Calculator.Net Annuity Payout 2024 provides a comprehensive tool for understanding and calculating your potential annuity payouts. Whether you’re planning for retirement or simply curious about how annuities work, this calculator offers valuable insights into your financial future.

Annuity payments are a form of income, but their tax implications can vary depending on your location and specific annuity type. You can find a comprehensive discussion on the taxability of annuity income in our article, Annuity Is Income 2024 , providing clarity on how annuity income is treated for tax purposes.

An annuity is a financial product that provides a stream of regular payments over a set period. Calculator.Net’s tool allows you to input various factors, such as your age, investment amount, and desired payout frequency, to generate personalized estimates of your potential annuity income.

Winning the lottery is exciting, but it’s crucial to understand how annuity payments work. Our article, Calculating Lottery Annuity Payments 2024 , will guide you through the process of calculating lottery annuity payments, helping you make informed decisions about your winnings.

This information can help you make informed decisions about your retirement savings and income planning.

Annuity is a financial product, and like any investment, it comes with risks. It’s natural to wonder about the safety of annuities. You can find a detailed discussion on the safety of annuities in our article, Is Annuity Safe 2024 , addressing common concerns and providing insights into factors that contribute to annuity safety.

Contents List

- 1 Calculator.Net Annuity Payout Overview

- 2 Annuity Payout Calculation Factors

- 3 Types of Annuities and Payout Options

- 4 Annuity Payout Considerations

- 5 Practical Applications and Use Cases

- 6 Alternative Annuity Calculators and Resources: Calculator.Net Annuity Payout 2024

- 7 Final Summary

- 8 Answers to Common Questions

Calculator.Net Annuity Payout Overview

An annuity payout is a stream of regular payments made to an individual over a predetermined period, typically for a fixed amount or based on a specific formula. These payments are usually derived from a lump-sum investment made earlier, with the purpose of providing a steady income stream during retirement or other life stages.

Annuity rates can vary, and a 7% rate can be attractive. You can find detailed information about 7% annuities in our article, Annuity 7 Percent 2024 , including factors influencing these rates and potential benefits of choosing a 7% annuity.

Calculator.Net’s annuity payout calculator is a user-friendly online tool designed to help individuals estimate their potential annuity payout based on various factors, such as the initial investment amount, interest rate, and payout duration. This calculator simplifies the process of understanding how an annuity works and its potential financial implications.

In India, the taxability of annuity income is subject to specific regulations. Our article, Is Annuity Taxable In India 2024 , provides a clear understanding of the tax implications of annuities in India, helping you navigate the tax landscape.

Key Features and Functionalities

- Investment Amount Input:The calculator allows users to input the initial investment amount that will be used to fund the annuity.

- Interest Rate Selection:Users can specify the expected interest rate that the investment will earn over time. This rate is crucial in determining the overall payout amount.

- Payout Period Customization:The calculator enables users to choose the desired payout period, whether it’s a fixed number of years, a lifetime, or a specific age range.

- Payout Frequency Options:Users can select the frequency of annuity payments, including monthly, quarterly, semi-annually, or annually.

- Detailed Payout Projections:The calculator provides a comprehensive breakdown of the projected annuity payouts, including the total amount received over the chosen payout period.

Annuity Payout Calculation Factors

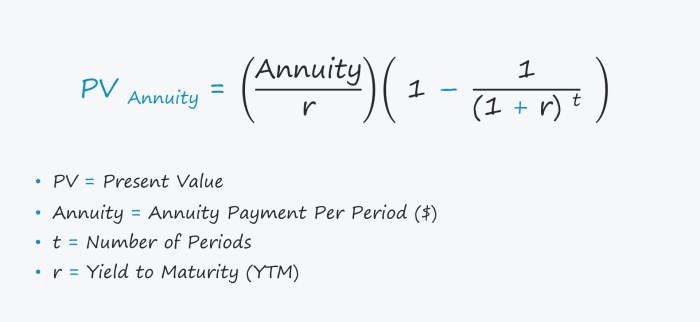

The calculation of an annuity payout involves several key variables that significantly impact the final amount received. Understanding these variables is crucial for making informed decisions about annuity investments.

Annuity is a life insurance product that provides a stream of income, often for a specific period or for life. It’s a valuable tool for retirement planning, but it’s essential to understand its nuances. You can find detailed information about annuities, including their benefits and risks, in our article, Annuity Is A Life Insurance Product That 2024.

Main Variables

- Initial Investment Amount:The larger the initial investment, the higher the potential payout amount. This is a fundamental principle of financial growth.

- Interest Rate:A higher interest rate generally results in a larger annuity payout, as the investment grows faster over time. However, interest rates can fluctuate, impacting the final payout.

- Payout Period:The duration of the annuity payout period directly affects the total amount received. A longer payout period allows for more frequent payments but may also result in smaller individual payments.

- Payout Frequency:More frequent payouts, such as monthly payments, generally lead to a smaller individual payment amount compared to less frequent payouts, such as annual payments. However, frequent payments can provide greater cash flow stability.

