Is Annuity Income 2024 the right choice for your retirement planning? Annuities, a financial product designed to provide a stream of income during retirement, have become increasingly popular as individuals seek secure and predictable income streams. This guide explores the various types of annuities available, their features, and how they can impact your retirement finances.

We delve into the key factors to consider, such as current interest rates, potential risks, and the suitability of annuities for different financial goals. Furthermore, we compare annuities to other retirement income sources and provide tips for choosing the right annuity to meet your individual needs.

Many people confuse annuities with pensions. Get clarity on the differences and similarities between Is Annuity The Same As Pension 2024.

Contents List

Understanding Annuities in 2024

Annuities are financial products that provide a stream of income payments for a specified period, often used to supplement retirement income. In 2024, annuities remain a popular option for individuals seeking guaranteed income and protection against longevity risk. Understanding the different types of annuities, their features, and potential tax implications is crucial for making informed financial decisions.

Want to calculate annuities using your TI-84 calculator? Learn the steps involved in Calculate Annuity On Ti 84 2024 for accurate financial calculations.

Types of Annuities

Annuities are broadly categorized into two main types: fixed and variable annuities. Each type offers distinct features and benefits, tailored to different risk tolerances and financial goals.

For accounting professionals, understanding how to calculate annuities is essential. Learn the methods for Calculating Annuity In Accounting 2024 and its impact on financial statements.

- Fixed Annuities:Fixed annuities provide a guaranteed rate of return on the principal investment. The payments received are fixed and predictable, making them ideal for individuals seeking stability and certainty. However, the fixed rate of return may not keep pace with inflation, potentially reducing the purchasing power of income over time.

- Variable Annuities:Variable annuities offer the potential for higher returns but come with greater risk. The value of the annuity is linked to the performance of underlying investments, such as mutual funds or stocks. This means that the income payments can fluctuate based on market conditions.

Variable annuities may be suitable for individuals with a higher risk tolerance and a longer investment horizon.

Key Features and Benefits

Annuities offer various features and benefits that can enhance retirement planning. These include:

- Guaranteed Income:Annuities provide a stream of income payments for a predetermined period, offering financial security and peace of mind.

- Longevity Protection:Annuities can help mitigate the risk of outliving your savings, ensuring a consistent income stream even in your later years.

- Tax Advantages:Depending on the type of annuity, certain tax benefits may be available, such as tax deferral on investment growth or tax-free withdrawals.

- Death Benefit:Some annuities offer a death benefit, which provides a lump-sum payment to beneficiaries upon the annuitant’s death.

Tax Implications of Annuity Income

The tax treatment of annuity income depends on the specific type of annuity and the timing of withdrawals. Generally, the principal invested in an annuity is not taxed until it is withdrawn. However, the interest or earnings generated by the annuity are taxable as ordinary income.

Considering Annuity Gator for your retirement planning? We’ve got you covered with information on Is Annuity Gator Legit 2024 and its legitimacy.

It’s important to consult with a tax professional to understand the tax implications of your specific annuity product and how it might affect your overall tax liability.

If you’re in the UK, there are specific regulations and options for annuities. Explore the details of Annuity Uk 2024 and its impact on your retirement planning.

Annuity Income in 2024: Factors to Consider: Is Annuity Income 2024

Before making a decision about annuities, it’s essential to consider several factors that can influence the suitability and potential outcomes of this financial product.

Understand the tax implications of annuities in 2024. Learn if your annuity is Is Annuity Tax Deferred 2024 or not.

Current Interest Rate Environment

Interest rates play a significant role in annuity payouts. In a low-interest rate environment, annuity payouts may be lower than in a high-interest rate environment. The current interest rate environment is characterized by relatively low rates, which can impact the returns offered by fixed annuities.

When considering an annuity, understanding the Annuity Issuer 2024 is crucial. Look for reputable and reliable providers to ensure your financial security.

However, variable annuities may offer the potential for higher returns if the underlying investments perform well.

Looking for annuity options in Kenya? Discover the details of Annuity Kenya 2024 and its implications for your retirement planning.

Potential Risks and Downsides

Annuities are not without risks and downsides. It’s crucial to understand these aspects before making a commitment.

