Calculate Interest Rate Annuity Excel 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. This guide will delve into the intricacies of calculating interest rates for annuities using Microsoft Excel, a powerful tool for financial analysis.

Calculating the potential return on an annuity can be helpful in making informed decisions. You can find a handy annuity loan calculator that can help you assess your options in this article: Annuity Loan Calculator 2024. This calculator can help you determine the potential benefits and drawbacks of different annuity options.

We’ll explore the fundamental concepts of annuities and interest rates, delve into the specific Excel functions designed for these calculations, and demonstrate how to apply these tools to real-world scenarios. By understanding these concepts and mastering these techniques, you’ll gain valuable insights into financial planning, investment strategies, and loan repayment options.

Calculating the value of an annuity can be complex, but there are calculators that can simplify the process. You can find a mathematical annuity calculator that can help you determine the value of an annuity in this article: Annuity Calculator Math 2024.

This calculator can help you make informed decisions about your annuity investments.

Whether you’re a financial professional, a student, or simply someone interested in managing their finances effectively, this guide will equip you with the knowledge and skills to confidently calculate interest rates for annuities using Excel. We’ll cover everything from the basics of annuities and interest rates to advanced concepts and considerations, ensuring that you have a comprehensive understanding of this important topic.

There are many different types of annuities available, each with its own set of features and benefits. You can explore seven popular types of annuities and their specific advantages in this article: 7 Annuities 2024. Understanding the various types of annuities can help you choose the one that best suits your financial goals.

Get ready to unlock the power of Excel and take control of your financial future.

Contents List

Understanding Annuities and Interest Rates

An annuity is a series of equal payments made over a specific period. It’s a fundamental concept in finance, crucial for understanding investments, loans, and retirement planning. Annuities involve a consistent stream of cash flows, either received or paid, which can be used to calculate future values, present values, and interest rates.

Some annuities are designed to last forever, providing a steady income stream for as long as you live. This is known as a perpetual annuity. You can find out more about perpetual annuities and their unique characteristics in this article: Annuity Is Perpetual 2024.

This type of annuity can be a great option for those seeking long-term financial security.

Key Features of Annuities

- Equal Payments:Each payment in an annuity is identical in amount.

- Regular Intervals:Payments occur at regular intervals, such as monthly, quarterly, or annually.

- Fixed Period:Annuities have a defined start and end date, determining the total number of payments.

- Interest Rate:The interest rate applied to the annuity determines the growth or decline of its value over time.

Types of Annuities

- Ordinary Annuities:Payments are made at the end of each period.

- Annuities Due:Payments are made at the beginning of each period.

- Perpetuities:Payments continue indefinitely, without an end date.

Relationship Between Interest Rates, Time Value of Money, and Annuities

The time value of money (TVM) is the core principle behind annuities. It states that money today is worth more than the same amount of money in the future due to its potential to earn interest. Interest rates play a vital role in the TVM, influencing the growth or decline of an annuity’s value over time.

A higher interest rate leads to a higher future value and a lower present value, and vice versa.

Annuity payments can be structured in various ways, with some offering a specific monthly payment. You can find out more about annuities with a $30,000 starting value in this article: Annuity 30k 2024. This article can help you understand how the starting value impacts your potential income.

Excel Functions for Annuity Calculations: Calculate Interest Rate Annuity Excel 2024

Excel provides powerful functions specifically designed for annuity calculations. These functions simplify complex calculations and allow for quick analysis of various financial scenarios.

Excel Functions for Annuities

- PV (Present Value):Calculates the present value of an annuity, considering the future payments, interest rate, and number of periods.

=PV(rate, nper, pmt, [fv], [type])

Financial calculators can be helpful tools for calculating the value of an annuity. You can learn more about how to calculate an annuity on a financial calculator in this article: Calculating Annuity On Financial Calculator 2024. This article can help you understand how to use a financial calculator to make informed decisions about your annuity investments.

- FV (Future Value):Determines the future value of an annuity, taking into account the present value, interest rate, and number of periods.

=FV(rate, nper, pmt, [pv], [type])

- PMT (Payment):Calculates the periodic payment required for an annuity, given the present value, interest rate, and number of periods.

