Calculate Annuity Amount 2024: Securing your future with annuities can seem complex, but it’s a powerful tool for retirement planning. This guide breaks down the essential aspects of annuities, from understanding their purpose and types to calculating their potential value.

Many people wonder if an annuity is essentially a loan. Find out more about the relationship between annuities and loans in 2024.

Annuities offer a structured stream of income, providing financial security during retirement. Understanding the factors that influence annuity amounts, such as interest rates, investment returns, and your personal circumstances, is crucial for making informed decisions.

Looking for the best annuity option for you? You can find out more about different annuity options available in 2024 and their suitability.

Contents List

Understanding Annuities

An annuity is a financial product that provides a stream of regular payments over a set period of time. It’s essentially a contract between you and an insurance company, where you make a lump-sum payment or a series of payments, and in return, the insurance company guarantees you a series of payments in the future, either for a fixed period or for the rest of your life.

Wondering about a specific type of annuity? Check out information on annuity 95-1 in 2024 and its features.

Types of Annuities

Annuities come in various forms, each with its own features and benefits. Here are some common types:

- Fixed Annuities:These provide guaranteed payments at a fixed interest rate. They offer stability and predictable income, but the growth potential is limited.

- Variable Annuities:These link payments to the performance of a specific investment portfolio. They offer the potential for higher returns, but also come with greater risk.

- Immediate Annuities:Payments begin immediately after the initial investment is made. They are ideal for those seeking immediate income.

- Deferred Annuities:Payments are delayed until a future date, often for retirement. They allow for tax-deferred growth and can be used to supplement retirement income.

- Indexed Annuities:Payments are tied to the performance of a specific index, such as the S&P 500. They offer potential for growth with some downside protection.

Examples of Annuity Use

Annuities can play a crucial role in financial planning, especially for retirement. Here are some examples:

- Retirement Income:Annuities can provide a steady stream of income during retirement, ensuring financial security.

- Long-Term Care:Annuities can be used to cover potential long-term care expenses, protecting your assets from depletion.

- Estate Planning:Annuities can be used to create a legacy for loved ones by providing them with a regular income stream after your passing.

Factors Affecting Annuity Amount: Calculate Annuity Amount 2024

The amount of your annuity payments is influenced by several factors, including:

Key Factors

- Interest Rates:Higher interest rates generally result in larger annuity payments.

- Investment Returns:For variable annuities, the investment returns directly impact the annuity payments.

- Inflation:Inflation erodes the purchasing power of money, so higher inflation can reduce the real value of annuity payments.

- Age:Younger individuals generally receive lower annuity payments than older individuals, as they have a longer life expectancy.

- Life Expectancy:The longer your life expectancy, the smaller your annuity payments will be.

- Payment Frequency:More frequent payments (e.g., monthly) will result in smaller individual payments compared to less frequent payments (e.g., annually).

Annuity Calculation Methods

There are different methods for calculating annuity amounts, each with its own assumptions and applications. Here are some common methods:

Annuity Calculation Methods, Calculate Annuity Amount 2024

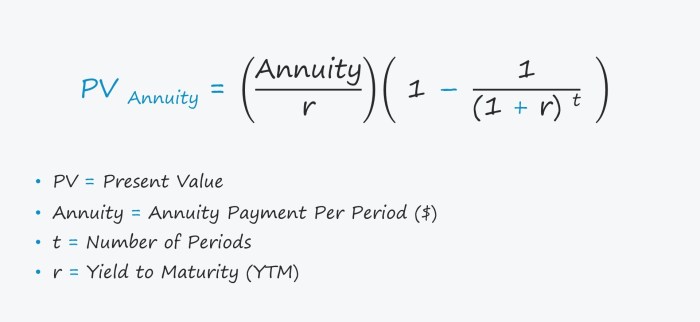

- Present Value of an Annuity:This method calculates the present value of a series of future payments, discounting them back to their current value. It’s used to determine how much you need to invest today to receive a specific stream of payments in the future.

Looking for information on a specific annuity amount? You can find out more about annuities for NZ$50,000 in 2024 and their potential benefits.

The formula is:

PV = PMT- [1 – (1 + r)^-n] / r

Want to understand how interest rates work within annuities? You can find out more about calculating annuity interest rates in 2024 and their impact.

Where:

- PV = Present Value

- PMT = Payment Amount

- r = Interest Rate

- n = Number of Payments

- Future Value of an Annuity:This method calculates the future value of a series of payments, compounding them forward to a future point in time. It’s used to determine the total amount you’ll have accumulated at the end of the annuity period. The formula is:

FV = PMT

Need help calculating annuity amounts? You can find out more about annuity calculators in 2024 and how they can assist you.

