Interest Calculator Annuity 2024: Planning for retirement is crucial, and annuities offer a structured way to secure your future. This guide delves into the world of annuities, exploring how interest calculators can help you make informed decisions about your financial well-being.

When it comes to retirement planning, many people wonder if an annuity is a better option than a 401(k). You can find a comparison of these two options in Is Annuity Better Than 401k 2024. This article explores the pros and cons of each option to help you make an informed decision.

We’ll examine the different types of annuities, how interest rates influence your returns, and provide insights into navigating the current market landscape.

Are annuities a good investment? This is a question that many people ask. You can find a detailed analysis of annuities as investments in Annuity Is It A Good Investment 2024. This article explores the risks and rewards of investing in annuities.

Understanding how annuities work and leveraging the power of interest calculators can empower you to make strategic choices for a comfortable retirement. Whether you’re just starting to plan or are looking to refine your existing strategy, this guide provides valuable information and practical tools to guide you on your journey.

Annuities are often associated with lottery winnings. If you’re curious about the “annuity jackpot,” you can find more information on Annuity Jackpot 2024. This article explores the concept of annuity jackpots and their implications for lottery winners.

Contents List

Understanding Annuities

Annuities are financial products that provide a stream of regular payments, often for a specified period or for life. They are commonly used in retirement planning to ensure a steady income stream during the golden years. Annuities are essentially a contract between an individual and an insurance company, where the individual invests a lump sum or makes regular payments, and in return, receives a guaranteed income stream later on.

Understanding the annuity factor is crucial for calculating the present value of an annuity. If you need to learn how to calculate an annuity factor, you can find a detailed explanation in Calculating An Annuity Factor 2024. This guide provides a step-by-step process to make the calculation easy.

Types of Annuities

Annuities are available in different forms, each designed to cater to specific financial needs and risk profiles. Here’s a breakdown of the common types:

- Fixed Annuities:These offer a guaranteed interest rate and fixed payment amounts. They provide stability and predictability but may not offer the potential for high growth.

- Variable Annuities:These link returns to the performance of underlying investments, such as stocks or mutual funds. They offer the potential for higher returns but also carry investment risk.

- Immediate Annuities:Payments begin immediately after the initial investment is made. They are suitable for those seeking immediate income generation, such as retirees.

- Deferred Annuities:Payments start at a later date, typically after a specific period or at a certain age. They allow individuals to accumulate funds over time before receiving income.

Advantages and Disadvantages of Annuities

Annuities offer several advantages, including:

- Guaranteed Income:Fixed annuities provide a steady stream of income that is not subject to market fluctuations.

- Tax Benefits:In some cases, annuity payments may be tax-deferred or tax-free, depending on the type of annuity and the individual’s tax situation.

- Protection from Longevity Risk:Annuities can help individuals avoid outliving their savings by providing a lifetime income stream.

However, annuities also have some drawbacks, including:

- Limited Liquidity:Accessing the funds invested in an annuity may be restricted, especially in the early years.

- Potential for Lower Returns:Fixed annuities may offer lower returns compared to other investments, especially during periods of high market growth.

- Fees and Expenses:Annuities typically involve fees and expenses, which can impact the overall return.

Interest Calculations for Annuities

Interest plays a crucial role in annuity payouts, as it determines the growth of the invested funds over time. Understanding how interest is calculated is essential for assessing the potential return on an annuity.

Annuity is a common topic in multiple-choice questions (MCQ) related to finance and investments. If you’re looking for a guide on annuities for MCQs, you can check out Annuity Is A Mcq 2024. This article provides explanations and examples of annuity-related MCQs.

Interest Calculation Methods

There are two main methods used for calculating interest on annuities:

- Simple Interest:Interest is calculated only on the principal amount invested. This method provides a consistent return but may not generate significant growth over time.

- Compound Interest:Interest is calculated on both the principal and accumulated interest. This method leads to exponential growth, as interest earned in previous periods earns interest in subsequent periods.

