Pv Annuity Sheet 2024 sets the stage for understanding the financial landscape of the year, providing a powerful tool for individuals and businesses alike. It offers a comprehensive framework for assessing the present value of future cash flows, making informed decisions about investments, savings, and debt management.

If you’re evaluating an annuity’s profitability, you’ll need to calculate its net present value. Annuity Npv Calculator 2024 can help you with that.

This sheet, a cornerstone of financial planning, empowers users to analyze various financial scenarios, from retirement planning to mortgage decisions, with a clear and insightful perspective. It takes into account key factors like interest rates, time periods, and payment frequencies, enabling users to make informed choices based on a solid foundation of data and calculations.

To understand how annuities are calculated, you can visit How Annuity Is Calculated 2024. It breaks down the process in a clear and concise manner.

Contents List

Understanding PV Annuity Sheets

A PV Annuity Sheet, or Present Value Annuity Sheet, is a powerful tool in financial planning that helps individuals understand the value of future cash flows in today’s dollars. By considering factors such as interest rates, time periods, and payment frequencies, a PV Annuity Sheet allows you to assess the present value of a stream of future payments, making informed decisions about investments, loans, and other financial products.

Purpose of a PV Annuity Sheet

The primary purpose of a PV Annuity Sheet is to determine the present value of a series of future payments, often referred to as an annuity. This is crucial for financial planning because it helps individuals compare different financial products and opportunities on an equal footing, considering the time value of money.

Calculating annuities for FERS (Federal Employees Retirement System) can be complex. You can find helpful information on Calculate Annuity Fers 2024.

For example, a PV Annuity Sheet can help you determine which investment option offers a better return, taking into account the present value of future earnings.

Calculator.net offers a tool for calculating annuity payouts. Visit Calculator.Net Annuity Payout 2024 for a convenient option.

Key Elements and Components

A typical PV Annuity Sheet consists of several key elements that work together to calculate the present value:

- Annuity Payment (PMT):The amount of each regular payment in the stream of future payments.

- Interest Rate (r):The rate of return or discount rate used to calculate the present value.

- Number of Periods (n):The total number of periods over which the payments are made.

- Present Value (PV):The calculated value of the future payments in today’s dollars.

Examples of Usage in Financial Planning

PV Annuity Sheets find applications in various financial planning scenarios:

- Retirement Planning:Determining the present value of future retirement income streams to ensure sufficient savings for retirement.

- Mortgage Analysis:Assessing the present value of future mortgage payments to compare different loan options.

- Investment Evaluation:Comparing the present value of returns from different investment opportunities to make informed investment decisions.

Key Concepts in PV Annuity Calculations

Understanding the key concepts behind PV Annuity calculations is essential for using the tool effectively. These concepts include present value (PV), annuity, discounting, and the factors that influence the calculation.

Present Value (PV) and Annuity

Present Value (PV)refers to the current worth of a future sum of money or stream of payments, considering the time value of money. In other words, it’s the amount of money you would need today to have the same value as a future sum, taking into account the potential for investment growth.

The Annuity 2000 Basic Mortality Table 2024 is a valuable tool for understanding mortality rates, which are crucial for annuity calculations.

Annuityis a series of equal payments made at regular intervals, such as monthly mortgage payments or annual pension payments. A PV Annuity Sheet specifically calculates the present value of such a series of payments.

Discounting

Discountingis the process of calculating the present value of future cash flows. It involves using a discount rate to reduce the future value to its present value. The discount rate reflects the opportunity cost of money, meaning the potential return you could earn by investing the money elsewhere.

For those interested in short-term annuities, Annuity 5 Year Payout 2024 explains how these work and their potential benefits.

Factors Influencing PV Annuity Calculations, Pv Annuity Sheet 2024

Several factors influence PV Annuity calculations, impacting the present value result:

- Interest Rate (r):A higher interest rate leads to a lower present value, as the future payments are discounted at a higher rate.

- Number of Periods (n):A longer time period results in a lower present value, as the future payments are discounted over a longer duration.

- Payment Frequency:More frequent payments generally lead to a higher present value, as the payments are discounted over shorter intervals.

Practical Applications of PV Annuity Sheets in 2024

PV Annuity Sheets remain relevant and widely used in 2024, finding practical applications in various financial scenarios. These applications are shaped by current economic trends and market conditions.

To determine how much annuity you can expect with a specific principal amount, explore How Much Annuity For 80000 2024 for insights.

Real-World Scenarios

Here are some real-world scenarios where PV Annuity Sheets are used in 2024:

- Retirement Planning:With increased life expectancies and potential market volatility, individuals are using PV Annuity Sheets to project their retirement income needs and adjust their savings strategies accordingly.

- Mortgage Refinancing:In a fluctuating interest rate environment, PV Annuity Sheets help homeowners assess the potential savings from refinancing their mortgages.

- Investment Analysis:As investors navigate complex market conditions, PV Annuity Sheets are used to compare the present value of returns from different investment options, such as stocks, bonds, and real estate.

Impact of Economic Trends

Current economic trends, such as inflation and interest rate fluctuations, directly impact PV Annuity calculations. Higher inflation rates can reduce the present value of future payments, while rising interest rates can increase the discount rate, leading to lower present values.

Annuity Gator, a popular financial product, is explained in detail in Annuity Gator 2024. It’s worth checking out if you’re considering this type of annuity.

For example, in a high-inflation environment, the present value of a fixed-income annuity stream might be lower than in a low-inflation environment, as the purchasing power of future payments is eroded.

The term “9 Annuity” might sound confusing. To clarify, 9 Annuity 2024 provides an explanation of this specific type of annuity.

