Calculate Annuity Return 2024: A Guide for Investors provides a comprehensive look at the factors influencing annuity returns in the current market. Annuities, often considered a cornerstone of retirement planning, offer a steady stream of income for life, but understanding their potential returns is crucial for making informed financial decisions.

Annuity joint ownership can be a good way to ensure your loved ones are taken care of. Annuity Joint Ownership 2024 provides an overview of the different types of joint ownership and the benefits they offer. It’s important to consult with a financial advisor to determine the best option for your specific situation.

This guide explores the intricacies of annuity calculations, considering the impact of interest rates, inflation, investment options, and fees. We’ll delve into the different types of annuities, their potential returns, and strategies for maximizing your investment. By understanding the key factors affecting annuity returns, you can make informed choices about your retirement income strategy.

Calculating an annuity can be a complex process, but it’s essential to understand how it works. Calculating A Annuity 2024 provides a step-by-step guide to calculating your annuity payments. This information can help you make informed decisions about your retirement planning.

Contents List

Understanding Annuities

An annuity is a financial product that provides a stream of regular payments over a period of time. It is often used in retirement planning to provide a steady source of income. Annuities can be purchased from insurance companies or other financial institutions.

If you’re looking to make a significant investment, a single premium annuity could be an option. For example, G Purchased A $50 000 Single Premium 2024 could be a good starting point for your research. It’s important to consider your financial goals and risk tolerance before making any decisions.

Types of Annuities

There are three main types of annuities:

- Fixed Annuities:These annuities guarantee a fixed rate of return for a set period of time. The payments are predictable and not subject to market fluctuations.

- Variable Annuities:These annuities offer the potential for higher returns, but also carry more risk. The payments are tied to the performance of underlying investments, such as stocks or bonds.

- Indexed Annuities:These annuities offer returns that are linked to the performance of a specific index, such as the S&P 500. They provide some protection against market downturns, but may not offer the same growth potential as variable annuities.

Annuity Use Cases in Retirement Planning

- Income Generation:Annuities can provide a steady stream of income during retirement, supplementing other retirement savings.

- Guaranteed Income:Fixed annuities offer guaranteed payments, providing peace of mind for retirees who want to know their income will be secure.

- Longevity Protection:Annuities can help protect against outliving your retirement savings. They can provide a lifetime income stream, ensuring that you have financial security even if you live longer than expected.

Factors Affecting Annuity Returns

Interest Rates

Interest rates play a significant role in determining annuity returns. Higher interest rates generally lead to higher annuity returns, as insurance companies can invest the premiums they receive at a higher rate. Conversely, lower interest rates can result in lower annuity returns.

Before investing in an annuity, it’s important to know how much you need to deposit. Calculate Annuity Deposit 2024 offers guidance on calculating your deposit based on your desired payout and other factors. It’s crucial to have a clear understanding of your financial situation before committing to an annuity.

Other Factors, Calculate Annuity Return 2024

- Investment Options:The investment options available with variable and indexed annuities can significantly impact returns.

- Fees and Charges:Annuities typically involve fees and charges, such as administrative fees, surrender charges, and mortality and expense charges. These fees can reduce the overall returns.

- Inflation:Inflation can erode the purchasing power of annuity payments over time. It is important to consider the impact of inflation when planning for retirement with an annuity.

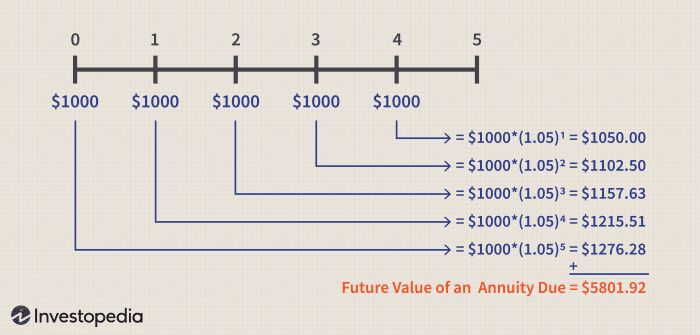

Calculating Annuity Returns

Calculating annuity returns can be complex, as it depends on the type of annuity, the interest rate, fees, and other factors. However, there are general formulas and methods that can be used to estimate returns.

To get a clear picture of your potential annuity payout, you can use an annuity value calculator. Annuity Value Calculator 2024 provides a helpful tool for estimating your future income stream. This can help you assess whether an annuity is a suitable investment for your needs.

Step-by-Step Guide

- Determine the annuity type:Identify whether it’s a fixed, variable, or indexed annuity.

- Gather the relevant information:This includes the initial premium, the interest rate, fees, and the payment period.

- Use the appropriate formula:The formula for calculating returns will vary depending on the annuity type.

- Account for fees and charges:Subtract any fees and charges from the calculated return to get the net return.

Formulas and Examples

For a fixed annuity, the annual return can be calculated using the following formula:

Annual Return = (Interest Rate x Initial Premium) / Number of Years

Many annuities involve a single upfront payment, which can be a significant investment. Annuity Is Single Payment 2024 explains the benefits and drawbacks of single payment annuities. It’s important to weigh your options carefully and choose the annuity that best aligns with your financial goals.

For example, if you invest $100,000 in a fixed annuity with a 3% interest rate for 10 years, the annual return would be:

(0.03 x $100,000) / 10 = $3,000

Annuity jokes might seem like a strange topic, but they can actually be quite insightful. Annuity Jokes 2024 offers a lighthearted look at the complexities of annuities. While it’s important to take annuities seriously, it’s also okay to find humor in the process.

