R Calculate Annuity 2024: A Guide to Financial Planning explores the world of annuities, offering a comprehensive overview of this financial tool. From understanding the basic concepts to calculating annuity payments using the powerful R programming language, this guide provides a practical and insightful journey into the realm of financial planning.

Hit the lottery and won a big prize? Congratulations! But before you start spending, remember that lottery winnings often come in the form of an annuity. To figure out your payment schedule, check out this guide on Calculating Lottery Annuity Payments 2024.

Annuities are a valuable tool for individuals seeking to secure their financial future. They offer a steady stream of income, often for a lifetime, providing peace of mind and financial stability. Whether you’re planning for retirement, seeking income generation, or aiming to achieve specific financial goals, understanding annuities is essential.

Understanding the annuity method is essential for financial professionals and individuals alike. It’s a powerful tool for valuing streams of income. This article on Calculating Annuity Method 2024 provides a comprehensive overview.

This guide delves into the different types of annuities, their applications, and the factors influencing their use in 2024. Through practical examples and code snippets, you’ll gain a deeper understanding of how to calculate annuity payments using the ‘annuity’ function in the ‘FinCal’ package in R.

Need to calculate annuity payments in Java? There are libraries and code examples available to help you. This article on Calculate Annuity Java 2024 will guide you through the process.

Contents List

Understanding Annuities: R Calculate Annuity 2024

An annuity is a financial product that provides a series of regular payments over a specified period. It’s essentially a stream of income that you can rely on, making it a popular choice for retirement planning and other financial goals.

Wondering if your annuity income is taxable in 2024? You’re not alone! It depends on several factors, so it’s essential to understand the rules. Check out this article on Annuity Is Taxable Or Not 2024 to get a clear picture.

Think of it like a steady stream of money flowing into your account, offering peace of mind and financial security.

Are you studying for the JAIIB exam? Annuity concepts are a key part of the curriculum. This article on Annuity Jaiib 2024 can help you understand the relevant topics and prepare for your exam.

Real-World Examples of Annuities

Annuities are widely used in various scenarios. Here are a few real-world examples:

- Retirement Income:Many individuals use annuities to supplement their retirement savings, providing a consistent income stream during their golden years.

- Life Insurance:Some life insurance policies offer annuity options, allowing beneficiaries to receive regular payments instead of a lump sum payout.

- Structured Settlements:In legal settlements, annuities can be used to distribute payments over time, ensuring that the recipient receives regular income.

Types of Annuities

Annuities come in various forms, each with its own characteristics and benefits. Here are some common types:

- Fixed Annuities:These offer a guaranteed interest rate, providing predictable income payments. They’re ideal for those seeking stability and risk aversion.

- Variable Annuities:These link payments to the performance of underlying investments, offering the potential for higher returns but also carrying more risk. They’re suitable for individuals with a higher risk tolerance.

- Immediate Annuities:Payments begin immediately after purchasing the annuity. These are often used for immediate income needs, such as supplementing retirement income.

- Deferred Annuities:Payments start at a future date, allowing for growth potential before income begins. They’re suitable for long-term financial goals, like saving for retirement.

Annuity Calculations in R

Calculating annuity payments involves understanding the underlying formula and leveraging the power of R’s financial functions. Let’s explore how to do this effectively.

An annuity is a type of payment structure that involves regular installments. Understanding how annuities work is crucial for financial planning. This article on Annuity Is Payment 2024 provides a clear explanation.

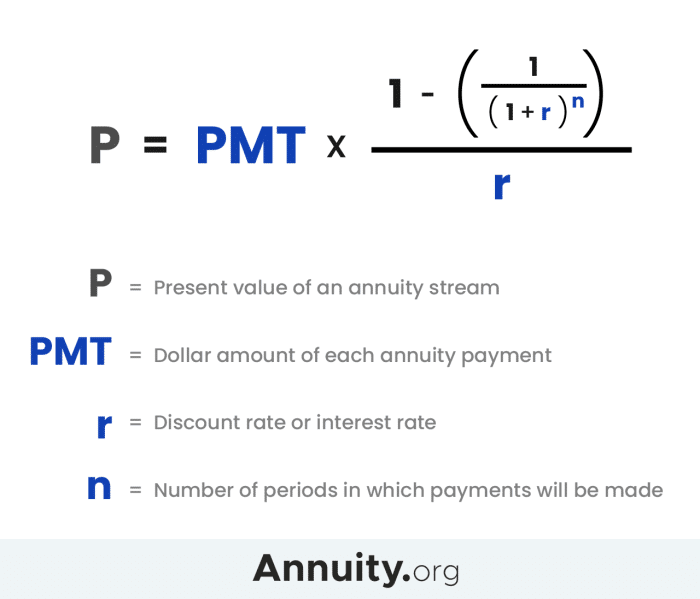

Basic Annuity Formula

PMT = PV- (r / (1 – (1 + r)^-n))

Is an annuity the same as a pension? It’s a common question, and the answer is, not exactly. While both provide regular income streams, they have distinct differences. Explore the nuances in this article on Annuity Is Pension 2024.

