Calculating Ordinary Annuity 2024 takes center stage, offering a deep dive into the world of financial planning. Annuity calculations are fundamental to understanding how investments grow over time, especially when it comes to regular, periodic payments. Whether you’re planning for retirement, saving for a major purchase, or simply seeking a better understanding of financial instruments, this guide will equip you with the knowledge to confidently navigate the intricacies of ordinary annuities.

Annuity contracts typically include a hardship withdrawal provision, which allows you to access your funds early in certain situations. However, these withdrawals often come with penalties, so it’s important to understand the terms of your contract before making a withdrawal.

To learn more about hardship withdrawals in 2024, visit Annuity Hardship Withdrawal 2024.

This guide explores the concept of ordinary annuities, delves into the formula used to calculate their future value, and examines the key factors that influence the outcome. We’ll also discuss practical applications of ordinary annuities in various financial scenarios, highlighting common pitfalls to avoid and providing resources to enhance your understanding.

Annuity NPV (Net Present Value) is a financial calculation that helps you determine the present value of future payments. This can be useful when comparing different annuity options or making investment decisions. To learn more about annuity NPV calculators and how to use them, visit Annuity Npv Calculator 2024.

Contents List

- 1 Understanding Ordinary Annuities

- 2 Formula for Calculating Ordinary Annuities

- 3 Factors Influencing Ordinary Annuity Calculations

- 4 Practical Applications of Ordinary Annuities

- 5 Common Mistakes in Annuity Calculations

- 6 Tools and Resources for Annuity Calculations

- 7 Summary: Calculating Ordinary Annuity 2024

- 8 FAQ

Understanding Ordinary Annuities

An ordinary annuity is a series of equal payments made at the end of each period for a specific duration. These payments are designed to grow over time due to the accumulation of interest. Ordinary annuities are commonly used in financial planning, retirement savings, and loan repayment.

If you’re lucky enough to win the Powerball jackpot, you’ll have a big decision to make: take the lump sum or the annuity? The annuity is paid out over 30 years, with each payment increasing slightly to account for inflation.

To figure out how much you’ll receive each year, you can use an online calculator like the one found at Calculating Powerball Annuity Payments 2024.

Real-World Example

Imagine you decide to invest $100 every month for 10 years in a savings account that earns 5% annual interest. This regular monthly investment represents an ordinary annuity. Over time, your initial investment grows due to the interest earned on both the principal and accumulated interest.

Calculating the value of an annuity can be a bit tricky, but there are online calculators that can help. You can find a calculator specifically for annuity pensions at Calculating Annuity Pension 2024. This calculator will help you estimate the future value of your pension based on your current income and other factors.

Key Characteristics

- Equal Payments:Each payment within an annuity is of the same amount.

- Regular Intervals:Payments are made at fixed intervals, such as monthly, quarterly, or annually.

- End of Period:Payments are made at the end of each period, distinguishing them from annuities due.

- Future Value:The goal of an ordinary annuity is to determine its future value, which represents the total amount accumulated at the end of the payment period.

Formula for Calculating Ordinary Annuities

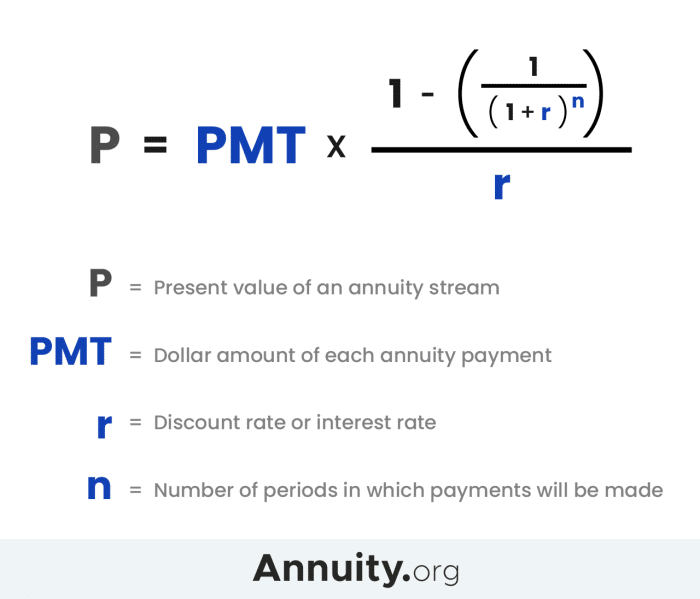

The future value of an ordinary annuity can be calculated using the following formula:

FV = P

If you’re unfamiliar with how annuities work, you’re not alone. It can be a complex financial product, but understanding the basics can help you make informed decisions about your retirement savings. For a comprehensive overview of how annuities work, check out Annuity How It Works 2024.

