Joint Claim Universal Credit offers a lifeline for couples facing financial hardship. This benefit, designed to help couples make ends meet, can be a valuable resource for those struggling to manage their finances. However, navigating the complexities of Joint Claim Universal Credit requires a clear understanding of its eligibility criteria, application process, and potential implications.

Not all claims are actionable. Understanding what constitutes a valid claim is essential for navigating legal matters. Learn more about the criteria for an Actionable Claim and what steps you can take to protect your rights.

This guide delves into the intricacies of Joint Claim Universal Credit, providing insights into its benefits and drawbacks, as well as the factors that determine eligibility and the amount of support received. We’ll explore the steps involved in applying, the documentation required, and the potential challenges couples may encounter along the way.

State Farm offers coverage for glass damage, but filing a claim can sometimes be confusing. Understanding the process and your options is important. Learn more about State Farm Glass Claim procedures and how to navigate them.

Additionally, we’ll examine the impact of Joint Claim Universal Credit on relationships and provide practical strategies for managing finances effectively as a couple.

The COVID-19 pandemic has brought about new challenges for insurance claims. Understanding how to file a claim related to COVID-19 is crucial. Learn more about Covid Claim processes and potential coverage.

Contents List

- 1 What is Joint Claim Universal Credit?

- 2 Applying for Joint Claim Universal Credit

- 3 Calculating Joint Claim Universal Credit

- 4 Managing Joint Claim Universal Credit

- 5 Changes and Updates to Joint Claim Universal Credit

- 6 Joint Claim Universal Credit and Relationships

- 7 Case Studies and Real-Life Examples

- 8 Final Thoughts

- 9 Answers to Common Questions

What is Joint Claim Universal Credit?

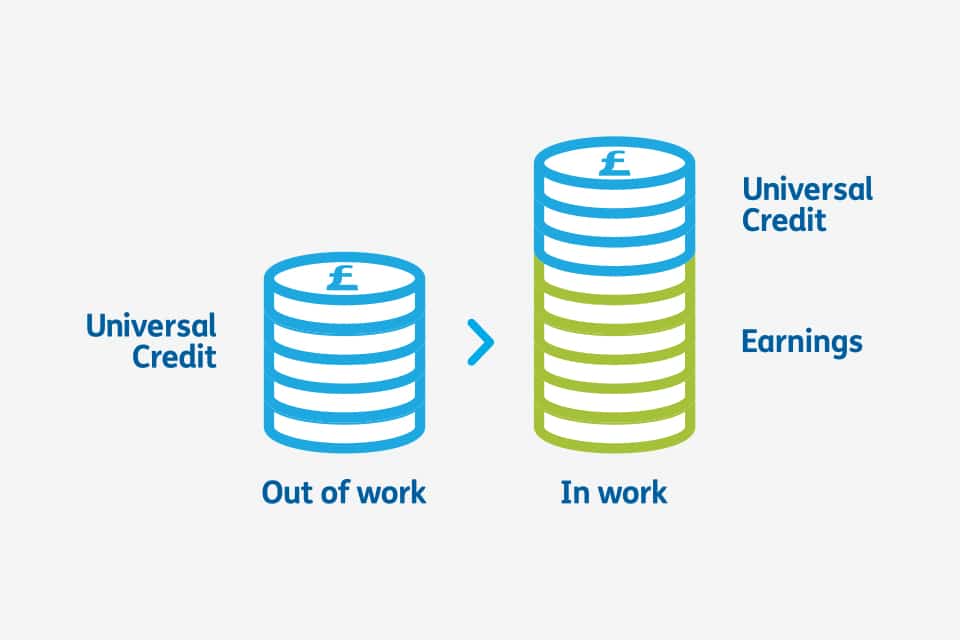

Universal Credit (UC) is a benefit payment in the UK that combines six existing benefits into one. Couples can choose to make a joint claim for Universal Credit, which means they will receive one payment for both of them. This can be beneficial for couples who are financially dependent on each other and want to simplify their benefit payments.

Navigating insurance claims can be tricky, especially with a company like Wawanesa. Understanding your rights and the process is crucial. If you’re facing a claim, it’s helpful to know about Wawanesa Claims and how they handle different situations.

Joint Claim Universal Credit Explained

A Joint Claim Universal Credit is a single payment for a couple who are both eligible for Universal Credit. The couple will be assessed as a single unit, and their combined income and expenses will be considered when calculating their benefit payment.

The Doctrine of Promissory Estoppel can be a powerful legal tool, but understanding its application and limitations is crucial. It can help enforce promises even without a formal contract. Learn more about Doctrine Of Promissory Estoppel and how it can be used in legal situations.

This means that the couple will receive a single payment, rather than two separate payments.

