Calculating Powerball Annuity Payments 2024: Understanding Your Options, you’ll learn how Powerball annuity payments work, how they’re calculated, and the factors that can influence your decision. We’ll delve into the estimated annual interest rate used in 2024, explore the impact of inflation on your winnings, and discuss the tax implications of choosing an annuity.

This comprehensive guide will empower you to make informed decisions about your potential Powerball winnings.

The Powerball lottery offers two payout options: a lump-sum payment or an annuity. While the lump sum is received all at once, the annuity distributes the winnings in 30 annual payments, with each payment slightly larger than the previous one due to interest accumulation.

Annuity plans can be integrated into your 401k to provide additional retirement income. Annuity 401k Plan 2024 explains how annuities can complement your existing retirement savings and help you secure your financial future.

This guide focuses on understanding the nuances of annuity payments in 2024, considering factors like interest rates, inflation, and tax implications.

Calculating the value of your annuity can be complex, but there are tools available to help you. Annuity Value Calculator 2024 provides an easy-to-use calculator that helps you estimate the current worth of your annuity.

Contents List

Understanding Powerball Annuity Payments

Winning the Powerball lottery is a life-changing event, and choosing how to receive your winnings is a crucial decision. The Powerball offers two payout options: a lump-sum payment or an annuity payment. Understanding the nuances of each option is essential to making an informed choice.

Contingent annuities are a type of annuity that provides income for a specific period or event. Annuity Contingent Is 2024 explores the different types of contingent annuities and their unique features.

Annuity Payments Explained

An annuity payment is a structured payout of the lottery winnings over a period of time, typically 30 years. This option allows you to receive a series of annual payments, rather than a single lump sum. The Powerball annuity payment is designed to provide a steady stream of income over a longer period, potentially helping to manage the financial impact of a large windfall.

Is an annuity a guaranteed source of income for life? Is Annuity For Life 2024 explores the different types of annuities available and explains the terms that ensure your income stream continues for your lifetime.

Lump-Sum vs. Annuity Payouts, Calculating Powerball Annuity Payments 2024

The key difference between a lump-sum payout and an annuity payment lies in the timing and amount of money received. A lump-sum payout provides the entire winnings at once, while an annuity payment spreads the winnings out over a predetermined period.

- Lump-Sum Payout:Offers immediate access to the entire jackpot amount, but it’s subject to taxes and potential financial mismanagement.

- Annuity Payout:Provides a regular stream of income over a longer term, potentially helping with financial planning and reducing the risk of impulsive spending.

Factors Influencing Annuity Choice

Several factors influence the decision to choose an annuity payment, including:

- Financial Planning:Annuity payments can help with long-term financial planning, providing a steady income stream for retirement or other goals.

- Risk Aversion:Some individuals prefer the security of regular payments over the potential risks of managing a large lump sum.

- Tax Implications:Annuity payments may have different tax implications compared to lump-sum payouts, depending on individual circumstances.

- Investment Strategies:Annuity payments can provide time for investing and growing the winnings over the long term.

Calculating Powerball Annuity Payments in 2024: Calculating Powerball Annuity Payments 2024

The Powerball annuity payments are calculated based on an estimated annual interest rate, which is determined by the Powerball lottery officials. This interest rate is applied to the jackpot amount to determine the annual payment amount.

Is an annuity a good investment option for you? Annuity Is It A Good Investment 2024 examines the pros and cons of annuities, helping you determine if it’s the right choice for your financial goals.

Estimated Interest Rate for 2024

The estimated annual interest rate used for Powerball annuity calculations in 2024 is expected to be around 5%. This rate is subject to change, but it provides a general understanding of how annuity payments are determined.

Charles Schwab offers a user-friendly annuity calculator to help you explore your options. Annuity Calculator Charles Schwab 2024 provides a step-by-step guide to using this tool and helps you make informed decisions about your retirement planning.

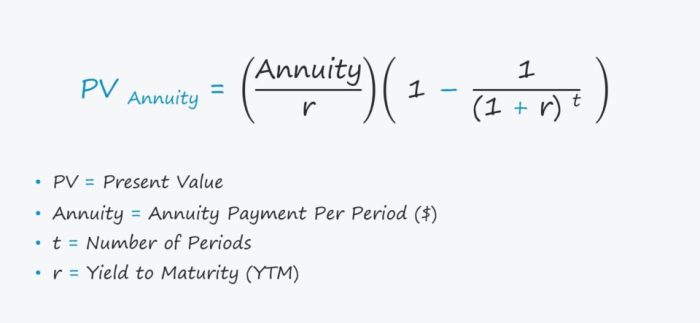

Formula for Annuity Payment Calculation

The annual annuity payment amount is calculated using the following formula:Annuity Payment = Jackpot Amount / Present Value FactorThe present value factor is a mathematical calculation that takes into account the estimated interest rate and the number of years over which the annuity payments are made.

Are you considering an annuity but worried about potential penalties? Annuity 10 Penalty 2024 provides a clear explanation of the rules and regulations surrounding early withdrawals and helps you avoid any unexpected fees.

Annuity Payment Schedule Example

Here’s an example of how annuity payments might be structured for a $100 million jackpot, assuming a 5% annual interest rate and a 30-year payout period:

| Year | Annuity Payment Amount | Total Received to Date |

|---|---|---|

| 1 | $5,000,000 | $5,000,000 |

| 2 | $5,250,000 | $10,250,000 |

| 3 | $5,512,500 | $15,762,500 |

| … | … | … |

| 30 | … | $100,000,000 |

Impact of Inflation on Annuity Payments

Inflation is a key factor to consider when evaluating annuity payments. Inflation erodes the purchasing power of money over time, meaning that the same amount of money will buy fewer goods and services in the future.

