How To Calculate Annuities On Ti 84 2024: Ever wondered how to easily calculate the present or future value of a series of payments? Annuities, a fundamental concept in finance, can be a bit daunting, but with the right tools, they become manageable.

For those familiar with Excel, you might be interested in learning about calculating future value of an annuity using Excel. But when it comes to retirement planning, you might wonder whether an annuity is a better choice than an IRA.

You can explore that comparison in detail by reading about annuities versus IRAs.

The TI-84 calculator, a popular choice among students and professionals, offers a straightforward way to tackle annuity calculations. This guide will walk you through the process, covering everything from understanding annuity types to utilizing the calculator’s powerful functions.

We’ll delve into the key formulas, explore various annuity scenarios, and demonstrate how to input variables into the TI-84. Whether you’re planning for retirement, analyzing loan amortization, or simply grasping the time value of money, this guide will equip you with the knowledge and skills to confidently navigate the world of annuities.

Ultimately, understanding how annuities generate income is crucial for making informed financial decisions. Whether you’re planning for retirement or simply seeking to learn more about this financial tool, there’s a wealth of information available to help you make the best choices for your future.

Contents List

Understanding Annuities

An annuity is a series of equal payments made over a specific period of time. In financial mathematics, annuities are crucial for understanding investments, loans, and retirement planning. They represent a stream of consistent cash flows, allowing for calculations of present and future values.

Types of Annuities

Annuities can be categorized based on when the payments are made:

- Ordinary Annuities:Payments are made at the end of each period. This is the most common type of annuity.

- Annuities Due:Payments are made at the beginning of each period. This type is often seen in rent or lease agreements.

- Perpetuities:Payments continue indefinitely. This type is rarely seen in practice but is useful for theoretical analysis.

Real-World Applications

Annuities have various applications in real life, including:

- Retirement Planning:Annuities can provide a steady stream of income during retirement years.

- Loan Amortization:Loan payments are often structured as annuities, allowing borrowers to pay off debt over time.

- Investment Strategies:Annuities can be used to invest and accumulate wealth over time.

Annuity Formulas

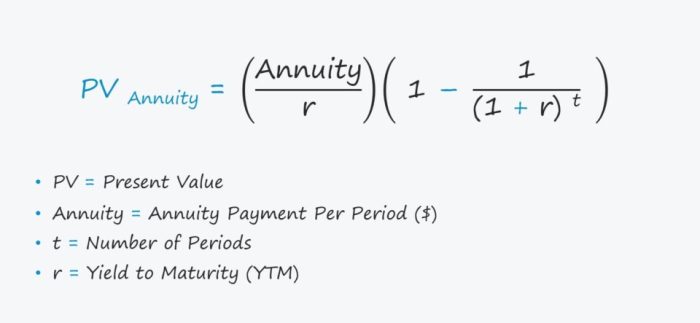

Two key formulas are used to calculate the present value (PV) and future value (FV) of an annuity:

Present Value of an Annuity

PV = PMT

- [1

- (1 + i)^-n] / i

Where:

- PV = Present Value

- PMT = Payment Amount

- i = Interest Rate per Period

- n = Number of Periods

Future Value of an Annuity

FV = PMT

The UK’s HMRC offers a helpful tool for calculating annuities, and you can find more information about the HMRC annuity calculator. If you’re considering a living annuity, you might have questions about its tax implications. Read more about whether living annuities are taxable to make informed financial decisions.

- [(1 + i)^n

- 1] / i

Where:

- FV = Future Value

- PMT = Payment Amount

- i = Interest Rate per Period

- n = Number of Periods

Solving Basic Annuity Problems

To solve basic annuity problems, you can use the formulas above. For example, let’s say you want to calculate the present value of an ordinary annuity with a payment of $100 per month for 5 years at an interest rate of 6% per year.

Understanding the present value of an annuity is essential, and you can find information on annuity present value calculations. For those studying finance, you might find multiple choice questions about annuities helpful, and you can access resources on annuity MCQs.

Perhaps you’re interested in generating a substantial income stream, and you’re considering an annuity that pays out 2 million in retirement.

First, you need to convert the annual interest rate to a monthly rate: 6% / 12 = 0.5% per month.

Then, you need to calculate the number of periods: 5 years – 12 months/year = 60 months.

