How To Calculate Annual Annuity 2024 sets the stage for understanding this powerful financial tool, offering readers a clear and concise guide to calculating annual annuity payments. An annuity is a series of regular payments made over a specified period, often used for retirement planning or income generation.

Annuity payments can be structured in different ways, including over a fixed period or for the rest of your life. Annuity 30 Years 2024 explores the details of annuities with a 30-year term. It’s crucial to choose the right type of annuity that aligns with your financial goals and circumstances.

This guide will delve into the fundamentals of annuities, explore the factors that influence payment amounts, and provide practical steps for calculating your own annual annuity payments.

Planning for retirement? An annuity can be a helpful tool to ensure a steady income stream. How Much Annuity For 100 000 2024 will help you determine how much income you can expect based on your savings. It’s essential to understand the factors that influence the amount of annuity payments you’ll receive, such as your age, life expectancy, and the interest rate.

We’ll cover the key components of an annuity, including principal, interest rate, and payment period, and explain the difference between ordinary annuities and annuities due. We’ll also examine the concept of present value and future value, which are essential for determining the appropriate payment amount.

Annuity ownership can be structured in various ways, including joint ownership. Annuity Joint Ownership 2024 explains the benefits and considerations of joint ownership. It’s important to choose the ownership structure that best suits your circumstances.

The guide will then provide a step-by-step walkthrough of the calculation process, including formulas and a hypothetical example to illustrate the concepts.

For a more accurate calculation of your potential annuity income, it’s important to consider your individual life expectancy. Utilizing a tool like the Annuity Calculator Based On Life Expectancy 2024 allows you to input your estimated life expectancy, along with other relevant factors, to receive a more tailored estimate of your potential annuity payments.

Contents List

Understanding Annuities: How To Calculate Annual Annuity 2024

An annuity is a financial product that provides a series of regular payments over a set period of time. It’s like a structured stream of income, designed to provide financial security and stability. Annuities are often used for retirement planning, but they can also serve other purposes, such as saving for a child’s education or supplementing income during a period of disability.

Choosing between an annuity and a 401k can be a complex decision. Annuity Vs 401k 2024 helps you understand the pros and cons of each option. It’s important to weigh your individual financial goals and risk tolerance before making a choice.

Key Components of an Annuity

To understand how annuities work, let’s break down their key components:

- Principal:The initial amount of money you invest in the annuity. This is the foundation of your annuity.

- Interest Rate:The rate at which your principal grows over time. This rate determines how much interest you earn on your investment.

- Payment Period:The frequency of the annuity payments. It could be annual, semi-annual, quarterly, or even monthly.

- Payment Amount:The amount of each regular payment you receive from the annuity.

- Term:The total duration of the annuity, or the length of time over which you receive payments.

Ordinary Annuities vs. Annuities Due

There are two main types of annuities:

- Ordinary Annuities:Payments are made at the end of each payment period. This is the most common type of annuity.

- Annuities Due:Payments are made at the beginning of each payment period. This type of annuity generally results in a slightly higher future value.

Present Value and Future Value

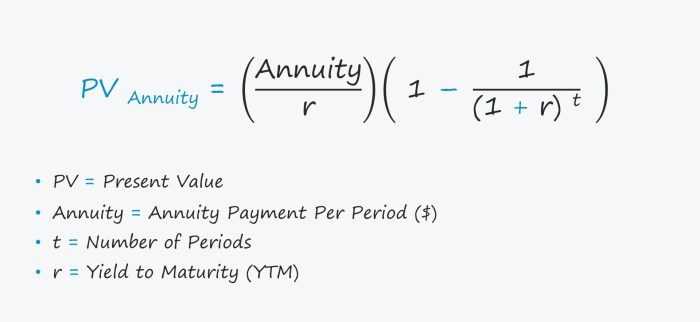

Understanding the concepts of present value (PV) and future value (FV) is crucial when working with annuities:

- Present Value (PV):The current value of a future stream of payments. It tells you how much you need to invest today to receive a specific series of future payments.

- Future Value (FV):The value of an annuity at a future point in time. It represents the total amount you will have accumulated from your annuity after a certain period.

Calculating Annual Annuity Payment

Calculating the annual annuity payment involves determining the amount you will receive each year from your annuity. The payment amount depends on several factors, including the principal, interest rate, and the duration of the annuity.