Impact of Interest Rates and Time Periods

The interest rate and the time period over which interest is compounded significantly impact the growth of annuity payments. Higher interest rates and longer time periods lead to greater returns. For example, a $100,000 annuity with a 5% annual interest rate compounded annually will grow to approximately $162,889 after 10 years.

Knowing how to calculate the interest rate of an annuity is essential for making informed financial decisions. If you’re looking for a guide on calculating annuity interest rates, Calculating Annuity Interest Rate 2024 provides a comprehensive explanation and practical examples.

However, the same annuity with a 3% interest rate will only grow to approximately $134,392 over the same period.

If you are in Canada and are looking for annuity quotes, you can find them online. Check out Annuity Quotes Canada 2024 for a comprehensive guide to finding the best annuity quotes in Canada.

Using an Interest Calculator for Annuities

An annuity interest calculator is a valuable tool for estimating the potential growth of annuity payments. These calculators simplify the process of calculating future values and total interest earned.

Annuity is a nine-letter word that refers to a financial product. If you’re looking for more information about annuities, you can check out Annuity 9 Letters 2024. This article provides a comprehensive overview of annuities and their various types.

Key Features of an Interest Calculator

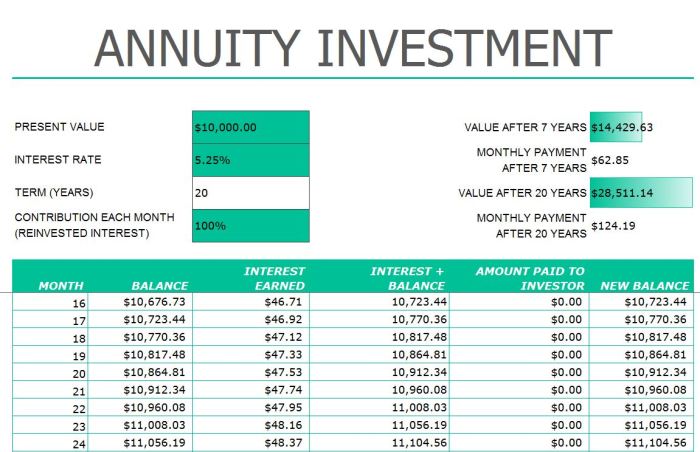

An annuity interest calculator typically requires the following input parameters:

- Principal:The initial amount invested in the annuity.

- Interest Rate:The annual interest rate earned on the annuity.

- Time Period:The number of years over which interest is compounded.

Based on these inputs, the calculator provides the following output results:

- Future Value:The estimated value of the annuity at the end of the specified time period.

- Total Interest Earned:The total amount of interest earned over the time period.

Using an Interest Calculator

To use an annuity interest calculator, simply input the required parameters and click on the “Calculate” button. The calculator will then display the estimated future value and total interest earned. You can adjust the input parameters to see how different interest rates, time periods, and principal amounts affect the potential growth of your annuity.

While annuities are often associated with retirement planning, they can also be used for other purposes. If you’re curious about the connection between annuities and loans, you can check out Annuity Is Loan 2024. This article explores the different ways annuities can be used in conjunction with loans.

Annuities in 2024

The annuity market is constantly evolving, influenced by factors such as interest rates, economic conditions, and regulatory changes. In 2024, the market is likely to be shaped by a combination of factors, including:

Current Economic Landscape, Interest Calculator Annuity 2024

The current economic landscape, characterized by rising inflation and interest rates, may impact annuity interest rates. As interest rates rise, annuity providers may offer higher interest rates to attract investors. However, the overall impact on annuity returns may be mixed, as higher interest rates can also lead to increased investment risk.

Annuity is a single payment, which is often used for retirement planning. If you’re interested in learning more about annuities, you can find information on Annuity Is Single Payment 2024. This article provides a comprehensive overview of annuities and their benefits.