- (((1 + i)^n

- 1) / i)

Where:

- FV= Future Value

- P= Payment amount

- i= Interest rate per period

- n= Number of periods

Step-by-Step Guide

- Identify the variables:Determine the payment amount (P), interest rate per period (i), and number of periods (n).

- Calculate the exponent:Raise (1 + i) to the power of n.

- Subtract 1:Subtract 1 from the result obtained in step 2.

- Divide by the interest rate:Divide the result from step 3 by the interest rate (i).

- Multiply by the payment amount:Multiply the result from step 4 by the payment amount (P) to obtain the future value (FV).

Factors Influencing Ordinary Annuity Calculations

Several factors significantly influence the future value of an ordinary annuity. Understanding these factors helps in making informed financial decisions.

It’s important to review your annuity statement regularly to ensure that your payments are being made correctly and that your account is performing as expected. You can find information about annuity statements and what to look for in 2024 at Annuity Statement Is 2024.

Interest Rate

A higher interest rate leads to a larger future value. This is because interest is compounded on both the principal and accumulated interest, resulting in exponential growth. Even a small increase in the interest rate can have a substantial impact on the final amount.

One of the main advantages of an annuity is that it provides guaranteed income for life. You don’t have to worry about running out of money, even if you live longer than expected. For more information about the indefinite duration of annuities, visit Annuity Is Indefinite Duration 2024.

Number of Periods

The longer the payment period, the higher the future value. As the number of periods increases, more interest is earned on the accumulated funds, leading to greater growth. This emphasizes the importance of starting early and investing consistently over time.

If you’re lucky enough to win a lottery prize of $3 million, you’ll have to decide whether to take the lump sum or the annuity. The annuity will pay you a set amount each year for 30 years, while the lump sum is paid out all at once.

To find out more about the annuity options for a $3 million prize in 2024, visit Annuity 3 Million 2024.

Payment Amount

The payment amount directly impacts the future value. A larger payment amount will naturally result in a higher future value. However, it’s important to balance the payment amount with affordability and long-term financial goals.

Annuity contracts can be complex, but there are a few key things to keep in mind to maximize your income. To learn about eight income secrets that can help you get the most out of your annuity, visit 8 Annuity Income Secret 2024.

Practical Applications of Ordinary Annuities

Ordinary annuities find widespread applications in various financial scenarios.

When it comes to retirement planning, you have many options, and choosing the right one depends on your individual needs and goals. Annuity and IRA are both popular choices, but they have different features and benefits. To learn more about the pros and cons of each, visit Annuity Vs Ira 2024.

Scenarios

| Scenario | Description |

|---|---|

| Retirement Savings | Regular contributions to a retirement account, where the accumulated funds provide income during retirement. |

| Loan Repayments | Monthly mortgage payments or car loan installments, where the annuity represents the total amount repaid over the loan term. |

| Insurance Premiums | Regular payments for life insurance or health insurance policies, ensuring financial protection for specific events. |

| Investment Plans | Systematic investments in mutual funds or stocks, allowing for long-term wealth accumulation. |

Financial Products

- Annuities:Financial products that provide a stream of regular payments, often used for retirement planning.

- Mutual Funds:Investment vehicles that pool money from multiple investors to buy a diversified portfolio of securities.

- Retirement Accounts:Tax-advantaged accounts designed for retirement savings, such as 401(k)s and IRAs.

- Loan Products:Mortgages, car loans, and student loans all utilize annuity principles for repayment.

Personal Finance Planning

Ordinary annuities are valuable tools for personal finance planning. They allow individuals to:

- Set financial goals:Determine the future value needed for specific goals, such as retirement or a down payment on a house.

- Plan for long-term investments:Calculate the amount needed to save regularly to reach financial goals.

- Evaluate loan options:Compare different loan terms and interest rates to find the most favorable option.

- Manage debt:Develop a repayment plan for loans, ensuring timely payments and reducing interest charges.

