Calculating Retirement Annuity 2024 takes center stage as we delve into the crucial aspects of securing your financial future. Retirement annuities provide a steady stream of income during your golden years, ensuring peace of mind and financial stability. This guide will explore the intricacies of calculating retirement annuities, empowering you to make informed decisions about your financial well-being.

We will examine the factors that influence retirement annuity calculations, including your age at retirement, expected lifespan, desired income, investment growth rate, and inflation rate. We’ll also discuss various methods for calculating retirement annuities, such as present value calculations, annuity formulas, and financial planning software, highlighting their advantages and disadvantages.

By understanding these concepts, you can gain a comprehensive understanding of how retirement annuities work and how to determine the amount you need to save for a comfortable retirement.

Contents List

- 1 Understanding Retirement Annuities: Calculating Retirement Annuity 2024

- 2 Factors Influencing Retirement Annuity Calculations

- 3 Methods for Calculating Retirement Annuities

- 4 Retirement Annuity Calculation Example

- 5 Considerations for Retirement Annuity Planning

- 6 Ultimate Conclusion

- 7 Questions Often Asked

Understanding Retirement Annuities: Calculating Retirement Annuity 2024

Retirement annuities are financial products designed to provide a steady stream of income during your retirement years. They work by converting a lump sum of money into a series of regular payments, ensuring a predictable income source for your later life.

This type of annuity is particularly valuable for individuals seeking a secure and reliable retirement income, as it offers a guaranteed stream of payments, unlike investments that can fluctuate in value.

Types of Retirement Annuities

Retirement annuities are available in various forms, each offering distinct features and benefits to cater to diverse financial needs and risk tolerances. Here are some common types:

- Fixed Annuities:These annuities provide a guaranteed fixed rate of return, offering predictable income payments. They are suitable for individuals seeking stability and certainty in their retirement income, as the payments are not affected by market fluctuations.

- Variable Annuities:Unlike fixed annuities, variable annuities invest your money in a range of sub-accounts, such as stocks, bonds, or mutual funds. The rate of return on these investments is not guaranteed, and your income payments can fluctuate based on the performance of the underlying investments.

Variable annuities are suitable for individuals with a higher risk tolerance who are seeking the potential for greater returns.

- Indexed Annuities:Indexed annuities offer a combination of guaranteed income and potential growth. They link your returns to the performance of a specific market index, such as the S&P 500, but with a guaranteed minimum return. This type of annuity can be a good option for individuals seeking a balance between stability and potential growth.

While not everyone uses annuities, they are a valuable option for those who want a Annuity Is A Voluntary Retirement Vehicle 2024.

Key Features and Benefits

Retirement annuities offer several key features and benefits that make them an attractive option for retirement planning:

- Guaranteed Income:Fixed annuities offer a guaranteed stream of income, providing financial security and peace of mind during retirement.

- Tax Advantages:The income payments from a retirement annuity are often tax-deferred, meaning you won’t pay taxes on the income until you start receiving payments in retirement. This can significantly reduce your tax liability over time.

- Protection Against Outliving Your Savings:Retirement annuities provide a steady income stream for the rest of your life, ensuring that you won’t outlive your savings. This is a significant advantage for individuals who are concerned about longevity risk.

- Flexibility:Some annuities offer flexibility in terms of how you receive your payments, such as lump-sum payments, monthly payments, or a combination of both.

Factors Influencing Retirement Annuity Calculations

Calculating the amount of income you will receive from a retirement annuity involves considering several factors that affect the overall calculation. These factors are crucial in determining the appropriate annuity amount to meet your retirement needs.

If you’re planning for retirement with a partner, an Annuity Calculator Joint Life 2024 can help you estimate your combined income stream.

Factors Impacting Retirement Annuity Calculations, Calculating Retirement Annuity 2024

- Age at Retirement:The earlier you retire, the longer you will need your retirement income to last, which means you will need a larger annuity to cover your expenses. The longer your annuity payment period, the higher the overall cost of the annuity.

While some argue that Why An Annuity Is Bad 2024 , many find annuities a valuable tool for guaranteed income.

- Expected Lifespan:Your expected lifespan is a significant factor in determining the amount of retirement income you need. The longer you are expected to live, the more income you will require to cover your expenses. You can use life expectancy tables or consult with a financial advisor to estimate your lifespan.

- Desired Income in Retirement:Your desired income in retirement is a key factor in determining the amount of your annuity. You should consider your current expenses, anticipated future expenses, and any other sources of retirement income, such as Social Security benefits or pensions, when deciding on your desired income.

