Calculating Monthly Annuity Payments 2024 takes center stage as we delve into the world of financial planning. Annuities, a powerful tool for securing your financial future, offer a steady stream of income, making them an attractive option for retirement planning, income generation, and even estate planning.

This guide will equip you with the knowledge to understand the fundamentals of annuities, master the art of calculating monthly payments, and make informed decisions that align with your financial goals.

Reversionary annuities offer a unique benefit to beneficiaries, providing a stream of income after the original annuitant passes away. For a comprehensive understanding of this type of annuity, check out Annuity Is Reversionary 2024 for detailed information.

We will explore the different types of annuities available, break down the formula used to calculate monthly payments, and analyze the factors that influence these payments. Through practical examples, we’ll illustrate how variations in interest rates, time periods, and principal amounts impact the final monthly payment.

We’ll also discuss the importance of considering inflation and taxes in your annuity calculations.

Contents List

Understanding Annuities

Annuities are financial products that provide a stream of regular payments over a specified period. They are often used in retirement planning, income generation, and estate planning to ensure a steady flow of funds for a certain duration.

Calculating an annuity involves several factors, including the initial investment, interest rate, and payment period. For a step-by-step guide on how to calculate an annuity, Calculating A Annuity 2024 provides practical instructions and examples.

Types of Annuities

Annuities can be classified into different types based on the payment structure and investment features. Here are some common types:

- Fixed Annuities:These annuities offer a guaranteed rate of return and a fixed stream of payments. They are suitable for individuals seeking stability and predictability in their income stream.

- Variable Annuities:These annuities invest in a variety of assets, such as stocks or bonds, and the payment amount fluctuates based on the performance of the underlying investments. They offer the potential for higher returns but also carry greater risk.

- Immediate Annuities:Payments begin immediately after the purchase of the annuity. They are often used for immediate income needs, such as covering living expenses or paying off debt.

- Deferred Annuities:Payments start at a future date, allowing the annuity to grow tax-deferred until payments begin. They are often used for retirement planning, as they provide a way to accumulate funds over time.

Examples of Annuity Use

- Retirement Planning:Annuities can provide a steady income stream during retirement, supplementing other sources of income such as Social Security or savings.

- Income Generation:Annuities can be used to generate a regular income stream for individuals who need additional income, such as those who have retired early or have experienced a job loss.

- Estate Planning:Annuities can be used to provide a stream of income for beneficiaries after the death of the annuitant, ensuring financial support for loved ones.

Annuity Payment Calculation Formula

The formula for calculating monthly annuity payments is as follows:

PMT = (PV

- r) / (1

- (1 + r)^-n)

Where:

- PMT: Monthly annuity payment

- PV: Principal amount (present value)

- r: Interest rate per period (monthly in this case)

- n: Total number of payment periods

For example, if you have a principal amount of $100,000, an annual interest rate of 5%, and a time period of 10 years, the monthly annuity payment would be calculated as follows:

PMT = ($100,000

Understanding how an annuity is calculated can be a bit complex, but it’s essential for making informed decisions about your retirement planning. You can find a detailed guide on How Annuity Is Calculated 2024 that breaks down the process and factors involved.

- 0.05/12) / (1

- (1 + 0.05/12)^-120) = $1,060.66

The compounding frequency also affects annuity payments. If the interest is compounded more frequently than monthly, the annuity payment will be slightly higher. For example, if the interest is compounded quarterly, the payment will be slightly higher than if it is compounded monthly.

An annuity is essentially a contract that provides a guaranteed stream of payments for a specific period. For a concise definition and explanation, Annuity Is Defined As 2024 provides a clear overview.

Factors Affecting Annuity Payments

Several factors influence the monthly annuity payments. These include:

Interest Rates

The interest rate directly impacts annuity payments. A higher interest rate results in larger annuity payments. This is because the investment earns more interest, allowing for larger payments to be made.

Length of the Annuity Period

The length of the annuity period also affects the payment amount. A longer annuity period will result in smaller monthly payments. This is because the payments are spread out over a longer time, reducing the amount of each individual payment.

Initial Principal Amount, Calculating Monthly Annuity Payments 2024

The initial principal amount is a significant factor determining the annuity payment. A larger principal amount leads to higher annuity payments. This is because the investment has a larger base to earn interest on, resulting in greater returns.

For those who prefer Hindi, Annuity Meaning In Hindi 2024 provides a clear and concise explanation of what an annuity is in the Hindi language.

Annuity Payment Calculation Examples

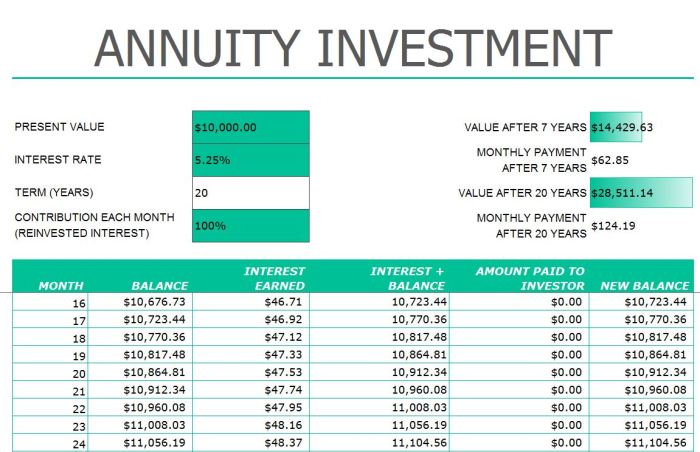

The following table shows examples of annuity payment calculations using different scenarios:

| Principal Amount | Interest Rate | Time Period | Monthly Payment |

|---|---|---|---|

| $100,000 | 5% | 10 years | $1,060.66 |

| $200,000 | 4% | 20 years | $1,199.10 |

| $500,000 | 3% | 30 years | $2,201.29 |

| $1,000,000 | 2% | 40 years | $4,429.36 |

As you can see, the monthly annuity payment varies depending on the principal amount, interest rate, and time period. For example, a higher principal amount leads to larger payments, while a longer time period results in smaller payments.

