Annuity Calculator Nsdl 2024 is a powerful tool that can help you plan for your financial future, particularly in retirement. It takes into account various factors like your age, investment amount, and expected interest rates to provide personalized estimates of your future annuity payments.

This calculator is particularly relevant for those seeking to utilize NSDL (National Securities Depository Limited) for their annuity transactions in India.

Annuity plans are a popular way to secure your financial future, and understanding the basics is crucial. You can find a comprehensive overview of annuities, including their various types and benefits, in our article on Annuity General 2024.

If you’re curious about how annuities are calculated, especially for half-yearly payments, be sure to check out our guide on Annuity Formula Half Yearly 2024.

The concept of annuities is simple: you invest a lump sum, and in return, you receive regular payments for a predetermined period. This can be a valuable way to ensure a steady stream of income during retirement, especially for those concerned about outliving their savings.

However, choosing the right annuity type and understanding its nuances is crucial. This guide will delve into the features and benefits of using an annuity calculator, as well as important considerations for making informed investment decisions.

For those seeking a higher monthly annuity payment, our article on Annuity 10000 Per Month 2024 can provide insights. Understanding annuities is crucial for making informed financial decisions. We hope this information has been helpful in your journey towards financial security.

Contents List

Understanding Annuities

An annuity is a financial product that provides a stream of regular payments for a specific period of time. It’s essentially a contract between you and an insurance company, where you make a lump-sum payment or a series of payments, and the insurance company guarantees you a stream of income in return.

Annuities can be a valuable tool for retirement planning, income generation, and protecting your savings.

Types of Annuities

Annuities come in various forms, each with its own features and benefits. Here are some common types:

- Fixed Annuities:These annuities offer a guaranteed fixed interest rate, ensuring predictable payments. They are ideal for individuals seeking stability and guaranteed income.

- Variable Annuities:The payments from variable annuities are linked to the performance of underlying investments, such as stocks or bonds. These annuities offer the potential for higher returns but also come with higher risk.

- Indexed Annuities:Indexed annuities link their returns to the performance of a specific index, such as the S&P 500. They offer the potential for growth while providing some protection against market downturns.

Advantages and Disadvantages of Annuities

Investing in an annuity has its advantages and disadvantages, which you should carefully consider before making a decision.

Annuity payments can provide a steady stream of income during retirement. If you’re looking for an annuity that pays out $2,000 per month, our article on Annuity 2000 Per Month 2024 can help you explore your options. Annuity payments can continue for an indefinite duration, as explained in our article on Annuity Is Indefinite Duration 2024.

- Advantages:

- Guaranteed Income:Fixed annuities provide guaranteed income for life, offering peace of mind and financial security.

- Tax Advantages:Annuity payments are generally taxed as ordinary income, but the growth of the annuity may be tax-deferred until you start receiving payments.

- Protection Against Market Volatility:Annuities can offer some protection against market fluctuations, especially fixed annuities.

- Disadvantages:

- Limited Liquidity:Accessing your annuity funds before the payout period may incur penalties or fees.

- Potential for Lower Returns:Fixed annuities may offer lower returns compared to other investments.

- Risk of Insurance Company Failure:While annuities are generally considered safe, there is a risk that the insurance company issuing the annuity may fail.

NSDL and Annuity Transactions: Annuity Calculator Nsdl 2024

The National Securities Depository Limited (NSDL) plays a crucial role in the Indian financial market, facilitating the electronic holding and transfer of securities. NSDL also plays a significant role in annuity transactions.

The tax treatment of annuities can vary depending on your location. In India, for example, you’ll want to understand the tax implications of annuity income. Our article on Is Annuity Income Taxable In India 2024 provides valuable insights.

There are different types of annuities, each with its own features and benefits. Our article on Annuity Kinds 2024 provides an overview of the various options available.

NSDL’s Role in Annuity Transactions

NSDL acts as a central depository for annuity transactions, providing a secure and efficient platform for buying, selling, and managing annuities.

- Buying and Selling Annuities:NSDL facilitates the purchase and sale of annuities through its network of depository participants (DPs), which are financial institutions authorized to handle securities transactions.

- Annuity Management:NSDL provides a platform for managing annuity holdings, including tracking payments, updating beneficiary information, and handling other related transactions.

Benefits of Using NSDL for Annuity Transactions

Using NSDL for annuity transactions offers several advantages:

- Security:NSDL’s electronic platform ensures the security of annuity holdings, reducing the risk of loss or theft.

- Transparency:All annuity transactions are recorded and tracked electronically, providing a clear and transparent audit trail.

- Efficiency:NSDL’s streamlined processes make annuity transactions faster and more efficient.

Annuity Calculator Functionality

An annuity calculator is a valuable tool that helps individuals estimate their future annuity payments based on various factors.

It’s important to understand the terms of your annuity contract, especially regarding surrender charges. Our article on My Annuity Is Out Of Surrender 2024 explores this topic. John Hancock is a well-known provider of annuities. Learn more about Annuity John Hancock 2024 in our article.

Purpose and Functionality of an Annuity Calculator

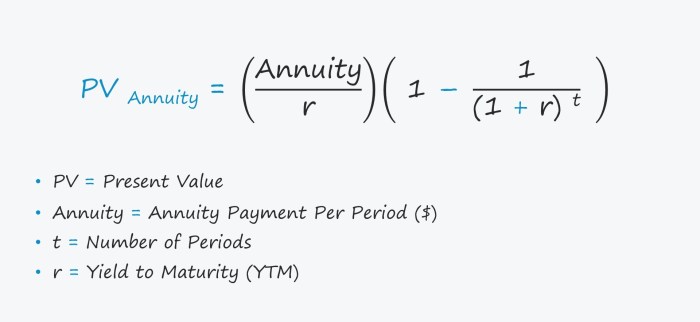

An annuity calculator uses mathematical formulas to calculate the estimated annuity payments you can expect to receive over time. It takes into account several variables, such as:

- Age:Your age at the time you start receiving annuity payments.