Impact of Variables on Payout

The relationship between these variables and the final payout amount is complex. For instance, a higher interest rate can offset the impact of a shorter payout period, leading to a larger total payout. Conversely, a lower interest rate might require a longer payout period to achieve a similar total payout.

Annuity payments are often a source of income, but it’s essential to understand the tax implications. Our article, Is Annuity Income 2024 , explores the taxability of annuity income, providing valuable insights into how annuity income is treated for tax purposes.

The calculator allows users to experiment with different input values to understand these relationships and make informed decisions.

A perpetual annuity, as the name suggests, provides payments that continue indefinitely. While this might sound ideal, it’s important to understand the intricacies of perpetual annuities. You can find a comprehensive explanation of perpetual annuities, including their advantages and disadvantages, in our article, Annuity Is Perpetual 2024.

Examples

- Scenario 1:A $100,000 investment earning 5% interest annually for 20 years, with monthly payouts, will generate a significantly higher total payout than a $50,000 investment earning 3% interest annually for 10 years, with annual payouts.

- Scenario 2:A $200,000 investment earning 4% interest annually for 15 years, with quarterly payouts, will result in a larger total payout than a $200,000 investment earning 4% interest annually for 10 years, with semi-annual payouts.

Types of Annuities and Payout Options

Annuities come in various forms, each with unique characteristics and payout options. Understanding these differences is essential for selecting the most suitable annuity for individual needs and financial goals.

Annuity options can be overwhelming, but we’ve narrowed it down to five popular types. You can explore the characteristics of each type in our article, 5 Annuity 2024 , to find the one that best suits your financial goals.

Whether you’re looking for guaranteed income or potential for growth, this article provides valuable insights into the different types of annuities available.

Types of Annuities

- Fixed Annuities:These annuities provide guaranteed, fixed payments for a predetermined period. They offer stability and predictability, making them suitable for individuals seeking a reliable income stream.

- Variable Annuities:These annuities offer payments that fluctuate based on the performance of underlying investments. They potentially provide higher returns but also carry greater risk. Variable annuities are suitable for individuals with a higher risk tolerance and longer investment horizons.

- Indexed Annuities:These annuities link their payments to the performance of a specific market index, such as the S&P 500. They offer potential growth while providing some downside protection. Indexed annuities are a good option for individuals seeking a balance between growth and security.

Annuity is a popular financial product, but is it the right choice for you? Before making any decisions, it’s important to consider your financial goals and circumstances. Our article, Is Annuity Right For Me 2024 , provides a comprehensive overview of the pros and cons of annuities, helping you determine if this financial product aligns with your individual needs.

Payout Options, Calculator.Net Annuity Payout 2024

- Lump Sum:In this option, the entire annuity value is paid out as a single lump sum payment. This is suitable for individuals with short-term financial needs or who prefer to manage their funds independently.

- Fixed Payments:This option provides regular, predetermined payments for a specific period, either for a fixed number of years or for life. Fixed payments offer stability and predictable cash flow.

- Variable Payments:These payments fluctuate based on the performance of underlying investments. Variable payments offer the potential for higher returns but also come with greater risk.

Advantages and Disadvantages

| Type | Advantages | Disadvantages |

|---|---|---|

| Fixed Annuities | Guaranteed payments, predictable income stream, suitable for risk-averse individuals | Lower potential returns compared to variable annuities, payments may not keep pace with inflation |

| Variable Annuities | Potential for higher returns, growth potential linked to market performance | Higher risk, payments can fluctuate, potential for losses |

| Indexed Annuities | Potential for growth linked to market index, downside protection, balance between growth and security | Returns may be limited by index performance, may not offer the same level of growth as variable annuities |

Annuity Payout Considerations

Before investing in an annuity, it’s crucial to consider several factors to ensure it aligns with individual financial goals and circumstances. These considerations help maximize potential benefits and minimize potential risks.

If you’re looking to make calculations on an annuity loan in Excel, you’re in the right place. There are various ways to calculate annuity loans using Excel, and you can find a detailed guide on how to do it in our article, Calculate Annuity Loan Excel 2024.

This guide will walk you through the steps of calculating annuity loans in Excel and provide you with a clear understanding of the process.

Factors to Consider

- Financial Goals:Define specific financial objectives, such as retirement income, income for a specific period, or estate planning. This helps determine the type of annuity and payout option that best fits your needs.

- Risk Tolerance:Assess your comfort level with investment risk. Fixed annuities offer greater stability, while variable annuities carry higher potential returns but also greater risk.

- Time Horizon:Consider how long you need the annuity income stream. A longer time horizon allows for greater potential growth but also exposes you to market fluctuations for a longer period.

- Tax Implications:Understand the tax implications of annuity payouts. Some annuities offer tax-deferred growth, while others may be subject to taxes on the payouts.

Maximizing Annuity Payout Potential

- Invest Early:Starting an annuity early allows for compounding interest to work its magic over a longer period, leading to a larger total payout.

