How To Calculate Annuity Formula 2024: Understanding annuities is crucial for anyone seeking to secure their financial future. Whether you’re planning for retirement, saving for a major purchase, or managing debt, annuities offer a structured way to manage your finances over time.

This guide will demystify the concept of annuities, exploring their various types, components, and practical applications.

For those seeking assistance with annuity calculations, the government offers helpful resources. Annuity Calculator Gov 2024 provides information on government-provided calculators and tools.

We’ll delve into the core annuity formula, breaking down its components and providing step-by-step instructions for calculation. You’ll learn how to adjust the formula based on different payment frequencies and interest rates. We’ll also discuss the concepts of present value and future value, highlighting their importance in financial planning.

John Hancock is a well-known provider of annuity products. Annuity John Hancock 2024 provides insights into their offerings. If you’re concerned about your annuity being “out of surrender,” My Annuity Is Out Of Surrender 2024 addresses this common concern.

Contents List

- 1 Understanding Annuities

- 2 Annuity Formula Components

- 3 Basic Annuity Formula

- 4 Annuity Formula Variations

- 5 Present Value and Future Value of Annuities

- 6 Annuity Calculations with Interest Rates: How To Calculate Annuity Formula 2024

- 7 Real-World Applications of Annuity Formulas

- 8 Concluding Remarks

- 9 Top FAQs

Understanding Annuities

An annuity is a financial product that provides a series of regular payments over a specified period of time. Think of it like a steady stream of income, often used for retirement planning or other long-term financial goals. Annuities are typically purchased with a lump sum payment, and the insurance company then makes regular payments to you, either for a fixed period or for the rest of your life.

Types of Annuities

There are many different types of annuities, each with its own features and benefits. Here are a few common examples:

- Fixed Annuities:These provide guaranteed payments at a fixed interest rate. This means you know exactly how much you’ll receive each month, providing predictable income. They are generally considered less risky than variable annuities.

- Variable Annuities:These offer the potential for higher returns but also carry more risk. The payments you receive are tied to the performance of the underlying investments, which can fluctuate. They are suitable for those seeking potential growth but willing to accept greater volatility.

- Immediate Annuities:These start making payments immediately after you purchase them. They are often used for retirement income or to provide a steady stream of cash flow. They can be a good option for those who need income right away.

- Deferred Annuities:These start making payments at a later date, often after a certain period of time or when you reach a specific age. They allow you to accumulate funds for a future goal, such as retirement, and then receive payments later.

Understanding how to withdraw funds from your annuity is essential. Annuity Withdrawal Calculator 2024 provides insights into the process. Annuity options vary based on age and other factors, as highlighted in Annuity 60 Year Old Man 2024 , which explores the specifics for a 60-year-old man.

Key Features and Benefits

Annuities offer several key features and benefits, making them an attractive option for many individuals:

- Guaranteed Income:Fixed annuities provide guaranteed payments, ensuring you receive a predictable stream of income.

- Tax-Deferred Growth:In most cases, the earnings on annuity investments grow tax-deferred, meaning you don’t pay taxes on them until you start receiving payments.

- Protection from Market Volatility:Fixed annuities offer protection from market downturns, as your payments are not tied to the performance of investments.

- Long-Term Income Security:Annuities can provide a steady stream of income for life, helping to ensure financial security in retirement.

Annuity Formula Components

The annuity formula is a mathematical equation used to calculate the present or future value of a series of regular payments. It takes into account several key variables, which are crucial for determining the overall value of the annuity.

Variables in the Annuity Formula

The following table summarizes the variables used in the annuity formula, their definitions, and typical units of measurement:

| Variable | Definition | Unit of Measurement |

|---|---|---|

| PV | Present Value | Dollars ($) |

| FV | Future Value | Dollars ($) |

| PMT | Payment Amount | Dollars ($) |

| r | Interest Rate | Percentage (%) |

| n | Number of Periods | Years, Months, or Quarters |

The relationship between these variables is crucial for understanding how the annuity calculation works. For instance, a higher interest rate (r) will result in a higher future value (FV) of the annuity, while a longer period (n) will also lead to a higher future value.

The payment amount (PMT) directly influences the overall value of the annuity, as larger payments will naturally result in a higher present or future value.

Annuity options often involve substantial sums. Annuity 300 000 2024 explores the implications of a $300,000 annuity. Understanding the tax implications is crucial, especially when determining if your annuity is qualified or non-qualified. Is An Annuity Qualified Or Nonqualified 2024 provides guidance on this aspect.

