Annuity Formula Questions 2024: Understanding annuities can be a game-changer for your financial future. Whether you’re planning for retirement, saving for college, or simply looking for a secure investment strategy, annuities offer a unique and often overlooked option. This guide will delve into the intricacies of annuity formulas, explaining their purpose, applications, and real-world implications.

From defining key terms like “present value” and “future value” to exploring different annuity types, this guide will provide a comprehensive understanding of how these formulas work and how they can be applied to various financial scenarios.

Contents List

Understanding Annuities

An annuity is a financial product that provides a series of regular payments over a set period of time. Annuities are commonly used for retirement planning, but they can also be used for other purposes, such as funding college expenses or providing income during a period of disability.

Some annuities offer guarantees for a certain period. If you’re looking for a guaranteed income stream, you might consider exploring Annuity 6 Guaranteed 2024 to learn about the specific terms and conditions of these types of annuities.

Key Components of an Annuity

An annuity has several key components, including:

- Principal:The initial amount of money invested in the annuity.

- Interest Rate:The rate at which the principal grows over time.

- Payment Period:The frequency of payments, such as monthly, quarterly, or annually.

- Term:The length of time over which payments are made.

Types of Annuities

There are many different types of annuities, each with its own unique features and benefits. Some common types include:

- Fixed Annuities:These annuities provide a guaranteed rate of return, which means that the payments will remain the same regardless of market fluctuations. Fixed annuities are generally considered to be less risky than variable annuities.

- Variable Annuities:These annuities invest in a portfolio of assets, such as stocks and bonds. The payments from a variable annuity will fluctuate depending on the performance of the underlying investments. Variable annuities can provide the potential for higher returns than fixed annuities, but they also carry more risk.

- Immediate Annuities:These annuities begin making payments immediately after the initial investment is made. Immediate annuities are often used to provide a steady stream of income for retirees.

- Deferred Annuities:These annuities begin making payments at a later date, such as after a certain number of years. Deferred annuities are often used to save for retirement or other long-term goals.

Advantages and Disadvantages of Annuities

Annuities can offer several advantages, including:

- Guaranteed Income:Fixed annuities provide a guaranteed stream of income, which can be helpful for retirees who want to ensure a steady flow of funds.

- Tax-Deferred Growth:The earnings from an annuity are typically tax-deferred, which means that you will not have to pay taxes on them until you begin receiving payments.

- Protection from Market Risk:Fixed annuities offer protection from market risk, which can be appealing to investors who are risk-averse.

However, annuities also have some disadvantages, such as:

- High Fees:Annuities can have high fees, which can eat into your returns.

- Limited Liquidity:It can be difficult to access the money in an annuity before you begin receiving payments.

- Potential for Lower Returns:Fixed annuities may provide lower returns than other investment options, such as stocks or bonds.

Annuity Formula Fundamentals

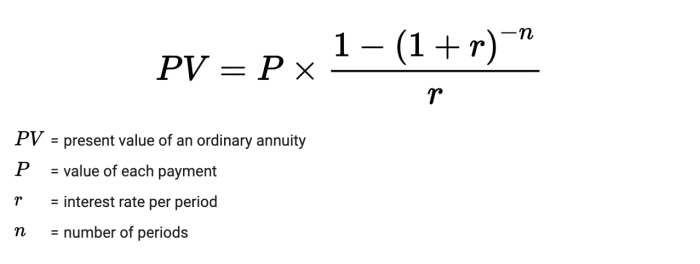

The annuity formula is a mathematical equation that is used to calculate the present value or future value of a series of equal payments. The formula can be used to determine the amount of money you need to invest today to receive a certain amount of income in the future, or to calculate the future value of a series of regular investments.

Annuity investments often involve compound interest, which can significantly impact your returns over time. To understand how this works, you can learn more about Is Annuity Compound Interest 2024 and its implications for your investment.

Basic Annuity Formula

PV = PMT- [1 – (1 + r)^-n] / r

Annuity 401(k) plans are a common way for individuals to save for retirement. If you’re considering this option, you can learn more about Annuity 401k 2024 to understand how it works and its potential benefits. It’s important to understand the terms and conditions of any annuity before making a decision.

Where:

- PV= Present value of the annuity

- PMT= Payment amount

- r= Interest rate per period

- n= Number of periods

Example

Suppose you want to receive $1,000 per month for 10 years, and the interest rate is 5% per year. To calculate the present value of this annuity, you would use the following formula:

PV = $1,000- [1 – (1 + 0.05/12)^-120] / (0.05/12)

Annuity payments can be guaranteed for a certain period or for life. You can explore the concept of Is Annuity Certain 2024 to understand the different types of guarantees available and their implications.

