Annuity Calculator HL 2024 empowers you to plan for a secure retirement by providing a comprehensive understanding of annuities. This powerful tool allows you to explore various annuity options, factor in current market conditions, and make informed decisions about your financial future.

If you’re looking for a career in the health industry, Annuity Health Careers 2024 might be a good place to start. They offer a variety of positions, from entry-level to management, and they are always looking for talented individuals to join their team.

From understanding the different types of annuities to calculating potential payouts, HL Annuity Calculators offer valuable insights that can help you navigate the complexities of retirement planning. By leveraging these calculators, you can gain a clearer picture of how annuities can contribute to your overall financial strategy.

For those seeking financial security in retirement, understanding FERS annuities is essential. Calculate Annuity Fers 2024 provides insights into calculating FERS annuities, helping you plan for a comfortable retirement.

Contents List

Introduction to Annuities

An annuity is a financial product that provides a stream of regular payments over a set period of time. It’s often used for retirement planning, but it can also be used for other purposes, such as supplementing income or providing a guaranteed stream of payments for a specific duration.

Annuity bonds are a specialized type of investment. Is Annuity Bond 2024 delves into the nature of annuity bonds, explaining their potential benefits and risks.

Types of Annuities

Annuities can be categorized into different types based on how the payments are structured and how the investment grows.

Annuity purchases can be a significant financial decision. Annuity Is Purchased 2024 explores the process of purchasing an annuity, helping you understand the factors to consider before making a purchase.

- Fixed Annuities:These offer guaranteed payments for a set period of time, with a fixed interest rate. They provide predictable income but may not keep pace with inflation.

- Variable Annuities:These are linked to the performance of underlying investments, such as stocks or mutual funds. They have the potential for higher returns but also carry higher risk.

- Immediate Annuities:Payments begin immediately after the annuity is purchased. These are suitable for those seeking immediate income.

- Deferred Annuities:Payments begin at a later date, allowing the investment to grow for a period of time before income is received. These are beneficial for those planning for retirement in the future.

Real-World Examples

Annuities are used in various real-world scenarios:

- Retirement Income:Annuities provide a reliable stream of income during retirement, helping individuals meet their financial needs.

- Long-Term Care:Annuities can help cover the costs of long-term care, providing financial security in case of health issues.

- Estate Planning:Annuities can be used to create a legacy by providing income to beneficiaries after the annuitant’s death.

Understanding HL Annuity Calculators

HL Annuity Calculators are online tools designed to help individuals understand and plan for their annuity needs. They provide personalized estimates of annuity payments, growth potential, and other relevant factors.

When considering annuities, it’s important to understand the tax implications. Is An Annuity Qualified Or Nonqualified 2024 explains the difference between qualified and nonqualified annuities, helping you make informed decisions about your financial future.

Functionality and Purpose

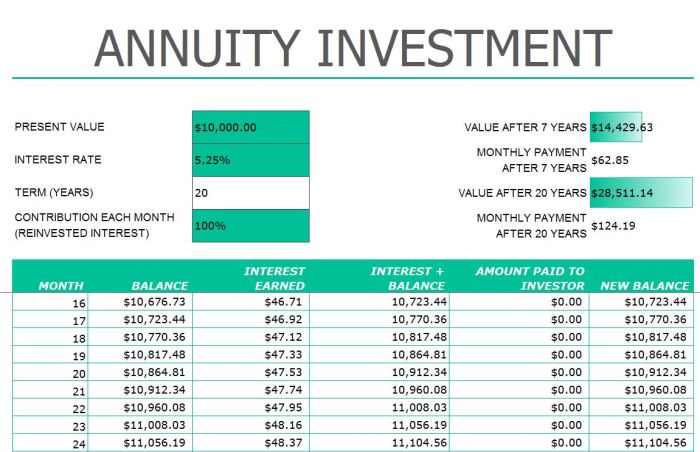

These calculators are user-friendly and allow users to input various parameters, such as:

- Investment amount

- Interest rate or investment growth rate

- Payment period

- Annuity type

Based on the inputs, the calculator provides estimates of:

- Monthly or annual payments

- Total income generated

- Projected growth over time

Benefits of Using HL Annuity Calculators

HL Annuity Calculators offer several benefits for individuals planning for retirement or other financial goals:

- Personalized Estimates:Calculators provide tailored estimates based on individual circumstances.

- Financial Planning Tool:They help individuals visualize their annuity options and make informed decisions.

- Scenario Analysis:Users can explore different scenarios by adjusting inputs to see how changes impact their annuity outcomes.

