Calculating Annuity Formula 2024 takes center stage, guiding you through the world of financial planning and investment strategies. Annuities, a powerful tool for securing your future, involve a series of regular payments over a set period, and understanding how to calculate them is essential for making informed financial decisions.

Tax implications vary depending on your location. If you’re in India, you might be curious about whether annuity income is taxable. You can find more information on annuity income taxability in India. For example, you might want to explore scenarios like ” Annuity 70000 ” to understand how different amounts can impact your tax situation.

Whether you’re planning for retirement, managing debt, or investing for your future, mastering the annuity formula can unlock new opportunities and help you achieve your financial goals.

This comprehensive guide delves into the intricacies of annuities, exploring their various types, breaking down the formula step-by-step, and showcasing practical applications in real-world scenarios. We’ll also examine the impact of factors like interest rates, time periods, and inflation on annuity calculations, equipping you with the knowledge to make sound financial choices.

Annuities can provide a sense of security for your retirement, with some offering 6 guaranteed payments. It’s important to consider the potential interest rates offered, and some annuities might provide a 4 percent return. To understand the basics, you can find helpful resources like Quizlet , which offers definitions and explanations.

When calculating your retirement income, you’ll need to consider how much you can withdraw each year, and a withdrawal calculator can be a valuable tool.

Contents List

Understanding Annuities

Annuities are financial instruments that provide a stream of regular payments over a specified period. They are commonly used for retirement planning, income generation, and managing financial obligations. Understanding the different types of annuities and their key components is crucial for making informed financial decisions.

It’s important to remember that an annuity’s value is based on its present value. If you’re considering a single premium annuity, you might want to look into scenarios like “G purchased a $50,000 single premium,” as described in this article.

There are different methods for calculating annuity payments, and you can explore the annuity method in detail.

Key Components of an Annuity

An annuity comprises several key components that determine its characteristics and value:

- Payment Amount:The amount of money received in each payment period.

- Payment Frequency:The frequency at which payments are made (e.g., monthly, quarterly, annually).

- Term:The duration of the annuity, or the number of payment periods.

- Interest Rate:The rate of return earned on the annuity’s principal.

- Present Value:The lump-sum amount invested to generate the annuity payments.

- Future Value:The total value of the annuity at the end of its term.

Types of Annuities

Annuities are categorized based on their payment structure and investment features:

- Ordinary Annuity:Payments are made at the end of each period.

- Annuity Due:Payments are made at the beginning of each period.

- Fixed Annuity:Provides a guaranteed rate of return and fixed payment amounts.

- Variable Annuity:The rate of return and payment amounts fluctuate based on the performance of underlying investments.

Real-World Examples of Annuities

Annuities are used in various real-world scenarios:

- Retirement Planning:Individuals can purchase annuities to generate a steady stream of income during retirement.

- Loan Repayment:Annuities can be used to structure loan payments, ensuring consistent repayments over a defined period.

- Investment Analysis:Annuities can be used to assess the value of investment opportunities, comparing potential returns and risks.

Annuity Formula Breakdown

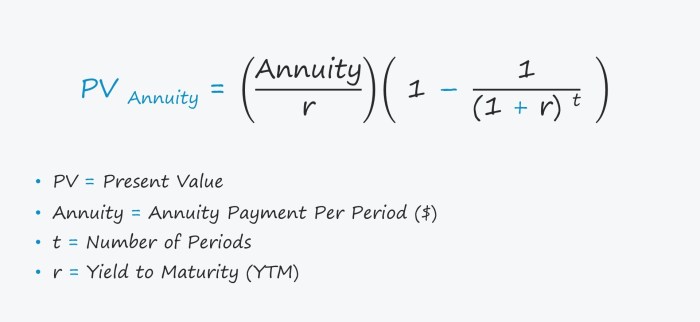

The standard annuity formula calculates the present value (PV) of an annuity, which represents the lump-sum amount needed to generate the stream of payments. The formula is as follows:

PV = PMT

Looking to explore annuity options in Sarasota? You might want to check out the Annuity King Sarasota 2024 guide for insights. It’s worth noting that annuities offer a guaranteed stream of income, but they also come with specific terms and conditions.

It’s crucial to understand the “free look” period, which allows you to review the contract within 30 days and potentially cancel it. Remember, an annuity is a voluntary retirement vehicle, so it’s essential to make informed decisions based on your financial goals and risk tolerance.

