How Do You Calculate Annuity Payments 2024? Understanding how to calculate annuity payments is crucial for anyone considering this financial instrument. Annuities are financial contracts that provide a stream of regular payments for a set period of time, making them a popular choice for retirement planning, income generation, and other financial goals.

By grasping the fundamental principles behind annuity calculations, you can make informed decisions about your financial future.

Annuity insurance is a type of insurance that provides a guaranteed stream of income. Explore the concept of Is Annuity Insurance 2024 and its potential benefits.

This guide delves into the intricacies of annuity payment calculations, breaking down the formula, identifying key influencing factors, and exploring various methods used to determine the payment amount. We will also examine the role of financial calculators and software in streamlining this process, ensuring accuracy and efficiency.

The 59 1/2 rule is an important consideration for retirement planning. Understand the Annuity 59 1/2 Rule 2024 and its impact on your financial decisions.

Furthermore, we’ll address essential considerations like inflation, taxes, and fees, which can significantly impact the overall cost of an annuity. Finally, we will illustrate the concepts with practical examples to demonstrate how these calculations apply to real-world scenarios.

Contents List

- 1 Understanding Annuities: How Do You Calculate Annuity Payments 2024

- 2 Annuity Payment Calculation Formula

- 3 Factors Influencing Annuity Payments

- 4 Annuity Payment Calculation Methods

- 5 Using Financial Calculators and Software

- 6 Annuity Payment Considerations

- 7 Practical Examples of Annuity Payment Calculations

- 8 Final Summary

- 9 Detailed FAQs

Understanding Annuities: How Do You Calculate Annuity Payments 2024

An annuity is a financial product that provides a stream of regular payments over a set period of time. It’s essentially a contract between you and an insurance company where you make a lump-sum payment or a series of payments, and in return, you receive a series of payments later on, often for life.

Annuities can be a valuable tool for retirement planning, income generation, and other financial goals.

The annuity equation is a fundamental formula used in financial calculations. Learn about the Annuity Equation 2024 and its applications.

Types of Annuities, How Do You Calculate Annuity Payments 2024

Annuities come in various forms, each with its own features and benefits. Here are some common types:

- Fixed Annuities:These annuities offer guaranteed payments based on a fixed interest rate. The amount of each payment is known in advance, providing stability and predictability.

- Variable Annuities:These annuities offer payments that fluctuate based on the performance of underlying investments. They have the potential for higher returns but also carry more risk.

- Immediate Annuities:These annuities start paying out immediately after you make the initial investment. They are often used for immediate income needs or to supplement retirement income.

Real-World Examples of Annuities

Annuities are used in various real-world scenarios. Here are some examples:

- Retirement Planning:Annuities can provide a steady stream of income during retirement, ensuring financial security.

- Income Generation:Annuities can be used to supplement income from other sources, such as Social Security or pensions.

- Long-Term Care:Annuities can help cover the costs of long-term care, such as nursing home expenses.

- Estate Planning:Annuities can be used to provide income to beneficiaries after your death.

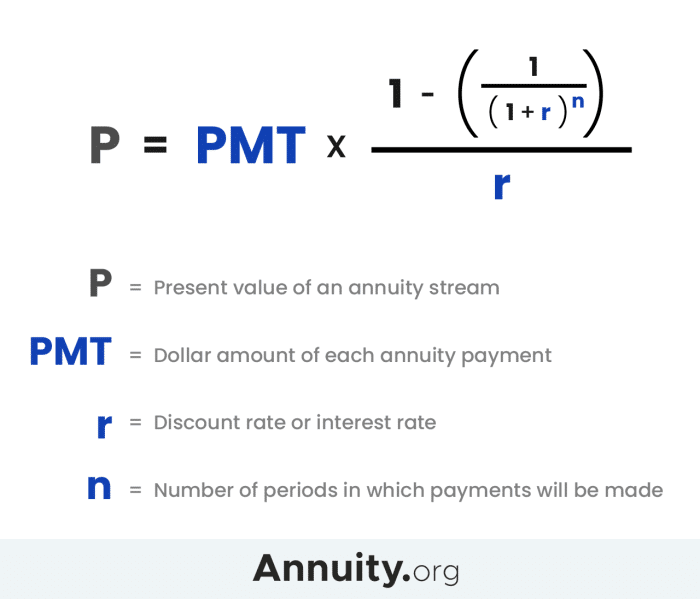

Annuity Payment Calculation Formula

The standard formula for calculating annuity payments is:

PMT = PV

An annuity stream refers to a series of payments made over a period of time. Explore the concept of Is Annuity Stream 2024 and its implications for financial planning.