Inheritance laws vary, and understanding How Is Inherited Annuity Taxed 2024 is important for estate planning.

- Investment Growth Rate:The investment growth rate of your annuity affects the amount of income you will receive. Higher growth rates generally lead to higher income payments. However, it’s important to note that investment returns are not guaranteed and can fluctuate based on market conditions.

When you’re looking at a long-term financial strategy, understanding Calculating A Deferred Annuity 2024 can be crucial.

- Inflation Rate:Inflation can erode the purchasing power of your retirement income. If inflation is high, your annuity payments may not be able to keep pace with rising prices, potentially reducing your standard of living. It’s essential to factor in inflation when calculating your retirement annuity needs.

For accountants, understanding Calculating Annuity In Accounting 2024 is essential for accurate financial reporting.

Examples of Factor Impact

- Age at Retirement:A person retiring at age 60 will need a larger annuity than someone retiring at age 65, assuming they want the same level of income for the same period. This is because the annuity will need to cover expenses for a longer duration.

Using a spreadsheet can make financial planning easier. Learn how to Calculating Annuity Cash Flows Excel 2024 for a more detailed look at your financial future.

- Expected Lifespan:If you expect to live to age 90, you will need a larger annuity than someone who expects to live to age 80. This is because your annuity needs to cover expenses for a longer period.

- Desired Income in Retirement:If you want to maintain your current lifestyle in retirement, you will need a larger annuity than someone who wants to reduce their expenses. For example, if your current annual expenses are $50,000, you will need a larger annuity than someone whose desired retirement income is $30,000.

Curious about how much income you can expect? Check out How Much Does A 80 000 Annuity Pay Per Month 2024 for an idea.

- Investment Growth Rate:A higher investment growth rate can lead to higher annuity payments. For example, if your annuity earns a 5% annual return, you will receive higher income payments than if it earns a 2% return.

- Inflation Rate:If inflation is 3%, your annuity payments will need to increase by 3% each year to maintain the same purchasing power. This is important to consider when calculating your retirement annuity needs.

Methods for Calculating Retirement Annuities

Several methods are used to calculate retirement annuities, each with its own advantages and disadvantages. The choice of method depends on factors such as your financial situation, risk tolerance, and desired level of complexity.

While Why An Annuity Is Bad 2024 may be a valid concern for some, they can provide valuable security for others.

Methods of Calculation

- Present Value Calculations:This method involves discounting future income payments back to their present value, using a specific discount rate that reflects the time value of money and investment returns. The present value calculation helps determine the lump sum needed today to generate the desired stream of income in retirement.

- Annuity Formulas:Mathematical formulas are used to calculate the annuity payment amount based on factors such as the principal amount, interest rate, and payment period. These formulas provide a precise calculation of the annuity payment based on the specified parameters.

- Financial Planning Software:Financial planning software can be used to calculate retirement annuities, considering various factors such as investment returns, inflation, taxes, and expenses. This software provides comprehensive calculations and projections for retirement planning, including annuity needs.

Comparison of Methods

| Method | Advantages | Disadvantages |

|---|---|---|

| Present Value Calculations | Accurate, considers time value of money, can be customized | Requires understanding of financial concepts, can be complex |

| Annuity Formulas | Precise, easy to use, readily available | May not account for all factors, limited flexibility |

| Financial Planning Software | Comprehensive, user-friendly, provides projections | May be expensive, requires input of personal data |

Retirement Annuity Calculation Example

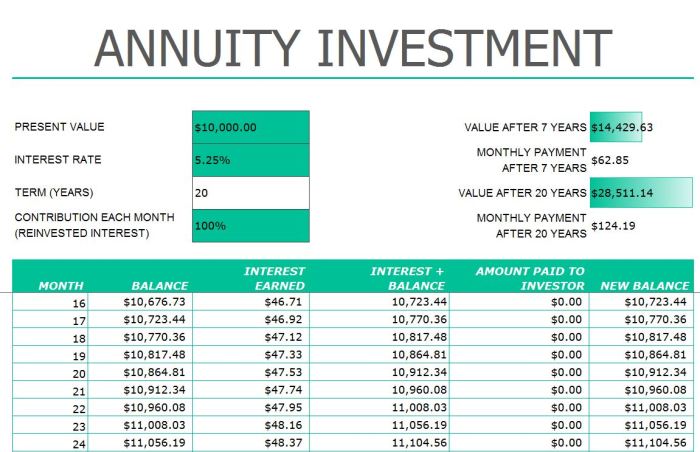

Let’s consider a hypothetical scenario to illustrate how a retirement annuity calculation can be performed. This example will use the present value calculation method.

