Calculating Annuity Factor In Excel 2024 is a powerful tool for financial professionals and anyone looking to make informed financial decisions. Understanding annuity factors allows you to accurately assess the present and future value of a series of payments, which is crucial for tasks like loan amortization, retirement planning, and investment analysis.

Annuity rates are based on mortality tables. Annuity 2000 Mortality Table 2024 provides information about the 2000 mortality table and its impact on annuity rates.

This guide will walk you through the process of calculating annuity factors using Excel’s built-in functions and provide practical examples to illustrate their application.

We will explore the different types of annuity factors, including present value, future value, ordinary annuity, and annuity due. You’ll learn how to utilize Excel formulas to calculate these factors, along with the essential inputs and outputs required for each calculation.

Annuity can be a complex investment. Annuity Is It A Good Investment 2024 explores the potential benefits and risks of investing in an annuity.

We will also delve into more advanced scenarios involving variable interest rates, irregular payments, and multiple payment periods, demonstrating how to handle these complexities using Excel’s versatile functions.

When considering retirement planning, many people wonder if an annuity is a better option than a 401(k). Is Annuity Better Than 401k 2024 provides a comprehensive overview of the pros and cons of each, helping you make an informed decision.

Contents List

Understanding Annuity Factors: Calculating Annuity Factor In Excel 2024

Annuity factors are essential tools in financial calculations, particularly when dealing with streams of regular payments or receipts over a specified period. They provide a standardized way to determine the present or future value of an annuity, simplifying complex calculations and enabling informed financial decisions.

To understand the potential return on an annuity, you can use a calculator. Annuity Calculator Bankrate 2024 offers a comprehensive annuity calculator tool.

Types of Annuity Factors

Annuity factors come in different forms, each tailored to specific financial scenarios. Here are some common types:

- Present Value Annuity Factor (PVAF):This factor calculates the present value of a series of future payments, discounting them back to the present using a given interest rate. It is used in scenarios like loan amortization, where you want to determine the current worth of future loan payments.

- Future Value Annuity Factor (FVAF):This factor calculates the future value of a series of regular payments, compounding them forward at a specific interest rate. It is relevant for situations like retirement planning, where you want to estimate the future value of regular savings contributions.

- Ordinary Annuity:This type assumes that payments are made at the end of each period (e.g., monthly mortgage payments). It is the most common type of annuity and is used in many financial calculations.

- Annuity Due:This type assumes that payments are made at the beginning of each period (e.g., rent payments). It is less common than an ordinary annuity but can be relevant in specific scenarios.

Real-World Applications of Annuity Factors

- Loan Amortization:Annuity factors are used to calculate the monthly payments on a loan, considering the principal amount, interest rate, and loan term. This helps borrowers understand their monthly obligations and lenders determine the profitability of loans.

- Retirement Planning:Annuity factors are essential for estimating the future value of retirement savings contributions. By inputting the expected savings amount, interest rate, and time horizon, you can project the future value of your retirement nest egg.

- Investment Analysis:Annuity factors can be used to evaluate the profitability of investment opportunities that generate regular cash flows. By comparing the present value of future cash flows to the initial investment cost, you can assess the investment’s potential return.

Calculating Annuity Factors in Excel

Excel offers a suite of built-in functions that simplify the calculation of annuity factors, making it easy to perform complex financial analyses. Here’s a breakdown of the functions and how to use them.

The value of an annuity can fluctuate over time. Annuity Is The Value Of 2024 provides insights into factors that affect annuity value.

Excel Functions for Annuity Factor Calculations

- PV (Present Value):This function calculates the present value of a series of future payments. Its syntax is:

=PV(rate, nper, pmt, [fv], [type]), where: rateis the interest rate per period.nperis the total number of payment periods.pmtis the payment amount per period.fv(optional) is the future value of the annuity. If omitted, it defaults to 0.type(optional) indicates when payments are made (0 for end of period, 1 for beginning of period).- FV (Future Value):This function calculates the future value of a series of regular payments. Its syntax is:

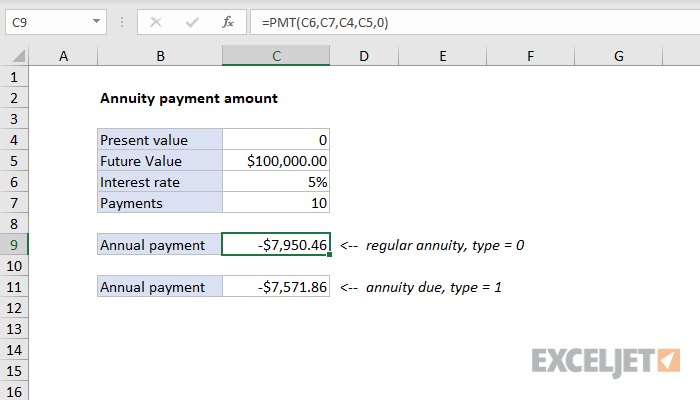

=FV(rate, nper, pmt, [pv], [type]), where the arguments are similar to the PV function. - PMT (Payment):This function calculates the payment amount per period for an annuity. Its syntax is:

=PMT(rate, nper, pv, [fv], [type]), where the arguments are similar to the PV and FV functions. - RATE (Interest Rate):This function calculates the interest rate per period for an annuity. Its syntax is:

=RATE(nper, pmt, pv, [fv], [type], [guess]), where the arguments are similar to the previous functions, andguessis an optional initial guess for the interest rate.

