Calculate Annuity Java 2024 dives into the world of financial calculations, exploring how to implement annuity formulas and concepts in Java. This guide is designed for programmers of all levels, from beginners seeking to understand the fundamentals of annuities to experienced developers looking to build sophisticated financial applications.

Life expectancy plays a crucial role in annuity calculations. This article explores whose life expectancy is considered when an annuity is written: When Annuity Is Written Whose Life Expectancy 2024.

We’ll cover the core Java concepts needed for annuity calculations, including data types, variables, operators, and control flow statements. We’ll also delve into the use of libraries like `java.math.BigDecimal` for precise calculations and demonstrate how to handle input and output operations for user interaction.

Most annuity contracts offer a “free look” period, typically 30 days. This article explains this feature: Annuity 30 Day Free Look 2024.

From there, we’ll build upon these fundamentals to implement Java programs that calculate the future value, present value, and payment amount of annuities.

Contents List

Understanding Annuities

An annuity is a series of equal payments made over a specified period of time. Annuities are commonly used in financial planning, retirement savings, and loan calculations. Understanding the components and types of annuities is crucial for effective financial decision-making.

Components of an Annuity

- Principal:The initial amount of money invested or borrowed.

- Interest Rate:The rate at which the principal grows or the cost of borrowing.

- Payment Period:The frequency of payments, such as monthly, quarterly, or annually.

- Number of Payments:The total number of payments made over the annuity’s duration.

Types of Annuities

- Ordinary Annuity:Payments are made at the end of each period.

- Annuity Due:Payments are made at the beginning of each period.

- Perpetuity:An annuity that continues indefinitely.

Real-World Scenarios

- Retirement Savings:Individuals can invest in annuities to provide a steady stream of income during retirement.

- Loan Repayments:Mortgages and car loans often involve annuity payments.

- Insurance Payments:Annuities are used in insurance products to provide regular payments to beneficiaries.

Java Fundamentals for Annuity Calculations

Java provides the necessary tools and libraries for performing annuity calculations. This section explores the fundamental Java concepts that are essential for implementing annuity logic.

If you inherit an annuity, it’s important to understand the implications. This article provides information on what happens when you inherit an annuity: What Happens When I Inherit An Annuity 2024.

Core Java Concepts

- Data Types:Java offers various data types to represent numerical values, such as `int`, `double`, and `BigDecimal`. `BigDecimal` is particularly useful for handling precise financial calculations to avoid rounding errors.

- Variables:Variables are used to store and manipulate data. For annuity calculations, variables can represent the principal, interest rate, payment period, and other relevant parameters.

- Operators:Java provides arithmetic operators (e.g., +, -, -, /) for performing calculations. These operators are crucial for implementing annuity formulas.

- Control Flow Statements:Statements like `if`, `else`, `for`, and `while` control the execution flow of the program. They enable you to implement conditional logic and repetitive calculations for annuities.

Java Libraries for Precision

The `java.math.BigDecimal` class in Java provides high-precision decimal arithmetic, which is essential for financial calculations. It allows you to perform calculations with a high degree of accuracy, minimizing rounding errors.

Many individuals consider rolling over their 401(k) into an annuity. If you’re interested in learning more about this process, check out this resource: Annuity 401k Rollover 2024.

Input and Output Operations, Calculate Annuity Java 2024

Java’s `Scanner` class provides a convenient way to read user input from the console. You can use it to prompt the user for annuity parameters, such as the principal, interest rate, and payment period. Similarly, the `System.out.println()` method can be used to display calculation results to the user.

Annuity rates fluctuate, and it’s important to stay informed. This article provides insights into annuity rates from 2021 to 2024: Annuity Rates 2021 2024.