Many people wonder if annuity income is considered capital gains. Find out the answer to Is Annuity Income Capital Gains 2024 and understand its implications.

- Limited Liquidity:Annuities typically involve a surrender charge for early withdrawals, making them less liquid than other investments.

- Potential for Lower Returns:Fixed annuities offer a guaranteed rate of return, but this rate may be lower than other investment options, potentially leading to lower returns over time.

- Complexity:Annuities can be complex financial products with various features and terms. Understanding the intricacies of a specific annuity product is essential before making a purchase.

Suitability for Different Financial Goals and Situations

Annuities may be suitable for different financial goals and situations. They can be valuable for:

- Guaranteed Income:Individuals seeking a predictable and reliable income stream in retirement.

- Longevity Protection:People concerned about outliving their savings and needing a consistent income source in their later years.

- Tax Advantages:Individuals seeking tax deferral or tax-free withdrawals.

However, annuities may not be suitable for everyone. For instance, individuals with a high risk tolerance and a longer investment horizon may find other investment options more appealing. It’s important to assess your individual financial situation, risk tolerance, and financial goals to determine if an annuity is the right choice for you.

Are you looking for a new career path in 2024? The Annuity Jobs 2024 market is growing, offering exciting opportunities for individuals with financial expertise.

Annuity Income in 2024: Comparison to Other Retirement Income Sources

Annuities are just one of many retirement income sources available. Comparing them to other options can help you make an informed decision about how to structure your retirement income plan.

Make informed decisions about your annuity with the help of a Financial Calculator Annuity 2024.

Benefits and Drawbacks of Other Retirement Income Sources

Other retirement income sources include:

- Social Security:A government-funded program providing monthly benefits to eligible retirees. It offers guaranteed income but may not be sufficient to cover all retirement expenses.

- Pensions:Traditional defined-benefit plans provide a fixed monthly payment to retirees based on their years of service and salary. They offer guaranteed income but are becoming less common.

- Investments:Stocks, bonds, mutual funds, and other investments can generate income and growth potential. However, they also carry investment risk and require active management.

Scenarios Where Annuities Might Be a Suitable Choice

Annuities can be a suitable choice in various scenarios, such as:

- Individuals with a high risk aversion:Fixed annuities provide guaranteed income and can reduce the anxiety associated with market volatility.

- People seeking longevity protection:Annuities can ensure a consistent income stream even in their later years, mitigating the risk of outliving their savings.

- Individuals with a specific income goal:Annuities can help individuals achieve a predetermined income level in retirement.

Comparison Table of Retirement Income Sources

| Retirement Income Source | Guaranteed Income | Growth Potential | Tax Advantages | Liquidity | Risk |

|---|---|---|---|---|---|

| Social Security | Yes | Limited | Taxable | Not applicable | Government funding risk |

| Pensions | Yes | Limited | Taxable | Not applicable | Employer solvency risk |

| Fixed Annuities | Yes | Limited | Tax deferral | Limited | Interest rate risk |

| Variable Annuities | No | High | Tax deferral | Limited | Market risk |

| Investments | No | High | Taxable | High | Market risk |

Choosing the Right Annuity in 2024

Selecting the right annuity requires careful consideration of your individual financial goals, risk tolerance, and investment horizon. Here are some tips to guide your decision-making process.

Tips for Selecting an Annuity

- Define your financial goals:Determine what you hope to achieve with an annuity, whether it’s guaranteed income, longevity protection, or tax advantages.

- Assess your risk tolerance:Consider your comfort level with market volatility and potential losses. Fixed annuities offer lower risk but may provide lower returns, while variable annuities offer higher growth potential but come with greater risk.

- Compare different annuity products:Research various annuity products from different providers to find one that aligns with your needs and financial goals.

- Consider the fees and charges:Compare the fees and charges associated with different annuity products, as these can significantly impact your returns.

- Consult with a financial advisor:Seek advice from a qualified financial advisor to understand the intricacies of annuities and how they can fit into your overall financial plan.

Key Factors to Consider When Comparing Annuities

- Guaranteed rate of return:For fixed annuities, compare the guaranteed rate of return offered by different providers.

