How Much Will An Annuity Pay Calculator 2024? This powerful tool can help you understand how much guaranteed income you could receive in retirement, but it’s important to know how these calculators work and what factors influence the results. Annuity payouts depend on your age, gender, investment amount, and the current interest rate environment.

The Bengali translation for “annuity” is “বৃত্তি” (briti). This term refers to a regular income stream, often used in the context of pensions and retirement planning. To learn more about annuities in Bengali, you can visit this link: Annuity Is Bengali Meaning 2024.

Understanding the intricacies of annuity calculators is crucial for making informed decisions about your retirement planning.

Annuity investments, like any financial product, come with inherent risks. However, annuities are generally considered safe investments due to the guarantees offered by insurance companies. You can learn more about the safety of annuities by visiting this link: Is Annuity Safe 2024.

Annuities can be a valuable tool for retirement planning, providing a steady stream of income and protecting against longevity risk. However, they are not without their drawbacks, and it’s essential to understand the different types of annuities available, their potential benefits and drawbacks, and the factors that can influence their payouts.

While annuities can be a valuable tool for retirement planning, they also come with certain drawbacks. It’s essential to weigh the pros and cons before investing in an annuity. To learn more about the potential downsides of annuities, you can visit this link: Why An Annuity Is Bad 2024.

This guide will delve into the world of annuities and provide you with the knowledge you need to make informed decisions about your retirement savings.

The term “6 Annuity” likely refers to a specific type of annuity product, but it’s not clear without more context. It could refer to a fixed annuity with a guaranteed return of 6%, or a variable annuity tied to a specific investment strategy.

To learn more about “6 Annuity,” you can visit this link: 6 Annuity 2024.

Contents List

Understanding Annuities: How Much Will An Annuity Pay Calculator 2024

Annuities are financial products that provide a stream of regular payments, either for a fixed period or for the rest of your life. They are often used as a way to generate income during retirement, but they can also be used for other purposes, such as supplementing your income during your working years or providing a guaranteed income stream for your beneficiaries.

An index annuity is a type of annuity that links its returns to the performance of a specific market index, such as the S&P 500. This can offer the potential for higher returns than traditional fixed annuities, but it also comes with more risk.

To learn more about index annuities, you can visit this link: Index Annuity Is What 2024.

Types of Annuities

There are many different types of annuities, each with its own unique features and benefits. Some of the most common types include:

- Fixed Annuities:These annuities guarantee a fixed rate of return on your investment, which means that you know exactly how much income you will receive each year. Fixed annuities are a good option for those who want to protect their principal and receive a predictable income stream.

When deciding on an annuity, the life expectancy of the individual receiving the payments is a crucial factor. This is because the longer the recipient lives, the more payments they will receive. You can learn more about how life expectancy impacts annuity payouts here: When Annuity Is Written Whose Life Expectancy 2024.

- Variable Annuities:These annuities invest your money in a variety of sub-accounts, such as stocks, bonds, and mutual funds. The amount of income you receive each year will depend on the performance of the sub-accounts. Variable annuities offer the potential for higher returns than fixed annuities, but they also come with more risk.

A deferred annuity is a type of annuity where payments are delayed until a future date. This can be beneficial for those who want to grow their investment before receiving payments. Learn more about calculating deferred annuities here: Calculating A Deferred Annuity 2024.

- Immediate Annuities:These annuities begin making payments immediately after you purchase them. They are a good option for those who need an immediate income stream, such as retirees who are ready to start drawing on their savings.

- Deferred Annuities:These annuities begin making payments at a later date, such as when you reach retirement age. Deferred annuities allow you to grow your investment over time and benefit from tax-deferred growth.

Benefits of Annuities, How Much Will An Annuity Pay Calculator 2024

Annuities offer a number of benefits, including:

- Guaranteed Income:Fixed annuities provide a guaranteed income stream for life, which can help you plan for your future and ensure that you have a steady source of income in retirement.

- Tax Advantages:Annuity payments are generally taxed as ordinary income, but the growth of your investment is tax-deferred. This means that you won’t have to pay taxes on your investment earnings until you begin receiving payments.

- Protection Against Longevity Risk:Annuities can help you protect yourself against the risk of outliving your savings. If you live longer than expected, an annuity will continue to provide you with income for the rest of your life.

Drawbacks of Annuities

While annuities offer many benefits, they also have some potential drawbacks, including:

- Limited Liquidity:Annuities are generally illiquid, which means that it can be difficult to access your money before you start receiving payments. If you need to withdraw your money early, you may be subject to penalties.

- Potential for Fees:Annuities can come with a variety of fees, such as surrender charges, administrative fees, and mortality and expense charges. These fees can reduce your overall returns.