- [(1 + r)^n

- 1] / r

Where:

- FV = Future Value

- PMT = Payment Amount

- r = Interest Rate

- n = Number of Payments

- Annuity Due:This method is similar to the present value of an annuity, but it assumes that payments are made at the beginning of each period. This results in slightly higher future values compared to an ordinary annuity. The formula is:

PV = PMT

Want to know more about joint life annuity options? You can find out more about joint life annuity options in 2024 and their potential benefits.

- [1

- (1 + r)^-n] / r

- (1 + r)

Where:

- PV = Present Value

- PMT = Payment Amount

- r = Interest Rate

- n = Number of Payments

- Perpetuity:This method calculates the present value of an annuity that continues forever. It’s used to value assets that generate a perpetual stream of income, such as real estate or certain bonds. The formula is:

PV = PMT / r

Annuity products can be a bit confusing. You can find out more about annuities as life insurance products in 2024 and their features.

Where:

- PV = Present Value

- PMT = Payment Amount

- r = Interest Rate

Annuity Calculators and Tools

Online annuity calculators are readily available and can be very useful for estimating annuity payments based on specific inputs. These calculators typically require you to enter information such as:

- Investment amount

- Interest rate or expected investment returns

- Payment frequency

- Duration of payments

Examples of Annuity Calculators

Some popular annuity calculator websites include:

- Bankrate.com

- Investopedia.com

- NerdWallet.com

These calculators can provide a quick and easy way to estimate annuity payments, but it’s important to remember that they are just estimates and may not reflect all the factors that can affect your actual payments.

Looking to use Excel for annuity calculations? You can find out more about calculating future value annuities in Excel in 2024 and its advantages.

Considerations for Annuity Planning

Annuities can be a valuable part of a retirement savings strategy, but it’s essential to weigh the pros and cons before making a decision.

If you’re looking for information on a specific annuity amount, you can find out more about annuities for NZ$75,000 in 2024.

Pros and Cons

- Pros:

- Guaranteed income stream

- Tax-deferred growth (for some types)

- Potential for higher returns (for variable annuities)

- Protection against outliving your savings

- Cons:

- Limited liquidity

- Potential for lower returns than other investments

- Fees and charges

- Risk of inflation eroding the value of payments

Risks

Some potential risks associated with annuities include:

- Market Volatility:Variable annuities are subject to market fluctuations, which can impact the value of your investment and your annuity payments.

- Inflation Risk:Inflation can erode the purchasing power of your annuity payments over time, especially if you choose a fixed annuity.

- Fees and Charges:Annuities often come with fees and charges, which can reduce your overall returns.

Consult a Financial Advisor

It’s essential to consult with a qualified financial advisor before purchasing an annuity. They can help you assess your financial goals, risk tolerance, and overall financial situation to determine if an annuity is the right investment for you. They can also help you choose the type of annuity that best suits your needs and explain the potential risks and benefits involved.

If you’re curious about the nature of annuity funds, you can find out more about whether annuity funds are unrestricted in 2024 and their implications.

Outcome Summary

As you embark on your retirement planning journey, understanding annuities can be a game-changer. By exploring the various types, calculating potential payouts, and considering the pros and cons, you can make informed decisions that align with your financial goals.

Understanding the difference between annuities and pensions can be helpful. You can find out more about the similarities and differences between annuities and pensions in 2024.

Remember, consulting with a financial advisor can provide valuable guidance and personalized insights for your unique situation.

Key Questions Answered

What is the difference between a fixed and variable annuity?

A fixed annuity offers a guaranteed rate of return, while a variable annuity’s return is tied to the performance of underlying investments.

Interested in the math behind annuities? You can learn more about calculating annuity formulas in 2024 and how they work.

How do I choose the right annuity for my needs?

Consider your risk tolerance, time horizon, and income needs. Consulting with a financial advisor can help you determine the best annuity for your situation.

Looking for information on annuities in New Zealand for 2024? You can find out more about annuity options in New Zealand and their potential benefits.

Are there any fees associated with annuities?

Yes, annuities often come with fees, such as administrative fees, mortality charges, and surrender charges. It’s essential to understand the fee structure before purchasing an annuity.

If you’re considering an annuity with a specific amount, you can find out more about annuities for NZ$300,000 in 2024 and how they might work for you.