- (r / (1

- (1 + r)^-n))

Where:

- PMTis the annuity payment amount

- PVis the present value of the annuity (the lump-sum investment)

- ris the interest rate per period

- nis the total number of payment periods

Example

Let’s say you invest $100,000 in an annuity that pays 5% annual interest, and you want to receive payments for 20 years. Using the formula, we can calculate the annuity payment:

PMT = $100,000 – (0.05 / (1 – (1 + 0.05)^-20))

PMT = $100,000 – (0.05 / (1 – 0.376889))

PMT = $100,000 – (0.05 / 0.623111)

The HP10bii calculator is a popular tool for financial calculations, including annuities. Learn how to Calculate Annuity Hp10bii 2024 and simplify your financial analysis.

PMT = $100,000 – 0.080135

PMT = $8,013.50

The TI-84 calculator is a versatile tool for financial calculations. Learn how to How To Calculate Annuities On Ti 84 2024 and simplify your financial analysis.

Therefore, the annuity payment would be $8,013.50 per year for 20 years.

Factors Influencing Annuity Payments

Several factors can influence the amount of annuity payments you receive. Understanding these factors can help you make informed decisions about your annuity investment.

Key Factors

- Interest Rates:Higher interest rates generally result in larger annuity payments. This is because the investment grows faster at higher interest rates, leading to larger payouts.

- Time Period:The length of the annuity payment period also affects the payment amount. Longer periods typically result in smaller payments, as the investment is spread out over a longer time.

- Present Value:The initial investment amount (present value) directly impacts the annuity payment. A larger investment will lead to larger payments, all other factors being equal.

Impact of Factors on Annuity Payments

| Factor | Impact on Annuity Payments |

|---|---|

| Higher Interest Rates | Larger Payments |

| Lower Interest Rates | Smaller Payments |

| Longer Time Period | Smaller Payments |

| Shorter Time Period | Larger Payments |

| Higher Present Value | Larger Payments |

| Lower Present Value | Smaller Payments |

Annuity Payment Calculation Methods

There are different methods for calculating annuity payments, each with its own advantages and disadvantages. Here are two common methods:

Present Value Method

The present value method calculates the annuity payment by discounting the future payments back to their present value. This method is useful for determining the amount you need to invest today to receive a specific stream of future payments.

Future Value Method

The future value method calculates the annuity payment by compounding the present value investment forward to its future value. This method is useful for determining the amount you will have accumulated at the end of the annuity period.

Comparison of Methods

The present value method is generally preferred for calculating annuity payments, as it provides a more accurate reflection of the actual value of the annuity. The future value method can be used for planning purposes, but it may not accurately reflect the present value of the annuity.

Annuity 712 is a specific type of annuity with unique characteristics. You can learn more about it by visiting Annuity 712 2024.

Using Financial Calculators and Software

Financial calculators and software can simplify the process of calculating annuity payments. These tools offer several benefits, including accuracy, efficiency, and ease of use.

Benefits of Using Financial Calculators and Software

- Accuracy:Financial calculators and software use complex algorithms to ensure accurate calculations.

- Efficiency:These tools automate the calculation process, saving you time and effort.

- Ease of Use:Many financial calculators and software programs have user-friendly interfaces, making them easy to use.

Popular Financial Calculators and Software

There are numerous financial calculators and software programs available, both online and offline. Some popular options include:

- Microsoft Excel:Excel provides built-in functions for calculating annuity payments.

- Financial Calculators:Handheld financial calculators are widely available and offer a range of functions for financial calculations.

- Online Annuity Calculators:Many websites offer free online annuity calculators that allow you to input your investment details and calculate your annuity payments.

Annuity Payment Considerations

When calculating annuity payments, it’s essential to consider several factors that can impact the overall cost and effectiveness of the annuity. These factors include:

Inflation

Inflation can erode the purchasing power of your annuity payments over time. This means that the same amount of money will buy less in the future than it does today. To mitigate the effects of inflation, you may consider investing in annuities that offer inflation protection.

Taxes

Annuity payments are generally taxable as ordinary income. The tax implications of annuity payments can vary depending on the type of annuity and your individual circumstances. It’s important to consult with a tax advisor to understand the tax implications of your annuity.

