Calculating Annuity Method 2024 is a crucial aspect of financial planning, allowing individuals to secure their future by generating a steady stream of income during retirement. Annuities offer a unique approach to retirement savings, providing guaranteed payments and potential tax advantages.

Annuity payments can vary depending on the amount of your initial investment. If you’re considering an annuity with a starting amount of $60,000, you can find more information on annuities with this specific amount for 2024 here. This resource can help you understand the potential payouts and features associated with such an annuity.

This comprehensive guide will delve into the intricacies of annuity calculations, exploring various factors that influence their value and examining the different types of annuities available in today’s market.

Mortality tables are crucial for calculating annuity payments, as they provide insights into life expectancy. You can find information on the Annuity 2000 Basic Mortality Table for 2024 here. This table can help you understand the factors that influence annuity payouts based on age and other demographic factors.

Understanding the mechanics of annuity calculations is essential for making informed financial decisions. This guide will equip you with the knowledge to determine the most suitable annuity options for your specific needs and financial goals. We will cover everything from the fundamental concepts of annuities to advanced investment strategies, providing you with a clear roadmap to navigate the world of retirement planning.

Contents List

Understanding Annuities

An annuity is a financial product that provides a stream of regular payments over a specified period. It’s essentially a contract between you and an insurance company where you make a lump-sum payment or series of payments, and in return, you receive guaranteed payments for a set duration.

Annuities are designed to provide financial security, especially during retirement, by ensuring a steady income stream.

Annuity payments can be calculated from a lump sum investment. To learn more about calculating annuity payouts from a lump sum for 2024, you can find information here. This resource will provide insights into the methods and formulas used to calculate annuity payouts from a lump sum.

Types of Annuities

Annuities come in various forms, each tailored to different needs and risk profiles. Here’s a breakdown of some common types:

- Fixed Annuities:These offer guaranteed interest rates, providing predictable income payments. They are ideal for those seeking stability and security, but the returns might not keep pace with inflation.

- Variable Annuities:These link returns to the performance of underlying investment accounts, offering potential for higher returns but also exposing you to market risks. They are suitable for those seeking growth potential but willing to accept some volatility.

- Immediate Annuities:These start paying out immediately after you make the initial investment. They are suitable for those seeking immediate income, such as retirees.

- Deferred Annuities:These begin payments at a future date, allowing you to grow your investment over time before receiving income. They are beneficial for those saving for retirement or other future financial goals.

Real-World Examples

Annuities are commonly used in various real-world scenarios:

- Retirement Income:Annuities can provide a steady income stream during retirement, ensuring financial stability and helping to cover living expenses.

- Longevity Protection:They can offer protection against outliving your savings, guaranteeing income for a lifetime, regardless of how long you live.

- Estate Planning:Annuities can be used to create a legacy by providing income to beneficiaries after your death.

- Supplementing Social Security:They can be used to supplement Social Security benefits and provide additional income for retirees.

Calculating Annuity Payments: Calculating Annuity Method 2024

The calculation of annuity payments involves determining the amount of regular income you’ll receive based on your initial investment, interest rate, and the duration of the annuity.

Edward Jones is a well-known financial institution that offers annuity products. You can find an annuity calculator specifically designed for Edward Jones for 2024 here. This calculator can help you understand the specific features and terms of annuities offered by Edward Jones.

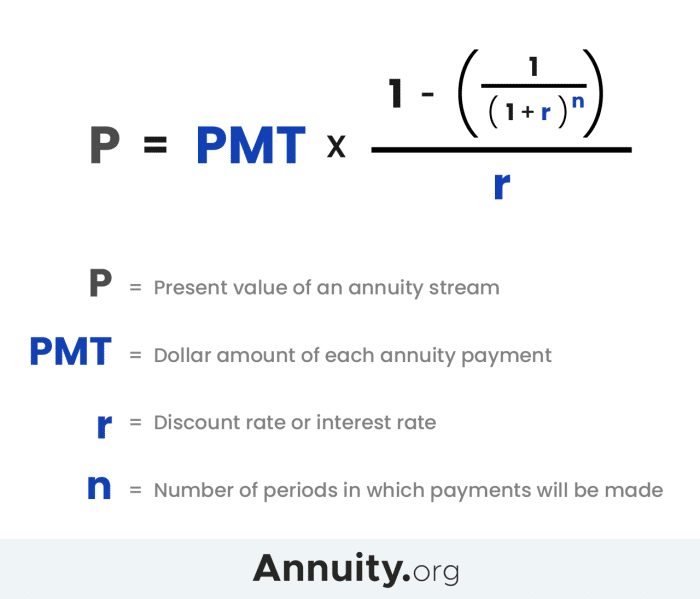

Annuity Payment Formula

The formula for calculating annuity payments is:

Payment = (PV

Some annuities compound interest monthly, leading to potentially higher returns. You can find an annuity calculator that accounts for monthly compounding for 2024 here. This calculator can help you compare the growth potential of annuities with different compounding frequencies.