Implementing Annuity Calculation Logic in Java

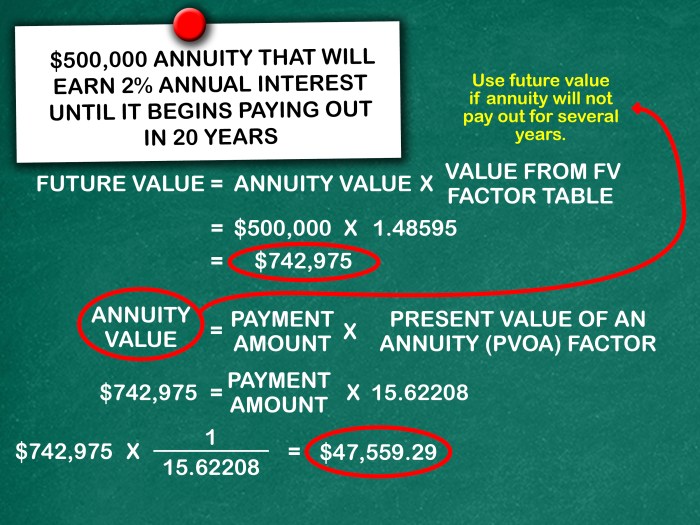

This section focuses on designing a Java program to calculate the future value of an annuity. It involves implementing the future value formula and handling user input.

Annuity contracts are often associated with certain key terms, and one such term is “7 letters.” You can find out more about this in this article: Annuity 7 Letters 2024.

Future Value Calculation

The future value (FV) of an ordinary annuity can be calculated using the following formula:

FV = P

Understanding the annuity exclusion ratio is essential for tax purposes. This article helps you calculate this ratio: Calculate Annuity Exclusion Ratio 2024.

- (((1 + r)^n

- 1) / r)

Where:

- FV is the future value

- P is the payment amount

- r is the interest rate per period

- n is the number of periods

Java Code for Future Value Calculation

The following Java code implements the future value formula:

“`javaimport java.math.BigDecimal;import java.math.RoundingMode;public class AnnuityCalculator public static BigDecimal calculateFutureValue(BigDecimal principal, BigDecimal interestRate, int paymentPeriod) BigDecimal onePlusRate = BigDecimal.ONE.add(interestRate); BigDecimal futureValue = principal.multiply(onePlusRate.pow(paymentPeriod).subtract(BigDecimal.ONE)).divide(interestRate, RoundingMode.HALF_UP); return futureValue; public static void main(String[] args) BigDecimal principal = new BigDecimal(“1000”); BigDecimal interestRate = new BigDecimal(“0.05”); // 5% annual interest int paymentPeriod = 12; // monthly payments for 1 year BigDecimal futureValue = calculateFutureValue(principal, interestRate, paymentPeriod); System.out.println(“Future Value: ” + futureValue); “`

Handling User Input

To make the program interactive, you can use the `Scanner` class to get user input for annuity parameters:

“`javaimport java.math.BigDecimal;import java.math.RoundingMode;import java.util.Scanner;public class AnnuityCalculator public static BigDecimal calculateFutureValue(BigDecimal principal, BigDecimal interestRate, int paymentPeriod) // … (same as before) public static void main(String[] args) Scanner scanner = new Scanner(System.in); System.out.print(“Enter principal amount: “); BigDecimal principal = new BigDecimal(scanner.nextLine()); System.out.print(“Enter annual interest rate (as a decimal): “); BigDecimal interestRate = new BigDecimal(scanner.nextLine()); System.out.print(“Enter number of payment periods: “); int paymentPeriod = Integer.parseInt(scanner.nextLine()); BigDecimal futureValue = calculateFutureValue(principal, interestRate, paymentPeriod); System.out.println(“Future Value: ” + futureValue); “`

For those seeking immediate income, an immediate annuity might be a good option. This article delves into the details of immediate annuities: Annuity Is Immediate 2024.

Examples of Future Value Calculations

- Scenario 1:Principal = $10,000, Interest Rate = 5% per year, Payment Period = 12 (monthly payments for 1 year) – Future Value = $10,511.43

- Scenario 2:Principal = $5,000, Interest Rate = 3% per year, Payment Period = 24 (monthly payments for 2 years) – Future Value = $5,310.23

Advanced Annuity Calculations in Java: Calculate Annuity Java 2024

Beyond calculating future value, Java can be used to perform other advanced annuity calculations, such as present value, payment amount, and more.

