or a death benefit, providing additional security for the investment.

Annuity Calculation Methods

Calculating the present or future value of an annuity involves considering factors like interest rates, time period, and payment frequency. These calculations help determine the amount of money needed to purchase an annuity or the future value of an annuity over time.

Canadians looking to explore annuities have a handy tool at their disposal. An annuity calculator designed for Canada can help you estimate potential payments based on your individual circumstances.

Calculating the Present Value of an Annuity

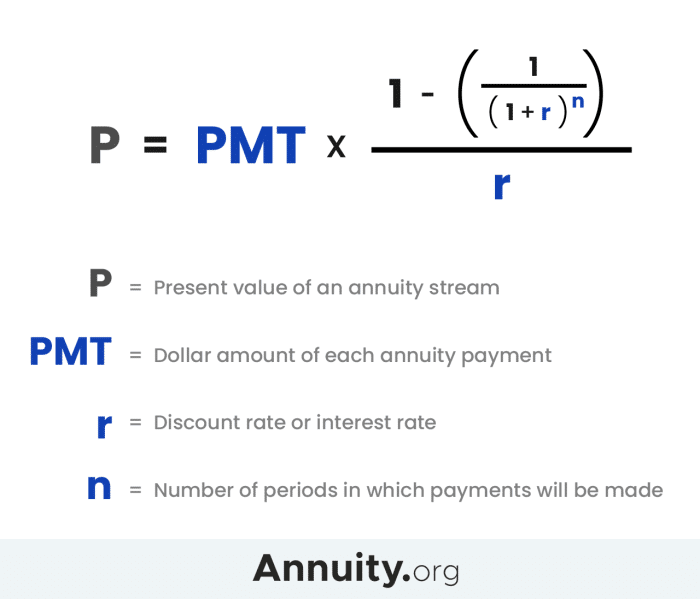

The present value of an annuity is the lump sum amount needed today to purchase an annuity that will provide a series of future payments. The formula for calculating the present value of an annuity is:

PV = PMT

The tax implications of annuities can be complex. This article addresses the specific question of whether annuity payments linked to life insurance are taxable, providing clarity on this aspect.

- [1

- (1 + r)^-n] / r

Where:

- PV = Present Value

- PMT = Payment Amount

- r = Interest Rate per Period

- n = Number of Periods

Calculating the Future Value of an Annuity

The future value of an annuity is the total value of the annuity at a future point in time, considering the growth of the invested funds. The formula for calculating the future value of an annuity is:

FV = PMT

Annuity payments can be structured in different ways. Deferred annuities offer flexibility, allowing you to delay receiving payments until a later date, potentially benefiting from tax-deferred growth.

- [(1 + r)^n

- 1] / r

Where:

- FV = Future Value

- PMT = Payment Amount

- r = Interest Rate per Period

- n = Number of Periods

Factors Influencing Annuity Calculations

- Interest Rates:Higher interest rates generally result in higher future values and lower present values.

- Time Period:The longer the time period, the greater the future value and the lower the present value.

- Payment Frequency:More frequent payments generally lead to higher future values and lower present values.

Annuity Applications

Annuities can serve various financial purposes, catering to different life stages and goals.

Wondering if your annuity income is taxable in 2024? It’s a common question, and the answer depends on several factors. This article breaks down the specifics, so you can understand how taxes impact your annuity payments.

Retirement Planning, How Calculate Annuity 2024

Annuities are a popular tool for retirement planning, providing a predictable income stream during retirement years. They can supplement other retirement savings, such as 401(k)s or IRAs, to ensure a comfortable lifestyle.

Income Generation During Retirement

Annuities can be used to generate a steady income during retirement, providing financial security and peace of mind. This is especially helpful for individuals who want to ensure a consistent source of income regardless of market fluctuations.

Annuity Gator is a well-known provider in the annuity market. This article delves into what makes Annuity Gator stand out, exploring their offerings and services.