Common Mistakes in Annuity Calculations

Errors in annuity calculations can lead to inaccurate financial projections and potentially costly consequences. It’s crucial to avoid these common mistakes.

If you’re interested in a career in healthcare, you may want to consider a role in the annuity industry. Annuity companies are always looking for talented individuals to help manage their growing customer base. For more information about career opportunities in the annuity industry, visit Annuity Health Careers 2024.

Common Errors

- Incorrect Interest Rate:Using the wrong interest rate, such as an annual rate instead of a monthly rate, can significantly affect the future value.

- Incorrect Number of Periods:Miscounting the number of payment periods, especially when dealing with different compounding frequencies, can lead to errors.

- Ignoring Fees and Taxes:Failing to account for fees associated with financial products or taxes on interest earned can underestimate the true cost or return.

- Using the Wrong Formula:Applying the formula for annuities due instead of ordinary annuities, or vice versa, will result in incorrect calculations.

Tips for Avoiding Mistakes

- Double-check your inputs:Carefully review all variables, including interest rates, payment amounts, and the number of periods, to ensure accuracy.

- Use reliable calculators:Utilize reputable online calculators or financial software specifically designed for annuity calculations.

- Consult a financial advisor:Seek professional guidance from a qualified financial advisor for complex calculations or personalized financial planning.

Real-Life Examples

Incorrectly calculating annuity payments for a retirement account could result in insufficient funds for retirement. Similarly, miscalculating loan repayments could lead to higher interest charges or even default on the loan.

When calculating the value of an annuity, you need to consider the time value of money. This means that money today is worth more than money in the future, due to inflation and the potential for investment growth. To calculate the discount factor for an annuity, you can use an online calculator like the one found at Calculate Annuity Discount Factor 2024.

Tools and Resources for Annuity Calculations

Various tools and resources are available to assist with annuity calculations.

Online Calculators

- Bankrate:Provides calculators for various financial products, including annuities.

- Investopedia:Offers a range of calculators for retirement planning, loan payments, and other financial scenarios.

- Calculator.net:Offers a dedicated annuity calculator for both ordinary and annuities due.

Software

- Microsoft Excel:Includes built-in functions for annuity calculations, allowing for customized analysis.

- Quicken:Financial software that provides tools for budgeting, investment tracking, and loan management.

- Mint:Personal finance management app that offers features for budgeting, bill tracking, and investment monitoring.

Resources for Further Learning, Calculating Ordinary Annuity 2024

- Investopedia:Offers comprehensive articles and tutorials on annuities and other financial concepts.

- Khan Academy:Provides free online courses and resources on personal finance and investment.

- Your local library:Offers books and resources on personal finance and investment planning.

Summary: Calculating Ordinary Annuity 2024

Understanding the intricacies of ordinary annuities empowers you to make informed financial decisions. Whether you’re a seasoned investor or just starting your financial journey, grasping the principles of annuity calculations can lead to a more secure and prosperous future. By applying the knowledge gleaned from this guide, you can confidently navigate the world of financial planning and make informed choices that align with your long-term goals.

If you’re planning for your retirement, you may want to consider a joint life annuity, which provides payments to two people, typically a couple. This type of annuity can ensure that your spouse continues to receive income after your death.

To learn more about the options available in 2024, check out Annuity Joint Life Option 2024.

FAQ

What is the difference between an ordinary annuity and an annuity due?

Annuity rates can fluctuate, and it’s important to understand the current market trends. An 8.5% return on an annuity is a good rate, but it’s important to compare different options before making a decision. To see how this rate compares to other options in 2024, you can visit Annuity 8.5 Percent 2024.

An ordinary annuity involves payments made at the end of each period, while an annuity due involves payments made at the beginning of each period. This difference in timing affects the future value of the annuity.

How can I use an annuity calculator to determine the future value of my investment?

Annuity calculators are readily available online and in financial software. Simply input the relevant information, such as the payment amount, interest rate, and number of periods, and the calculator will provide the future value of the annuity.

What are some real-life examples of ordinary annuities?

An annuity is a financial product that provides regular payments over a set period of time. If you’re looking to invest $250,000 in an annuity, you can find out more about the different options available to you in 2024 by visiting Annuity 250k 2024.

Common examples include monthly mortgage payments, regular contributions to a 401(k) retirement plan, and monthly insurance premiums.