- Investment options:For variable annuities, evaluate the underlying investments available and their performance history.

- Fees and charges:Compare the fees and charges associated with different annuity products, such as surrender charges, administrative fees, and mortality and expense charges.

- Death benefit:If a death benefit is important to you, compare the features and benefits offered by different annuity products.

Annuities and the Future of Retirement Planning

Annuities are expected to play an increasingly significant role in retirement planning as individuals seek to secure a reliable income stream and protect themselves against longevity risk. Emerging trends in annuity products and the potential impact on retirement income are worth exploring.

Still unsure about what an annuity is? Get a comprehensive explanation with examples in our guide on Annuity Meaning With Example 2024.

Role of Annuities in a Diversified Retirement Portfolio, Is Annuity Income 2024

Annuities can serve as a valuable component of a diversified retirement portfolio, providing a guaranteed income stream to supplement other retirement income sources. They can help mitigate the risk of outliving your savings and ensure a consistent income flow throughout retirement.

Emerging Trends in Annuity Products

The annuity market is constantly evolving, with new products and features emerging to meet the changing needs of retirees. Some emerging trends include:

- Income-for-life annuities:These annuities provide a guaranteed income stream for the rest of the annuitant’s life, offering maximum longevity protection.

- Hybrid annuities:These products combine features of both fixed and variable annuities, offering a balance between guaranteed income and growth potential.

- Indexed annuities:These annuities link their returns to the performance of a specific index, such as the S&P 500, offering potential for growth with some downside protection.

Potential Growth of Annuity Income Over Time

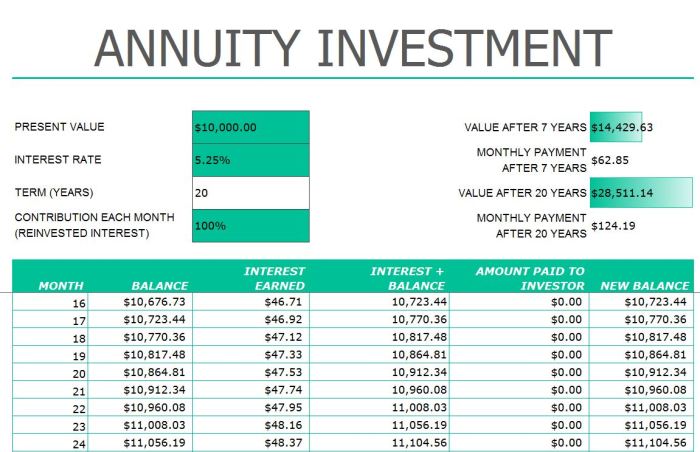

Annuities can provide a predictable and consistent income stream throughout retirement. The potential growth of annuity income over time can be illustrated through a visual representation. This representation would demonstrate the compounding effect of annuity payments, showing how the total income received can increase over time.

Explore the different types of annuities available in 2024. Learn about the various Annuity Kinds 2024 and choose the one that best suits your needs.

However, it’s important to note that the actual growth of annuity income will depend on the specific type of annuity, the interest rate environment, and the performance of any underlying investments.

Planning for your future income? Discover the details of receiving a Annuity 2000 Per Month 2024 and its potential benefits.

Final Thoughts

Understanding the intricacies of annuity income in 2024 is crucial for making informed retirement planning decisions. By carefully considering the various factors discussed in this guide, you can determine if annuities are a suitable component of your retirement portfolio. Remember, consulting with a financial advisor is always recommended to ensure your choices align with your unique financial goals and risk tolerance.

Need to calculate the future value of your growing annuity? Learn how to use Excel to do just that with our guide on Calculate Growing Annuity In Excel 2024.

Top FAQs

What is the difference between a fixed and variable annuity?

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s return fluctuates based on the performance of the underlying investments.

Are annuity payments taxable?

Yes, annuity payments are generally taxable as ordinary income. However, the tax treatment can vary depending on the type of annuity and how it was purchased.

How do I choose the right annuity for me?

Consider your financial goals, risk tolerance, and time horizon. Consult with a financial advisor to determine the best annuity type and provider for your needs.