Calculate Annuity Factor On BA II Plus 2024: A Guide provides a comprehensive walkthrough on utilizing the powerful BA II Plus calculator for determining annuity factors. This guide delves into the fundamental concept of annuity factors, exploring their significance in financial calculations and how they are employed to ascertain present and future values of annuities.

We will guide you through the intricacies of the BA II Plus calculator, emphasizing features specifically designed for annuity calculations. This includes a step-by-step breakdown of inputting data, performing calculations, and understanding the key functions and buttons dedicated to annuities on the calculator.

To get a better understanding of how annuities work in real-world scenarios, you can explore Annuity Examples In Real Life 2024. This will give you a clearer picture of how annuities can be used to achieve financial goals.

It’s also essential to consider the tax implications of different annuity types. For example, Is A Single Life Annuity Taxable 2024 examines the tax implications of a specific type of annuity.

The guide further explores the practical applications of annuity factor calculations, demonstrating how they are instrumental in real-world scenarios across finance, investments, and retirement planning. You will learn how annuity factors are used to evaluate different investment options and make informed financial decisions.

Before committing to an annuity, it’s crucial to weigh the pros and cons. Annuity Is It A Good Idea 2024 provides insights into the potential benefits and drawbacks of annuities. Ultimately, deciding if an annuity is the right choice for you depends on your individual financial situation and goals.

We will also address common mistakes and provide troubleshooting tips to ensure accuracy in your calculations. By the end of this guide, you will gain a solid understanding of annuity factors and become proficient in utilizing the BA II Plus calculator for efficient and accurate financial analysis.

Contents List

Understanding Annuity Factors

Annuity factors are essential tools in financial calculations, particularly when dealing with streams of regular payments or receipts. They help determine the present and future values of annuities, which are series of equal payments made over a set period.

Annuity Factor Definition and Application

An annuity factor is a numerical representation that captures the time value of money within an annuity. It essentially factors in the impact of interest rates and the duration of the payment stream to arrive at a single value that reflects the worth of the annuity.

- Present Value Annuity Factor (PVAF):This factor is used to calculate the present value of an annuity, which is the lump sum amount you would need today to generate the future stream of payments. The PVAF is lower than 1 when the interest rate is positive, indicating that money received in the future is worth less than money received today.

Annuity contracts can have different beneficiary options. For example, Annuity Beneficiary Is A Trust 2024 explores how to designate a trust as the beneficiary. Understanding the tax implications is also important, as explained in Is Annuity Income Taxable 2024.

In some cases, the annuity payments are determined by a specific entity, as discussed in Annuity Is Given By 2024.

- Future Value Annuity Factor (FVAF):This factor is used to calculate the future value of an annuity, which is the total amount the annuity will be worth at a specific future point in time. The FVAF is greater than 1 when the interest rate is positive, indicating that money invested today will grow over time.

Before deciding on an annuity, it’s essential to consider the factors involved. Calculating Annuity Factor 2024 can help you understand the relationship between your initial investment and the future payments you receive. You can also use tools like Excel to make these calculations easier, as explained in Calculating Annuity Due In Excel 2024.

Types of Annuity Factors

Annuity factors are classified based on the timing of payments within the annuity stream.

- Ordinary Annuity:Payments are made at the end of each period. This is the most common type of annuity and is the default setting on most financial calculators.

- Annuity Due:Payments are made at the beginning of each period. This type of annuity is less common but can be encountered in situations like lease payments or rent.