If you’re using Excel for financial calculations, you can utilize the built-in functions to calculate annuity payments. Calculating Annuity Due In Excel 2024 provides a guide on how to do this. This can help you understand the potential return on your investment and make informed financial decisions.

Step-by-Step Calculation, How To Calculate Annual Annuity 2024

Here’s a step-by-step guide to calculating the annual annuity payment:

- Identify the Present Value (PV):This is the amount you are investing in the annuity today.

- Determine the Interest Rate (i):This is the annual interest rate offered by the annuity.

- Specify the Number of Payment Periods (n):This represents the total number of years you will receive payments.

- Apply the Annuity Formula:The formula for calculating the annual annuity payment (PMT) is:

PMT = PV

The 59.5 rule governs early withdrawals from annuities. Annuity 59.5 Rule 2024 provides information about this rule and its implications. It’s crucial to understand the tax implications of withdrawing from an annuity before age 59.5.

- [i

- (1 + i)^n] / [(1 + i)^n

- 1]

Let’s illustrate this with an example:

| Variable | Value |

|---|---|

| Present Value (PV) | $100,000 |

| Interest Rate (i) | 5% |

| Number of Payment Periods (n) | 10 years |

Using the formula, the annual annuity payment would be:

PMT = $100,000

Calculating the annual payment of an annuity can be done using various methods. Calculating Annuity Annual Payment 2024 offers a detailed explanation of the process. It’s crucial to accurately calculate the annual payment to ensure that your financial needs are met.

- [0.05

- (1 + 0.05)^10] / [(1 + 0.05)^10

- 1] = $12,950.46

Therefore, the annual annuity payment in this scenario would be approximately $12,950.46.

Annuity formulas are used to calculate the present or future value of a stream of payments. Annuity Calculation Formula 2024 provides a comprehensive guide on the formulas involved. Understanding these formulas can help you make informed financial decisions regarding annuities.

Factors Affecting Annuity Payments

Several factors can influence the amount of your annuity payments. Understanding these factors can help you make informed decisions about your annuity investments.

Annuity payments can be structured to be made on a half-yearly basis. Annuity Formula Half Yearly 2024 explains the formula used to calculate these payments. This information can be useful for those who prefer more frequent payments.

Interest Rates

Interest rates play a crucial role in determining annuity payments. Higher interest rates generally lead to larger annuity payments, as your principal grows faster. Conversely, lower interest rates result in smaller payments. It’s important to compare interest rates offered by different annuity providers to find the best deal.

The UK government provides a calculator to help individuals understand their annuity options. Annuity Calculator Gov Uk 2024 offers a user-friendly tool to estimate your annuity payments based on your circumstances. It’s a helpful resource for individuals considering annuities in the UK.

Payment Period

The frequency of annuity payments also impacts the payment amount. If you receive payments more frequently (e.g., monthly instead of annually), the individual payment amount will be smaller, but you will receive more payments overall. The total amount received over the annuity’s term will remain the same, regardless of the payment frequency.

Looking to understand the concept of an annuity? An Annuity Is Quizlet 2024 can help you grasp the basics. An annuity is a financial product that provides a stream of regular payments for a set period of time. This can be a valuable tool for retirement planning, as it provides a steady income stream that can help you cover your expenses.

Inflation and Taxes

Inflation can erode the purchasing power of your annuity payments over time. While annuities are designed to provide a steady stream of income, the real value of those payments may decrease if inflation outpaces the interest rate. Similarly, taxes can impact your annuity payments, as interest earned on your annuity may be subject to taxation.

Are you interested in understanding the average return on annuities? 7 Annuity Return 2024 explores the historical performance of annuities and provides insights into potential returns. It’s important to be aware of the potential risks and rewards associated with annuities before investing.

It’s essential to factor in these potential impacts when considering an annuity.

Want to calculate the potential annuity payments you could receive? Annuity Calculator Based On Life Expectancy 2024 provides a tool to estimate your payments based on your life expectancy. This can help you plan for your retirement income needs.

Annuity Types and Applications

Annuities come in various forms, each with unique characteristics and applications. Understanding these different types can help you choose the annuity that best aligns with your financial goals.

Annuity bonds are a type of investment that provides a guaranteed stream of income. Calculate Annuity Bond 2024 provides information on how to calculate the potential return on an annuity bond. This can be a valuable tool for those looking for a secure investment with predictable income.

