Annuity Calculator Soup 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Navigating the complex world of retirement planning can be daunting, but with the right tools and resources, it can be a smooth and rewarding journey.

While annuities typically involve regular payments, there are also single payment annuities. To understand more about single payment annuities, you can find more information on the Annuity Is Single Payment 2024 page.

Annuity Calculator Soup provides a comprehensive platform for understanding and exploring annuities, one of the essential components of a robust retirement strategy.

While annuities are primarily associated with retirement planning, they can also be used to supplement health insurance. To learn more about this aspect of annuities, visit the Annuity Health Insurance 2024 page.

This guide delves into the intricacies of annuities, exploring their various types, benefits, and potential drawbacks. We will guide you through the process of utilizing annuity calculators effectively, empowering you to make informed decisions about your retirement savings. Furthermore, we will analyze the current market conditions and their impact on annuities, keeping you informed about the latest trends and regulations within this industry.

An annuity is a financial product that provides a guaranteed stream of income for a specific period of time. To understand the definition of an annuity, you can visit the Annuity Is Definition 2024 page.

Contents List

Understanding Annuities

Annuities are financial products that provide a stream of regular payments for a specific period. They are often used for retirement planning, but can also be used for other purposes, such as funding college expenses or providing income during a period of disability.

An annuitant is someone who receives payments from an annuity. If you’re interested in learning more about the rights and responsibilities of an annuitant, check out the K Is An Annuitant Currently Receiving Payments 2024 page.

Types of Annuities, Annuity Calculator Soup 2024

Annuities come in a variety of forms, each with its own unique features and benefits. Some common types of annuities include:

- Fixed annuities:These annuities guarantee a fixed rate of return, providing predictable income payments.

- Variable annuities:These annuities offer the potential for higher returns, but also carry more risk. The value of the annuity is tied to the performance of underlying investments, such as stocks or bonds.

- Indexed annuities:These annuities offer a combination of guaranteed income payments and potential growth tied to a specific market index, such as the S&P 500.

Purpose and Benefits of Annuities

Annuities can be a valuable tool for retirement planning, offering a number of benefits, such as:

- Guaranteed income stream:Annuities can provide a steady stream of income for life, regardless of market conditions.

- Protection from market volatility:Fixed annuities offer protection from market downturns, providing peace of mind during retirement.

- Tax advantages:Annuity payments may be taxed differently than other forms of income, potentially resulting in tax savings.

Risks and Drawbacks of Annuities

While annuities can offer significant benefits, it is important to be aware of their potential risks and drawbacks:

- Limited liquidity:Annuities are typically illiquid, meaning that it can be difficult to access your funds before the annuity’s maturity date.

- High fees:Annuities often come with high fees, which can eat into your returns.

- Potential for loss of principal:Variable annuities are subject to market risk, and the value of your annuity can fluctuate.

Annuity Calculators

Annuity calculators are online tools that help you estimate the potential returns and payments of an annuity. They can be a valuable resource for understanding the different types of annuities and making informed decisions about your retirement planning.

Annuity loans are a type of loan where the borrower makes regular payments over a set period of time. You can learn more about the formula used for annuity loans on the Annuity Loan Formula 2024 page.

Functionality of Annuity Calculators

Annuity calculators typically allow you to input various factors, such as:

- The amount of your initial investment

- The type of annuity

- The interest rate or growth rate

- The duration of the annuity

Based on these inputs, the calculator will provide estimates of:

- The total amount of income you can expect to receive

- The monthly or annual payment amount

- The potential growth of your investment

Comparison of Annuity Calculator Features

Annuity calculators vary in their features and options. Some calculators offer more advanced features, such as the ability to:

- Adjust for inflation

- Factor in taxes

- Compare different annuity products

Advantages and Disadvantages of Online Annuity Calculators

Online annuity calculators offer a number of advantages, such as:

- Convenience:Calculators are available 24/7, allowing you to access them at your convenience.

- Free of charge:Most online calculators are free to use.