Step-by-Step Guide to Calculating Annuity Factors in Excel

To illustrate the calculation of annuity factors in Excel, let’s consider an example of a loan with the following parameters:

- Loan amount (PV): $100,000

- Interest rate (rate): 5% per year

- Loan term (nper): 10 years

- Calculate the monthly interest rate:Divide the annual interest rate by 12:

=5%/12. - Calculate the total number of monthly payments:Multiply the loan term in years by 12:

=10*12. - Calculate the monthly payment using the PMT function:

=PMT(5%/12, 10*12, 100000). This will give you the monthly payment amount. - Calculate the future value of the loan using the FV function:

=FV(5%/12, 10*12,PMT(5%/12, 10*12, 100000), 100000). This will show you the total amount you will have paid back at the end of the loan term.

Annuity Factor Calculation Table, Calculating Annuity Factor In Excel 2024

| Annuity Factor | Excel Function | Inputs | Output |

|---|---|---|---|

| Present Value (PV) | =PV(rate, nper, pmt, [fv], [type]) |

Rate, Number of periods, Payment amount, Future value (optional), Payment type (optional) | Present value of the annuity |

| Future Value (FV) | =FV(rate, nper, pmt, [pv], [type]) |

Rate, Number of periods, Payment amount, Present value (optional), Payment type (optional) | Future value of the annuity |

| Payment (PMT) | =PMT(rate, nper, pv, [fv], [type]) |

Rate, Number of periods, Present value, Future value (optional), Payment type (optional) | Payment amount per period |

| Interest Rate (RATE) | =RATE(nper, pmt, pv, [fv], [type], [guess]) |

Number of periods, Payment amount, Present value, Future value (optional), Payment type (optional), Initial guess for rate (optional) | Interest rate per period |

Applying Annuity Factors in Financial Modeling

Annuity factors are indispensable components of financial models, providing a framework for analyzing various financial scenarios involving regular cash flows. Their application extends across diverse financial modeling contexts, including loan amortization, retirement planning, and investment analysis.

Choosing the right retirement plan is crucial. Is Annuity Right For Me 2024 helps you determine if an annuity is the right choice for your individual needs and financial goals.

Integration of Annuity Factors in Financial Models

- Loan Amortization Models:Annuity factors are used to calculate the monthly payments, interest expense, and principal repayment for a loan. These models help borrowers understand their loan obligations and lenders assess the profitability of loans.

- Retirement Planning Models:Annuity factors are crucial for projecting the future value of retirement savings contributions. These models help individuals estimate their retirement income needs and plan for their financial future.

- Investment Analysis Models:Annuity factors are used to evaluate the profitability of investment opportunities that generate regular cash flows. By discounting future cash flows to their present value, you can assess the investment’s potential return and make informed investment decisions.

Examples of Financial Models Utilizing Annuity Factors

- Loan Amortization Schedule:This model uses annuity factors to create a detailed schedule of monthly payments, interest expense, and principal repayment for a loan. It helps borrowers visualize their loan repayment journey and lenders track loan performance.

- Retirement Savings Calculator:This model utilizes annuity factors to project the future value of retirement savings contributions based on assumed savings rates, investment returns, and time horizons. It helps individuals plan for their retirement income needs.

- Investment Valuation Model:This model uses annuity factors to discount future cash flows from an investment to their present value. By comparing the present value of future cash flows to the initial investment cost, you can assess the investment’s potential return and make informed investment decisions.

Annuity is a versatile financial product that can serve various purposes. An Annuity Is Primarily Used To Provide 2024 highlights the primary uses of annuities.

Benefits and Limitations of Using Annuity Factors in Financial Modeling

Benefits

- Standardization:Annuity factors provide a standardized framework for analyzing regular cash flows, simplifying complex calculations and enabling consistent financial modeling.

- Accuracy:By incorporating the time value of money, annuity factors ensure accurate calculations, reflecting the impact of interest rates and time on financial values.

- Flexibility:Annuity factors can be adapted to various financial scenarios, allowing for the analysis of different loan terms, investment horizons, and savings rates.