Types of Annuities

| Type | Key Characteristics |

|---|---|

| Fixed Annuity | Guarantees a fixed interest rate and payment amount. Provides stability and predictability. |

| Variable Annuity | Investment options linked to the performance of underlying assets. Potential for higher returns but also greater risk. |

| Immediate Annuity | Payments begin immediately after the annuity is purchased. Ideal for immediate income needs. |

| Deferred Annuity | Payments begin at a later date, allowing time for the principal to grow. Suitable for long-term savings goals. |

Applications of Annuities

Annuities can be used for various financial purposes, including:

- Retirement Planning:Annuities can provide a steady stream of income during retirement, helping to ensure financial security in your later years.

- Savings:Annuities can be used as a tax-deferred savings vehicle, allowing your money to grow over time.

- Investment Strategies:Annuities can be incorporated into investment portfolios to provide diversification and income generation.

Pros and Cons of Annuity Types

Each type of annuity has its own advantages and disadvantages:

- Fixed Annuities:Pros: Predictable income, guaranteed interest rate. Cons: Limited growth potential, potential for inflation erosion.

- Variable Annuities:Pros: Potential for higher returns, investment flexibility. Cons: Higher risk, no guaranteed return.

- Immediate Annuities:Pros: Immediate income, guaranteed payments. Cons: Lower overall returns, limited flexibility.

- Deferred Annuities:Pros: Tax-deferred growth, potential for higher returns. Cons: No immediate income, potential for market fluctuations.

Annuity Calculators and Resources

Several online tools and resources can help you calculate annuity payments and explore different annuity options.

Annuity payments can vary depending on the interest rate offered. 6 Percent Annuity 2024 delves into the details of annuities with a 6% interest rate. It’s important to compare different annuity options and consider the interest rate when making your decision.

Annuity Calculators

Online annuity calculators can help you estimate your potential annuity payments based on your investment amount, interest rate, and payment period. These calculators can be valuable for comparing different annuity options and making informed decisions.

Financial Planning Tools

Financial planning tools can provide comprehensive guidance on annuity investments, including retirement planning, savings, and investment strategies. These tools can help you create a personalized financial plan that incorporates annuities and other financial products.

Financial Institutions and Organizations

Many financial institutions and organizations offer annuity products. It’s essential to research different providers and compare their offerings, including interest rates, fees, and features.

Understanding how much income you can expect from your annuity can be crucial in planning your retirement finances. To help you estimate your potential income, the UK government provides an online tool, the Annuity Calculator Gov Uk 2024. This calculator considers factors like your age, health, and the amount of your pension pot to give you a personalized estimate of your potential annuity payments.

Financial Advisor

Before making any annuity decisions, it’s highly recommended to consult with a qualified financial advisor. A financial advisor can help you assess your financial goals, understand the intricacies of annuities, and choose the annuity that best suits your needs.

Closing Notes

Understanding how to calculate annual annuity payments empowers you to make informed financial decisions. By grasping the key concepts and applying the formulas provided in this guide, you can determine the appropriate annuity payment for your specific needs and financial goals.

Remember to consider factors like interest rates, payment periods, and inflation, and consult with a financial advisor for personalized guidance. With the knowledge gained, you can confidently navigate the world of annuities and make strategic choices for your financial future.

Annuity payments can be structured in various ways, including half-yearly payments. If you’re interested in understanding the formula used for calculating half-yearly annuity payments, you can explore the Annuity Formula Half Yearly 2024 resource. This resource provides a detailed explanation of the formula and its application, helping you to understand the mechanics of annuity calculations.

Questions and Answers

What are the different types of annuities?

Annuities can be categorized into fixed, variable, immediate, and deferred. Fixed annuities offer a guaranteed rate of return, while variable annuities are linked to market performance. Immediate annuities provide payments starting immediately, while deferred annuities have a delayed start date.

How do taxes affect annuity payments?

The tax treatment of annuity payments depends on the type of annuity and the tax laws in your jurisdiction. Consult with a tax professional for personalized guidance on the tax implications of your specific annuity.

Are annuities right for everyone?

Annuity bonds are a popular investment option, particularly for retirees seeking a steady stream of income. To calculate the potential return on your annuity bond, you can utilize online tools like the Calculate Annuity Bond 2024 calculator. This tool allows you to input various factors, such as the principal amount, interest rate, and duration, to estimate your potential income stream.

Annuities can be a valuable tool for retirement planning and income generation, but they are not suitable for everyone. Consider your individual financial situation, risk tolerance, and investment goals before making any decisions.