- Risk of Outliving Your Annuity Payments:If you choose an annuity with a fixed payment period, you may run the risk of outliving your payments. This is especially true if you live longer than expected.

How Annuity Payout Calculators Work

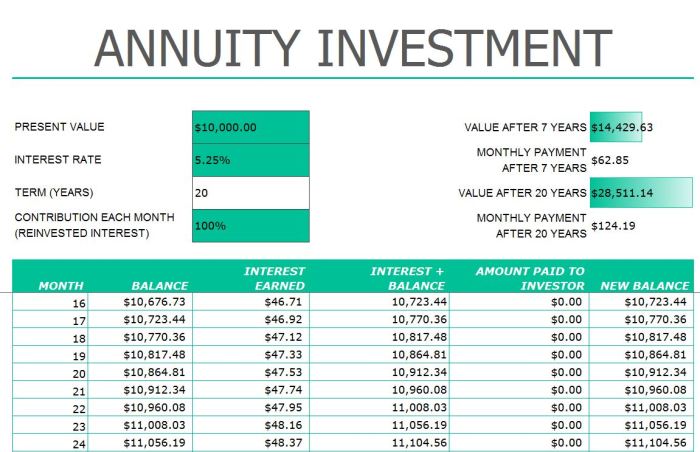

Annuity payout calculators are online tools that can help you estimate how much income you will receive from an annuity. These calculators take into account a number of factors, including your age, gender, interest rates, and the amount of your investment.

The present value of an annuity is the current value of future payments, discounted to reflect the time value of money. Understanding the present value of an annuity is essential for comparing different investment options. You can learn more about the present value of annuities by visiting this link: Annuity Is Present Value 2024.

Factors Considered by Annuity Payout Calculators

Annuity payout calculators typically consider the following factors:

- Age:Your age is a key factor in determining your annuity payout, as it influences your life expectancy. The older you are, the lower your annuity payout will generally be.

- Gender:Women typically have longer life expectancies than men, so they may receive lower annuity payouts than men of the same age.

- Interest Rates:Interest rates play a significant role in annuity payouts. Higher interest rates generally result in higher payouts, while lower interest rates result in lower payouts.

- Investment Amount:The amount of money you invest in an annuity will directly impact your payout. The more you invest, the higher your payout will be.

Variations in Projected Payouts

Different annuity payout calculators may use different formulas and assumptions, which can lead to variations in projected payouts. It’s important to compare results from multiple calculators to get a range of potential payouts.

An annuity due is a type of annuity where payments are made at the beginning of each period, rather than at the end. This can result in slightly higher overall returns due to the compounding effect. To learn more about calculating annuity due, you can visit this link: Calculating An Annuity Due 2024.

Using an Annuity Payout Calculator

Using an annuity payout calculator is a straightforward process. Here are the steps:

- Enter your personal information:This includes your age, gender, and investment amount.

- Select the type of annuity:Choose the type of annuity you are interested in, such as a fixed annuity or a variable annuity.

- Specify the payout options:Determine how you want to receive your payments, such as monthly, quarterly, or annually.

- Review the projected payout:The calculator will display your estimated monthly or annual payout based on the information you provided.

Factors Influencing Annuity Payouts in 2024

Several factors can influence annuity payouts in 2024, including interest rates, tax laws, and economic conditions.

The annuity market is constantly evolving, with new products and regulations emerging. Staying informed about the latest annuity news can help you make informed decisions. To stay up-to-date on annuity news, you can visit this link: Annuity News 2024.

Interest Rate Environment

Interest rates are a key factor in determining annuity payouts. When interest rates rise, annuity payouts tend to increase, as insurance companies can earn more on their investments. Conversely, when interest rates fall, annuity payouts tend to decrease. The current interest rate environment is expected to remain relatively low in 2024, which could potentially limit annuity payouts.

The term “annuity unit” refers to a unit of measurement used to calculate annuity payments. It represents a specific portion of the initial investment, and its value can fluctuate over time. You can learn more about annuity units by visiting this link: Annuity Unit Is 2024.

Tax Laws and Regulations

Changes in tax laws or regulations could also impact annuity payouts. For example, changes to the tax treatment of annuity income or the deductibility of annuity premiums could affect the overall return on your investment. It’s important to stay informed about any potential changes in tax laws that could affect your annuity.

Annuity calculators are useful tools for estimating future payments based on various factors, such as the initial investment, interest rate, and payout period. Some calculators even allow you to factor in monthly compounding. To use an annuity calculator that considers monthly compounding, you can visit this link: Annuity Calculator Compounded Monthly 2024.