- Choose a Higher Interest Rate:Opt for an annuity with a higher interest rate to maximize potential returns. However, consider the associated risks and make sure the interest rate is sustainable.

- Consider a Longer Payout Period:A longer payout period allows for more frequent payments and potentially higher total payouts, especially if the interest rate is favorable.

Potential Risks and Limitations

- Interest Rate Risk:Interest rates can fluctuate, potentially impacting the payout amount. This risk is more pronounced with variable annuities.

- Market Risk:Variable annuities are subject to market risk, meaning the value of the underlying investments can decline, impacting payout amounts.

- Liquidity Risk:Annuities are typically illiquid, meaning it can be difficult to access the funds before the payout period begins. This can pose a challenge if unexpected financial needs arise.

Practical Applications and Use Cases

Calculator.Net’s annuity payout tool is valuable for various financial planning scenarios, providing insights into potential income streams and helping individuals make informed decisions.

Annuity rates fluctuate depending on various factors, including the duration of the contract. If you’re looking for a 3-year annuity, you might be interested in knowing the current rates. Our article, Annuity 3 Year Rates 2024 , provides an overview of the latest 3-year annuity rates and offers valuable insights into factors influencing these rates.

Real-World Scenarios

- Retirement Planning:Individuals can use the calculator to estimate their potential retirement income based on their savings, expected interest rates, and desired payout period. This helps them plan for a comfortable retirement and adjust their savings goals accordingly.

- Estate Planning:The calculator can assist in determining the potential inheritance amount for beneficiaries based on an annuity investment. This allows for better planning and distribution of assets.

- Long-Term Care Planning:Individuals can use the calculator to estimate the potential income stream from an annuity to cover long-term care expenses. This helps them assess the feasibility of using an annuity as a source of funding for long-term care needs.

Use Cases with Input Variables and Outputs

| Use Case | Input Variables | Expected Outputs |

|---|---|---|

| Retirement Income Planning | Initial Investment: $500,000, Interest Rate: 4%, Payout Period: 20 years, Payout Frequency: Monthly | Projected Monthly Payout: $3,000, Total Payout: $720,000 |

| Estate Planning | Initial Investment: $1,000,000, Interest Rate: 3%, Payout Period: 10 years, Payout Frequency: Annual | Projected Annual Payout: $110,000, Total Payout: $1,100,000 |

| Long-Term Care Planning | Initial Investment: $250,000, Interest Rate: 2.5%, Payout Period: 5 years, Payout Frequency: Quarterly | Projected Quarterly Payout: $7,000, Total Payout: $140,000 |

Alternative Annuity Calculators and Resources: Calculator.Net Annuity Payout 2024

While Calculator.Net’s annuity payout tool is a valuable resource, other reputable calculators and resources provide additional information and insights into annuities and retirement planning.

If you’re interested in learning more about annuities in Hindi, you can visit our article, Annuity Ka Hindi Meaning 2024. This article provides a comprehensive explanation of annuities in Hindi, covering key concepts and definitions.

Alternative Calculators and Resources

| Resource | Description | Link |

|---|---|---|

| Bankrate Annuity Calculator | A comprehensive annuity calculator that allows users to compare different annuity types and payout options. | [Link to Bankrate Annuity Calculator] |

| Investopedia Annuity Calculator | A user-friendly calculator that provides estimates of annuity payouts and helps users understand the key factors involved. | [Link to Investopedia Annuity Calculator] |

| AARP Annuity Guide | A comprehensive guide to annuities, covering different types, payout options, and factors to consider. | [Link to AARP Annuity Guide] |

| FINRA Investor Education | A website with educational resources on annuities, including articles, videos, and interactive tools. | [Link to FINRA Investor Education] |

Final Summary

Calculator.Net Annuity Payout 2024 is a valuable resource for anyone seeking to understand and plan for their retirement income. By utilizing this calculator and exploring the various annuity options available, you can gain a clearer picture of your financial future and make informed decisions that align with your individual needs and goals.

Answers to Common Questions

Is Calculator.Net Annuity Payout 2024 free to use?

Yes, Calculator.Net Annuity Payout 2024 is a free online tool.

What types of annuities can I calculate with this tool?

Calculator.Net Annuity Payout 2024 allows you to calculate payouts for various types of annuities, including fixed, variable, and indexed annuities.

How accurate are the results provided by the calculator?

The calculator provides estimates based on the input data you provide. It’s important to remember that actual annuity payouts may vary depending on market conditions and other factors.

Where can I find more information about annuities?

You can find additional information about annuities on the Calculator.Net website, as well as through reputable financial institutions and retirement planning resources.

Annuity options can be tailored to your financial goals, and a 2 million annuity can be a significant financial instrument. You can find information about 2 million annuities in our article, Annuity 2 Million 2024 , exploring the advantages and considerations of choosing such a large annuity.

Excel is a powerful tool for financial calculations, and you can use it to analyze annuities. Our article, Annuity Is Excel 2024 , provides a detailed guide on how to use Excel for annuity calculations, helping you make informed financial decisions.