=PMT(rate, nper, pv, [fv], [type])

Annuity contracts can be a valuable financial tool, but they may not be suitable for everyone. You can explore the potential benefits and drawbacks of annuities in this article: Annuity Is Good Or Bad 2024. It’s important to carefully consider your individual circumstances before making a decision.

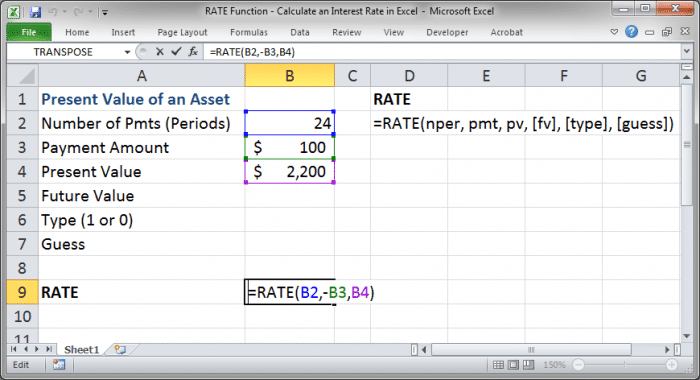

- RATE (Interest Rate):Calculates the interest rate of an annuity, considering the present value, future value, number of periods, and payment amount.

=RATE(nper, pmt, pv, [fv], [type], [guess])

Annuity bonds are a type of financial instrument that can be used to secure a steady income stream. You can learn more about the formula used to calculate annuity bond values in this article: Formula Annuity Bond 2024.

Understanding the formula can help you make informed decisions about annuity bond investments.

- NPER (Number of Periods):Determines the number of periods for an annuity, given the present value, future value, interest rate, and payment amount.

=NPER(rate, pmt, pv, [fv], [type])

Annuity contracts can be complex, but they offer a structured way to manage your finances. You can learn more about the key features and benefits of four types of annuities in this article: 4 Annuity 2024. By understanding the different types of annuities, you can make an informed decision about whether they are right for you.

Calculating Interest Rate for an Annuity

Calculating the interest rate for an annuity is a common requirement in financial analysis. It helps determine the return on investment, the cost of borrowing, or the effective interest rate on a loan.

Example: Calculating Interest Rate for an Annuity

Suppose you have an annuity with a present value of $10,000, a future value of $15,000, and a term of 5 years. You need to find the interest rate that makes this possible.

To understand the potential returns of an annuity, you can calculate the annuity rate. You can learn more about how to calculate annuity rates in this article: Calculating An Annuity Rate 2024. This article can help you make informed decisions about your annuity investment.

Steps:

- Set up the spreadsheet:Enter the known values in separate cells.

- Present Value (PV): $10,000

- Future Value (FV): $15,000

- Number of Periods (NPER): 5 years

- Use the RATE function:In an empty cell, enter the following formula:

=RATE(NPER, 0, PV, FV)

- Result:The calculated interest rate will be displayed in the cell. In this example, the interest rate is approximately 8.45%.

Scenario Table

| Present Value (PV) | Future Value (FV) | Number of Periods (NPER) | Interest Rate |

|---|---|---|---|

| $10,000 | $15,000 | 5 years | 8.45% |

| $5,000 | $10,000 | 10 years | 7.27% |

| $20,000 | $30,000 | 3 years | 14.47% |

Practical Applications of Annuity Calculations in Excel

Annuity calculations are widely used in various financial scenarios, helping to make informed decisions about investments, loans, and retirement planning.

Annuity payments can provide a steady stream of income, but they may not always be the best option for everyone. You can compare annuities with drawdown options and their respective advantages in this article: Annuity Or Drawdown 2024.

Weighing the pros and cons of each option can help you choose the strategy that aligns with your financial goals.

Scenario: Retirement Planning

Imagine you’re planning for retirement and want to know how much you need to save annually to reach your desired retirement fund goal. You can use Excel’s annuity functions to calculate the required annual savings amount, considering your expected return on investment (interest rate) and the number of years until retirement.

The process of receiving annuity payments can vary depending on the type of annuity you choose. You can learn more about how annuity payments are typically structured in this article: Annuity Is Given By 2024. Understanding the payment structure can help you manage your expectations and plan for the future.

Steps:

- Define your goal:Set your desired retirement fund amount.

- Example: $1,000,000

- Determine the investment period:Calculate the number of years until retirement.