Allianz Assistance provides travel insurance and assistance services. Understanding their claims process is essential if you need to file a claim while traveling. Learn more about Allianz Assistance Claims and how to navigate them.

Eligibility Criteria for Joint Claim Universal Credit

To be eligible for a Joint Claim Universal Credit, couples must meet certain criteria, including:

- Both partners must be aged 18 or over.

- Both partners must be living together as a couple.

- Both partners must be either working, looking for work, or unable to work due to illness or disability.

- Both partners must be in the UK and have a valid National Insurance number.

- Both partners must be in a relationship that is recognized as a partnership by the UK government.

Benefits and Drawbacks of Joint Claim Universal Credit

There are several benefits and drawbacks to making a Joint Claim Universal Credit. Here are some of the key considerations:

Benefits

- Simplified payments:Couples receive a single payment, simplifying budgeting and managing finances.

- Potential for higher benefit:Combined income and expenses may result in a higher overall benefit amount.

- Shared responsibility:Joint management encourages communication and shared financial responsibility.

Drawbacks

- Potential for lower benefit:If one partner has a significantly higher income, the combined income may reduce the benefit amount for both.

- Financial dependence:Joint claim creates financial dependence, which can be problematic if the relationship ends.

- Complexity:Managing a joint claim can be more complex than managing individual claims.

Applying for Joint Claim Universal Credit

Applying for Joint Claim Universal Credit involves a few steps, and it’s crucial to have all the necessary documents prepared before starting the application process.

Farm Bureau Insurance is a popular choice for many, but knowing how to file a claim effectively is crucial. Understanding their procedures and your rights can help you navigate the process smoothly. Learn more about Farm Bureau Insurance Claims and how to approach them.

Steps Involved in Applying

- Gather necessary documents:This includes both partners’ ID, National Insurance numbers, bank details, and details of any income or savings.

- Complete the application form:Both partners must complete the application form online or by phone.

- Provide evidence:You will need to provide evidence to support your application, such as payslips, bank statements, or medical certificates.

- Attend an assessment:You may be required to attend an assessment to discuss your circumstances and income.

- Receive a decision:The DWP will review your application and inform you of their decision.

Required Documentation

The necessary documentation for a Joint Claim Universal Credit application includes:

- Identification:Passport, driving license, or other government-issued ID.

- National Insurance number:Both partners’ National Insurance numbers.

- Bank details:Both partners’ bank account details for receiving payments.

- Income details:Payslips, self-assessment tax returns, or other income documentation.

- Savings details:Bank statements or other documentation showing savings amounts.

- Other relevant documents:Evidence of any other income or expenses, such as rent agreements, childcare costs, or medical certificates.

Application Methods

You can apply for Joint Claim Universal Credit through various methods:

- Online:Apply directly through the GOV.UK website.

- Telephone:Contact the Universal Credit helpline to apply over the phone.

- Offline:Request an application form from your local Jobcentre Plus office.

Potential Challenges

Couples might encounter some challenges during the application process, including:

- Complex forms:The application forms can be lengthy and complex.

- Evidence requirements:Providing sufficient evidence to support your application can be challenging.

- Processing time:It can take several weeks for the DWP to process your application.

- Communication issues:Miscommunication or misunderstandings can lead to delays or errors in the application process.

Calculating Joint Claim Universal Credit

The amount of Universal Credit a couple receives is calculated based on their combined income, expenses, and other financial factors. This section explores the factors involved in calculating Joint Claim Universal Credit and provides a detailed breakdown of the process.

Asurion provides insurance for electronic devices, but filing a claim can be a complex process. Understanding their procedures and your rights is essential. Learn more about Asurion Phone Claim procedures and how to navigate them.

Factors Considered in Calculation

The calculation of Joint Claim Universal Credit takes into account various factors, including:

- Combined income:This includes both partners’ earnings, pensions, benefits, and any other income sources.

- Combined expenses:These include rent, council tax, childcare costs, and other essential expenses.

- Savings:Any savings held by either partner will be considered.

- Other financial factors:These can include any debts, childcare responsibilities, or disability-related expenses.

Breakdown of Calculation

The Universal Credit amount is calculated based on the following steps:

- Calculate the standard allowance:This is a base amount based on the couple’s age and circumstances.

- Add any applicable work allowances:These allowances are based on the couple’s working hours and earnings.

- Subtract any deductions:This includes deductions for income, savings, and other financial factors.

- Calculate the final Universal Credit amount:The final amount is the standard allowance plus any work allowances, minus any deductions.

Impact of Income, Savings, and Financial Factors

The calculated Universal Credit amount can be affected by various financial factors:

- Income:Higher income will generally lead to a lower Universal Credit amount.

