Annuity Formula Half Yearly 2024 delves into the intricate world of financial planning, specifically focusing on the calculation of annuities with half-yearly payments. Understanding these formulas is crucial for individuals seeking to secure their financial future, whether through retirement planning, loan calculations, or investment strategies.

If you’re in the UK and considering an annuity, you’ll want to compare quotes from different providers to find the best deal. You can find annuity quotes from UK providers in 2024 on Annuity Quotes Uk 2024.

This guide will explore the fundamental concepts of annuities, including their different types, present and future values, and the impact of compounding frequency.

Annuities can be structured in different ways, depending on your needs. If you’re looking for information about joint life options for annuities in 2024, you can find it on Annuity Joint Life Option 2024.

We’ll then dive into the specific nuances of applying the annuity formula for half-yearly payments, providing practical examples and demonstrating how economic conditions and interest rates influence these calculations. By the end, you’ll gain valuable insights into how to utilize these formulas effectively for making informed financial decisions in 2024 and beyond.

An annuity can be a great way to supplement your retirement income. But before you invest, it’s important to do your research and understand the different types of annuities available. For example, if you’re looking for a way to invest 50k in 2024, you might want to check out Annuity 50k 2024.

Contents List

Understanding Annuities

An annuity is a series of equal payments made over a specified period of time. Annuities are commonly used in financial planning, insurance, and investment banking. They provide a steady stream of income for a set period of time, making them a valuable tool for retirement planning, loan repayment, and other financial goals.

You might be wondering if an annuity is the same as an IRA. While they share some similarities, there are also key differences. You can learn more about the differences between annuities and IRAs in 2024 on Is Annuity Same As Ira 2024.

Key Characteristics of Annuities

- Regular Payments:Annuities involve a series of equal payments made at regular intervals, such as monthly, quarterly, or annually.

- Fixed Period:Annuities have a defined start and end date, specifying the duration of the payment stream.

- Interest Rate:Annuities typically earn interest, which is compounded over time, increasing the overall value of the annuity.

Present Value and Future Value

Understanding the concepts of present value and future value is crucial when dealing with annuities. Present value refers to the current worth of a future stream of payments, while future value represents the value of an investment at a specific point in the future.

When it comes to taxes, it’s important to understand how annuities are treated. If you’re wondering whether an annuity from LIC is taxable in 2024, you can find the answer on Is Annuity From Lic Taxable 2024.

Types of Annuities

Annuities come in various forms, each with its unique characteristics and applications. Some common types include:

- Ordinary Annuity:Payments are made at the end of each period.

- Annuity Due:Payments are made at the beginning of each period.

- Fixed Annuity:The payment amount remains constant throughout the annuity period.

- Variable Annuity:The payment amount fluctuates based on the performance of underlying investments.

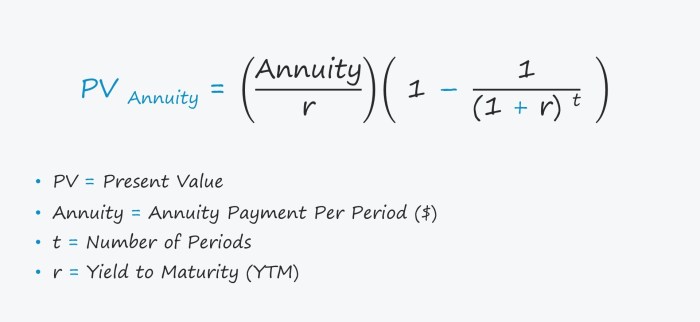

The Annuity Formula

The annuity formula is a mathematical equation used to calculate the present value of an annuity. It takes into account the payment amount, interest rate, and number of periods.

Annuities can be a complex financial product, but they can also be a valuable tool for retirement planning. If you’re looking for information about a specific type of annuity, like an annuity with a term of 4 years, you can find resources on Annuity 4 2024.

General Formula

Present Value = Payment Amount x [1- (1 + Interest Rate)^-Number of Periods] / Interest Rate

If you’re using Microsoft Excel, you can easily calculate a growing annuity. You can find a guide on how to calculate a growing annuity in Excel in 2024 on Calculate Growing Annuity In Excel 2024.

Variables in the Formula

- Payment Amount:The amount of each regular payment.

- Interest Rate:The rate at which the annuity earns interest.

- Number of Periods:The total number of payment periods in the annuity.

Applications of the Formula

The annuity formula can be applied in various scenarios, such as:

- Calculating the present value of a loan:Determining the current value of a series of future loan payments.

- Evaluating the present value of an investment:Assessing the current worth of a stream of future investment returns.

- Retirement planning:Estimating the present value of future retirement income streams.

Annuity Calculations: Half-Yearly Payments: Annuity Formula Half Yearly 2024

When dealing with half-yearly payments, the annuity formula needs to be adjusted to reflect the shorter payment period. This involves adjusting the interest rate and the number of periods.

One of the defining characteristics of an annuity is that it involves a series of equal payments. You can find more information about this characteristic of annuities in 2024 on Annuity Is A Series Of Equal Payments 2024.

Adjusting the Formula

- Interest Rate:The annual interest rate is divided by 2 to obtain the half-yearly interest rate.