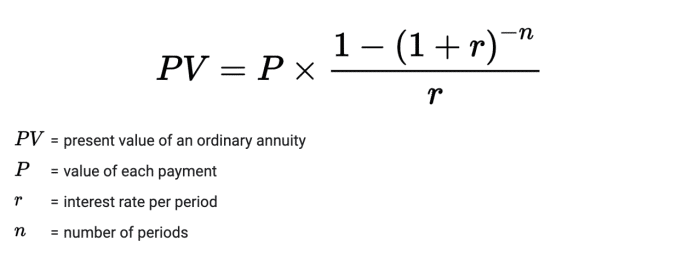

Basic Annuity Formula

The basic annuity formula is used to calculate the present value (PV) of an annuity, which represents the current worth of a series of future payments. This formula is particularly useful for determining the lump sum amount needed to purchase an annuity that will provide a specific stream of income.

Formula Components

PV = PMT

- [1

- (1 + r)^-n] / r

Where:

- PV = Present Value

- PMT = Payment Amount

- r = Interest Rate

- n = Number of Periods

Step-by-Step Calculation, How To Calculate Annuity Formula 2024

Here’s a step-by-step guide on how to calculate the present value of an annuity using the formula:

- Identify the payment amount (PMT):This is the regular payment you will receive from the annuity.

- Determine the interest rate (r):This is the rate of return on the annuity investment.

- Calculate the number of periods (n):This is the total number of payments you will receive.

- Plug the values into the formula:Substitute the values for PMT, r, and n into the annuity formula.

- Solve for the present value (PV):Use a calculator or spreadsheet software to calculate the present value of the annuity.

Example Calculation

Let’s say you want to purchase an annuity that will provide you with $1,000 per month for 20 years. The annuity offers an interest rate of 5% per year. To calculate the present value of this annuity, we can use the following steps:

- PMT = $1,000

- r = 5% per year = 0.05/12 per month

- n = 20 years

12 months/year = 240 months

- PV = $1,000

- [1

- (1 + 0.05/12)^-240] / (0.05/12)

- PV ≈ $156,508

Therefore, the present value of this annuity is approximately $156,508. This means you would need to invest $156,508 today to receive $1,000 per month for 20 years at a 5% annual interest rate.

Annuity Formula Variations

The basic annuity formula can be modified to accommodate different payment frequencies. For example, if payments are made quarterly or annually, the formula needs to be adjusted accordingly.

Payment Frequencies and Formula Adjustments

The following table summarizes the variations of the annuity formula based on different payment frequencies:

| Payment Frequency | Formula | Adjustment |

|---|---|---|

| Monthly | PV = PMT

|

Divide the interest rate (r) by 12 to get the monthly interest rate. |

| Quarterly | PV = PMT

|

Divide the interest rate (r) by 4 to get the quarterly interest rate. |

| Annually | PV = PMT

|

No adjustment needed. |

The adjustments to the formula ensure that the calculation accurately reflects the timing and frequency of payments. For example, when calculating the present value of a quarterly annuity, the interest rate needs to be adjusted to a quarterly rate by dividing the annual rate by 4.

Wondering if an annuity bond is right for you in 2024? Is Annuity Bond 2024 provides insights into this financial product, explaining its features and potential benefits. Understanding how annuities work is crucial, especially when considering their indefinite duration, as explained in Annuity Is Indefinite Duration 2024.

This ensures that the calculation takes into account the compounding effect of interest over the quarterly periods.

Present Value and Future Value of Annuities

The annuity formula can be used to calculate both the present value (PV) and future value (FV) of a series of regular payments. The present value represents the current worth of the future payments, while the future value represents the value of the payments at a specific point in the future.

Calculating Present Value and Future Value

Here are the formulas for calculating present value (PV) and future value (FV) of annuities:

Present Value (PV) = PMT

- [1

- (1 + r)^-n] / r

Future Value (FV) = PMT

Before making any decisions, it’s crucial to grasp the fundamental definition of an annuity. Annuity Is Defined As 2024 provides a clear explanation. Annuity drawdown, a common strategy for accessing funds, is discussed in Is Annuity Drawdown 2024.