Calculating an annuity can seem daunting, but it’s a straightforward process with the right knowledge. Learn how to How Calculate Annuity 2024 and gain a better understanding of your financial future.

Fees

Annuities often come with fees, such as administrative fees, surrender charges, and mortality and expense charges. These fees can reduce the overall return on your annuity investment. It’s essential to carefully review the fees associated with any annuity before making a decision.

Tips for Minimizing Impact

- Choose an Annuity with Low Fees:Look for annuities with low fees to maximize your returns.

- Consider Inflation Protection:Invest in an annuity that offers inflation protection to help preserve the purchasing power of your payments.

- Seek Professional Advice:Consult with a financial advisor to understand the tax implications and fees associated with different annuities.

Practical Examples of Annuity Payment Calculations

Here are some practical examples of annuity payment calculations using different scenarios:

Retirement Planning

Suppose you want to retire in 10 years and have saved $500, 000. You want to receive an annual income of $40,000 from an annuity for 20 years. Using the annuity payment formula, we can calculate the required interest rate:

PMT = PV – (r / (1 – (1 + r)^-n))

$40,000 = $500,000 – (r / (1 – (1 + r)^-20))

The 59.5 rule is a common guideline for accessing retirement funds. Discover more about the Annuity 59.5 Rule 2024 and its implications for your retirement savings.

Solving for r, we find that the required interest rate is approximately 3.75%. This means you would need to find an annuity that offers at least a 3.75% annual interest rate to achieve your desired retirement income.

Saving for a Down Payment

You want to save for a down payment on a house in 5 years. You can afford to save $1,000 per month. You want to know how much you will have saved at the end of the 5-year period, assuming an annual interest rate of 4%.

Calculating your annuity income is crucial for understanding your financial future. This guide on Calculating Annuity Income 2024 provides insights into the process.

Using the future value method, we can calculate the future value of your savings:

FV = PMT – (((1 + r)^n – 1) / r)

FV = $1,000 – (((1 + 0.04/12)^60 – 1) / (0.04/12))

Joint and survivor annuities are designed to provide income for two individuals. Learn more about Annuity Joint And Survivor 2024 and how they can benefit couples.

FV = $1,000 – (1.22019 – 1) / (0.04/12)

FV = $1,000 – 0.22019 / (0.04/12)

Annuity 5 is a specific type of annuity, often used for retirement planning. Discover more about Annuity 5 2024 and its potential benefits.

FV = $1,000 – 66.057

FV = $66,057

Therefore, you will have saved approximately $66,057 at the end of the 5-year period.

Funding Education Expenses

You want to save for your child’s college education. You estimate that you will need $100,000 in 18 years. You can afford to save $500 per month. Using the present value method, we can calculate the required interest rate to reach your goal:

PV = PMT – ((1 – (1 + r)^-n) / r)

Understanding the value of an annuity is essential for making informed financial decisions. Read about Annuity Is The Value Of 2024 to gain insights into this important concept.

$100,000 = $500 – ((1 – (1 + r)^-216) / r)

Solving for r, we find that the required interest rate is approximately 6.25%. This means you would need to find an investment that offers at least a 6.25% annual interest rate to achieve your education savings goal.

Final Summary

Mastering the art of annuity payment calculations empowers you to make informed financial decisions. Whether you’re planning for retirement, saving for a down payment, or funding education expenses, understanding the factors that influence annuity payments is crucial. By utilizing the formulas, methods, and tools discussed in this guide, you can confidently navigate the world of annuities and achieve your financial goals.

Detailed FAQs

What is the difference between a fixed and a variable annuity?

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s return is tied to the performance of underlying investments.

How often are annuity payments typically made?

Annuity payments can be made monthly, quarterly, semi-annually, or annually, depending on the terms of the contract.

The UK government provides an annuity calculator for those looking to understand their options. Find out more about the Annuity Calculator Gov Uk 2024 and how it can help you.

Are there any tax implications associated with annuities?

Yes, annuity payments are typically taxed as ordinary income. However, there are tax-advantaged annuities, such as Roth IRAs, which offer tax-free withdrawals in retirement.

Calculating the payment for a growing annuity can be tricky, but it’s crucial for financial planning. Check out this guide on Calculating Growing Annuity Payment 2024 to understand the concepts and formulas involved.