- r) / (1

- (1 + r)^-n)

Where:* PV = Present Value (the initial investment)

- r = Interest Rate (expressed as a decimal)

- n = Number of Payment Periods

Key Variables

Understanding the variables involved in the formula is crucial:

- Present Value (PV):This is the lump-sum amount you invest in the annuity.

- Interest Rate (r):This is the rate of return you earn on your investment, which can be fixed or variable.

- Time Period (n):This is the number of payment periods (e.g., monthly, annually) over which you’ll receive income.

Annuity Payment Scenarios

Here’s a table showcasing different annuity payment scenarios with varying interest rates and time periods:

| Interest Rate | Time Period (Years) | Annuity Payment |

|---|---|---|

| 3% | 10 | $11,956 |

| 5% | 15 | $16,385 |

| 7% | 20 | $22,462 |

*Note: These are hypothetical examples and actual payments may vary based on specific annuity terms and market conditions.*

Annuity payments can provide a steady stream of income in retirement, and understanding how they work is crucial. If you’re looking for information about the LIC Annuity Number for 2024, you can find it here. This will help you understand the specifics of LIC annuities and how they might fit into your retirement planning.

Factors Affecting Annuity Calculations

Several factors can influence the calculation of annuity payments, impacting the amount of income you receive.

The “Is Annuity Stream” refers to a specific type of annuity that provides a consistent stream of income. You can find information on this type of annuity for 2024 here. This resource will provide insights into the benefits and considerations of an Is Annuity Stream.

Inflation

Inflation erodes the purchasing power of money over time. If the interest rate on your annuity doesn’t outpace inflation, your payments may not maintain their real value.

If you’re considering an annuity with a large initial investment, you might be interested in annuities starting at $750,000. To find information on annuities with this amount for 2024, you can visit this link. This resource will provide details on the potential payouts and features of such annuities.

Interest Rate Changes

Fluctuations in interest rates can affect the value of your annuity. If interest rates rise after you purchase an annuity, the value of your investment may increase. Conversely, if interest rates fall, the value may decrease.

Annuity calculations can be complex, but using an Excel template can simplify the process. You can find an annuity calculator Excel template for 2024 here. This template can help you quickly calculate various annuity scenarios, saving you time and effort.

Taxes

Taxes can play a role in annuity calculations. Interest earned on annuities is typically taxable, and withdrawals may be subject to ordinary income tax rates.

If you’re unfamiliar with annuities, you might be wondering “What is an annuity?” You can find an explanation of annuities in simple terms for 2024 here. This resource will provide a clear and concise definition of annuities and their potential benefits.

Annuity Investment Strategies

Choosing the right annuity investment strategy is crucial to achieving your financial goals.

Deciding between an annuity and a 401k can be a tough choice. To help you make the best decision, consider the pros and cons of each. You can find a comprehensive comparison of annuities and 401ks for 2024 here.

This resource can help you determine which option aligns better with your financial goals and risk tolerance.

Investment Options

Annuities offer various investment options, each with its own risk and return profile:

- Fixed Income:These investments provide a steady stream of income with lower risk, such as bonds and CDs.

- Equity:These investments offer the potential for higher returns but also carry greater risk, such as stocks and mutual funds.

- Real Estate:This asset class can provide diversification and potential for appreciation, but it requires active management and can be illiquid.

Choosing the Right Annuity

Selecting the right annuity depends on your individual financial goals, risk tolerance, and time horizon:

- Financial Goals:Consider your retirement income needs, longevity protection, or estate planning objectives.

- Risk Tolerance:Determine your comfort level with market volatility and potential for losses.

- Time Horizon:Consider how long you plan to hold the annuity and when you need to access the funds.

Hypothetical Annuity Investment Portfolio

For a hypothetical investor with a moderate risk tolerance and a 20-year time horizon, a diversified portfolio could include:

- 60% Fixed Income: This provides stability and a steady income stream.