Understanding the annuity formula is crucial for making informed financial decisions. How To Calculate Annuity Formula 2024 provides a step-by-step guide to calculating your annuity payments and helps you understand the factors that influence your payout.

Inflation’s Impact on Purchasing Power

The impact of inflation on annuity payments can be significant. For example, if the annual inflation rate is 3%, the purchasing power of the first annuity payment will be reduced by approximately 90% by the time the last payment is received in 30 years.

This means that the final payment will be worth significantly less in real terms than the initial payment.

There are various types of annuities available, each with its own features and benefits. Annuity Kinds 2024 provides a comprehensive overview of the different types of annuities, helping you choose the one that best suits your financial goals.

Strategies for Mitigating Inflation

To mitigate the effects of inflation on annuity payments, consider these strategies:

- Invest the Payments:Investing annuity payments in assets that outpace inflation, such as stocks or real estate, can help preserve their purchasing power.

- Adjust Spending:Adjusting spending habits over time to account for inflation can help maintain a comfortable standard of living.

- Seek Professional Advice:Consulting with a financial advisor can provide personalized strategies for managing annuity payments and mitigating inflation risks.

Tax Implications of Annuity Payments

Receiving Powerball annuity payments has tax implications that must be considered. Lottery winnings are subject to federal and state income taxes, and the tax rate can vary depending on your income level.

Looking for the best annuity quotes in Canada for 2024? You’ve come to the right place! Annuity Quotes Canada 2024 provides a comprehensive guide to help you compare rates and find the perfect annuity for your needs.

Tax Rate on Lottery Winnings

The federal tax rate on lottery winnings is generally the same as your ordinary income tax rate. State tax rates on lottery winnings can vary significantly, so it’s important to research the specific tax regulations in your state.

Tax Rate Table

| Tax Bracket | Federal Tax Rate | Example State Tax Rate (California) |

|---|---|---|

| 10% | 10% | 7% |

| 12% | 12% | 9% |

| 22% | 22% | 11% |

| 24% | 24% | 12% |

| 32% | 32% | 13% |

| 35% | 35% | 14% |

| 37% | 37% | 15% |

Note: This table provides a general overview of tax rates and may not reflect the most recent tax laws or individual circumstances. It’s essential to consult with a tax professional for personalized advice.

The 5-year rule for annuities can impact your tax liability. Annuity 5 Year Rule 2024 provides a comprehensive overview of this rule and its implications for your annuity investment.

Financial Planning with Annuity Payments

Managing and investing Powerball annuity payments effectively is crucial to maximizing their long-term value. A thoughtful financial plan can help ensure that these winnings are used wisely and provide a lasting impact.

Wondering how much annuity income you could receive from a lump sum of $40,000? How Much Annuity For 40 000 2024 helps you estimate your potential annuity payments based on your chosen annuity type and current interest rates.

Tips for Managing Annuity Payments

- Establish a Budget:Create a detailed budget that Artikels income and expenses, helping to track spending and make informed financial decisions.

- Pay Down Debt:Use annuity payments to pay off high-interest debt, such as credit card debt, freeing up cash flow for other financial goals.

- Save for Retirement:Contribute to retirement accounts, such as 401(k)s or IRAs, to secure your financial future.

- Invest for Growth:Invest annuity payments in a diversified portfolio of assets, such as stocks, bonds, and real estate, to potentially grow your wealth over time.

Financial Strategies for Maximizing Value

Consider these financial strategies to maximize the long-term value of annuity payments:

- Seek Professional Advice:Consult with a financial advisor who can provide personalized guidance on managing large sums of money.

- Establish a Trust:Setting up a trust can help protect assets and manage wealth for future generations.

- Invest in Education:Use annuity payments to fund education for yourself or your children, enhancing future earning potential.

- Philanthropy:Consider donating a portion of your winnings to charitable causes that align with your values.

Final Thoughts

By understanding the mechanics of Powerball annuity payments, including the interest rate, inflation impact, and tax implications, you can make a well-informed decision about how to manage your potential winnings. Remember, seeking professional financial advice is crucial when dealing with large sums of money to ensure your financial future is secure and prosperous.

Annuity contracts can offer a reliable income stream for your retirement years. Annuity Is A Voluntary Retirement Vehicle 2024 explores how annuities can help you plan for your future and achieve your financial goals.

Popular Questions

How are Powerball annuity payments calculated?

Want to know how much you could receive with a monthly annuity payment of $2,000? Annuity 2000 Per Month 2024 breaks down the factors that influence your payout and helps you understand the potential benefits of this type of income stream.

The annual payment amount is calculated based on the estimated annual interest rate used by the lottery organization. This rate is applied to the remaining principal amount, and the interest is added to the next year’s payment.

What is the estimated annual interest rate used for Powerball annuity calculations in 2024?

Annuity jokes can be a fun way to learn about this financial product. Annuity Jokes 2024 offers a lighthearted look at annuities, helping you understand the basics in a humorous way.

The estimated annual interest rate for Powerball annuity payments in 2024 is typically around 5%. However, it’s important to check the official lottery rules for the most up-to-date information.

What are the tax implications of receiving Powerball annuity payments?

Powerball annuity payments are subject to federal and state income taxes. The tax rate applicable to lottery winnings varies depending on your income level and the state where you reside.

Is it better to choose a lump-sum payout or an annuity?

The best option depends on your individual financial circumstances and risk tolerance. A lump-sum payment offers immediate access to a large sum of money, but you’ll need to manage it wisely. An annuity provides a steady stream of income over time, but its real value can be eroded by inflation.