The BA II Plus Calculator: Calculate Annuity Factor On Ba Ii Plus 2024

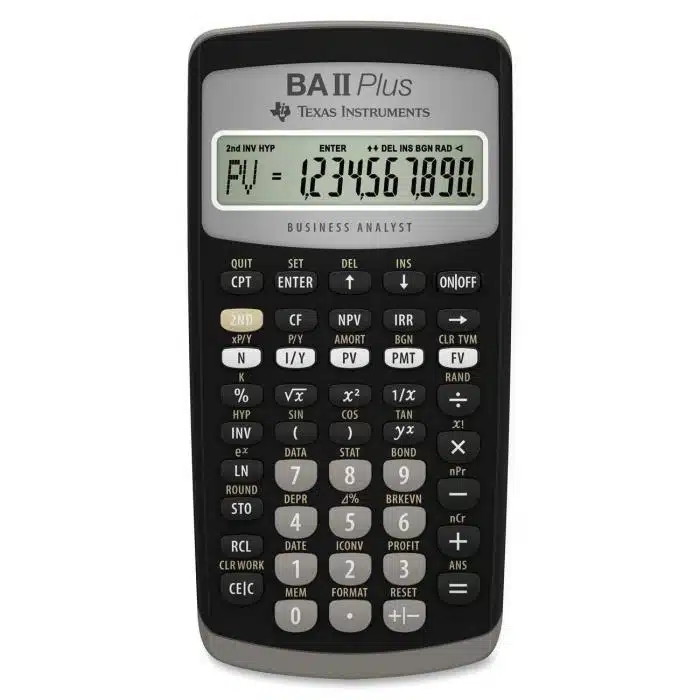

The BA II Plus calculator is a popular financial calculator widely used by professionals and students for various financial calculations, including annuity analysis. It offers a comprehensive set of functions and features specifically designed for complex financial computations.

Key Features of the BA II Plus for Annuity Calculations

- Time Value of Money (TVM) Functions:The calculator features dedicated keys for inputting and calculating variables like present value (PV), future value (FV), payment (PMT), number of periods (N), and interest rate (I/Y). These functions are essential for annuity calculations.

- Annuity Modes:The BA II Plus allows you to switch between ordinary annuity and annuity due modes, ensuring accurate calculations based on the timing of payments.

- Cash Flow Functions:The calculator can handle complex cash flow scenarios, allowing you to analyze annuities with irregular payments or multiple cash flows.

- Memory and Storage:The BA II Plus provides memory functions to store and retrieve values, simplifying calculations and reducing the risk of errors.

Inputting Data and Performing Calculations

To perform annuity calculations on the BA II Plus, you need to input the relevant variables into the calculator’s TVM registers. The calculator follows a specific input order for the TVM variables, which is crucial for obtaining accurate results.

To accurately calculate the payments you will receive, you need to understand the payment structure. Calculating Annuity Due Payment 2024 provides information on calculating payments when they are made at the beginning of each period. While annuities can be complex, some key terms are relatively straightforward.

For instance, Annuity 7 Letters 2024 helps you understand the basic definition of an annuity.

- Clear the calculator memory:Press the “2nd” key followed by “CLR TVM.” This ensures that any previous data is cleared.

- Input the variables:Enter the values for N, I/Y, PV, PMT, and FV, making sure to adjust the signs according to the cash flow convention (inflows are positive, outflows are negative). For example, if you are calculating the present value of an annuity, PV will be positive (inflow) and PMT will be negative (outflow).

- Select the annuity mode:Press the “2nd” key followed by “BGN” to switch to annuity due mode. If you are working with an ordinary annuity, ensure the calculator is in the default “END” mode.

- Calculate the desired value:Press the key corresponding to the variable you want to calculate. For example, to calculate the present value, press the “PV” key. The calculator will display the result.

Calculating Annuity Factors on the BA II Plus

The BA II Plus calculator simplifies annuity factor calculations by providing dedicated functions for determining the present and future values of annuities. The following steps illustrate how to calculate annuity factors using the BA II Plus.

Calculating the Present Value Annuity Factor (PVAF)

- Input the variables:Enter the values for N, I/Y, and PMT. Ensure that PMT is negative (outflow) since it represents the regular payments.

- Select the annuity mode:Choose the appropriate mode (END for ordinary annuity, BGN for annuity due) based on the timing of payments.

- Calculate the present value (PV):Press the “PV” key to calculate the present value of the annuity. The displayed value represents the PVAF, which is the present value of a stream of $1 payments.

Calculating the Future Value Annuity Factor (FVAF), Calculate Annuity Factor On Ba Ii Plus 2024

- Input the variables:Enter the values for N, I/Y, and PMT. Ensure that PMT is negative (outflow) since it represents the regular payments.

- Select the annuity mode:Choose the appropriate mode (END for ordinary annuity, BGN for annuity due) based on the timing of payments.

- Calculate the future value (FV):Press the “FV” key to calculate the future value of the annuity. The displayed value represents the FVAF, which is the future value of a stream of $1 payments.