Other Applications

- Funding Education Expenses:Deferred annuities can be used to save for future education expenses, allowing the funds to grow tax-deferred.

- Providing Long-Term Care:Annuities can provide a source of income for long-term care expenses, helping individuals maintain their quality of life in their later years.

Factors to Consider When Choosing an Annuity

Selecting the right annuity requires careful consideration of your individual financial goals and risk tolerance.

For a comprehensive overview of annuities, this general article covers the basics, different types, and important considerations when choosing an annuity.

Financial Goals and Risk Tolerance

It’s essential to assess your financial goals and risk tolerance before choosing an annuity. Consider factors like your desired income level, time horizon, and investment objectives.

Wondering how an annuity with a lump sum of $750,000 might work? This article explores the possibilities and factors to consider when working with a large annuity amount.

Comparing Annuity Options

When comparing different annuity options, consider the following factors:

- Features:Compare the features of different annuities, such as payment structure, interest rates, and guarantees.

- Fees:Annuities often come with fees, such as surrender charges or administrative fees. Compare the fees associated with different annuities.

- Guarantees:Some annuities offer guarantees, such as a minimum return or a death benefit. Evaluate the guarantees offered by different annuities.

Selecting the Right Annuity Provider

Choose an annuity provider with a strong reputation for financial stability and customer service. Research the provider’s track record, financial strength, and customer reviews before making a decision.

Understanding how annuities work in real-life scenarios can be illuminating. This article provides practical examples of how annuities are used in everyday situations.

Real-World Examples

Retirement Planning Scenario

Imagine a 65-year-old individual retiring with a lump sum of $500,000 in savings. They want to use this money to generate a steady income during retirement. They purchase a fixed annuity that guarantees a 4% annual return and provides monthly payments for 20 years.

While annuities are primarily for retirement income, some can offer health insurance benefits. This article discusses how annuities can be linked to health insurance, providing additional coverage during retirement.

Using the annuity calculation formula, we can determine that the individual will receive approximately $2,100 per month in retirement income. This predictable income stream helps ensure financial security during their retirement years.

Funding Education Expenses

A young couple is saving for their child’s college education. They decide to purchase a deferred annuity with a lump sum of $20,000. The annuity offers a 5% annual return and allows them to defer payments for 18 years until their child starts college.

Over time, the annuity grows to a substantial amount, providing a significant contribution towards their child’s education expenses.

Impact of Interest Rates on Future Value

| Interest Rate | Future Value after 10 Years (Monthly Payments of $100) |

|---|---|

| 2% | $12,845 |

| 3% | $13,841 |

| 4% | $14,888 |

| 5% | $16,006 |

This table illustrates the impact of different interest rates on the future value of an annuity. As the interest rate increases, the future value also increases, demonstrating the importance of choosing an annuity with a favorable interest rate.

Planning your annuity strategy? BMO’s annuity calculator can be a helpful tool for estimating potential payments and understanding how your chosen annuity might perform.

Epilogue: How Calculate Annuity 2024

Understanding annuity calculations is crucial for making informed financial decisions, especially when planning for retirement or other long-term goals. By carefully considering your financial goals, risk tolerance, and the various types of annuities available, you can choose the option that best aligns with your needs and aspirations.

Remember, seeking professional advice from a financial advisor can provide valuable guidance in navigating the intricacies of annuity calculations and selecting the right annuity for your unique circumstances.

Query Resolution

What are the tax implications of annuities?

The tax implications of annuities vary depending on the type of annuity and how it is structured. It’s essential to consult with a tax professional to understand the specific tax treatment of your annuity.

Are there any fees associated with annuities?

Yes, annuities often come with fees, such as administrative fees, surrender charges, and mortality and expense charges. It’s crucial to carefully review the fee structure of any annuity you are considering.

How do I choose the right annuity provider?

When choosing an annuity provider, consider their financial stability, reputation, and the fees associated with their products. It’s also important to compare the features and guarantees offered by different providers.