- Easy to Use:HL Annuity Calculators are designed to be user-friendly and accessible to a wide range of individuals.

Using HL Annuity Calculators in 2024

HL Annuity Calculators continue to evolve, reflecting changes in the financial landscape. In 2024, these calculators may incorporate new features and functionalities based on current market conditions.

With interest rates fluctuating, understanding the current market is crucial. Annuity 8.5 Percent 2024 provides insights into the current annuity market, helping you navigate the landscape of interest rates.

Factors Influencing Annuity Calculations

Several factors can influence annuity calculations in 2024:

- Interest Rates:Interest rate fluctuations can impact annuity payments and growth potential. Higher interest rates generally lead to higher annuity payouts.

- Inflation:Inflation erodes the purchasing power of money over time. Annuities should consider inflation to ensure that payments maintain their value.

- Market Volatility:Market fluctuations can affect the performance of variable annuities. Calculators may incorporate market volatility into their projections.

Step-by-Step Guide, Annuity Calculator Hl 2024

To use HL Annuity Calculators effectively, follow these steps:

- Gather your financial information:This includes your investment amount, desired payment period, and any other relevant details.

- Choose the appropriate calculator:HL may offer various calculators for different annuity types. Select the one that best aligns with your needs.

- Input your information:Carefully enter your financial data into the calculator’s fields.

- Review the results:Analyze the calculator’s estimates and consider their implications for your financial planning.

- Explore different scenarios:Adjust inputs to see how changes affect your annuity outcomes.

Factors to Consider When Choosing an Annuity

Selecting the right annuity is crucial for maximizing its benefits and aligning it with your financial goals.

Annuity insurance can be a complex topic, but understanding the basics is essential. Is Annuity Insurance 2024 delves into the ins and outs of annuity insurance, helping you determine if it’s the right fit for your financial goals.

Key Considerations

When choosing an annuity, consider these key factors:

- Annuity Type:Determine the type of annuity that best suits your needs, considering factors like risk tolerance, income requirements, and investment horizon.

- Payment Structure:Understand the payment schedule and how payments are calculated.

- Fees and Expenses:Compare fees and expenses associated with different annuity options.

- Guarantees and Riders:Explore any guarantees or riders that provide additional protection or benefits.

- Tax Implications:Understand the tax implications of annuity payments and withdrawals.

Comparing Annuity Options

Compare different annuity options based on their features and benefits:

| Feature | Fixed Annuity | Variable Annuity | Immediate Annuity | Deferred Annuity |

|---|---|---|---|---|

| Payment Structure | Guaranteed fixed payments | Payments vary based on investment performance | Payments begin immediately | Payments begin at a later date |

| Risk Level | Low risk | Higher risk | Low risk | Variable risk depending on investment options |

| Potential Returns | Limited growth potential | Potential for higher returns | Limited growth potential | Potential for higher returns depending on investment options |

| Suitability | Suitable for those seeking predictable income | Suitable for those with higher risk tolerance and seeking potential for higher returns | Suitable for those seeking immediate income | Suitable for those planning for retirement in the future |

Aligning with Financial Goals

Select an annuity that aligns with your specific financial goals. Consider factors like:

- Retirement Income:Choose an annuity that provides a reliable stream of income during retirement.

- Income Supplement:An annuity can supplement your existing income and provide additional financial security.

- Long-Term Care:Annuities can help cover the costs of long-term care, protecting your assets.

Risks and Considerations Associated with Annuities

While annuities can be valuable financial tools, they also come with potential risks and drawbacks that should be carefully considered.

While annuities and life insurance both offer financial protection, they serve different purposes. Is Annuity A Life Insurance Policy 2024 clarifies the distinction between these two financial instruments, helping you understand their unique benefits.

Potential Risks

Annuities may involve the following risks:

- Interest Rate Risk:Fixed annuities are sensitive to interest rate changes. If interest rates decline, annuity payouts may be lower than expected.

- Market Risk:Variable annuities are subject to market volatility, and their value can fluctuate. This can impact annuity payments and the overall return on investment.

- Inflation Risk:Inflation can erode the purchasing power of annuity payments, particularly with fixed annuities. This means that the value of your payments may decrease over time.

- Liquidity Risk:Annuities may have restrictions on accessing your funds, making it difficult to withdraw money before the annuity period ends.

Importance of Understanding Terms and Conditions

It’s crucial to carefully review the terms and conditions of any annuity contract. This includes understanding:

- Payment Schedule:The frequency and amount of annuity payments.