When purchasing an annuity, it’s crucial to carefully consider your options. Knowing when and how an Annuity Is Purchased 2024 can help you make informed decisions. Research different types of annuities and their features to find the one that aligns with your financial goals.

This would give you a present value of approximately $95,137. This means that you would need to invest $95,137 today to receive $1,000 per month for 10 years at a 5% interest rate.

Annuity Formula Applications

The annuity formula can be used to calculate both the present value and the future value of an annuity. The present value of an annuity is the amount of money you need to invest today to receive a certain amount of income in the future.

When calculating the future value of an annuity, it’s important to consider whether it’s an ordinary annuity or an annuity due. You can learn how to Calculate Annuity Due Future Value 2024 to determine the potential future value of your annuity investment.

The future value of an annuity is the amount of money you will have at the end of the annuity period, after all the payments have been made.

Calculating Present Value, Annuity Formula Questions 2024

The formula for calculating the present value of an ordinary annuity is:

PV = PMT- [1 – (1 + r)^-n] / r

Annuity investments can be a complex topic, and it’s essential to understand the basics before making any decisions. You can find information about Annuity Is 2024 to gain a better understanding of what annuities are, how they work, and their potential benefits and drawbacks.

Where:

- PV= Present value of the annuity

- PMT= Payment amount

- r= Interest rate per period

- n= Number of periods

Calculating Future Value

The formula for calculating the future value of an annuity due is:

FV = PMT- [(1 + r)^n – 1] / r – (1 + r)

Excel is a versatile tool that can be used for various financial calculations, including annuities. If you’re interested in learning more, you can explore Calculating Annuity Factor In Excel 2024 to understand how to calculate annuity factors and values using this software.

Where:

- FV= Future value of the annuity

- PMT= Payment amount

- r= Interest rate per period

- n= Number of periods

Examples

Here are some examples of how to calculate the present value and future value of an annuity:

- Present Value:Suppose you want to receive $1,000 per month for 10 years, and the interest rate is 5% per year. The present value of this annuity is $95,137. This means that you would need to invest $95,137 today to receive $1,000 per month for 10 years at a 5% interest rate.

The HP-12C is a popular financial calculator that can be used to calculate annuity values. You can learn how to Calculate Annuity Hp12c 2024 to determine the present and future values of annuities.

- Future Value:Suppose you invest $1,000 per month for 10 years, and the interest rate is 5% per year. The future value of this annuity is $163,862. This means that you will have $163,862 at the end of 10 years, after all the payments have been made.

Annuity Formula Variations: Annuity Formula Questions 2024

The basic annuity formula can be modified to account for different types of annuities and compounding periods. For example, the formula for calculating the present value of an annuity due is different from the formula for calculating the present value of an ordinary annuity.

Understanding how to calculate annuities is essential for financial planning. You can find resources on Calculating Annuities 2024 to learn about the different methods and formulas involved.

Similarly, the formula for calculating the present value of an annuity with monthly compounding is different from the formula for calculating the present value of an annuity with annual compounding.

If you’re considering a significant annuity investment, you might want to explore Annuity $400 000 2024 to understand the potential returns and risks associated with such a large investment.

Variations for Different Annuity Types

The annuity formula can be modified to account for different types of annuities, such as:

- Fixed Annuities:The formula for calculating the present value or future value of a fixed annuity is the same as the basic annuity formula.

- Variable Annuities:The formula for calculating the present value or future value of a variable annuity is more complex, as it takes into account the fluctuations in the underlying investments.

- Immediate Annuities:The formula for calculating the present value or future value of an immediate annuity is the same as the basic annuity formula.

- Deferred Annuities:The formula for calculating the present value or future value of a deferred annuity is more complex, as it takes into account the period of time before payments begin.

Variations for Compounding Periods

The annuity formula can also be modified to account for different compounding periods, such as:

- Annual Compounding:The basic annuity formula assumes annual compounding.

- Monthly Compounding:To account for monthly compounding, you would need to adjust the interest rate and the number of periods in the formula. The interest rate would be divided by 12, and the number of periods would be multiplied by 12.

- Quarterly Compounding:To account for quarterly compounding, you would need to adjust the interest rate and the number of periods in the formula. The interest rate would be divided by 4, and the number of periods would be multiplied by 4.