Example Calculation: Ordinary Annuity

Let’s assume you want to calculate the present value of an ordinary annuity with a 5-year term, an annual interest rate of 5%, and annual payments of $1, 000. To calculate the PVAF, you would input the following variables into the BA II Plus:

- N = 5 (number of periods)

- I/Y = 5 (annual interest rate)

- PMT = -1000 (annual payment, negative as it is an outflow)

- FV = 0 (future value is zero, as we are calculating the present value)

After inputting these variables, press the “PV” key. The calculator will display the present value of the annuity, which is approximately $4,329.48. This value represents the PVAF for this specific annuity.

Annuity contracts can provide a steady stream of income for a set period, and understanding the different types can help you make informed decisions. For example, a Annuity 20 Year Certain 2024 guarantees payments for 20 years, regardless of your lifespan.

You can also explore options like Annuity 3 2024 which may offer a shorter term but potentially higher payments.

Practical Applications of Annuity Factor Calculations

Annuity factor calculations have wide-ranging applications in various financial contexts, helping individuals and businesses make informed decisions about investments, savings, and debt management.

Finance and Investments

- Loan Amortization:Annuity factors are used to calculate the monthly payments on loans, such as mortgages and car loans. By understanding the annuity factor, borrowers can determine the total interest paid over the loan’s lifetime.

- Investment Analysis:Annuity factors are used to evaluate the present and future values of investment streams, such as regular dividend payments or bond coupon payments. This helps investors compare different investment options and make informed decisions based on their financial goals.

Retirement Planning

- Retirement Savings:Annuity factors are used to determine the amount of regular contributions needed to accumulate a desired retirement nest egg. By understanding the impact of interest rates and the time horizon, individuals can plan their retirement savings effectively.

- Retirement Income:Annuity factors are used to calculate the monthly income stream generated by retirement savings, such as annuities or pensions. This helps retirees understand their potential income in retirement and plan their spending accordingly.

Common Mistakes and Troubleshooting

While the BA II Plus calculator simplifies annuity calculations, it is crucial to understand potential pitfalls and how to troubleshoot common errors. Here are some common mistakes and troubleshooting tips to ensure accurate results.

Common Mistakes

- Incorrect Input:Double-check that you have entered the correct values for N, I/Y, PV, PMT, and FV. Ensure that the signs of the cash flows are consistent with the convention (inflows positive, outflows negative).

- Incorrect Annuity Mode:Make sure you have selected the correct annuity mode (END for ordinary annuity, BGN for annuity due) based on the timing of payments.

- Incorrect Interest Rate:Ensure that the interest rate (I/Y) is entered as a percentage and not a decimal. For example, 5% should be entered as “5” and not “0.05.”

Troubleshooting Tips

- Clear the Calculator Memory:Press “2nd” followed by “CLR TVM” to clear the calculator’s memory and start fresh.

- Double-Check Input:Carefully review all the input variables to ensure they are correct and consistent with the cash flow convention.

- Consult the User Manual:The BA II Plus user manual provides detailed instructions and explanations of the calculator’s functions and features. Refer to the manual for specific guidance on troubleshooting errors or unfamiliar features.

End of Discussion

Understanding and calculating annuity factors is crucial for anyone involved in financial planning or investment analysis. The BA II Plus calculator, with its specialized functions and user-friendly interface, makes this process efficient and accessible. This guide has provided a comprehensive overview of the concept of annuity factors, their practical applications, and how to effectively utilize the BA II Plus calculator for accurate calculations.

Annuity products can vary widely, and researching specific options like Annuity Gator 2024 can be helpful. If you’re considering an annuity, it’s crucial to understand the terms and conditions. For instance, My Annuity Is Out Of Surrender 2024 explains the surrender period and its implications.

You might also want to consider rolling over funds from a 401k to an annuity, as discussed in Annuity 401k Rollover 2024.

By mastering these concepts and utilizing the calculator effectively, you can make informed financial decisions and achieve your financial goals.

Essential FAQs

What is an annuity factor?

An annuity factor is a multiplier used to calculate the present or future value of a series of equal payments, known as an annuity.

How do I adjust the calculator settings for different time periods and interest rates?

The BA II Plus calculator allows you to adjust settings for the number of periods (N), interest rate (I/Y), and payment amount (PMT) to accommodate different scenarios.

What are some common mistakes to avoid when calculating annuity factors?

Common mistakes include entering incorrect values, forgetting to adjust the calculator settings, and misinterpreting the results.

How can I troubleshoot errors or unexpected results?

Double-check your input data, review the calculator settings, and refer to the user manual for troubleshooting guidance.