Recent Changes and Trends

The annuity market has seen several recent changes, including the introduction of new product offerings and regulatory updates. These changes may impact the availability, features, and pricing of annuities. It’s important to stay informed about these developments to make informed decisions about annuity investments.

One common question about annuities is whether the payments are taxable. You can find information on the taxability of annuity payments in Is Annuity Payments Taxable 2024. This article discusses the tax implications of annuity payments.

Choosing an Annuity

When choosing an annuity in 2024, it’s essential to consider factors such as:

- Interest Rates:Compare interest rates offered by different annuity providers to ensure you are getting a competitive return.

- Fees and Expenses:Consider the fees and expenses associated with the annuity, as they can significantly impact your overall returns.

- Guarantees:Assess the level of guarantees offered by the annuity, such as guaranteed interest rates or guaranteed death benefits.

- Flexibility:Consider the flexibility of the annuity, such as the ability to withdraw funds or change the payment schedule.

Annuity Planning and Strategies: Interest Calculator Annuity 2024

Annuity planning involves carefully considering your individual financial goals, risk tolerance, and time horizon. Here are some strategies for maximizing annuity returns and integrating them into your overall retirement plan:

Financial Goals and Risk Tolerance

Consider your specific retirement income needs, such as your desired monthly income, the length of time you expect to live in retirement, and your tolerance for investment risk. Annuities can be tailored to meet these needs, with options ranging from low-risk fixed annuities to higher-risk variable annuities.

An annuity is a financial product that provides a stream of payments over a period of time. If you’re looking for a definition of an annuity, you can find it in Annuity Is Meaning 2024. This article provides a clear and concise explanation of the concept of annuities.

Maximizing Returns

To maximize annuity returns, consider the following strategies:

- Diversification:Spread your investments across different asset classes, such as stocks, bonds, and real estate, to reduce overall risk.

- Tax Optimization:Explore tax-advantaged annuity options to minimize your tax liability.

- Regular Contributions:Make regular contributions to your annuity to increase the amount of funds available for future income generation.

Retirement Planning

Annuities can play a crucial role in a comprehensive retirement planning strategy. They can provide a reliable income stream during retirement, supplement other retirement savings, and help address longevity risk. It’s important to consult with a financial advisor to develop a personalized retirement plan that includes appropriate annuity investments.

An annuity is a sequence of payments made over a specific period. If you’re interested in learning more about the different modes of payment for annuities, you can check out Annuity Is Sequence Of Mode Of Payment 2024. This article discusses various payment options and their implications.

Conclusion

In conclusion, interest calculators are invaluable tools for understanding the intricacies of annuities and maximizing your potential returns. By carefully considering your individual financial goals, risk tolerance, and the current economic climate, you can make informed decisions about how to integrate annuities into your retirement plan.

Remember, the key to a successful retirement lies in proactive planning and understanding the various financial instruments available to you.

FAQ Compilation

What is the difference between a fixed and a variable annuity?

A fixed annuity offers a guaranteed interest rate, providing predictable income payments. A variable annuity, on the other hand, invests in the market, offering the potential for higher returns but also carrying greater risk.

How often are annuity interest rates adjusted?

Interest rates for fixed annuities are typically fixed for a specific period, such as a year or more. Variable annuity interest rates fluctuate based on the performance of the underlying investments.

Looking for an annuity calculator? Groww is a popular platform that offers an easy-to-use annuity calculator. You can find more information about it in Annuity Calculator Groww 2024. This article explains the features and benefits of using the Groww annuity calculator.

Can I withdraw from an annuity before retirement?

Most annuities allow for withdrawals, but they may be subject to penalties depending on the type of annuity and the withdrawal terms.

Are annuities tax-deferred?

Annuities generally offer tax-deferred growth, meaning that you don’t pay taxes on the earnings until you withdraw them.

Annuity plans can be a complex topic, and it’s helpful to understand how they have evolved over time. For information about annuities in 2021 and 2024, you can check out Annuity 2021 2024. This article discusses the latest trends and changes in annuity plans.