Annuity Calculator HDFC 2024 empowers you to visualize your retirement future, offering insights into the potential returns and payouts of HDFC’s diverse annuity products. Whether you’re seeking guaranteed income, tax benefits, or protection against market volatility, understanding the intricacies of annuities can help you make informed financial decisions.

Want to know how much annuity you can expect for a principal of 40,000? This guide, How Much Annuity For 40 000 2024 , will help you understand the potential payouts for a 40,000 annuity.

This guide delves into the world of annuities, exploring their purpose, types, and how they can be used for retirement planning, income generation, and other financial goals. We’ll specifically focus on HDFC’s annuity products, comparing their features, benefits, and risks.

Additionally, we’ll provide a step-by-step walkthrough of the HDFC Annuity Calculator, showcasing how to utilize it to project your potential annuity payments and returns.

Excel is a powerful tool for financial planning. If you’re looking for a way to calculate annuity cash flows in Excel, check out this guide: Calculating Annuity Cash Flows Excel 2024. This guide will walk you through the steps of creating a spreadsheet to track your annuity payments.

Contents List

Understanding Annuities

An annuity is a financial product that provides a stream of regular payments for a specific period of time. It’s essentially a contract between you and an insurance company, where you make a lump-sum payment or a series of payments in exchange for a guaranteed income stream.

If you’re looking to learn about the annuity payout for a principal of 100,000, this article, How Much Annuity For 100 000 2024 , can help you understand the potential payouts and factors that influence them.

Annuities can be a valuable tool for retirement planning, income generation, and other financial goals.

There are various methods used to calculate annuities. The Annuity Method 2024 article outlines some of the most common approaches, including the simple interest method and the compound interest method. Understanding these methods can help you choose the right annuity for your needs.

Types of Annuities

There are various types of annuities, each with its own characteristics and suitability for different needs. Here are some common types:

- Immediate Annuities:These start paying out immediately after you purchase them. They are ideal for those who need immediate income.

- Deferred Annuities:These start paying out at a later date, often during retirement. They offer the opportunity to grow your investment over time.

- Fixed Annuities:These provide a guaranteed fixed rate of return, ensuring predictable payments. They are suitable for those seeking stability and certainty.

- Variable Annuities:These offer the potential for higher returns but also carry higher risk. The payouts depend on the performance of the underlying investments.

Examples of Annuity Usage

Annuities can be used in various ways to achieve financial goals:

- Retirement Planning:Annuities can provide a steady stream of income during retirement, supplementing other retirement savings.

- Income Generation:Annuities can generate regular income for individuals who are not yet ready to retire or who need additional income.

- Protecting Against Market Volatility:Fixed annuities can help protect your savings from market fluctuations, offering stability and predictability.

- Long-Term Care:Annuities can provide financial protection against the costs of long-term care, ensuring you have the resources you need.

HDFC Annuity Products

HDFC offers a range of annuity products designed to meet different financial needs. These products are tailored to provide guaranteed income streams, wealth accumulation, and financial security.

If you’re looking for a way to grow your annuity over time, you can consider a growing annuity. This article, Calculating Growing Annuity 2024 , explains how to calculate the growth of your annuity and the factors that can influence it.

HDFC Annuity Products

- HDFC Life Pension Plus:This is a single premium deferred annuity that offers guaranteed income for life. It’s suitable for individuals seeking a secure income stream during retirement.

- HDFC Life Guaranteed Income Plan:This is a regular premium deferred annuity that provides guaranteed income for a specified period. It’s ideal for those who want to accumulate savings and then receive regular income.

- HDFC Life Annuity Plus:This is a single premium immediate annuity that provides immediate income payments. It’s suitable for individuals who need immediate income after retirement.

Features, Benefits, and Risks

Each HDFC annuity product has unique features, benefits, and risks. It’s essential to carefully consider these factors before making a decision.

For those who speak Hindi, understanding the concept of annuities in Hindi can be beneficial. This article, Annuity Ka Hindi Meaning 2024 , provides a comprehensive explanation of annuities in Hindi.

- Guaranteed Income:HDFC annuity products offer guaranteed income streams, ensuring you receive regular payments for a specified period or for life.

- Tax Benefits:Some HDFC annuity products offer tax benefits on premiums and payouts, depending on the specific product and applicable tax regulations.

