Calculate Annuity FERS 2024: Planning for Your Retirement is a crucial step in securing a comfortable future. This guide explores the world of annuities, explaining their various types, how to calculate your payments, and important considerations for making informed decisions.

If you’re looking for an annuity calculator specifically designed for the UK market, the Annuity Calculator Uk 2024 can help you estimate your potential annuity payouts based on UK-specific factors.

Annuities are financial instruments that provide a steady stream of income during retirement, acting as a valuable component of your retirement planning strategy. Understanding the intricacies of annuities, including their different types, calculation methods, and potential risks, empowers you to make informed choices that align with your financial goals.

If you’re looking for information on annuities in Hindi, the Annuity Meaning In Hindi 2024 page is a good resource. It provides a clear and concise explanation of annuities in the Hindi language.

Contents List

Understanding Annuities: Calculate Annuity Fers 2024

Annuities are financial products designed to provide a steady stream of income, typically during retirement. They work by converting a lump sum of money into a series of regular payments. Annuities play a crucial role in retirement planning by helping individuals secure a reliable income source during their golden years.

In simple terms, an annuity is a financial product that provides a stream of regular payments over a set period of time. The An Annuity Is 2024 page provides a more detailed explanation of how annuities work and their potential uses.

They offer a way to protect against outliving their savings and ensure financial stability in retirement.

The Annuity Formula Is 2024 page explains the mathematical formula used to calculate annuity payments. Understanding this formula can help you make informed decisions about your annuity choices.

Types of Annuities

Annuities come in various forms, each with its own characteristics and risk-return profile. Understanding the different types of annuities is essential for choosing the one that aligns with your financial goals and risk tolerance.

- Fixed Annuities: These annuities guarantee a fixed interest rate for a specified period, providing predictable payments. The principal amount is protected from market fluctuations, making them a suitable option for those seeking stability and guaranteed income. However, fixed annuities typically offer lower returns compared to other types.

To understand how annuities work in practice, it’s helpful to see some real-life examples. The Annuity Examples 2024 page provides a range of scenarios that illustrate the different types of annuities and their potential outcomes.

- Variable Annuities: These annuities invest your principal in a variety of sub-accounts, such as mutual funds, allowing for potential growth. The payments are not fixed and fluctuate based on the performance of the underlying investments. Variable annuities offer the potential for higher returns but also carry greater risk.

Getting quotes online can be a convenient way to compare annuity options from different providers. The Annuity Quotes Online 2024 page provides tips and resources for finding the best annuity quotes online.

- Indexed Annuities: These annuities link their returns to the performance of a specific index, such as the S&P 500. They offer a combination of principal protection and potential growth. Indexed annuities provide a minimum guaranteed return and may offer participation in the upside potential of the index.

However, their returns are often capped, limiting potential gains.

Advantages and Disadvantages

Each type of annuity comes with its own set of advantages and disadvantages. It’s crucial to weigh these factors carefully before making a decision.

An annuity with an 8% interest rate can provide a significant boost to your retirement income. The Annuity 8 Percent 2024 page discusses the potential benefits and drawbacks of this type of annuity.

| Type | Advantages | Disadvantages |

|---|---|---|

| Fixed Annuity | Guaranteed income, principal protection, predictable payments | Lower returns, inflation risk, potential for low interest rates |

| Variable Annuity | Potential for higher returns, flexibility, tax-deferred growth | Market risk, potential for losses, higher fees |

| Indexed Annuity | Principal protection, potential for growth, participation in market gains | Capped returns, complex features, potential for limited upside |

Annuity Rates in 2024

Annuity rates are influenced by various factors, including interest rates, market conditions, and the financial health of annuity providers. Understanding the current annuity rate environment is essential for making informed decisions.

One of the main advantages of annuities is that they offer a certain level of security. But, the question of whether they’re truly guaranteed is important. The Is Annuity Guaranteed 2024 article provides valuable insights into the risks and guarantees associated with annuities.

Current Rate Environment

As of early 2024, annuity rates have been on an upward trend, reflecting rising interest rates. However, rates can fluctuate significantly based on economic conditions and market volatility. It’s important to compare rates from different providers to find the best offers.

If you’re looking to understand the math behind annuities, the Annuity Equation 2024 is a good place to start. It outlines the key variables that determine the amount of your payments, such as the initial investment, interest rate, and duration of the annuity.