- [(1 + r)^n

- 1] / r

Where:

- PV = Present Value

- FV = Future Value

- PMT = Payment Amount

- r = Interest Rate

- n = Number of Periods

Factors Affecting Present Value and Future Value

Several factors influence the present value and future value of annuities, including:

- Payment Amount (PMT):Higher payments result in higher present and future values.

- Interest Rate (r):A higher interest rate leads to a higher future value and a lower present value.

- Number of Periods (n):A longer period (more payments) results in a higher future value and a lower present value.

Annuity Calculations with Interest Rates: How To Calculate Annuity Formula 2024

Interest rates play a significant role in annuity calculations, as they determine the rate at which the annuity grows over time. The higher the interest rate, the faster the annuity will grow, resulting in a higher future value.

Annuity options can be complex, especially when navigating the rules surrounding withdrawals at age 70 1/2. Annuity 70 1/2 2024 delves into this specific aspect of annuity planning. To make informed decisions, it’s essential to understand how to calculate the discount factor, a key concept explored in Calculate Annuity Discount Factor 2024.

Impact of Compounding Interest

Compounding interest is a key factor in annuity growth. When interest is compounded, it is earned not only on the initial principal amount but also on the accumulated interest. This compounding effect can significantly enhance the growth of an annuity over time.

Examples of Annuity Calculations with Different Interest Rates

Here are some examples of annuity calculations with different interest rates and time periods:

- Annuity with a 5% annual interest rate:If you invest $10,000 in an annuity that earns 5% per year, the future value of the annuity after 10 years will be significantly higher than an annuity with a lower interest rate.

- Annuity with a 10% annual interest rate:A 10% annual interest rate will result in even faster growth than a 5% rate. The future value of the annuity after 10 years will be significantly higher, highlighting the impact of interest rates on annuity growth.

Real-World Applications of Annuity Formulas

Annuity formulas are widely used in financial planning and decision-making, helping individuals make informed choices about their long-term financial goals.

Applications in Financial Planning

Here are some real-world applications of annuity formulas in financial planning:

- Retirement Planning:Annuities can be a valuable tool for retirement planning, providing a steady stream of income during retirement years. By using annuity formulas, individuals can determine the amount they need to save and the type of annuity that best suits their needs.

- Investment Strategies:Annuities can be incorporated into investment strategies to provide a consistent source of income or to help manage risk. Annuity formulas can be used to evaluate the potential returns and risks associated with different annuity options.

- Loan Calculations:Annuity formulas are also used in loan calculations, such as mortgages and car loans. These formulas help determine the monthly payments required to repay the loan over a specified period.

Real-World Scenarios

Here are some examples of real-world scenarios where annuity formulas are applied:

- Retirement Income Planning:A retiree wants to receive $3,000 per month for 20 years from an annuity. Using the annuity formula, they can determine the lump sum amount needed to purchase this annuity.

- Investment Strategy:An investor wants to allocate a portion of their portfolio to a fixed annuity to provide a guaranteed income stream. By using annuity formulas, they can evaluate the potential returns and risks associated with different annuity options.

- Mortgage Loan Calculation:A homeowner wants to calculate their monthly mortgage payments. The annuity formula is used to determine the monthly payment amount based on the loan amount, interest rate, and loan term.

Concluding Remarks

Mastering the art of calculating annuities empowers you to make informed financial decisions. Whether you’re seeking to understand the potential growth of your savings, plan for your retirement years, or assess the feasibility of a loan, the annuity formula provides a powerful tool.

By understanding the principles behind this formula, you gain the knowledge to navigate the complexities of financial planning with confidence.

Top FAQs

What is the difference between a fixed annuity and a variable annuity?

A fixed annuity offers a guaranteed rate of return, while a variable annuity’s return fluctuates based on the performance of underlying investments.

How does compounding interest affect annuity growth?

Compounding interest allows earnings to grow exponentially over time, as interest is earned on both the principal and accumulated interest.

Annuity calculators can be helpful tools for planning. Annuity Calculator Compounded Monthly 2024 focuses on monthly compounding, a common feature of annuity calculations. If you’re considering rolling over your 401k into an annuity, Annuity 401k Rollover 2024 offers valuable information.

Can I use the annuity formula to calculate loan payments?

Yes, you can use a modified annuity formula to calculate loan payments, considering the loan amount, interest rate, and repayment period.

What are some real-world applications of annuity formulas beyond retirement planning?

Annuity formulas are used in various financial scenarios, including calculating lease payments, determining the value of a stream of income, and analyzing investment strategies.