- Flexibility:Some HDFC annuities offer flexibility in choosing the payout period, frequency, and other options to meet your individual needs.

- Liquidity:Annuities typically have limited liquidity, meaning you may not be able to access your funds easily. However, some HDFC annuity products offer options for partial withdrawals.

- Fees:HDFC annuity products may involve fees, such as premium charges, administration fees, and surrender charges. It’s crucial to understand the fee structure before investing.

Eligibility Criteria and Application Process

The eligibility criteria and application process for HDFC annuity products vary depending on the specific product. You can find detailed information on HDFC’s website or by contacting their customer service.

Visualizing the present value of an annuity can be helpful. You can find a handy chart that breaks down the present value of annuities in this article: Pv Annuity Chart 2024. This chart can help you understand how the time value of money impacts your future financial goals.

Using the HDFC Annuity Calculator: Annuity Calculator Hdfc 2024

The HDFC Annuity Calculator is a user-friendly tool that helps you estimate your potential annuity payments and total returns. It allows you to input various parameters and see the projected outcomes.

Annuity payments are often considered the “flip side” of a lump sum investment. To learn more about this concept, you can check out this article: An Annuity Is Sometimes Called The Flip Side Of 2024. It explores the relationship between annuities and lump sum investments.

Using the HDFC Annuity Calculator

Here’s a step-by-step guide on how to use the HDFC Annuity Calculator:

- Visit the HDFC website:Go to the official HDFC website and locate the Annuity Calculator section.

- Select the annuity product:Choose the HDFC annuity product you’re interested in.

- Input the parameters:Enter the required information, such as the investment amount, interest rate, and payout period.

- Calculate the results:Click on the “Calculate” button to generate the projected annuity payments and total returns.

- Analyze the results:Review the calculator’s output and understand the potential outcomes based on your inputs.

Calculator Parameters

The HDFC Annuity Calculator typically allows you to adjust the following parameters:

- Investment Amount:This is the lump-sum payment or the total amount you plan to invest in the annuity.

- Interest Rate:This represents the assumed rate of return on your investment. The interest rate may be fixed or variable depending on the annuity product.

- Payout Period:This is the duration for which you’ll receive annuity payments, which can be for a specified period or for life.

Factors to Consider When Choosing an Annuity

Choosing the right annuity requires careful consideration of your individual circumstances and financial goals. Several factors can influence your decision.

Factors to Consider

- Investment Goals:What are your primary financial objectives? Do you need immediate income, long-term growth, or protection against market volatility?

- Risk Tolerance:How comfortable are you with taking on investment risk? Fixed annuities offer guaranteed returns, while variable annuities have higher potential returns but also higher risk.

- Financial Situation:What are your current financial resources, income, and expenses? Consider your overall financial health and how an annuity fits into your overall financial plan.

- Tax Implications:Understand the tax implications of different annuity products, including premium payments, payouts, and potential tax benefits.

- Fees and Charges:Compare the fees associated with different annuity products, including premium charges, administration fees, and surrender charges.

- Liquidity:Consider your need for access to your funds. Annuities typically have limited liquidity, but some products offer options for partial withdrawals.

Influence on Annuity Selection

The factors discussed above can significantly influence your choice of annuity product. For example, if you have a high risk tolerance and are seeking potential for higher returns, a variable annuity might be suitable. However, if you prioritize stability and guaranteed income, a fixed annuity might be a better option.

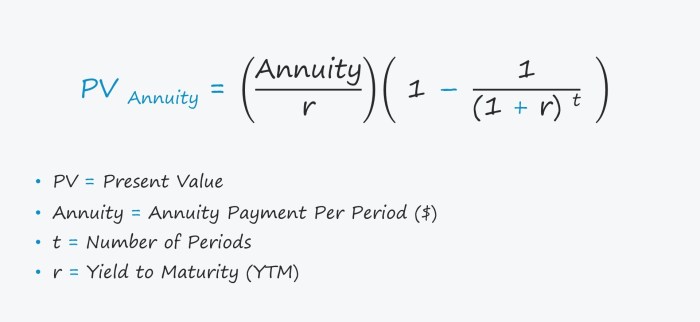

Understanding the discount factor is essential for calculating the present value of an annuity. This article, Calculate Annuity Discount Factor 2024 , explains how to calculate the discount factor and its importance in annuity calculations.