- Savings:Savings above a certain threshold will reduce the Universal Credit amount.

- Other financial factors:Other factors, such as debts or childcare costs, can affect the calculated amount.

Comparison to Individual Claims

The calculation method for Joint Claim Universal Credit differs from individual claims in several ways:

- Combined income:The combined income of both partners is considered for a joint claim, while individual claims only consider individual income.

- Shared expenses:Shared expenses, such as rent and council tax, are considered for a joint claim, while individual claims only consider individual expenses.

- Potential for higher or lower benefit:The combined income and expenses can result in a higher or lower benefit amount compared to individual claims.

Managing Joint Claim Universal Credit

Managing a Joint Claim Universal Credit effectively requires careful budgeting, financial planning, and clear communication between partners. This section provides a guide for couples on managing their Joint Claim Universal Credit efficiently.

Defamation can have serious consequences, impacting your reputation and even leading to financial losses. If you’re facing a situation where someone has made false statements about you, it’s essential to understand your rights and potential recourse. Learn more about Defamation and how it can affect you.

Budgeting and Financial Planning

Here are some tips for budgeting and financial planning for couples receiving Joint Claim Universal Credit:

- Create a joint budget:Track all income and expenses to understand your overall financial situation.

- Prioritize essential expenses:Ensure you have enough money for rent, food, utilities, and other essential needs.

- Allocate funds for savings:Even small amounts saved regularly can provide a financial cushion for emergencies.

- Track spending:Use budgeting apps or spreadsheets to monitor your spending habits.

- Seek financial advice:Consult with a financial advisor or debt management service for guidance on managing your finances.

Responsibilities of Each Partner

Both partners have responsibilities in managing the Joint Claim Universal Credit:

- Shared responsibility for budgeting and financial planning:Both partners should actively participate in creating and managing the budget.

- Open communication:Discuss financial matters openly and honestly with each other.

- Transparency in income and expenses:Ensure both partners are aware of all income and expenses.

- Shared decision-making:Make financial decisions together, considering each other’s needs and priorities.

Resources and Support Services

Couples receiving Joint Claim Universal Credit can access various resources and support services:

- Jobcentre Plus:Provides support with finding work, training, and other employment-related services.

- Citizens Advice:Offers free, confidential advice on benefits, debt, and other legal matters.

- Money Advice Service:Provides guidance on managing money, budgeting, and debt.

- Local council:May offer support with housing, childcare, and other essential services.

Changes and Updates to Joint Claim Universal Credit

The Joint Claim Universal Credit policy is subject to changes and updates. Staying informed about these changes is crucial for couples receiving this benefit, as they can impact their financial situation.

AT&T offers various services, and filing a claim for issues with their products or services can be a necessary step. Knowing how to navigate their claims process is important. Learn more about Att File A Claim procedures and how to approach them.

Recent Changes and Updates

Recent changes to the Joint Claim Universal Credit policy include:

- Changes to the benefit cap:The maximum amount of Universal Credit a household can receive has been adjusted.

- Updates to work allowances:The amount of work allowance available to couples has been revised.

- Changes to the taper rate:The rate at which Universal Credit payments reduce as income increases has been adjusted.

Impact of Changes on Couples

These changes can have a significant impact on couples receiving Joint Claim Universal Credit, potentially leading to:

- Reduced benefit payments:Changes to the benefit cap, work allowances, or taper rate can result in lower benefit amounts.

- Increased financial pressure:Lower benefit payments can put additional pressure on couples to manage their finances.

- Need for adjustment to budgeting:Couples may need to adjust their budgets to accommodate changes in their Universal Credit payments.

Upcoming Changes and Potential Future Updates

The government may introduce further changes to the Joint Claim Universal Credit policy in the future. These changes could include:

- Further adjustments to the benefit cap:The government may adjust the maximum benefit amount again.

- Changes to the eligibility criteria:The criteria for receiving Joint Claim Universal Credit may be revised.

- Introduction of new conditions:New conditions or requirements may be added to the policy.

Implications for Financial Planning

Couples receiving Joint Claim Universal Credit should stay informed about any changes or updates to the policy. This will help them to:

- Understand the potential impact on their finances:Assess how changes may affect their benefit payments.

- Adjust their budgeting accordingly:Make necessary adjustments to their budgets to accommodate any changes.

- Plan for future financial needs:Prepare for potential changes in their financial situation.

Joint Claim Universal Credit and Relationships

Receiving Joint Claim Universal Credit can have a significant impact on a couple’s relationship. This section explores the potential impact of Joint Claim Universal Credit on relationships, discussing the challenges and opportunities couples might face.

Unemployment benefits can provide financial support during difficult times. Knowing how to apply and file weekly claims is essential. Learn more about Apply For Unemployment and how to navigate the process.