- Easy to use:Calculators are typically user-friendly and require minimal input.

However, there are also some potential disadvantages to consider:

- Limited scope:Calculators may not provide a complete picture of all the factors involved in annuity planning.

- Potential for inaccuracies:Calculators rely on user inputs, which may not always be accurate.

- Lack of personalized advice:Calculators cannot provide personalized financial advice.

Annuity Calculator Soup

Annuity Calculator Soup is a comprehensive resource that provides access to a wide variety of annuity calculators. This platform allows you to compare different calculators and find the one that best meets your needs.

Annuity due payments are made at the beginning of each period, rather than at the end. To understand how to calculate annuity due payments, you can find resources on the Calculating Annuity Due Payment 2024 page.

Types of Annuity Calculators in Annuity Calculator Soup

Annuity Calculator Soup offers a diverse range of calculators, including:

- Fixed annuity calculators

- Variable annuity calculators

- Indexed annuity calculators

- Immediate annuity calculators

- Deferred annuity calculators

Benefits of Using Annuity Calculator Soup

Annuity Calculator Soup can be a valuable resource for consumers researching annuities, offering benefits such as:

- Comprehensive comparison:The platform allows you to compare different calculators side-by-side.

- Variety of options:Annuity Calculator Soup provides access to a wide range of calculators, ensuring you find the right one for your needs.

- Easy to use interface:The platform is designed to be user-friendly and intuitive.

Using Annuity Calculators Effectively

To make the most of annuity calculators, it’s important to use them effectively. Here are some best practices to follow:

Best Practices for Using Annuity Calculators

- Use multiple calculators:Compare results from different calculators to get a broader perspective.

- Be realistic about your inputs:Input accurate and realistic data to ensure accurate results.

- Consider all factors:Don’t rely solely on calculator results; factor in other relevant factors, such as your financial goals, risk tolerance, and tax situation.

Key Factors to Consider When Inputting Data

When using an annuity calculator, consider the following key factors:

- Your age and life expectancy:These factors will affect the duration of your annuity payments.

- Your investment goals:What are you hoping to achieve with your annuity?

- Your risk tolerance:How much risk are you willing to take on?

Interpreting and Analyzing Calculator Results

Once you have obtained results from an annuity calculator, it’s important to interpret them carefully. Consider:

- The assumptions used in the calculation:Understand the assumptions behind the calculator’s results, such as the interest rate or growth rate.

- The potential for variations:Remember that annuity calculators provide estimates, and actual results may vary.

- The overall financial picture:Consider how the calculator’s results fit into your overall financial plan.

The Role of Annuity Calculators in Financial Planning

Annuity calculators can play a valuable role in your financial planning process. They can help you:

Assessing Retirement Needs and Goals

Annuity calculators can help you determine how much income you will need in retirement and how much you need to save to reach your goals. By inputting your desired retirement income and other relevant factors, you can get an estimate of the annuity payments you would need to receive to meet your needs.

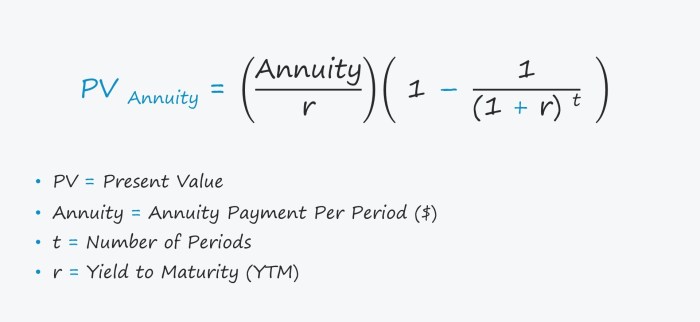

Annuity formulas are used to calculate the present value, future value, or payment amount of an annuity. If you’re looking for practice questions involving annuity formulas, you can find them on the Annuity Formula Questions 2024 page.