Economic Factors

Inflation and other economic factors can also influence annuity payouts. Inflation can erode the purchasing power of your annuity payments over time, making it essential to consider the potential impact of inflation on your future income. Other economic factors, such as changes in the stock market or interest rates, can also affect annuity payouts.

Choosing the Right Annuity

Choosing the right annuity is an important decision that requires careful consideration. There are many different annuity options available, each with its own unique features and benefits. It’s important to compare different annuities based on key features like payout structure, guarantees, and fees to find the best option for your individual needs.

Comparing Annuity Options

| Annuity Type | Payout Structure | Guarantees | Fees |

|---|---|---|---|

| Fixed Annuity | Fixed payments for life or a specified period | Guaranteed rate of return, principal protection | Surrender charges, administrative fees, mortality and expense charges |

| Variable Annuity | Payments based on the performance of sub-accounts | No guaranteed rate of return, potential for higher returns | Surrender charges, administrative fees, mortality and expense charges, investment fees |

| Immediate Annuity | Payments begin immediately after purchase | Guaranteed income stream for life or a specified period | Surrender charges, administrative fees, mortality and expense charges |

| Deferred Annuity | Payments begin at a later date, such as retirement | Tax-deferred growth, potential for higher returns | Surrender charges, administrative fees, mortality and expense charges |

Questions to Ask Yourself

When choosing an annuity, it’s important to ask yourself the following questions:

- What are my financial goals? What am I trying to achieve with an annuity?

- What is my risk tolerance? Am I comfortable with the potential for higher returns, or do I prefer a guaranteed income stream?

- What is my time horizon? How long do I need my annuity to last?

Consulting with a Financial Advisor

It’s always a good idea to consult with a financial advisor to determine the best annuity option for your individual needs. A financial advisor can help you understand the different types of annuities available, evaluate your risk tolerance, and choose an annuity that aligns with your financial goals.

Annuity products are available in various countries, including the United Kingdom. The specifics of annuities and their regulations can vary by location. For more information about annuities in the UK, you can visit this link: Annuity Uk 2024.

Real-World Examples of Annuity Payouts

Annuity payouts can vary widely depending on a number of factors, including the type of annuity, the investment amount, the age of the annuitant, and the interest rate environment. Here are some real-world examples of annuity payouts:

Hypothetical Annuity Payouts

| Investment Amount | Age | Interest Rate | Monthly Payout |

|---|---|---|---|

| $100,000 | 65 | 3% | $500 |

| $200,000 | 65 | 3% | $1,000 |

| $100,000 | 70 | 3% | $450 |

| $100,000 | 65 | 4% | $550 |

These examples are hypothetical and are for illustrative purposes only. Actual annuity payouts may vary depending on the specific terms of the annuity contract and other factors.

Annuity is a financial product that offers regular payments, often for life, in exchange for a lump sum payment. It can be a great way to ensure a steady stream of income in retirement, but it’s important to understand how it works before making a decision.

If you’re wondering about the longevity of annuities in 2024, you can read more about it here: Is Annuity Lifetime 2024.

Importance of Long-Term Implications

It’s important to understand the long-term implications of annuity payouts, including the potential for growth or decline. Annuities can provide a steady stream of income, but they can also be affected by factors such as inflation, interest rate changes, and changes in tax laws.

Annuity payouts can vary greatly depending on several factors, including the initial lump sum invested and the chosen payout structure. For example, an annuity with a $400,000 initial investment will generate different payments than one with a smaller investment.

You can explore this topic further by clicking here: Annuity $400 000 2024.

It’s essential to carefully consider the long-term implications of annuity payouts before making a decision.

Conclusion

When it comes to retirement planning, understanding annuities and their potential impact on your income is essential. By utilizing annuity payout calculators and considering factors like interest rates, tax laws, and inflation, you can gain valuable insights into how your retirement savings might translate into a steady stream of income.

Remember, consulting with a financial advisor can help you navigate the complexities of annuities and tailor a retirement plan that meets your unique needs and goals.

FAQ Corner

What are the different types of annuities?

There are various types of annuities, including fixed, variable, immediate, and deferred. Each type offers different payout structures, guarantees, and risk levels. It’s crucial to understand the characteristics of each type to choose the one that aligns with your retirement goals and risk tolerance.

Are annuity payouts guaranteed?

The level of guarantee depends on the type of annuity. Fixed annuities offer guaranteed payouts, while variable annuities provide payouts that fluctuate based on market performance. It’s important to understand the guarantees associated with each type of annuity before making a decision.

How often can I withdraw from my annuity?

The withdrawal frequency depends on the terms of your annuity contract. Some annuities allow for monthly withdrawals, while others may have more restrictive withdrawal terms. It’s essential to carefully review the terms and conditions of your annuity contract to understand your withdrawal options.