- Investment Amount:The initial amount you invest in the annuity.

- Interest Rate:The rate of return on your annuity investment.

- Payment Period:The length of time you will receive annuity payments.

How an Annuity Calculator Helps

An annuity calculator can be helpful for:

- Estimating Retirement Income:It can help you estimate the amount of income you can expect to receive from an annuity during retirement.

- Planning for Financial Goals:You can use the calculator to see how different investment amounts, interest rates, and payment periods affect your future annuity payments.

- Comparing Annuity Options:The calculator can help you compare different annuity products and choose the one that best meets your needs.

Annuity Calculator NSDL 2024: Features and Usage

NSDL offers an annuity calculator specifically designed for Indian investors in 2024. This calculator provides a user-friendly interface and incorporates various features to help individuals plan their annuity investments effectively.

Features of the NSDL Annuity Calculator, Annuity Calculator Nsdl 2024

The NSDL annuity calculator for 2024 is expected to offer features such as:

- Multiple Annuity Types:The calculator will likely support different types of annuities, including fixed, variable, and indexed annuities.

- Customized Calculations:Users can customize the calculator’s inputs to reflect their individual circumstances, such as age, investment amount, and desired payment period.

- Tax Considerations:The calculator may factor in tax implications, helping users estimate their after-tax annuity payments.

- Graphical Representation:The calculator may provide graphical representations of projected annuity payments, making it easier to visualize future income streams.

How to Use the NSDL Annuity Calculator

Using the NSDL annuity calculator is straightforward:

- Access the Calculator:Visit the NSDL website or its dedicated platform to access the annuity calculator.

- Input Your Details:Enter your personal information, such as your age, investment amount, and desired payment period.

- Select Annuity Type:Choose the type of annuity you are interested in, such as fixed, variable, or indexed.

- Review the Results:The calculator will display your estimated annuity payments based on the inputs you provided.

Key Considerations for Annuity Investments

Before investing in an annuity, it is crucial to consider several factors to ensure it aligns with your financial goals and risk tolerance.

Factors to Consider

Here are some key considerations before investing in an annuity:

- Your Financial Goals:Determine whether an annuity aligns with your specific financial goals, such as retirement planning, income generation, or legacy planning.

- Risk Tolerance:Evaluate your risk tolerance. Fixed annuities are less risky but may offer lower returns, while variable annuities offer the potential for higher returns but also come with higher risk.

- Time Horizon:Consider your time horizon for the annuity. If you need access to your funds sooner, you may want to choose an annuity with a shorter payout period.

- Fees and Charges:Understand the fees and charges associated with the annuity, including surrender charges, administrative fees, and mortality charges.

- Insurance Company Reputation:Research the reputation and financial stability of the insurance company issuing the annuity.

Essential Questions to Ask

Before making an annuity investment decision, it is essential to ask yourself the following questions:

- What are my financial goals?

- How much risk am I willing to take?

- What is my time horizon for this investment?

- What are the fees and charges associated with this annuity?

- What is the reputation of the insurance company issuing this annuity?

Seek Professional Advice

Making significant investment decisions, such as investing in an annuity, can be complex. It is highly recommended to seek professional financial advice from a qualified financial advisor who can help you assess your individual circumstances, understand the intricacies of annuity products, and make informed investment decisions.

Calculating the income you’ll receive from an annuity is essential for planning your retirement. Our guide on Calculating Annuity Income 2024 provides you with the tools and information you need. If you’re in the UK, you can use the Annuity Calculator Gov Uk 2024 to get an idea of your potential income.

End of Discussion

Ultimately, the Annuity Calculator Nsdl 2024 empowers you to take control of your financial planning. By understanding how annuities work and utilizing this calculator, you can gain valuable insights into your future income potential. Remember, it’s always wise to consult with a financial advisor before making significant investment decisions, especially when it comes to annuities.

They can provide tailored guidance based on your individual circumstances and financial goals.

When deciding between an annuity and an IRA, it’s important to consider your financial goals and risk tolerance. Our article on Annuity Or Ira 2024 can help you make an informed decision. Fixed annuities are a popular choice for those seeking guaranteed income.

Learn more about 4 Fixed Annuity 2024 in our article.

Essential FAQs

Is the Annuity Calculator Nsdl 2024 free to use?

Yes, the Annuity Calculator Nsdl 2024 is typically free to use. It is often provided as a service by financial institutions or online platforms.

An annuity is a financial product that provides a series of equal periodic payments, as outlined in our article on An Annuity Is A Series Of Equal Periodic Payments 2024. It’s important to understand the tax implications of annuities.

For example, our article on Is Annuity Income Capital Gains 2024 addresses whether annuity income is considered capital gains.

What are the risks associated with annuities?

Annuities carry some risks, such as the potential for lower returns than other investments, and the possibility of losing principal in certain cases. It’s essential to carefully consider these risks before investing in an annuity.

Can I use the Annuity Calculator Nsdl 2024 for other financial goals besides retirement?

While the calculator is primarily designed for retirement planning, it can also be used to estimate payments for other financial goals, such as funding education or a down payment on a house. However, you may need to adjust the variables accordingly.