Making Informed Investment Decisions

Annuity calculators can help you compare different annuity products and make informed investment decisions. By inputting your investment goals, risk tolerance, and other factors, you can get estimates of the potential returns and risks associated with different annuities.

Annuities are used in a variety of financial situations, including retirement planning, estate planning, and income generation. To learn more about the various uses of annuities, visit the Annuity Is Used In 2024 page.

Integrating into Broader Financial Planning Strategies

Annuity calculators can be integrated into broader financial planning strategies, such as:

- Retirement planning:Annuities can be a key component of your retirement plan, providing a steady stream of income.

- Estate planning:Annuities can be used to provide for your loved ones after your death.

- Long-term care planning:Annuities can help you fund long-term care expenses.

Considerations for 2024

The annuity market is constantly evolving, and there are a number of factors to consider for 2024.

An annuity is a financial contract that provides a guaranteed stream of income for a specific period of time. You can learn more about the basics of annuities on the Annuity Is 2024 page.

Market Conditions and Their Impact on Annuity Products

Interest rates and market volatility can have a significant impact on annuity products. In a rising interest rate environment, fixed annuities may become more attractive, while variable annuities may become less appealing. Conversely, in a low-interest rate environment, variable annuities may offer more potential for growth.

The annuity factor is a key component in annuity calculations. To understand how to calculate the annuity factor on a financial calculator, you can find helpful resources on the Calculate Annuity Factor On Ba Ii Plus 2024 page.

Recent Changes to Annuity Regulations or Legislation

There have been recent changes to annuity regulations, such as the SECURE Act 2.0, which has made changes to retirement savings rules. These changes can impact the availability and features of annuity products.

An annuity is a common topic in financial exams and quizzes. If you’re looking for practice multiple-choice questions about annuities, you can find them on the Annuity Is Mcq 2024 page.

Emerging Trends in the Annuity Industry

The annuity industry is constantly evolving, with new products and features emerging. Some emerging trends include:

- Increased use of technology:Annuity companies are increasingly using technology to improve customer service and make it easier to purchase and manage annuities.

- Focus on personalization:Annuity companies are developing products that are tailored to the specific needs of individual consumers.

- Growth of hybrid products:Hybrid annuities combine features of fixed and variable annuities, offering a balance of guaranteed income and growth potential.

Outcome Summary: Annuity Calculator Soup 2024

As you embark on your retirement planning journey, remember that Annuity Calculator Soup 2024 is your comprehensive companion. By understanding the nuances of annuities and utilizing the powerful tools available, you can confidently navigate the complexities of retirement savings.

Let this guide serve as your roadmap, empowering you to make informed decisions that will secure a comfortable and fulfilling future.

An annuity beneficiary is the person or entity that receives the annuity payments after the annuitant dies. If you’re curious about how trusts can be used as annuity beneficiaries, you can find more information on the Annuity Beneficiary Is A Trust 2024 page.

FAQ Overview

What is the main purpose of Annuity Calculator Soup 2024?

Annuity Calculator Soup 2024 aims to provide a comprehensive resource for individuals to understand and explore annuities as a part of their retirement planning.

An annuity is a financial product that provides a stream of regular payments over a set period of time. You can find a clear and concise definition of what an annuity is on the An Annuity Is Known 2024 page.

Are there any specific types of annuities covered in this resource?

Annuity products in Kenya are becoming increasingly popular as people look for ways to secure their financial future. If you’re interested in learning more about these products, you can find comprehensive information on the Annuity Kenya 2024 page.

Yes, this guide discusses various types of annuities, including fixed annuities, variable annuities, and indexed annuities, among others.

How can I access the annuity calculators mentioned in this guide?

You can find a wide range of annuity calculators online, many of which are integrated into the Annuity Calculator Soup platform. We provide links and resources to help you locate the most suitable calculators for your needs.

Annuity calculators are helpful tools for estimating the potential payments or present value of an annuity. If you’re looking for a user-friendly annuity calculator, you can find one on the Annuity Calculator Cnn 2024 page.