Annuity options are diverse, and one type to consider is the “712” annuity. You can read more about this specific type of annuity in this article: Annuity 712 2024.

Present Value Calculation

The present value (PV) of an annuity represents the current value of a series of future payments. The formula for calculating the present value of an ordinary annuity is:

PV = P

- ((1

- (1 + r)^-n) / r)

Where:

- PV is the present value

- P is the payment amount

- r is the interest rate per period

- n is the number of periods

Java Code for Present Value Calculation

The following Java code implements the present value formula:

“`javaimport java.math.BigDecimal;import java.math.RoundingMode;public class AnnuityCalculator // … (future value calculation method) public static BigDecimal calculatePresentValue(BigDecimal paymentAmount, BigDecimal interestRate, int paymentPeriod) BigDecimal onePlusRate = BigDecimal.ONE.add(interestRate); BigDecimal presentValue = paymentAmount.multiply(BigDecimal.ONE.subtract(onePlusRate.pow(-paymentPeriod))).divide(interestRate, RoundingMode.HALF_UP); return presentValue; public static void main(String[] args) // …

The “59 1/2 Rule” is a significant factor in annuity planning. This article provides details about this rule: Annuity 59 1/2 Rule 2024.

(user input handling) BigDecimal presentValue = calculatePresentValue(principal, interestRate, paymentPeriod); System.out.println(“Present Value: ” + presentValue); “`

Annuity contracts can be used within retirement plans. This article discusses whether an annuity qualifies as a retirement plan: Is An Annuity A Qualified Retirement Plan 2024.

Payment Amount Calculation

The payment amount (P) of an annuity can be calculated using the following formula:

P = (PV

- r) / (1

- (1 + r)^-n)

Where:

- P is the payment amount

- PV is the present value

- r is the interest rate per period

- n is the number of periods

Java Code for Payment Amount Calculation

The following Java code implements the payment amount formula:

“`javaimport java.math.BigDecimal;import java.math.RoundingMode;public class AnnuityCalculator // … (future value and present value calculation methods) public static BigDecimal calculatePaymentAmount(BigDecimal presentValue, BigDecimal interestRate, int paymentPeriod) BigDecimal onePlusRate = BigDecimal.ONE.add(interestRate); BigDecimal paymentAmount = presentValue.multiply(interestRate).divide(BigDecimal.ONE.subtract(onePlusRate.pow(-paymentPeriod)), RoundingMode.HALF_UP); return paymentAmount; public static void main(String[] args) // …

Annuity growth is often associated with compound interest. To learn more about how compound interest applies to annuities, read this article: Is Annuity Compound Interest 2024.

(user input handling) BigDecimal paymentAmount = calculatePaymentAmount(principal, interestRate, paymentPeriod); System.out.println(“Payment Amount: ” + paymentAmount); “`

Annuity contracts can be complex, and it’s essential to determine if an annuity is the right choice for you. This article provides guidance on this decision: Is Annuity Right For Me 2024.

Examples of Advanced Annuity Calculations

- Scenario 1:Present Value = $10,000, Interest Rate = 5% per year, Payment Period = 12 (monthly payments for 1 year) – Payment Amount = $856.07

- Scenario 2:Payment Amount = $500, Interest Rate = 3% per year, Payment Period = 24 (monthly payments for 2 years) – Present Value = $10,934.52

Error Handling and Input Validation

Error handling and input validation are crucial aspects of any robust software application, especially when dealing with financial calculations. This section explores how to implement these features in Java code for annuity calculations.

Importance of Error Handling and Input Validation

- Data Integrity:Input validation ensures that the data entered by the user is in the correct format and range, preventing invalid calculations.

- Program Stability:Error handling prevents the program from crashing due to unexpected input or errors during calculations. It gracefully handles errors and provides informative messages to the user.

- User Experience:By providing clear error messages and guiding the user towards valid input, error handling improves the user experience.

