Calculating Monthly Annuity 2024 is a crucial aspect of financial planning, particularly for individuals seeking to secure their future. Annuities, essentially a series of regular payments, are commonly used for retirement planning, loan repayment, and investment strategies. This guide provides a comprehensive overview of annuity calculations, covering key concepts, factors influencing payments, and practical applications.

If you’re looking to calculate the cash flows of an annuity in Excel 2024, you can find helpful information on Calculating Annuity Cash Flows Excel 2024. This resource will guide you through the process of calculating these flows, which are crucial for understanding the financial implications of an annuity.

Understanding the fundamentals of annuities, including the distinction between ordinary annuities and annuities due, is essential for making informed financial decisions. This guide explores the key variables that impact annuity payments, such as interest rates, time periods, and the type of annuity.

Financial calculators can be valuable tools for analyzing and comparing annuity options. You can find information on using financial calculators to evaluate annuities in 2024 on Financial Calculator Annuity 2024. This guide can help you leverage these calculators for making informed decisions.

It also delves into the formulas used for calculating monthly annuity payments, providing clear explanations and practical examples to illustrate their application.

Annuity contracts can be complex, and it’s important to understand their relationship with retirement plans. You can find information on whether an annuity qualifies as a retirement plan in 2024 on Is An Annuity A Qualified Retirement Plan 2024.

This resource can help you understand the tax implications and other considerations.

Contents List

Understanding Annuities

An annuity is a series of equal payments made over a specified period of time. It’s a financial instrument that provides a steady stream of income, making it a popular choice for retirement planning, loan repayment, and investment strategies. Annuities can be structured in various ways, but the fundamental concept remains the same: regular payments for a set duration.

The term “X Share Annuity” might sound unfamiliar, but it refers to a specific type of annuity where the payout is tied to the performance of a particular asset or index. You can find out more about this unique annuity and its implications in 2024 by visiting X Share Annuity 2024.

Types of Annuities, Calculating Monthly Annuity 2024

- Ordinary Annuities:Payments are made at the end of each period. This is the most common type of annuity.

- Annuities Due:Payments are made at the beginning of each period. This type of annuity typically results in a higher future value due to the earlier payment timing.

Purpose of Calculating Monthly Annuities

Calculating monthly annuities is essential for various financial planning purposes, including:

- Retirement Planning:Determining how much income an annuity can provide during retirement.

- Loan Repayment:Calculating the monthly payments required to repay a loan over a specific period.

- Investment Strategies:Understanding the future value of an annuity investment and its potential returns.

Factors Affecting Annuity Calculations: Calculating Monthly Annuity 2024

Several factors influence the monthly annuity payment amount. Understanding these factors is crucial for making informed financial decisions.

The terms “annuity” and “pension” are often used interchangeably, but there are key differences. You can find a clear explanation of the distinctions between these retirement income options in 2024 on Is Annuity Same As Pension 2024.

Key Variables

- Present Value (PV):The initial lump sum invested or borrowed.

- Interest Rate (r):The annual rate of return or cost of borrowing.

- Number of Periods (n):The total number of payment periods (e.g., months, years).

- Payment Amount (PMT):The regular payment made each period.

Impact of Interest Rates

Higher interest rates generally lead to larger monthly annuity payments. This is because the interest earned or paid on the principal grows faster, requiring larger payments to cover the accumulated interest.

Annuities can be structured in various ways, including as a series of payments. To understand the concept of an annuity series in 2024, you can visit Annuity Is Series 2024. This resource will provide insights into the characteristics and applications of annuity series.

Relationship Between Time Period and Annuity Payments

The longer the time period, the smaller the monthly annuity payment. This is because the payments are spread out over a longer duration, reducing the burden on each individual payment.

Multiple-choice questions (MCQs) are often used to test understanding of financial concepts, including annuities. You can find a collection of MCQs related to annuities in 2024 on Annuity Is Mcq 2024. This resource can help you assess your knowledge and prepare for exams or assessments.

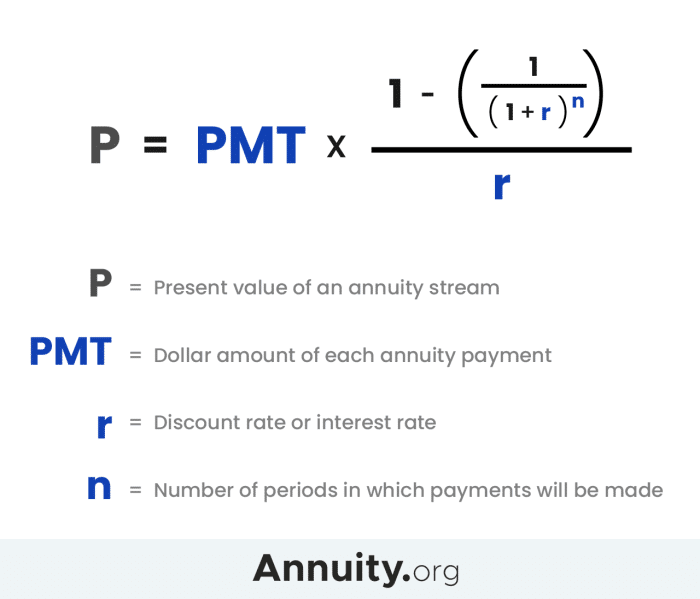

Annuity Calculation Formulas

The formula for calculating monthly annuity payments is:

PMT = PV

When dealing with annuities, you might need to calculate the lump sum value, especially if you’re considering selling or transferring your annuity. A guide on Calculate Annuity Lump Sum 2024 can help you determine the current value of your annuity, which can be useful for making informed financial decisions.