Tools and Resources for Creating PV Annuity Sheets

Numerous software programs and online tools are available to help individuals create PV Annuity Sheets, offering varying levels of functionality and ease of use.

When dealing with annuities, it’s important to be aware of potential issues. Annuity Issues 2024 provides insights into common challenges.

Popular Software and Online Tools

- Microsoft Excel:A versatile spreadsheet program that allows users to create custom PV Annuity calculations using built-in financial functions.

- Google Sheets:A free online spreadsheet program that offers similar functionality to Excel, making it accessible to anyone with an internet connection.

- Financial Calculators:Dedicated financial calculators, both physical and online, are specifically designed for PV Annuity calculations and other financial computations.

- Financial Planning Software:Comprehensive financial planning software packages often include PV Annuity calculation features as part of their broader financial analysis tools.

Advantages and Disadvantages

The choice of tool depends on individual needs and preferences. Consider the following advantages and disadvantages:

| Tool | Advantages | Disadvantages |

|---|---|---|

| Microsoft Excel/Google Sheets | Highly customizable, versatile, and widely accessible. | Requires basic spreadsheet knowledge, may be time-consuming for complex calculations. |

| Financial Calculators | User-friendly, specifically designed for financial calculations. | Limited customization options, may not be suitable for complex scenarios. |

| Financial Planning Software | Comprehensive features, integrated with other financial planning tools. | Can be expensive, may have a steep learning curve. |

Choosing the Right Tool

When selecting a tool, consider the following factors:

- Complexity of the calculation:For simple calculations, a financial calculator or online tool may suffice. For complex scenarios, spreadsheet software or financial planning software may be more suitable.

- Customization needs:If you require a high level of customization, spreadsheet software like Excel or Google Sheets is a good option.

- Budget:Free online tools or financial calculators are readily available, while spreadsheet software and financial planning software may involve costs.

Considerations for Using PV Annuity Sheets

While PV Annuity Sheets are valuable tools, it’s crucial to understand their limitations and potential pitfalls to make informed financial decisions.

Understanding how much annuity is needed over a specific period is crucial. What Annuity Is Required Over 12 Years 2024 provides guidance on this aspect.

Limitations and Potential Pitfalls

- Assumptions and Uncertainties:PV Annuity calculations rely on assumptions about future interest rates, inflation, and other economic variables. These assumptions may not always hold true, leading to inaccurate results.

- Time Value of Money:The concept of time value of money is based on the potential for investment growth. However, actual returns may deviate from expected rates, affecting the accuracy of present value calculations.

- Oversimplification:PV Annuity calculations often simplify complex financial situations, neglecting factors such as taxes, fees, and other expenses that can impact the true value of future payments.

Importance of Professional Advice

When making significant financial decisions based on PV Annuity calculations, it’s essential to seek professional financial advice. A qualified financial advisor can help you understand the limitations of PV Annuity Sheets, consider relevant factors, and develop a comprehensive financial plan that aligns with your goals and risk tolerance.

If you’re looking to understand the concept of an annuity, you might be interested in reading about Annuity 60000 2024. It provides a starting point to explore this financial instrument.

Final Conclusion: Pv Annuity Sheet 2024

Understanding and utilizing the Pv Annuity Sheet 2024 is crucial for navigating the complexities of modern finance. It empowers individuals to make informed financial decisions, optimizing their resources and achieving their long-term financial goals. While the sheet provides valuable insights, it’s important to remember that it’s just one piece of the puzzle.

Consulting with a qualified financial advisor can provide personalized guidance and help tailor financial strategies to individual needs and circumstances.

If you’re looking for a tool to calculate annuity payouts, Annuity Calculator Nsdl 2024 might be helpful.

Essential FAQs

What are some common uses of a PV Annuity Sheet in 2024?

PV Annuity Sheets are used in various scenarios, including assessing the value of different investment options, evaluating the affordability of a mortgage, planning for retirement, and determining the present value of future income streams.

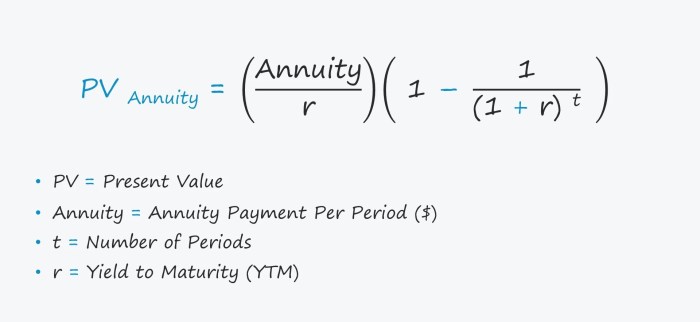

Is there a specific formula used for calculating PV Annuity?

Calculating annuities can be done on a calculator like the TI-84, check out Calculate Annuity On Ti 84 2024 for a guide.

Yes, the formula for calculating PV Annuity takes into account the amount of each payment, the interest rate, the number of periods, and the frequency of payments.

How can I create a PV Annuity Sheet?

There are numerous software programs and online tools available that can help you create a PV Annuity Sheet. You can also create one manually using a spreadsheet program.

Are there any risks associated with using a PV Annuity Sheet?

While annuities can be beneficial, it’s important to consider their drawbacks. For a balanced perspective, check out Why An Annuity Is Bad 2024.

While PV Annuity Sheets are useful tools, it’s important to remember that they rely on assumptions about future events. Changes in interest rates, economic conditions, or personal circumstances can affect the accuracy of the calculations.