Importance of Financial Advice, Annuity Calculator Hdfc 2024

It’s crucial to consult with a qualified financial advisor before making any investment decisions. A financial advisor can help you assess your individual circumstances, understand the complexities of annuities, and choose the most appropriate product for your needs.

Wondering what an annuity with a principal of 750k might look like? This article, Annuity 750k 2024 , provides insights into the potential payouts and growth of a 750k annuity. It’s a great way to visualize how a large annuity can grow over time.

Pros and Cons of Annuities

Annuities offer several advantages but also have potential drawbacks. It’s essential to weigh the pros and cons carefully before making a decision.

Want to know what annuity is required over a 12-year period to achieve a specific financial goal? This article, What Annuity Is Required Over 12 Years 2024 , can help you determine the necessary annuity amount.

Advantages of Annuities

- Guaranteed Income:Fixed annuities provide a guaranteed stream of income for a specified period or for life, ensuring financial security.

- Tax Benefits:Some annuities offer tax benefits on premiums and payouts, depending on the specific product and applicable tax regulations.

- Protection Against Market Volatility:Fixed annuities can help protect your savings from market fluctuations, offering stability and predictability.

- Longevity Protection:Some annuities provide longevity protection, ensuring you receive payments for life, regardless of how long you live.

Disadvantages of Annuities

- Limited Liquidity:Annuities typically have limited liquidity, meaning you may not be able to access your funds easily. Early withdrawals may incur penalties.

- Potential for Fees:Annuities may involve fees, such as premium charges, administration fees, and surrender charges. These fees can impact your overall returns.

- Possibility of Outliving the Annuity Payments:If you live longer than the payout period, you may run out of annuity payments. This is a concern with annuities that have a fixed payout period.

Annuity Calculations and Examples

Here are some examples illustrating different annuity scenarios with varying investment amounts, interest rates, and payout periods. These examples provide a general understanding of how annuity calculations work.

If you’re looking to convert your pension pot into an annuity, this guide, Calculate Annuity From Pension Pot 2024 , can help you understand the process and factors involved in calculating your annuity payout.

Annuity Scenarios

| Scenario | Investment Amount | Interest Rate | Payout Period | Projected Annual Payment | Total Returns |

|---|---|---|---|---|---|

| 1 | $100,000 | 4% | 20 years | $7,358 | $147,160 |

| 2 | $200,000 | 5% | 15 years | $19,540 | $293,100 |

| 3 | $50,000 | 3% | 10 years | $5,907 | $59,070 |

Impact of Parameters

The examples demonstrate how different parameters can impact the projected annuity payments and total returns. A higher investment amount, interest rate, or payout period generally results in higher projected payments and total returns. Conversely, lower values for these parameters lead to lower projected payments and returns.

Final Review

By carefully considering your investment goals, risk tolerance, and financial situation, you can leverage the HDFC Annuity Calculator to create a retirement plan that aligns with your aspirations. Remember, seeking advice from a financial advisor can provide personalized guidance and ensure your chosen annuity product meets your unique needs.

Choosing the right annuity can be tricky. This article, Annuity Which Is Best 2024 , provides a comprehensive overview of different annuity types and helps you determine which one might be the best fit for your financial goals.

Helpful Answers

How does the HDFC Annuity Calculator work?

If you’re interested in seeing how monthly compounding affects your annuity, you can use an Annuity Calculator Compounded Monthly 2024. This type of calculator shows you the growth of your annuity over time, taking into account the effects of monthly compounding.

The calculator requires you to input your desired investment amount, expected interest rate, and desired payout period. It then uses this information to generate projected annuity payments and total returns, providing a clear picture of your potential future income.

What are the key differences between immediate and deferred annuities?

Immediate annuities begin making payments immediately after purchase, while deferred annuities have a delay before payments start, allowing your investment to grow for a specified period.

Annuity calculators can be incredibly useful for planning your financial future. If you’re looking for a basic calculator to get started, check out this Annuity Calculator Basic 2024 guide. It’s a great starting point for understanding how annuities work and how they can benefit you.

Is there a minimum investment amount for HDFC annuity products?

HDFC may have minimum investment requirements for their annuity products, which vary depending on the specific product. It’s best to consult their website or a financial advisor for current details.

Can I withdraw my investment before the payout period ends?

Typically, annuities have a surrender period, which may incur penalties if you withdraw your investment before the end of the specified term. Consult the product terms and conditions for specific details.