Impact on Relationships

Joint Claim Universal Credit can create both challenges and opportunities for couples:

Challenges

- Financial dependence:Joint claim can create financial dependence, which can be challenging if the relationship ends.

- Increased financial pressure:Managing finances on a limited budget can create stress and tension in the relationship.

- Communication issues:Miscommunication about finances can lead to conflict and resentment.

- Power imbalances:One partner may feel more control over finances, leading to power imbalances in the relationship.

Opportunities

- Shared responsibility:Joint claim encourages shared responsibility for finances, fostering communication and teamwork.

- Financial transparency:Open communication about finances can build trust and understanding in the relationship.

- Financial planning:Joint budgeting and financial planning can help couples achieve their financial goals together.

- Strengthened relationship:Working together to manage finances can strengthen the bond between partners.

Strategies for Maintaining Healthy Communication and Financial Transparency, Joint Claim Universal Credit

Couples can take several steps to maintain healthy communication and financial transparency:

- Regularly discuss finances:Schedule regular meetings to discuss budgeting, spending, and financial goals.

- Be open and honest:Share all income and expenses with each other, even if they seem small.

- Listen to each other’s concerns:Understand each other’s financial priorities and challenges.

- Seek professional help:If communication becomes difficult, consider seeking couples therapy or financial counseling.

Examples of Impact on Relationship Dynamics

Here are some examples of how Joint Claim Universal Credit can affect relationship dynamics:

- Increased conflict:Couples may experience more conflict over financial decisions, particularly if they have different spending habits or priorities.

- Improved communication:Open communication about finances can lead to a stronger and more trusting relationship.

- Greater financial stability:Joint budgeting and financial planning can help couples achieve greater financial stability and security.

Case Studies and Real-Life Examples

To illustrate the real-world impact of Joint Claim Universal Credit on couples, here are some case studies showcasing different scenarios:

| Scenario | Income | Expenses | Calculated Universal Credit | Outcome |

|---|---|---|---|---|

| Couple with one partner working full-time and the other unemployed | £2,500 (working partner) | £1,500 (rent, bills, etc.) | £500 | The couple receives a Universal Credit payment of £500, providing additional financial support for their household expenses. |

| Couple with both partners working part-time | £1,000 (partner 1) + £800 (partner 2) | £1,200 (rent, bills, etc.) | £300 | The couple receives a Universal Credit payment of £300, supplementing their combined income to cover their expenses. |

| Couple with one partner working and the other disabled | £1,800 (working partner) | £1,800 (rent, bills, disability-related expenses) | £700 | The couple receives a Universal Credit payment of £700, helping them manage their expenses, particularly the costs associated with disability. |

These case studies demonstrate the varying financial situations couples can face when receiving Joint Claim Universal Credit. The calculated Universal Credit amount can significantly impact their ability to manage expenses and achieve financial stability.

Uninsured motorist coverage is crucial, especially in cases where you’re involved in an accident with a driver who doesn’t have insurance. It’s important to understand your rights and the process for filing a claim. Learn more about Uninsured Motorist Bodily Injury coverage and how it can protect you.

Final Thoughts

Understanding the nuances of Joint Claim Universal Credit empowers couples to make informed decisions about their finances. By carefully navigating the application process, managing their finances effectively, and maintaining open communication, couples can leverage this benefit to create a more secure financial future.

Home warranties can provide peace of mind, but navigating claims can be challenging. Understanding the process and your rights is key. If you have a Choice Home Warranty, learn more about Choice Home Warranty Claim procedures.

Answers to Common Questions

How does Joint Claim Universal Credit differ from individual claims?

Joint Claim Universal Credit considers the combined income and circumstances of both partners, while individual claims are based on each person’s individual situation.

What happens if one partner’s income changes after applying for Joint Claim Universal Credit?

You must report any changes in income or circumstances to the Department for Work and Pensions (DWP) promptly. This may affect your Universal Credit payments.

Can we apply for Joint Claim Universal Credit if we are not married?

Loss adjusters play a vital role in the insurance process, especially when dealing with complex claims. They help assess damages and determine the appropriate compensation. If you need to understand the role of a loss adjuster, check out this resource on Loss Adjuster.

Yes, you can apply for Joint Claim Universal Credit if you are in a relationship and live together as a couple, regardless of your marital status.

What are the consequences of providing false information on the application?

Providing false information can lead to penalties, including fines and potential legal action. It’s essential to be honest and accurate in your application.

Staying on top of your unemployment benefits is crucial. Understanding how to file weekly claims online can help you receive your benefits smoothly. Learn more about File Unemployment Weekly Claim Online and how to navigate the process.