Receiving a monthly annuity payment of $10,000 might seem like a dream come true. To learn more about the possibilities and how to achieve this, explore Annuity 10000 Per Month 2024 for insights on planning and strategies.

Annuity Payment Calculation Tools and Resources: Calculating Monthly Annuity Payments 2024

Several online calculators and financial software programs can help calculate annuity payments. These tools can simplify the calculation process and provide accurate results.

Calculating the number of periods for an annuity can be a helpful tool for planning and forecasting. For a practical calculator and explanations, check out Annuity Number Of Periods Calculator 2024 to streamline your calculations.

Online Calculators

Many websites offer free online annuity calculators. These calculators typically require you to input the principal amount, interest rate, and time period, and then they calculate the monthly annuity payment. Some online calculators also allow you to adjust the compounding frequency and other factors.

An annuity is essentially a financial product that provides a guaranteed stream of income for a set period. If you’re looking for a simple explanation, Annuity Meaning In English 2024 offers a clear and concise definition.

Financial Software

Financial software programs, such as Microsoft Excel or personal finance software, can also calculate annuity payments. These programs offer more advanced features, such as the ability to create amortization schedules and perform complex financial analysis.

Choosing the right annuity issuer is crucial to ensure you’re working with a reputable and reliable provider. Learn about different issuers and their offerings by visiting Annuity Issuer 2024 for a detailed overview.

When choosing an annuity payment calculation tool, consider your specific needs and preferences. If you only need a simple calculation, an online calculator may suffice. However, if you require more advanced features or want to perform more complex financial analysis, financial software may be a better option.

Considerations for Annuity Payments

When calculating annuity payments, it’s crucial to consider inflation and taxes. Inflation can erode the purchasing power of your annuity payments over time, while taxes can reduce the amount you receive. It’s also important to understand the potential risks and benefits associated with annuities.

If you have questions about annuities, you’re not alone! There are numerous resources available to help you find answers. For a comprehensive Q&A guide, visit Annuity Questions And Answers 2024 for clear and helpful information.

Inflation

Inflation can reduce the real value of your annuity payments over time. For example, if your annuity pays you $1,000 per month and inflation is 3% per year, your $1,000 will only have the purchasing power of $970 in one year.

The Internal Rate of Return (IRR) is a key metric for evaluating the profitability of an annuity. To learn how to calculate the IRR for an annuity, Irr Calculator Annuity 2024 offers a comprehensive guide and online tool.

To mitigate the impact of inflation, consider investing in annuities that offer inflation protection.

If you’re comfortable working with spreadsheets, using Excel can be a great way to manage your annuity calculations. There are resources available to help you get started, such as Annuity Is Excel 2024 , which offers practical tips and examples.

Taxes

Annuities are generally subject to taxes. The interest earned on an annuity is typically taxed as ordinary income. It’s essential to understand the tax implications of annuities before investing in them.

There are different types of annuities available, each with its own features and benefits. To explore a variety of annuity options, visit 7 Annuities 2024 for a detailed overview of popular types.

Risks and Benefits

Annuities offer both risks and benefits. One of the main risks associated with annuities is the potential for investment losses. Variable annuities, for example, are subject to market fluctuations, which could lead to a decrease in the value of your investment.

However, annuities also offer several benefits, such as guaranteed income payments, tax deferral, and protection from market volatility.

Tax implications are an important factor to consider when dealing with annuities. To understand the taxability of annuity income, Is Annuity Income Taxable 2024 provides valuable insights on this topic.

When choosing an annuity, it’s essential to consider your individual financial goals and risk tolerance. If you are risk-averse and need a guaranteed income stream, a fixed annuity may be a good option. However, if you are willing to take on more risk for the potential of higher returns, a variable annuity may be more suitable.

Inheriting an annuity can bring both opportunities and challenges. To understand the implications and how to manage inherited annuities, explore What Happens When I Inherit An Annuity 2024 for guidance and insights.

Wrap-Up

By understanding the nuances of annuity payments, you can navigate the complexities of financial planning with confidence. Whether you are aiming to secure a comfortable retirement, supplement your income, or plan for your legacy, annuities offer a valuable tool. With the knowledge gained from this guide, you can make informed decisions about annuities and choose the option that best suits your individual needs and financial aspirations.

Remember, the key to a successful financial future lies in understanding the intricacies of financial instruments and making informed decisions that align with your goals.

Essential FAQs

How do I choose the right annuity for my needs?

The best annuity for you depends on your individual financial goals, risk tolerance, and time horizon. It’s essential to consult with a financial advisor to determine the most suitable annuity for your specific circumstances.

What are the potential risks associated with annuities?

Annuities, like any financial instrument, carry inherent risks. These include the risk of losing principal, interest rate risk, and the possibility of outliving your annuity payments. It’s crucial to understand these risks before investing in an annuity.

What are the tax implications of annuity payments?

The tax implications of annuity payments vary depending on the type of annuity and the specific terms of the contract. It’s important to consult with a tax advisor to understand the tax implications of your annuity payments.