Comparing Rates

When comparing annuity rates, consider the following factors:

- Interest Rate: The interest rate determines the amount of income you will receive from your annuity. Higher interest rates generally result in higher payments.

- Fees: Annuities typically involve various fees, such as administrative fees, surrender charges, and mortality and expense charges. These fees can significantly impact your overall returns. Be sure to compare fees from different providers.

- Guarantee Period: The guarantee period refers to the length of time for which the interest rate or payment amount is fixed. Longer guarantee periods provide more certainty but may come with lower initial interest rates.

Factors Influencing Rates

Annuity rates are influenced by several factors, including:

- Interest Rates: When interest rates rise, annuity rates tend to follow suit, offering higher returns. Conversely, when interest rates fall, annuity rates may decline.

- Market Conditions: Stock market performance and overall economic conditions can impact annuity rates. During periods of market volatility, annuity rates may be lower as providers seek to protect their investments.

- Competition: Competition among annuity providers can also influence rates. Providers may offer higher rates to attract new customers and retain existing ones.

Calculating Annuity Payments

Calculating annuity payments involves determining the regular income stream you will receive based on your principal amount, interest rate, and payment frequency. Understanding how to calculate these payments is crucial for making informed decisions about your retirement planning.

Annuity 95-1 is a type of annuity that guarantees payments for life, even if you live to be 95 years old. It’s often used as a way to provide income security in retirement. To learn more about this specific type of annuity, you can visit the Annuity 95-1 2024 page.

Methods of Calculation

There are two main methods for calculating annuity payments: present value and future value calculations.

If you’re in the UK and considering an annuity, you’ll want to get quotes from different providers. The Annuity Quotes Uk 2024 page provides a comprehensive guide to getting quotes and comparing options.

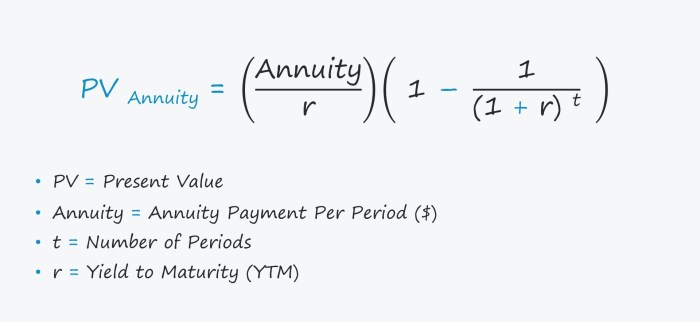

- Present Value: This method calculates the present value of a future stream of payments. It helps determine how much money you need to invest today to receive a certain amount of income in the future.

- Future Value: This method calculates the future value of a lump sum investment, considering the interest rate and payment frequency. It helps determine how much your investment will grow over time.

Variables Affecting Payments, Calculate Annuity Fers 2024

Several variables affect annuity payments, including:

- Principal Amount: The amount of money you invest in the annuity. A higher principal amount generally results in higher payments.

- Interest Rate: The interest rate earned on your annuity. Higher interest rates lead to higher payments.

- Payment Frequency: How often you receive payments, such as monthly, quarterly, or annually. More frequent payments result in smaller individual payments but more frequent income.

- Annuity Period: The duration of the annuity contract, which determines the total number of payments you will receive.

Step-by-Step Guide

Here’s a step-by-step guide for calculating annuity payments:

- Determine the principal amount: This is the lump sum you will invest in the annuity.

- Identify the interest rate: This is the rate of return you will earn on your annuity.

- Choose the payment frequency: This determines how often you will receive payments.

- Calculate the annuity period: This is the duration of the annuity contract, expressed in years or months.

- Use an annuity calculator: Many online calculators can help you calculate annuity payments based on the variables you have identified.

Annuity Considerations

Before investing in an annuity, it’s crucial to consider the tax implications, potential risks, and other factors that can impact your financial well-being.

While annuities are often used as a retirement income strategy, they are not technically insurance products. The Is Annuity Insurance 2024 page clarifies the distinction between annuities and insurance.

Tax Implications

Annuities can have tax implications, depending on the type of annuity and how it is structured. It’s essential to understand these implications to make informed financial decisions.

The value of an annuity depends on a number of factors, including the initial investment, interest rate, and duration of the payments. The Annuity Is The Value Of 2024 page discusses the key elements that determine the value of an annuity.