- Number of Periods:The total number of years is multiplied by 2 to get the number of half-yearly periods.

Example Calculation

Suppose you have a half-yearly annuity with a payment amount of $1,000, an annual interest rate of 5%, and a duration of 10 years. To calculate the present value, we adjust the formula as follows:

- Half-yearly interest rate:5% / 2 = 2.5%

- Number of half-yearly periods:10 years x 2 = 20 periods

Present Value = $1,000 x [1- (1 + 0.025)^-20] / 0.025

Annuities can be a flexible financial product. If you’re looking for information about annuity drawdown in 2024, you can find it on Is Annuity Drawdown 2024.

Present Value = $15,672.53

Impact of Compounding Frequency

The frequency of compounding affects annuity calculations. More frequent compounding leads to higher future values and lower present values. In the case of half-yearly payments, the interest is compounded twice a year, resulting in a slightly higher future value compared to annual compounding.

Annuities come in different types, each with its own features and benefits. If you’re looking for a comprehensive guide to different types of annuities in 2024, you can find it on Annuity Kinds 2024.

Real-World Applications of Annuity Formulas

Annuity formulas are widely used in various financial contexts, providing valuable insights for planning and decision-making.

Annuities can be a great way to supplement your retirement income, but it’s important to understand how they are taxed. You can find information about whether annuity income is considered capital gains in 2024 on Is Annuity Income Capital Gains 2024.

Financial Planning

- Retirement Planning:Annuities play a crucial role in retirement planning, allowing individuals to estimate the amount of income they can expect from their savings during retirement.

- Loan Calculations:Annuity formulas are used to calculate the monthly payments on loans, such as mortgages, car loans, and student loans.

Industries

- Insurance:Insurance companies use annuity formulas to calculate premiums for life insurance policies and to determine the payouts for annuities.

- Investment Banking:Investment banks utilize annuity formulas to value financial instruments, such as bonds and structured products, that involve regular payments.

Factors Influencing Calculations

- Inflation:Inflation erodes the purchasing power of money over time, affecting the present value and future value of annuities. Higher inflation rates generally lead to lower present values and higher future values.

- Taxes:Taxes can impact annuity calculations, as interest earned on annuities is often subject to taxation. Tax rates and regulations can vary depending on the jurisdiction.

Annuity Formula in 2024

The current economic climate and interest rate environment significantly influence annuity calculations. Understanding these factors is essential for accurate financial planning and decision-making.

If you’re looking for a way to secure your future, you might want to consider an annuity. But first, it’s important to understand what an annuity is and how it works. You can find a detailed explanation in Hindi about what an annuity is in 2024 on Annuity Meaning In Hindi 2024.

Impact of Interest Rates and Economic Conditions, Annuity Formula Half Yearly 2024

Interest rates are a key determinant of annuity values. In periods of low interest rates, the present value of annuities is higher, while future values are lower. Conversely, high interest rates lead to lower present values and higher future values.

Understanding the math behind annuities can be a bit tricky, but there are plenty of resources available to help you. If you’re looking for information on calculating an annuity, you can find a comprehensive guide on Calculating Annuity Formula 2024.

Economic conditions, such as inflation and economic growth, also influence annuity calculations.

When you’re considering an annuity, you might want to calculate how much you can expect to receive. If you’re using a financial calculator like the BA II Plus, you can find helpful information on Calculating Annuity Ba Ii Plus 2024.

Changes and Updates in 2024

The annuity formula itself is unlikely to change significantly in 2024. However, there may be updates to regulations or guidelines related to annuities, such as changes to tax laws or investment restrictions.

If you’re thinking about rolling over your 401k into an annuity, it’s important to consider the pros and cons of this decision. You can find information about rolling over your 401k into an annuity in 2024 on Annuity 401k Rollover 2024.

Future Trends

As interest rates and economic conditions continue to evolve, annuity calculations will be affected. It’s crucial to stay informed about these trends and their potential impact on your financial planning. With the rise of technology and automation, there may be advancements in annuity calculation tools and software, making it easier to estimate annuity values and manage financial planning.

Last Point

In conclusion, the Annuity Formula Half Yearly 2024 serves as a powerful tool for individuals seeking to plan their financial future. By understanding the principles of annuities and their variations, you can make informed decisions about investments, retirement planning, and other financial goals.

The ability to calculate present and future values of annuities, especially with half-yearly payments, empowers you to navigate the complexities of financial planning with greater confidence. As we move forward, it’s crucial to stay abreast of evolving economic conditions and their impact on annuity calculations.

By embracing the insights provided in this guide, you can equip yourself with the knowledge and tools to make informed decisions that shape your financial well-being for years to come.

Answers to Common Questions

What is the difference between an ordinary annuity and an annuity due?

An ordinary annuity has payments made at the end of each period, while an annuity due has payments made at the beginning of each period.

How does inflation affect annuity calculations?

Inflation can erode the purchasing power of future payments, making it important to consider inflation when calculating the present value of an annuity.

Are there any tax implications associated with annuities?

Yes, annuity payments may be subject to taxes, depending on the type of annuity and the individual’s tax situation.