Calculate Annuity Rate In Excel 2024: A Guide for Financial Planning is a comprehensive guide to understanding and calculating annuity rates using Microsoft Excel. Annuities, a stream of regular payments over a set period, are essential tools for financial planning, retirement savings, and investment strategies.

For those who prefer not to share personal details, there are annuity calculators that don’t require this information. Annuity Calculator No Personal Details 2024 offers a convenient way to estimate annuity payouts without disclosing sensitive data.

This guide explores the fundamentals of annuities, their various types, and how to utilize Excel’s powerful functions to calculate annuity rates effectively.

We will delve into the standard formula for calculating annuity rates, breaking down each variable and exploring their relationships. We will then dive into the practical applications of annuity calculations in Excel, demonstrating how to use the PMT function for mortgage payments, analyze the impact of interest rates on annuity payments, and calculate the present value of annuities.

Additionally, we will explore advanced concepts like using the RATE function to determine interest rates and utilizing Excel for future value calculations.

A $70,000 annuity can be a significant source of income. Annuity 70000 2024 explores the details of this specific scenario, including potential payouts and how it might impact your retirement planning.

Contents List

Understanding Annuities

An annuity is a series of equal payments made over a period of time. Annuities are commonly used in financial planning, retirement savings, and insurance products. They offer a predictable stream of income, making them a valuable tool for managing financial obligations and achieving long-term financial goals.

Components of an Annuity

An annuity consists of several key components:

- Payment Amount:The fixed amount of money paid out at regular intervals.

- Payment Frequency:The frequency at which payments are made (e.g., monthly, quarterly, annually).

- Time Period:The total duration over which payments are made.

- Interest Rate:The rate of return earned on the annuity’s principal.

Types of Annuities, Calculate Annuity Rate In Excel 2024

There are two main types of annuities:

- Ordinary Annuity:Payments are made at the end of each period.

- Annuity Due:Payments are made at the beginning of each period.

Real-World Scenarios

Annuities are used in various real-world scenarios, including:

- Retirement Planning:Annuities provide a steady income stream during retirement.

- Mortgage Payments:Home loans are often structured as annuities, with fixed monthly payments.

- Insurance Products:Annuities are incorporated into insurance policies, such as life insurance and annuities.

Annuity Rate Calculation Formula: Calculate Annuity Rate In Excel 2024

The annuity rate is the periodic payment amount that needs to be made to ensure the present value of the annuity equals the future value. The formula for calculating the annuity rate is as follows:

PMT = PV

Annuities can be deferred, meaning payments start at a later date. Annuity Is Deferred 2024 explains the concept of deferred annuities and how they can be used to plan for retirement.

- (r

- (1 + r)^n) / ((1 + r)^n

- 1)

Where:

- PMTis the annuity payment amount.

- PVis the present value of the annuity.

- ris the interest rate per period.

- nis the total number of periods.

The annuity rate is directly proportional to the present value and the interest rate. As the present value or the interest rate increases, the annuity rate also increases. Conversely, the annuity rate is inversely proportional to the number of periods.

When considering annuities, it’s important to understand if they qualify as a tax-advantaged plan. Is Annuity A Qualified Plan 2024 delves into the tax implications of annuities and helps you determine if they fit your financial situation.

As the number of periods increases, the annuity rate decreases.

Sometimes you come across the term “annuity” and need to unscramble it. Annuity Unscramble 2024 offers a fun and engaging way to test your knowledge of this financial concept.

Excel Functions for Annuity Rate Calculation

Excel provides a convenient function called PMT to calculate the annuity payment amount. This function simplifies the calculation process, eliminating the need to manually input the formula.

Annuities are primarily used to provide a steady stream of income during retirement. An Annuity Is Primarily Used To Provide 2024 dives deeper into the benefits of annuities for retirement planning and how they can help secure your financial future.

Using the PMT Function

To use the PMT function, follow these steps:

- Open a new Excel spreadsheet.

- In a cell, type “=PMT(“.

- Enter the following arguments within the parentheses, separated by commas:

- Rate:The interest rate per period.

- Nper:The total number of periods.

- PV:The present value of the annuity.

- FV:The future value of the annuity (optional, defaults to 0).

- Type:Indicates whether payments are made at the beginning or end of each period (0 for end, 1 for beginning).

- Close the parentheses and press Enter.

For example, to calculate the monthly payment for a $100,000 loan with a 5% annual interest rate over 30 years, the formula would be:

=PMT(0.05/12, 30*12, 100000)

Annuities can be linked to bonds. Calculate Annuity Bond 2024 provides information on how to calculate the value of an annuity backed by a bond, considering factors like interest rates and maturity dates.

This would return a monthly payment of $536.82.

Visualizing the present value of an annuity can be helpful. Pv Annuity Chart 2024 provides charts and visualizations that illustrate how the present value of an annuity changes over time.

It’s crucial to understand the function’s arguments and their impact on the result. For instance, changing the interest rate or the number of periods will directly affect the calculated annuity payment amount.