Finally, you can plug these values into the present value formula:

PV = $100

- [1

- (1 + 0.005)^-60] / 0.005

This will give you the present value of the annuity, which is approximately $4,917.34.

For a comprehensive understanding of annuities, explore resources on calculating annuity discount factors and the general concepts of annuities. You might be particularly interested in the specifics of annuities with a 20-year certain period. Whether you’re starting your financial planning journey or looking to optimize your retirement income, learning how to calculate an annuity can be beneficial.

Using the TI-84 Calculator

The TI-84 calculator offers dedicated functions for calculating annuities, making the process much easier and faster. Here’s how to use the calculator:

Calculator Functions

The TI-84 has two primary functions for annuities:

- TVM Solver:This function allows you to input the necessary variables and solve for any unknown value.

- Finance App:This app provides a more comprehensive set of financial functions, including annuity calculations.

Inputting Variables

To use the TVM Solver or the Finance App, you need to input the following variables:

- N:Number of Periods

- I%:Interest Rate per Period

- PV:Present Value

- PMT:Payment Amount

- FV:Future Value

- P/Y:Payments per Year

- C/Y:Compounding Periods per Year

Calculating Values, How To Calculate Annuities On Ti 84 2024

Once you have entered all the variables, you can solve for any unknown value by pressing the “Solve” button on the TVM Solver or using the appropriate function in the Finance App.

Understanding how to calculate an annuity in 2024 can be crucial for financial planning. Whether you’re looking to calculate a specific annuity , explore the features of an annuity 5 , or delve into the intricacies of an annuity series , there’s information readily available.

Example Problems and Solutions

Here are some example annuity problems with varying parameters, solved using the TI-84 calculator:

| Type | Interest Rate | Payment Amount | Number of Periods | Calculation | Result |

|---|---|---|---|---|---|

| Ordinary Annuity | 5% per year | $500 | 10 years | PV = $500

|

$4,163.22 |

| Annuity Due | 8% per year | $1,000 | 5 years | FV = $1,000

|

$5,866.60 |

| Perpetuity | 4% per year | $200 | Infinite | PV = $200 / 0.04 | $5,000 |

Common Errors

Some common errors when using the TI-84 calculator for annuities include:

- Incorrectly entering variables:Double-check that you have entered the correct values for N, I%, PV, PMT, FV, P/Y, and C/Y.

- Using the wrong function:Make sure you are using the appropriate function for the type of annuity you are calculating (ordinary, due, or perpetuity).

- Misinterpreting results:Understand the meaning of the calculated values (PV, FV, etc.) and how they relate to the specific annuity problem.

Advanced Applications of Annuities: How To Calculate Annuities On Ti 84 2024

Annuities are widely used in various financial contexts, beyond basic calculations. Understanding their advanced applications can help you make informed financial decisions.

Retirement Planning

Annuities can be used to create a steady stream of income during retirement. By investing in an annuity, you can guarantee a certain amount of income for a specified period, reducing the risk of outliving your savings.

Loan Amortization

Most loans are structured as annuities, where regular payments are made over a specific period to pay off the principal and interest. Understanding annuity principles can help you analyze loan terms and make informed borrowing decisions.

Investment Strategies

Annuities can be incorporated into investment strategies to achieve specific financial goals. For example, an annuity can be used to provide a guaranteed return on investment, while other investments can be used for growth potential.

Time Value of Money

The concept of time value of money is fundamental to annuities. This concept recognizes that money today is worth more than the same amount of money in the future due to its potential earning capacity. Annuities take this into account by discounting future payments to their present value or compounding present payments to their future value.

Last Point

Mastering annuity calculations using the TI-84 calculator opens doors to a deeper understanding of financial concepts. By understanding the different types of annuities, the underlying formulas, and the calculator’s functions, you can make informed decisions in various financial situations.

Whether you’re a student, a professional, or simply seeking to enhance your financial literacy, this guide provides a solid foundation for tackling complex annuity problems with ease and confidence.

User Queries

What are the limitations of using the TI-84 calculator for annuity calculations?

While the TI-84 is powerful, it may not handle every complex annuity scenario. For instance, it might not support certain non-standard annuity types or complex payment schedules.

Can I use the TI-84 calculator for other financial calculations besides annuities?

Yes, the TI-84 is versatile and can handle various financial calculations, including loan payments, bond yields, and amortization schedules.