Implementing Error Handling in Java

Java provides various mechanisms for error handling, including `try-catch` blocks and exceptions. Here’s an example of how to handle invalid input using `try-catch`:

“`javaimport java.math.BigDecimal;import java.math.RoundingMode;import java.util.InputMismatchException;import java.util.Scanner;public class AnnuityCalculator // … (calculation methods) public static void main(String[] args) Scanner scanner = new Scanner(System.in); BigDecimal principal = null; BigDecimal interestRate = null; int paymentPeriod = 0; try System.out.print(“Enter principal amount: “); principal = new BigDecimal(scanner.nextLine()); System.out.print(“Enter annual interest rate (as a decimal): “); interestRate = new BigDecimal(scanner.nextLine()); System.out.print(“Enter number of payment periods: “); paymentPeriod = Integer.parseInt(scanner.nextLine()); catch (InputMismatchException e) System.out.println(“Invalid input.

Annuity contracts can be complex, and it’s important to understand the nuances of these financial products. If you’re wondering about the certainty of annuities in 2024, you can find more information in this article: Annuity Uncertain 2024.

Please enter valid numbers.”); return; // … (calculation and output) “`

Input Validation Examples

- Principal:Ensure the principal amount is a positive number.

- Interest Rate:Validate that the interest rate is within a reasonable range (e.g., 0 to 1).

- Payment Period:Check if the payment period is a positive integer.

Error Handling and Input Validation in Java

The following code demonstrates error handling and input validation in Java:

“`javaimport java.math.BigDecimal;import java.math.RoundingMode;import java.util.InputMismatchException;import java.util.Scanner;public class AnnuityCalculator // … (calculation methods) public static void main(String[] args) Scanner scanner = new Scanner(System.in); BigDecimal principal = null; BigDecimal interestRate = null; int paymentPeriod = 0; try System.out.print(“Enter principal amount: “); principal = new BigDecimal(scanner.nextLine()); if (principal.compareTo(BigDecimal.ZERO) <= 0) throw new IllegalArgumentException("Principal amount must be positive."); System.out.print("Enter annual interest rate (as a decimal): "); interestRate = new BigDecimal(scanner.nextLine()); if (interestRate.compareTo(BigDecimal.ZERO) < 0 || interestRate.compareTo(BigDecimal.ONE) > 0) throw new IllegalArgumentException(“Interest rate must be between 0 and 1.”); System.out.print(“Enter number of payment periods: “); paymentPeriod = Integer.parseInt(scanner.nextLine()); if (paymentPeriod <= 0) throw new IllegalArgumentException("Payment period must be a positive integer."); // ... (calculation and output) catch (InputMismatchException e) System.out.println("Invalid input. Please enter valid numbers."); catch (IllegalArgumentException e) System.out.println(e.getMessage()); ```

Final Thoughts

By understanding the principles behind annuity calculations and leveraging the power of Java, you can build robust and versatile financial applications.

If you’re looking to utilize an annuity for a home loan, this article provides valuable information: Annuity Home Loan 2024.

This guide has provided a comprehensive framework for tackling annuity calculations in Java, equipping you with the knowledge and skills to handle a wide range of financial scenarios. Whether you’re building financial planning tools, retirement calculators, or loan management systems, the concepts and techniques discussed here will serve as a valuable foundation.

Q&A

What is the difference between an ordinary annuity and an annuity due?

An ordinary annuity has payments made at the end of each period, while an annuity due has payments made at the beginning of each period. This difference affects the timing of interest accrual and the overall value of the annuity.

How can I handle potential errors in user input for annuity calculations?

Implement error handling mechanisms in your Java code to validate user input and prevent incorrect calculations. Use try-catch blocks to handle potential exceptions, such as invalid data types or out-of-range values. Additionally, use input validation techniques to ensure that user input conforms to expected formats and constraints.

What are some real-world applications of annuity calculations in Java beyond financial planning?

Annuity calculations can be applied in areas such as loan amortization schedules, mortgage payments, and even in calculating the depreciation of assets over time. Java provides the tools to implement these calculations effectively and efficiently.