- (r / (1

- (1 + r)^-n))

Where:

- PMTis the monthly payment amount.

- PVis the present value (initial investment or loan amount).

- ris the interest rate per period (annual rate divided by the number of periods per year).

- nis the total number of payment periods.

Examples

Let’s consider a few examples to illustrate how to apply the formula:

- Example 1:Calculating the monthly payment for a $100,000 loan with a 5% annual interest rate over 30 years. In this case, PV = $100,000, r = 0.05/12 (monthly interest rate), and n = 30 – 12 (total number of months).

An annuity is a financial product that provides a stream of payments for a specific period. To understand the basics of annuities in 2024, you can refer to the comprehensive guide available at An Annuity Is 2024. This resource covers various types of annuities and their characteristics.

Plugging these values into the formula, we get a monthly payment of approximately $536.82.

- Example 2:Determining the monthly income from a $500,000 annuity with a 4% annual interest rate for 20 years. Here, PV = $500,000, r = 0.04/12, and n = 20 – 12. The calculated monthly payment would be approximately $2,954.86.

Practical Applications of Annuity Calculations

Annuity calculations have numerous practical applications in personal finance and business.

The formula used to calculate the present value of an annuity can vary depending on the type of annuity. You can find information on the specific formula used to calculate the present value of an annuity in 2024 on Annuity Is Given By 2024.

This resource can help you understand the underlying mathematical principles.

Impact of Interest Rates on Monthly Payments

| Interest Rate (%) | Monthly Payment ($) |

|---|---|

| 2 | $4,153.03 |

| 3 | $4,774.15 |

| 4 | $5,440.02 |

| 5 | $6,158.78 |

This table illustrates how monthly payments increase as interest rates rise, assuming a constant present value and time period.

Annuity payments often involve compound interest, where interest is earned on both the principal and accumulated interest. You can find information on whether annuities involve compound interest in 2024 on Is Annuity Compound Interest 2024. This resource can help you understand how compound interest affects your annuity returns.

Impact of Time Period on Monthly Payments

| Time Period (Years) | Monthly Payment ($) |

|---|---|

| 10 | $8,775.71 |

| 15 | $6,284.69 |

| 20 | $5,040.63 |

| 25 | $4,324.36 |

This table demonstrates how monthly payments decrease as the time period extends, assuming a constant present value and interest rate.

Real-World Applications

- Retirement Planning:Annuities can provide a steady stream of income during retirement, helping individuals maintain their lifestyle.

- Loan Repayment:Annuity calculations are used to determine the monthly payments required to repay loans, such as mortgages and student loans.

- Investment Strategies:Annuities can be used as a tool for long-term investment growth, providing regular payments and potential capital appreciation.

Considerations for Annuity Calculations in 2024

The current economic landscape and regulatory changes may influence annuity calculations in 2024. It’s crucial to consider these factors when making financial decisions.

Excel is a powerful tool for managing and analyzing financial data, including annuities. You can learn how to use Excel for annuity calculations in 2024 by visiting Annuity Is Excel 2024. This resource provides practical examples and insights on using Excel for annuity calculations.

Economic Trends and Regulatory Changes

Factors such as interest rate fluctuations, inflation, and changes in tax laws can impact annuity calculations. For example, rising interest rates may lead to higher monthly payments, while inflation can erode the purchasing power of annuity payments over time.

Impact of Inflation

Inflation can significantly impact the real value of annuity payments. As prices rise, the purchasing power of fixed annuity payments decreases. It’s essential to consider inflation when planning for retirement or other long-term financial goals.

Current Market Conditions

Market conditions, such as stock market volatility and economic growth, can influence annuity investment strategies and returns. It’s advisable to consult with a financial advisor to understand the current market environment and its implications for annuity calculations.

Tax implications are a crucial aspect of annuities, especially when withdrawing funds. You can find a handy tool to calculate the potential tax liability on your annuity withdrawals in 2024 on Annuity Withdrawal Tax Calculator 2024. This calculator can help you plan for tax obligations and make informed financial decisions.

Closing Summary

By understanding the principles of annuity calculations, individuals can make informed decisions about their financial future. This guide provides valuable insights into the factors influencing annuity payments and the practical applications of these calculations. Whether you are planning for retirement, managing debt, or exploring investment opportunities, understanding annuities is crucial for achieving your financial goals.

Understanding the interest earned on an annuity is essential, especially when considering the various options available. You can explore the intricacies of calculating annuity interest in 2024 with the help of the guide available at Calculating Annuity Interest 2024.

This resource can shed light on how interest rates and other factors influence your returns.

With this knowledge, you can confidently navigate the complexities of annuity calculations and make sound financial decisions for a secure future.

Key Questions Answered

What are the main types of annuities?

The two primary types are fixed annuities and variable annuities. Fixed annuities provide a guaranteed rate of return, while variable annuities offer returns that fluctuate based on market performance.

How does inflation affect annuity payments?

Inflation can erode the purchasing power of annuity payments over time. To mitigate this, some annuities offer inflation protection, adjusting payments upwards to keep pace with rising prices.

What are some common annuity scams to be aware of?

Beware of high-pressure sales tactics, promises of unrealistic returns, and lack of transparency in fees and charges. Always research thoroughly before investing in any annuity product.

The return on an annuity can vary depending on the type of annuity and the underlying investment strategy. You can explore the potential returns of different annuity options in 2024 by visiting 7 Annuity Return 2024. This resource can help you compare and contrast different annuity products.