- Fees and Expenses:Any fees or expenses associated with the annuity.

- Guarantees and Riders:Any guarantees or riders that provide additional protection or benefits.

- Withdrawal Restrictions:Any restrictions on accessing your funds before the annuity period ends.

Mitigating Risks

To mitigate potential risks when investing in annuities, consider the following:

- Diversify your portfolio:Don’t rely solely on annuities for your retirement income. Diversify your investments to spread risk.

- Choose an annuity that aligns with your risk tolerance:Select an annuity that matches your comfort level with risk.

- Seek professional financial advice:Consult with a financial advisor to discuss your financial goals and determine if an annuity is the right investment for you.

Alternatives to Annuities: Annuity Calculator Hl 2024

While annuities can be a valuable retirement planning tool, they are not the only option. Consider these alternatives:

Alternative Investment Options

Explore other investment options for retirement planning, such as:

- Stocks:Stocks offer the potential for higher returns but also carry higher risk.

- Bonds:Bonds are generally considered less risky than stocks and provide a steady stream of income.

- Mutual Funds:Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets.

- Exchange-Traded Funds (ETFs):ETFs are similar to mutual funds but trade on stock exchanges, providing greater flexibility.

- Real Estate:Real estate investments can provide rental income and appreciation potential.

Comparison with Other Investment Strategies

Compare annuities with other investment strategies based on their features and benefits:

| Feature | Annuities | Stocks | Bonds | Mutual Funds | Real Estate |

|---|---|---|---|---|---|

| Risk Level | Variable depending on type | High | Moderate | Variable depending on fund | Moderate to High |

| Potential Returns | Variable depending on type | High | Moderate | Variable depending on fund | Variable depending on market conditions |

| Income Stream | Guaranteed or variable depending on type | Dividends | Interest payments | Dividends and interest payments | Rental income |

| Liquidity | May have restrictions | Highly liquid | Moderate liquidity | Moderate liquidity | Low liquidity |

| Tax Implications | Tax-deferred growth | Taxed on capital gains | Interest income taxed | Taxed on capital gains and dividends | Taxed on capital gains and rental income |

Advantages and Disadvantages

Each alternative investment option has its advantages and disadvantages:

- Stocks:High potential returns but also high risk.

- Bonds:Lower risk than stocks but also lower potential returns.

- Mutual Funds:Diversification and professional management but may have higher fees.

- Real Estate:Potential for rental income and appreciation but illiquidity and high upfront costs.

Last Point

In conclusion, HL Annuity Calculators provide a valuable resource for individuals seeking to plan for a comfortable retirement. By understanding the intricacies of annuities and utilizing these calculators, you can make informed decisions that align with your financial goals. Remember, consulting with a financial advisor is always recommended to personalize your retirement plan and ensure it meets your specific needs.

FAQ Explained

What are the key benefits of using HL Annuity Calculators?

HL Annuity Calculators offer several benefits, including personalized projections, a user-friendly interface, and access to current market data.

Are HL Annuity Calculators free to use?

Yes, HL Annuity Calculators are typically free to use, making them accessible to a wide range of individuals.

When it comes to financial planning, understanding annuities is crucial. Calculating Annuity Ba Ii Plus 2024 provides a comprehensive guide on how to use the BA II Plus calculator to determine annuity values, helping you make informed decisions.

How often should I use HL Annuity Calculators?

It’s recommended to use HL Annuity Calculators at least annually to review your retirement plan and adjust it as needed based on your financial situation and market changes.

For those in the UK, understanding annuity rates is essential. Annuity Rates Uk 2024 provides insights into current annuity rates in the UK, helping you compare and choose the best option for your needs.

The value of an annuity can fluctuate over time. Annuity Is The Value Of 2024 explores the factors that influence annuity value, helping you understand the dynamics of this financial instrument.

Calculating annuity payments is a crucial step in financial planning. Calculating Annuity Payments 2024 provides a comprehensive guide on how to calculate annuity payments, helping you understand your potential income stream.

Excel can be a valuable tool for financial planning, including annuity calculations. Calculating Annuity Due In Excel 2024 provides insights into using Excel to calculate annuity due payments, simplifying your financial planning process.

Tax implications are a significant consideration for any financial investment, including annuities. Is Annuity Income Taxable In Uk 2024 addresses the taxability of annuity income in the UK, helping you understand the potential tax implications.

Understanding the impact of a single premium on an annuity is crucial for financial planning. G Purchased A $50 000 Single Premium 2024 provides insights into how a single premium affects annuity growth and income, helping you make informed financial decisions.