Practical Applications of Annuity Rate Calculation in Excel

Excel’s PMT function can be applied to various real-world scenarios involving annuities. Here are a few practical applications:

Mortgage Loan Calculation

You can use the PMT function to calculate the monthly payment for a mortgage loan. Create a spreadsheet with the following columns:

| Loan Amount | Interest Rate | Loan Term (Years) | Monthly Payment |

|---|

Enter the loan details in the first three columns. In the “Monthly Payment” column, use the PMT function to calculate the monthly payment amount. For example, if the loan amount is $200,000, the interest rate is 4%, and the loan term is 25 years, the formula would be:

=PMT(0.04/12, 25*12, 200000)

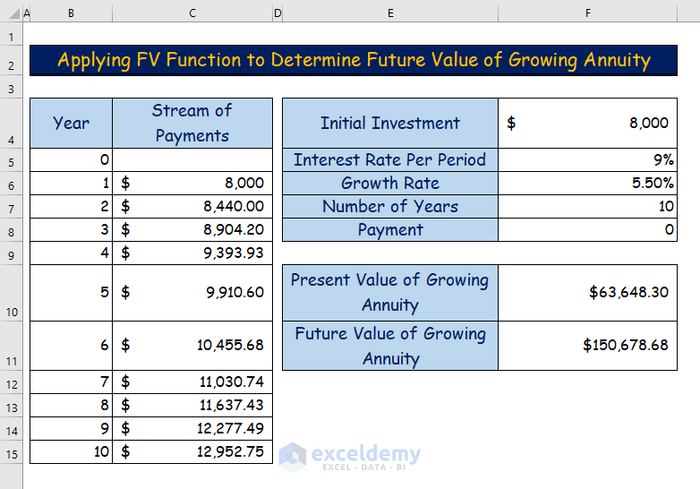

If you’re familiar with Excel, you can use it to calculate the value of a growing annuity. Calculate Growing Annuity In Excel 2024 provides step-by-step instructions and formulas to help you calculate this type of annuity.

This would return a monthly payment of $1,011.96.

Impact of Interest Rates

You can use the PMT function to create a table illustrating the impact of different interest rates on the annuity rate. Create a table with the following columns:

| Interest Rate | Annuity Rate |

|---|

In the “Interest Rate” column, enter different interest rates. In the “Annuity Rate” column, use the PMT function to calculate the annuity rate for each interest rate, keeping the other variables constant. This table will show how the annuity rate changes with different interest rates.

Present Value Calculation

Excel’s PV function can be used to calculate the present value of an annuity. The PV function takes the following arguments:

- Rate:The interest rate per period.

- Nper:The total number of periods.

- PMT:The annuity payment amount.

- FV:The future value of the annuity (optional, defaults to 0).

- Type:Indicates whether payments are made at the beginning or end of each period (0 for end, 1 for beginning).

For example, to calculate the present value of an annuity with a monthly payment of $1,000, a 5% annual interest rate, and a 10-year term, the formula would be:

=PV(0.05/12, 10*12, 1000)

This would return a present value of $95,137.55.

Curious about the specifics of a $300,000 annuity? Annuity 300 000 2024 dives into the details of this specific scenario, providing insights on potential payouts and other factors to consider.

Advanced Annuity Calculations in Excel

Excel offers additional functions for advanced annuity calculations, providing insights into the underlying financial principles.

To figure out how much you need to deposit into an annuity, there are handy calculators available online. Calculate Annuity Deposit 2024 provides insights on how to determine the right deposit amount based on your desired payout.

Calculating the Interest Rate

Excel’s RATE function can be used to calculate the interest rate of an annuity. The RATE function takes the following arguments:

- Nper:The total number of periods.

- PMT:The annuity payment amount.

- PV:The present value of the annuity.

- FV:The future value of the annuity (optional, defaults to 0).

- Type:Indicates whether payments are made at the beginning or end of each period (0 for end, 1 for beginning).

For example, to calculate the interest rate of an annuity with a present value of $10,000, a monthly payment of $500, and a 5-year term, the formula would be:

=RATE(5*12, 500,

10000)

When considering your retirement options, you might wonder if an annuity is a better choice than drawdown. To explore this, check out Is Annuity Better Than Drawdown 2024 for a detailed comparison and see what suits your financial goals best.

This would return an interest rate of 1.67% per month, or 20.04% per year.

If you’re in Canada, you’ll need a specific calculator for annuities. Annuity Calculator Canada 2024 provides tools tailored to the Canadian market, helping you plan your retirement income.

Discounting

Discounting is a crucial concept in annuity calculations. It involves reducing the future value of an annuity to its present value, taking into account the time value of money. Excel’s PV function performs discounting automatically.

The formula used to calculate an annuity can seem a bit complex. Annuity Formula Is 2024 breaks down the formula and explains its components, making it easier to understand.

Future Value Calculation

Excel’s FV function can be used to calculate the future value of an annuity. The FV function takes the following arguments:

- Rate:The interest rate per period.

- Nper:The total number of periods.

- PMT:The annuity payment amount.

- PV:The present value of the annuity (optional, defaults to 0).

- Type:Indicates whether payments are made at the beginning or end of each period (0 for end, 1 for beginning).

For example, to calculate the future value of an annuity with a monthly payment of $500, a 5% annual interest rate, and a 10-year term, the formula would be:

=FV(0.05/12, 10*12, 500)

This would return a future value of $78,007.47.

Final Review

By mastering the techniques Artikeld in this guide, you will gain the confidence and expertise to confidently calculate annuity rates and incorporate them into your financial planning strategies. Whether you’re a seasoned investor or just starting your financial journey, understanding annuities and how to utilize Excel’s capabilities can provide you with valuable insights for making informed financial decisions.

Questions and Answers

What is the difference between an ordinary annuity and an annuity due?

An ordinary annuity has payments made at the end of each period, while an annuity due has payments made at the beginning of each period. This difference affects the calculation of the annuity rate.

How can I use the PMT function to calculate the present value of an annuity?

For a deeper understanding of annuities, Khan Academy offers valuable resources. Annuity Khan Academy 2024 provides a comprehensive overview of annuities, explaining their different types and how they work.

While the PMT function primarily calculates payments, you can use it to calculate the present value by setting the future value (FV) argument to zero and solving for the payment (PMT). The resulting payment value will represent the present value of the annuity.

What are some real-world applications of annuity calculations?

Besides retirement planning, annuity calculations are used for various purposes, including mortgage payments, loan amortization, lease payments, and calculating the present value of future cash flows.