Scenario

Suppose you are 55 years old and plan to retire at age 65. You want to receive an annual retirement income of $50,000 for 20 years, assuming a 4% annual investment growth rate and a 2% inflation rate.

Annuities are a complex financial product, and understanding Annuity Is Future Value 2024 is key to making informed decisions.

Calculation Process

| Step | Description | Calculation | Result |

|---|---|---|---|

| 1 | Calculate the present value of each year’s income payment. | PV = FV / (1 + r)^n | |

| 2 | Sum the present values of all income payments. | Total PV = PV1 + PV2 + … + PV20 |

For each year, we need to calculate the present value (PV) of the future income payment. We can use the formula PV = FV / (1 + r)^n, where:

- FV is the future value of the income payment (e.g., $50,000)

- r is the discount rate (4% in this example)

- n is the number of years until the payment is received (e.g., 1 for the first year, 2 for the second year, etc.)

For example, the present value of the first year’s income payment would be:

PV = $50,000 / (1 + 0.04)^1 = $48,076.92

When planning for the future, it’s important to understand the implications of an Annuity No Beneficiary 2024.

We would then repeat this calculation for each of the 20 years, adjusting the value of n accordingly. Once we have the present value of each year’s income payment, we would sum them up to get the total present value.

For those who speak Hindi, understanding Annuity Meaning In Hindi 2024 is crucial for making informed financial decisions.

This total present value represents the lump sum you would need today to generate your desired retirement income stream.

Considerations for Retirement Annuity Planning

When planning for retirement annuities, it’s crucial to consider various factors that can significantly impact your overall financial planning. These factors can influence your annuity choices, investment strategies, and overall retirement preparedness.

Important Considerations

- Taxes and Fees:Retirement annuities are subject to taxes and fees, which can impact your overall returns. You should carefully consider the tax implications and fees associated with different annuity options to ensure that you understand the net impact on your income.

- Risk Tolerance and Investment Strategies:Your risk tolerance and investment strategies play a significant role in selecting the right annuity. If you are risk-averse, you may prefer a fixed annuity with a guaranteed return. However, if you are willing to take on more risk, you may consider a variable annuity with the potential for higher returns.

It’s helpful to see Annuity Examples In Real Life 2024 to understand how they can work for your specific situation.

- Potential Changes in Economic Conditions:Economic conditions can significantly impact your retirement planning. Inflation, interest rates, and market volatility can affect the value of your annuity and your overall retirement income. It’s important to consider these factors and plan for potential economic fluctuations.

- Social Security Benefits and Other Sources of Retirement Income:You should factor in Social Security benefits, pensions, and other sources of retirement income when planning for your annuity. These sources can contribute to your overall retirement income and may affect your annuity needs.

Ultimate Conclusion

As you embark on your retirement planning journey, remember that calculating your retirement annuity is just one piece of the puzzle. It’s essential to consider factors like taxes, fees, risk tolerance, and potential economic changes. By carefully assessing these factors and seeking professional guidance, you can create a robust retirement plan that aligns with your individual needs and goals.

Take control of your financial future and secure a comfortable and fulfilling retirement.

The Annuity Gator 2024 is a popular tool for understanding the intricacies of annuities, but it’s important to remember that every individual’s financial situation is unique.

Questions Often Asked

How often should I review my retirement annuity calculations?

It’s recommended to review your retirement annuity calculations at least annually, or more frequently if there are significant changes in your financial circumstances, such as a change in income, investment performance, or retirement goals.

What are some common mistakes people make when calculating their retirement annuity?

Some common mistakes include underestimating expenses, assuming a high investment return, and not accounting for inflation. It’s crucial to be realistic and conservative in your assumptions.

Can I adjust my retirement annuity contributions over time?

Yes, you can often adjust your retirement annuity contributions over time. This flexibility allows you to adapt to changes in your financial situation and retirement goals.

To make the most of your financial planning, consider the Calculate Annuity Due Future Value 2024 to understand how your investments can grow.

How can I find a qualified financial advisor to help me with retirement planning?

You can seek recommendations from trusted sources like friends, family, or your employer. You can also search for certified financial planners (CFPs) or other qualified professionals through organizations like the Financial Planning Association (FPA) or the Certified Financial Planner Board of Standards (CFP Board).