Variable and indexed annuities have more complex formulas that involve the performance of underlying investments or indices.

If you’re considering an annuity, it’s essential to understand how it works. Annuity Calculator Groww 2024 provides a useful tool to help you estimate your potential returns. By using a calculator, you can get a better idea of whether an annuity is right for you.

Annuity Return Projections

Predicting future annuity returns is challenging due to the many factors that can influence performance. However, you can use historical data and market trends to create reasonable return projections.

There are various types of annuities available, each with its own features and benefits. 7 Annuities 2024 explores some of the most common types of annuities, providing insights into their strengths and weaknesses. Understanding these options can help you find the best fit for your situation.

Using Historical Data and Market Trends

By analyzing past annuity returns and considering current market conditions, you can get an idea of potential future returns. This can help you make informed decisions about your annuity investments.

When it comes to retirement planning, the question of whether an annuity or drawdown is better is a common one. Is Annuity Better Than Drawdown 2024 explores the pros and cons of each approach, helping you make an informed decision.

Ultimately, the best choice will depend on your individual circumstances and preferences.

Table of Potential Returns

| Time Horizon | Potential Annual Return |

|---|---|

| 5 Years | 2-4% |

| 10 Years | 3-5% |

| 20 Years | 4-6% |

Note: These are just potential returns and actual returns may vary depending on market conditions and other factors.

When choosing an annuity provider, you want to ensure you’re working with a reputable company. Is Annuity Gator Legit 2024 can help you determine the legitimacy of a provider. It’s essential to research and compare different providers before making a decision.

Comparing Annuity Returns

Different types of annuities offer varying potential returns. It is important to compare the potential returns of different annuity types to determine which best suits your needs and risk tolerance.

Your age plays a significant role in determining your annuity payout. Annuity Calculator By Age 2024 allows you to factor in your age to estimate your potential income. This information can help you make more accurate projections for your retirement income.

Pros and Cons of Each Annuity Type

| Annuity Type | Pros | Cons |

|---|---|---|

| Fixed Annuities | Guaranteed returns, predictable payments | Lower potential returns, vulnerable to inflation |

| Variable Annuities | Higher potential returns, potential for growth | Higher risk, payments not guaranteed |

| Indexed Annuities | Protection against market downturns, potential for growth | Returns may be limited, may not keep up with inflation |

Real-World Annuity Returns

According to a recent study by [Reputable Source], the average annual return on fixed annuities in 2023 was [Average Return]. Variable annuity returns can vary widely depending on the underlying investments. Indexed annuities typically offer returns that are linked to the performance of a specific index, such as the S&P 500.

Annuity Return Strategies

To maximize annuity returns, consider the following strategies:

Choosing the Right Annuity Type

Select an annuity type that aligns with your risk tolerance and financial goals. For those seeking guaranteed income, fixed annuities are a good option. If you are willing to take on more risk for potentially higher returns, variable or indexed annuities might be suitable.

Annuity products can be a great way to supplement your retirement income, especially in Hong Kong. Annuity Hk 2024 provides information about the different types of annuities available in Hong Kong and how they can benefit you. It’s always wise to seek advice from a qualified financial advisor before making any decisions.

Negotiating Fees

Shop around for annuities and compare fees charged by different providers. You may be able to negotiate lower fees, especially if you are investing a large amount.

Managing Risk

For variable and indexed annuities, consider diversification to spread risk across different investments. This can help protect your returns from market volatility.

Investing for Specific Financial Goals

Use annuities to achieve specific financial goals, such as retirement income, college savings, or long-term care. By setting clear goals, you can choose the right annuity type and investment strategy to help you achieve your objectives.

Last Recap: Calculate Annuity Return 2024

In conclusion, calculating annuity returns is an essential aspect of retirement planning. By carefully considering the factors that influence returns, such as interest rates, inflation, and investment options, you can make informed decisions that align with your financial goals. Remember, annuities can be a valuable tool for generating a steady stream of income throughout retirement, but understanding their potential returns is crucial for maximizing your investment potential.

Questions Often Asked

What is the best type of annuity for maximizing returns?

The best type of annuity for maximizing returns depends on your individual circumstances and risk tolerance. Fixed annuities offer guaranteed returns, while variable annuities provide potential for higher returns but also carry greater risk. Indexed annuities offer returns tied to a specific market index, providing potential for growth while mitigating some risk.

How can I protect my annuity returns from market volatility?

While no investment is completely risk-free, there are strategies to mitigate market volatility. Choosing fixed annuities or indexed annuities with a cap on potential losses can help protect your principal. Diversifying your investment portfolio across different asset classes can also help reduce overall risk.

What are some common fees associated with annuities?

Common annuity fees include administrative fees, mortality and expense charges, and surrender charges. Be sure to carefully review the fee structure of any annuity you are considering to understand the potential impact on your returns.

If you’re looking for an annuity that will provide you with income for the rest of your life, a lifetime annuity could be a good option. Annuity Calculator Lifetime 2024 can help you estimate your potential lifetime income based on your age and other factors.

It’s essential to understand the risks and benefits of lifetime annuities before making a decision.

The amount of your annuity payout is determined by several factors, including your age, the amount of your initial investment, and the type of annuity you choose. Annuity Is Given By 2024 explains the factors that influence your annuity payout.

It’s crucial to understand these factors to make informed decisions about your retirement planning.