- Example: 20 years

- Estimate the return on investment:Research and determine a reasonable interest rate for your investment strategy.

- Example: 6% annual return

- Use the PMT function:Calculate the required annual savings using the PMT function in Excel.

=PMT(rate, nper, pv, [fv], [type])

- Rate: 6%

- NPER: 20 years

- PV: 0 (assuming you start saving from scratch)

- FV: $1,000,000

- Result:The PMT function will calculate the annual savings required to reach your retirement goal. In this example, the required annual savings would be approximately $27,740.

Impact of Different Interest Rates

The interest rate significantly impacts the required savings amount. A higher interest rate allows you to save less annually to reach your goal. Conversely, a lower interest rate requires higher annual savings. By analyzing different interest rate scenarios, you can make informed decisions about your investment strategy and adjust your savings plan accordingly.

If you’re considering an annuity for retirement income, you can use an annuity calculator to estimate your potential payments. You can find a lifetime annuity calculator that can help you project your income in this article: Annuity Calculator Lifetime 2024.

This calculator can provide valuable insights into your potential retirement income.

Advanced Concepts and Considerations

Annuity calculations can be further refined by considering compounding frequency, inflation, and other economic factors.

Compounding Frequency, Calculate Interest Rate Annuity Excel 2024

Compounding frequency refers to how often interest is calculated and added to the principal. More frequent compounding leads to higher future values. Excel’s annuity functions allow you to specify the compounding frequency using the “type” argument. A value of 0 indicates payments at the end of each period (ordinary annuity), while a value of 1 indicates payments at the beginning of each period (annuity due).

Inflation

Inflation erodes the purchasing power of money over time. To account for inflation, you can adjust the interest rate used in annuity calculations. This is done by subtracting the expected inflation rate from the nominal interest rate to get the real interest rate.

An annuity is a financial product that provides a stream of payments over a period of time. To understand what an annuity is, you can read more about it in this article: An Annuity Is Defined As 2024. These payments can be fixed or variable, and they can be used for a variety of purposes, such as retirement income, income for life, or even to pay off debt.

For example, if the nominal interest rate is 5% and the inflation rate is 2%, the real interest rate is 3%.

Methods for Calculating Interest Rates

- Excel RATE function:This is the most common method for calculating interest rates in annuities. It’s straightforward and efficient.

=RATE(nper, pmt, pv, [fv], [type], [guess])

- Goal Seek:This method uses Excel’s Goal Seek tool to find the interest rate that makes the future value equal to a target value. It’s useful for scenarios where you want to achieve a specific future value.

- Iteration:This method involves manually adjusting the interest rate until the future value matches the target value. It’s less efficient than the other methods but provides a deeper understanding of the relationship between interest rates and future values.

Last Word

By mastering the art of calculating interest rates for annuities in Excel, you unlock a powerful tool for financial analysis. This guide has equipped you with the knowledge and skills to confidently navigate the world of annuities, whether you’re planning for retirement, managing a loan, or making investment decisions.

Remember, the power of Excel lies in its ability to streamline complex calculations and provide valuable insights into your financial journey. So, embrace the power of Excel, and let it guide you towards achieving your financial goals.

General Inquiries

What are the different types of annuities?

There are various types of annuities, including ordinary annuities, annuities due, and perpetuities. Ordinary annuities involve payments made at the end of each period, while annuities due involve payments at the beginning. Perpetuities are annuities that continue indefinitely.

How do I account for inflation when calculating interest rates for annuities?

You can account for inflation by using a real interest rate, which adjusts the nominal interest rate for inflation. Excel provides functions to calculate both nominal and real interest rates.

Can I use Excel to calculate interest rates for annuities with varying payment frequencies?

Yes, Excel allows you to adjust the payment frequency in annuity calculations. You can specify whether payments are made monthly, quarterly, annually, or at any other desired frequency.

What are some common applications of annuity calculations in Excel?

When you’re looking into annuities, it’s important to understand who is issuing them. You can learn more about annuity issuers and their role in the market by reading this article: Annuity Issuer 2024. These companies play a crucial role in ensuring the stability and security of your annuity payments.

Annuity calculations are widely used in financial planning, such as calculating retirement income, mortgage payments, and loan repayments. They can also be applied to investment analysis, determining the future value of investments and the present value of future cash flows.