Limitations

- Assumptions:Annuity factor calculations rely on assumptions about interest rates, payment periods, and future cash flows, which may not always hold true in real-world scenarios.

- Complexity:While Excel simplifies annuity factor calculations, advanced scenarios involving variable interest rates, irregular payments, and multiple payment periods can require more complex modeling techniques.

- Oversimplification:Annuity factors can sometimes oversimplify financial scenarios, ignoring factors like inflation, taxes, and investment fees that can impact actual financial outcomes.

Advanced Annuity Factor Calculations

While Excel provides straightforward functions for calculating annuity factors, advanced scenarios may involve variable interest rates, irregular payments, and multiple payment periods, requiring more sophisticated approaches. This section explores how to handle these complexities using Excel’s capabilities.

Variable Interest Rates

In scenarios where interest rates fluctuate over time, the standard annuity factor functions may not be suitable. To address this, you can use Excel’s IRRfunction, which calculates the internal rate of return for a series of cash flows, effectively accounting for variable interest rates.

You can also use a combination of PV, FV, and PMTfunctions to calculate the present or future value of an annuity with varying interest rates over different periods.

If you inherited an annuity, you might be wondering about its tax implications. I Inherited An Annuity Is It Taxable 2024 clarifies the tax treatment of inherited annuities.

Irregular Payments

When payments are not consistent, you can use the NPV(Net Present Value) function to calculate the present value of a series of irregular payments. This function discounts each payment to its present value based on a given discount rate, effectively handling the uneven payment amounts.

Chapter 9 of a financial textbook often covers annuities. Chapter 9 Annuities 2024 provides a comprehensive overview of annuities, including their types and applications.

For future value calculations with irregular payments, you can use the FVfunction, but you need to adjust the payment amount for each period accordingly.

The interest rate an annuity pays is a key factor to consider. Annuity Rate Is 2024 provides insights into the current annuity rates and how they are determined.

Multiple Payment Periods

When dealing with annuities that have multiple payment periods within a year (e.g., quarterly payments), you need to adjust the interest rate and number of periods accordingly. For example, if the annual interest rate is 5%, and payments are made quarterly, you need to use a quarterly interest rate of 5%/4 and a total number of periods equal to the number of years multiplied by 4.

While both annuities and life insurance provide financial protection, they have distinct purposes. Is Annuity The Same As Life Insurance 2024 explains the key differences between these two financial products.

You can then use the standard annuity factor functions to calculate the present or future value of the annuity.

An annuity can be structured to provide payments for both spouses. Annuity Joint Life Option 2024 explains the joint life option and its benefits for couples.

Tips and Best Practices for Advanced Annuity Factor Calculations

- Clearly Define Assumptions:Ensure that you clearly define the assumptions underlying your calculations, including interest rates, payment periods, and future cash flows, to avoid errors and ensure accurate results.

- Use Sensitivity Analysis:Conduct sensitivity analysis to understand the impact of changing assumptions on the calculated annuity factors. This helps assess the robustness of your results and identify potential risks.

- Validate Results:Compare your calculated annuity factors to those obtained using other methods or financial calculators to validate your results and ensure accuracy.

- Document Your Calculations:Document your calculations clearly and comprehensively, including the formulas used, assumptions made, and any limitations considered. This helps ensure transparency and facilitates future analysis.

Concluding Remarks

Mastering the calculation of annuity factors in Excel opens up a world of possibilities for financial modeling and decision-making. By leveraging the power of Excel’s built-in functions and understanding the different types of annuity factors, you can confidently analyze financial scenarios, optimize investment strategies, and make informed financial decisions.

Deciding whether an annuity is a good idea for you requires careful consideration. Annuity Is It A Good Idea 2024 provides insights to help you weigh the pros and cons.

Whether you are a seasoned financial professional or an individual seeking to gain a deeper understanding of personal finance, this guide provides a comprehensive foundation for effectively using annuity factors in your financial endeavors.

FAQs

What are the limitations of using annuity factors in financial modeling?

An annuity is a financial product that provides a stream of payments over time. An Annuity Is Quizlet 2024 offers a quick and easy explanation of annuities through a quizlet-style format.

Annuity factors assume a constant interest rate and regular payments, which may not always be the case in real-world scenarios. Additionally, they do not account for inflation or other external factors that can impact financial outcomes.

How can I ensure accuracy in advanced annuity factor calculations?

Carefully review your inputs, use appropriate Excel functions, and double-check your calculations. It’s also helpful to test your model with different scenarios to assess its sensitivity to changes in key variables.

Can I use annuity factors to calculate the value of a property?

Annuity is a financial product that provides a stream of payments over time. Annuity What Is The Meaning 2024 explains the concept in detail, covering its different types and how it works.

While annuity factors are primarily used for financial calculations involving cash flows, they can be adapted to estimate the present value of a property’s future rental income.