- [1

- (1 + r)^-n] / r

Where:

- PV:Present value of the annuity.

- PMT:Payment amount per period.

- r:Interest rate per period.

- n:Number of payment periods.

Applying the Annuity Formula

To apply the formula, follow these steps:

- Identify the variables:Determine the payment amount, interest rate, and number of periods.

- Plug the values into the formula:Substitute the identified values into the annuity formula.

- Calculate the present value:Use a calculator or spreadsheet software to compute the present value.

Annuity Calculation Methods

Various methods can be used to calculate annuities, each with its own advantages and disadvantages:

Methods for Calculating Annuities

- Financial Calculators:Dedicated financial calculators are specifically designed for annuity calculations, offering ease of use and accuracy.

- Spreadsheets:Spreadsheet software like Microsoft Excel or Google Sheets provides powerful tools for annuity calculations, allowing for customization and complex scenarios.

- Online Tools:Numerous online calculators and tools are available, providing quick and convenient annuity calculations without requiring specialized software.

Comparing Calculation Methods

| Method | Advantages | Disadvantages |

|---|---|---|

| Financial Calculators | Ease of use, accuracy, dedicated functions | Limited customization, potential cost |

| Spreadsheets | Customization, complex scenarios, readily available | Requires basic spreadsheet knowledge, potential for errors |

| Online Tools | Convenience, free availability, user-friendly interfaces | Limited customization, potential for inaccuracies |

Real-World Annuity Applications

Annuity calculations are essential in various financial planning and investment scenarios:

Retirement Planning

Annuities play a crucial role in retirement planning, providing a predictable stream of income during retirement years. By calculating the present value of an annuity, individuals can determine the amount they need to save to generate a desired level of retirement income.

Loan Repayment, Calculating Annuity Formula 2024

Annuity calculations are used to structure loan payments, ensuring consistent repayments over the loan term. By calculating the present value of the loan, lenders can determine the appropriate interest rate and monthly payment amount.

Investment Analysis

Annuities can be used to assess the value of investment opportunities, comparing potential returns and risks. By calculating the future value of an annuity, investors can determine the potential growth of their investments over time.

If you have a 401k, you might consider rolling it over into an annuity. Learn more about annuity 401k rollovers and how they can impact your retirement planning. When it comes to defining an annuity, it’s best described as a contract that guarantees a stream of payments.

Understanding how to calculate annuity payments is crucial, and you can find resources on calculating annuity due payments.

Annuity Concepts and Considerations

Understanding the time value of money and compounding is crucial for comprehending annuity calculations.

Time Value of Money

The time value of money principle recognizes that money today is worth more than the same amount of money in the future due to its potential earning capacity. Annuities incorporate this principle by discounting future payments to their present value, reflecting the opportunity cost of receiving those payments later.

Compounding

Compounding refers to the process of earning interest on both the principal and previously earned interest. Annuities utilize compounding to generate growth over time, as interest earned in each period is added to the principal, earning further interest in subsequent periods.

The effect of compounding can significantly enhance the value of an annuity over time.

Factors Influencing Annuity Payments

Several factors can influence annuity payments, affecting their value and longevity:

- Inflation:Inflation erodes the purchasing power of money over time. Annuities may include adjustments for inflation to ensure that payments maintain their real value.

- Investment Performance:Variable annuities are subject to investment performance, meaning that payment amounts can fluctuate based on the underlying investments. Market volatility and economic conditions can impact the value of variable annuities.

Final Wrap-Up

By understanding the intricacies of the annuity formula and its applications, you can navigate the complexities of financial planning with confidence. From retirement planning to loan repayment and investment strategies, annuities offer a versatile tool for securing your financial future.

Embrace the power of annuities and unlock the potential for achieving your financial aspirations.

FAQ Resource: Calculating Annuity Formula 2024

What is the difference between an ordinary annuity and an annuity due?

An ordinary annuity makes payments at the end of each period, while an annuity due makes payments at the beginning of each period.

How does compounding affect annuity calculations?

Compounding allows interest earned to accumulate and earn interest itself, leading to faster growth in the value of the annuity.

Are there any online tools available for calculating annuities?

Yes, several online calculators and financial software programs can help you calculate annuities quickly and accurately.