Examples

Here are some examples of how to calculate annuities with different compounding frequencies:

- Monthly Compounding:Suppose you want to receive $1,000 per month for 10 years, and the interest rate is 5% per year, compounded monthly. To calculate the present value of this annuity, you would use the following formula:

PV = $1,000- [1 – (1 + 0.05/12)^-120] / (0.05/12)

This would give you a present value of approximately $95,137.

- Quarterly Compounding:Suppose you want to receive $1,000 per quarter for 10 years, and the interest rate is 5% per year, compounded quarterly. To calculate the present value of this annuity, you would use the following formula:

PV = $1,000- [1 – (1 + 0.05/4)^-40] / (0.05/4)

If you’re using a financial calculator, you can learn how to Calculate Annuity On Hp10bii 2024 to determine annuity values. This can be a useful tool for understanding the potential return on your annuity investment.

This would give you a present value of approximately $33,558.

Annuity options can be particularly attractive for individuals nearing retirement. You can find information about Annuity 60 Year Old Man 2024 to understand the specific considerations for this age group. It’s essential to consult with a financial advisor to determine the best annuity strategy for your individual circumstances.

Real-World Annuity Examples

Annuities are used in a variety of real-world applications, including:

| Example | Description | Annuity Formula Application | Implications of Different Annuity Parameters |

|---|---|---|---|

| Retirement Plans | Many retirement plans offer annuity options, which allow you to receive a regular stream of income after you retire. | The annuity formula can be used to calculate the amount of money you need to invest in a retirement plan to receive a certain amount of income in retirement. | A higher interest rate will result in a higher future value, while a longer time period will also result in a higher future value. |

| Insurance Policies | Some insurance policies, such as life insurance policies, offer annuity options, which allow you to receive a regular stream of income after the death of the insured. | The annuity formula can be used to calculate the amount of money you need to invest in an insurance policy to receive a certain amount of income after the death of the insured. | A higher interest rate will result in a higher future value, while a shorter time period will result in a lower future value. |

| Loan Payments | Loan payments are often structured as annuities, with a series of equal payments made over a set period of time. | The annuity formula can be used to calculate the amount of each loan payment, as well as the total amount of interest paid over the life of the loan. | A higher interest rate will result in a higher total amount of interest paid, while a shorter time period will result in a higher amount of each payment. |

Annuity Formula in Financial Planning

Annuities play a significant role in financial planning, particularly for retirement planning. They can be used to achieve a variety of financial goals, such as:

- Retirement Income:Annuities can provide a steady stream of income during retirement, which can help you cover your expenses and maintain your lifestyle.

- College Savings:Annuities can be used to save for college expenses, as the tax-deferred growth can help your savings grow faster.

- Long-Term Care:Annuities can be used to fund long-term care expenses, which can be significant in later years.

Assessing Financial Planning Scenarios

The annuity formula can be used to assess different financial planning scenarios. For example, you can use the formula to:

- Determine how much you need to save for retirement:You can use the annuity formula to calculate the amount of money you need to invest today to receive a certain amount of income in retirement.

- Compare different investment options:You can use the annuity formula to compare the returns of different investment options, such as annuities, stocks, and bonds.

- Plan for unexpected expenses:You can use the annuity formula to plan for unexpected expenses, such as medical bills or home repairs.

Epilogue

By understanding the intricacies of annuity formulas, you can make informed financial decisions that align with your long-term goals. Whether you’re a seasoned investor or just starting your financial journey, this guide provides the knowledge you need to navigate the world of annuities with confidence.

For those who prefer using a financial calculator, understanding how to Calculating Annuity Ba Ii Plus 2024 can be helpful. This calculator can help you calculate the present and future values of annuities, providing valuable insights for financial planning.

Quick FAQs

How do annuities work?

Annuity contracts provide a stream of regular payments over a set period, either for a fixed term or for life. These payments can be used for retirement income, investment growth, or other financial goals.

Annuity calculations can be helpful for various financial planning needs in Nigeria. You can use an Annuity Calculator Nigeria 2024 to determine the potential income stream you might receive from an annuity investment. This tool can be particularly useful for individuals considering retirement planning.

What are the risks associated with annuities?

Like any investment, annuities come with risks. One potential risk is that the interest rate earned on your annuity may be lower than expected, impacting your future payments. Additionally, some annuities have fees or surrender charges that can reduce your returns.

What are the benefits of using an annuity formula?

Annuity formulas allow you to accurately calculate the present and future values of annuity payments, helping you make informed decisions about your investment strategy. They also provide insights into the impact of different factors, such as interest rates and time periods, on your overall returns.