- Income Taxes: Annuity payments are typically taxed as ordinary income. This means that you will need to pay taxes on the payments you receive, similar to other forms of income.

- Capital Gains Taxes: If you withdraw your principal amount before the end of the annuity period, you may be subject to capital gains taxes on any appreciation in value.

- Tax-Deferred Growth: Some annuities offer tax-deferred growth, meaning that you won’t pay taxes on the earnings until you withdraw them.

Potential Risks

Annuities can carry certain risks that should be carefully considered before investing.

Figuring out how much you’ll get from an annuity can be tricky, but an Annuity Calculator Based On Life Expectancy 2024 can help you estimate your potential payouts. It takes your age and expected lifespan into account to provide a more personalized estimate.

- Market Volatility: Variable annuities are subject to market risk, meaning that the value of your investment can fluctuate based on market conditions. This can affect the amount of income you receive.

- Longevity Risk: If you live longer than expected, your annuity payments may run out before you do. This is a risk that should be considered, especially if you are planning to use an annuity as your primary source of retirement income.

In some cases, it may be possible to withdraw funds from an annuity before the scheduled payout period. The Annuity Hardship Withdrawal 2024 page explains the conditions and restrictions that apply to hardship withdrawals.

- Fees: Annuities can involve various fees, which can impact your overall returns. It’s important to compare fees from different providers to find the most competitive options.

Checklist of Factors

When choosing an annuity, consider the following factors:

- Age: Your age can influence the type of annuity that is most suitable for you. Younger individuals may prefer variable annuities with growth potential, while older individuals may prefer fixed annuities for stability.

- Health: Your health can also play a role in annuity selection. If you have health concerns, you may want to consider an annuity with a guaranteed period to ensure that you receive payments for a specific duration.

- Financial Goals: Your financial goals, such as retirement income, long-term savings, or legacy planning, will influence the type of annuity you choose.

- Risk Tolerance: Your risk tolerance will determine the level of risk you are comfortable with. If you are risk-averse, you may prefer a fixed annuity. If you are comfortable with higher risk, you may consider a variable annuity.

Annuity Resources

There are numerous resources available to help you learn more about annuities and make informed decisions. These resources can provide valuable information, tools, and guidance.

Reputable Sources

Here are some reputable sources for obtaining information about annuities:

- Government Websites: The Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) offer information and resources on annuities.

- Financial Institutions: Banks, credit unions, and insurance companies often offer annuity products and provide information about them.

- Independent Organizations: The Consumer Federation of America and the National Endowment for Financial Education provide unbiased information and resources on annuities.

Key Resources

| Resource | Website | Contact Information | Areas of Expertise |

|---|---|---|---|

| Securities and Exchange Commission (SEC) | www.sec.gov | (800) 732-0330 | Annuities, investment fraud, investor protection |

| Financial Industry Regulatory Authority (FINRA) | www.finra.org | (800) 289-9999 | Annuity regulation, broker-dealer oversight, investor education |

| Consumer Federation of America (CFA) | www.consumerfed.org | (202) 387-6121 | Consumer advocacy, financial literacy, retirement planning |

| National Endowment for Financial Education (NEFE) | www.nefe.org | (800) 392-NEFE | Financial education, retirement planning, consumer resources |

Online Calculators and Tools

Many online calculators and tools can help you estimate annuity payments and compare different annuity options. These tools can provide valuable insights into the potential returns and costs of various annuities.

Ultimate Conclusion

As you navigate the world of annuities, remember that careful planning and understanding are key. By utilizing the information provided in this guide, you can confidently approach your retirement planning, ensuring a secure and comfortable future. Consider seeking professional financial advice to tailor your annuity strategy to your unique circumstances and maximize its potential.

FAQ Corner

What is the difference between a fixed and a variable annuity?

A fixed annuity offers a guaranteed rate of return, while a variable annuity’s returns are tied to the performance of underlying investments, making it riskier but potentially more lucrative.

How do I determine the right annuity for my needs?

Consider your risk tolerance, time horizon, and financial goals. Seek advice from a financial professional to assess your specific situation and recommend suitable annuity options.

What are the tax implications of annuities?

Annuities are subject to income tax upon withdrawal. Consult with a tax advisor to understand the tax implications of your specific annuity type and withdrawal strategy.