- 30% Equity: This offers potential for growth and outpacing inflation.

- 10% Real Estate: This provides diversification and potential for appreciation.

*Remember, this is a hypothetical example, and individual investment strategies should be tailored to specific circumstances and professional advice should be sought.*

When considering annuities, it’s important to evaluate the potential return on investment. A helpful tool for this is the Annuity NPV Calculator. You can find one for 2024 here. This calculator allows you to input various variables to determine the net present value of an annuity, giving you a better idea of its financial viability.

Annuity Benefits and Risks

Annuities offer potential benefits but also carry certain risks. It’s essential to weigh these factors before making an investment decision.

Annuity payouts can be influenced by factors like age and gender. To find information about annuities for a 65-year-old male in 2024, you can visit this link. This resource will provide insights into the potential payouts and features of annuities for individuals in this demographic.

Benefits, Calculating Annuity Method 2024

Here are some key benefits of investing in annuities:

- Guaranteed Income:Annuities provide a steady income stream, ensuring financial security, especially during retirement.

- Tax Advantages:Some annuities offer tax deferral on earnings, allowing your investment to grow tax-free until withdrawal.

- Longevity Protection:They can offer income for a lifetime, regardless of how long you live, protecting you from outliving your savings.

Risks

It’s important to be aware of the potential risks associated with annuities:

- Market Volatility:Variable annuities are exposed to market risks, and the value of your investment can fluctuate.

- Surrender Charges:Some annuities impose surrender charges if you withdraw funds before a certain period, reducing your returns.

- Inflation:Fixed annuities may not keep pace with inflation, eroding the purchasing power of your payments.

Annuity Pros and Cons

Here’s a table comparing the pros and cons of different annuity types:

| Annuity Type | Pros | Cons |

|---|---|---|

| Fixed Annuities | Guaranteed interest rates, predictable income, low risk | Returns may not keep pace with inflation, limited growth potential |

| Variable Annuities | Potential for higher returns, investment flexibility | Market volatility, risk of losses, surrender charges |

| Immediate Annuities | Immediate income stream, guaranteed payments | Limited growth potential, may not be suitable for long-term savings |

| Deferred Annuities | Tax deferral on earnings, potential for growth | May have surrender charges, limited access to funds before maturity |

Annuities in 2024

The annuity market is constantly evolving, influenced by economic conditions and regulatory changes.

Recent Trends

In 2024, there’s been a growing demand for annuities as individuals seek guaranteed income and protection against market volatility. The market is seeing innovation in product offerings, with new types of annuities emerging to meet diverse needs.

Economic Impact

Economic conditions play a significant role in annuity investments. Rising interest rates can impact annuity values, while inflation can erode the purchasing power of payments.

To understand how annuities work, it’s helpful to see an example. You can find a detailed example of a PV Annuity calculation for 2024 here. This example will illustrate the steps involved in calculating the present value of an annuity, helping you understand the underlying concepts.

Future Outlook

The outlook for annuities in 2024 and beyond is positive, driven by factors such as an aging population, increased demand for retirement income solutions, and continued innovation in the market. However, it’s essential to consider the potential risks and consult with a financial advisor before making any investment decisions.

If you’re looking for a shorter-term annuity, a 5-year payout might be an option. To learn more about how these annuities work, you can find information on 5-year annuity payouts for 2024 here. This resource will provide insights into the potential benefits and drawbacks of such an annuity.

Summary

As we conclude our exploration of Calculating Annuity Method 2024, it becomes clear that annuities offer a powerful tool for retirement planning. By understanding the nuances of annuity calculations and considering the various factors that influence their value, individuals can make informed decisions that align with their financial objectives.

Remember, the key to maximizing your retirement income lies in careful planning, diversification, and seeking professional advice when needed.

Detailed FAQs

What are the tax implications of annuities?

The tax treatment of annuities depends on the specific type of annuity and how it is structured. Some annuities may offer tax-deferred growth, while others may be subject to ordinary income tax on distributions. It’s essential to consult with a tax professional to understand the tax implications of your chosen annuity.

How do I choose the right annuity for my needs?

The best annuity for you depends on your individual circumstances, financial goals, and risk tolerance. Consider factors like your age, income, investment horizon, and desired level of guaranteed income when making your selection.

What are the risks associated with annuities?

Annuities can involve certain risks, such as market volatility, surrender charges, and inflation. It’s crucial to understand these risks before investing in an annuity and to carefully evaluate the terms and conditions of the contract.