Where:

- PMTis the periodic payment amount

- PVis the present value (initial investment)

- ris the interest rate per period

- nis the total number of periods

Using the ‘annuity’ Function in the ‘FinCal’ Package

The ‘FinCal’ package in R provides a convenient function called ‘annuity’ for calculating annuity payments. Let’s see how it works:

# Install and load the 'FinCal' package

install.packages("FinCal")

library(FinCal)

# Define the parameters

pv <- 100000 # Present value

r <- 0.05 # Interest rate per year

n <- 20 # Number of years

# Calculate the annuity payment

annuity(pv = pv, r = r, n = n)

Annuity Payment Scenarios

Let’s illustrate how annuity payments vary based on different interest rates, time periods, and payment frequencies.

Need to calculate the payments on an annuity loan in Excel? It’s easier than you think! There are handy formulas and tools within Excel that can help you get accurate calculations. Learn more about the process in this article on Calculate Annuity Loan Excel 2024.

| Interest Rate | Time Period (Years) | Payment Frequency | Annuity Payment |

|---|---|---|---|

| 5% | 10 | Annual | $12,950.46 |

| 6% | 15 | Semi-annual | $9,712.25 |

| 7% | 20 | Quarterly | $8,052.49 |

Annuity Applications in 2024

Annuities remain relevant in today’s financial landscape, offering valuable tools for various financial planning needs. Let’s explore their current applications and considerations.

Looking for information on annuities specifically for individuals aged 65 and above? This article on Annuity 65 2024 provides insights into the options available and how they can benefit you.

Trends and Factors Influencing Annuity Use, R Calculate Annuity 2024

Several factors are shaping the use of annuities in 2024:

- Rising Life Expectancy:As people live longer, the need for guaranteed income streams in retirement becomes more critical.

- Low Interest Rates:With interest rates historically low, annuities can offer a more attractive return compared to traditional savings accounts.

- Market Volatility:In times of market uncertainty, annuities can provide a sense of security and stability.

Annuity Applications for Financial Goals

Annuities can be valuable tools for achieving various financial goals:

- Retirement Planning:Annuities can provide a predictable income stream during retirement, supplementing other savings and investments.

- Income Generation:Annuities can be used to generate income for individuals who need supplemental income or want to create a steady stream of cash flow.

- Long-Term Care:Annuities can help cover the costs of long-term care, providing financial protection against unexpected medical expenses.

Risks and Benefits of Annuities

While annuities offer benefits, it’s crucial to understand the potential risks:

- Limited Liquidity:Annuities typically have restrictions on accessing the principal, making them less liquid than other investments.

- Fees and Expenses:Annuities can have various fees and expenses, which can impact returns.

- Interest Rate Risk:Fixed annuities can be affected by changes in interest rates, potentially reducing future payments.

Practical Examples and Code Snippets

Let’s delve into practical examples and code snippets to illustrate how annuities work in real-world scenarios.

Annuity payments can be a valuable source of income, but are they taxable? It’s a question that many people have. This article on Is Annuity Payments Taxable 2024 provides insights into the tax implications.

Impact of Interest Rates on Annuity Payments

| Interest Rate | Annuity Payment |

|---|---|

| 4% | $7,358.18 |

| 5% | $8,654.29 |

| 6% | $9,950.46 |

This table demonstrates how higher interest rates lead to larger annuity payments, assuming all other factors remain constant.

Code Snippet for Annuity Calculation

# Calculate the annuity payment for a $100,000 investment

# at 5% interest rate for 20 years

pv <- 100000

r <- 0.05

n <- 20

annuity(pv = pv, r = r, n = n)

Hypothetical Scenario

Imagine you want to retire with a $5,000 monthly income for 20 years. You have $500,000 in savings and are considering using an annuity to supplement your income. Assuming a 5% annual interest rate, you can calculate the annuity payment needed:

# Calculate the annuity payment needed for a $5,000 monthly income

# for 20 years, with a $500,000 investment and a 5% interest rate

pv <- 500000

r <- 0.05 / 12 # Monthly interest rate

n <- 20

- 12 # Total number of months

annuity(pv = pv, r = r, n = n)

The result will show the monthly annuity payment required to achieve your retirement income goal. This hypothetical scenario highlights how annuities can be used to supplement existing savings and create a steady income stream for retirement.

Want to understand the present value of an annuity due? It’s a crucial concept in financial planning. This article on Calculate Annuity Due Present Value 2024 will break down the calculation and its implications.

Last Point

By understanding the concepts, calculations, and applications of annuities, you can make informed decisions about incorporating them into your financial planning strategies. This guide equips you with the knowledge and tools to navigate the world of annuities with confidence, empowering you to make sound financial choices that align with your goals and aspirations.

FAQ Resource

What is the difference between a fixed and variable annuity?

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s return fluctuates based on the performance of underlying investments.

Can I use annuities for income generation during my working years?

Yes, some annuities, like immediate annuities, can provide income starting immediately. This can be beneficial if you need supplemental income or want to create a consistent income stream.

What are some potential risks associated with annuities?

Annuities can have fees, surrender charges, and limitations on withdrawals, so it’s crucial to understand the terms and conditions before investing.

Want to estimate your future annuity payments? There are online calculators and tools available that can help you get a personalized projection. Explore the options in this article on Annuity Estimator 2024.

Are you interested in learning about annuities in Hong Kong? This article on Annuity Hk 2024 provides insights into the market and available options.

Annuity payments can be structured in a series of installments. Understanding the different types of annuity series is essential for financial planning. This article on Annuity Is Series 2024 provides an overview.

Want to explore the potential of an annuity with a 4% interest rate? It’s a common scenario, and this article on Annuity 4 Percent 2024 will help you understand the implications.