Calculate Annuity Using BA II Plus 2024 sets the stage for this comprehensive guide, empowering you to confidently navigate the intricacies of annuity calculations using the powerful BA II Plus calculator. This guide delves into the fundamental concepts of annuities, including their different types and applications in financial planning.

If you’re considering buying an annuity, it’s a good idea to speak with a financial advisor. They can help you understand the different types of annuities available and choose one that’s right for you. You can also use an online calculator to help you estimate the potential payouts of an annuity.

Calculating Annuity Excel 2024 is a great tool for this.

It then provides a detailed walkthrough of the BA II Plus calculator’s features, step-by-step instructions for accessing annuity functions, and clear explanations of key input variables.

The word “annuity” has seven letters. You can find out more about the history and etymology of the word “annuity” on Annuity 7 Letters 2024.

From calculating the present and future values of annuities to determining the appropriate payment amount, this guide equips you with the knowledge and practical skills to effectively utilize the BA II Plus calculator for various annuity scenarios. It also addresses common errors encountered during calculations, offering solutions and insights to ensure accurate and reliable results.

A simple annuity is an annuity where payments are made at the end of each period. To calculate the present value of a simple annuity, you can use a simple formula. Calculating Simple Annuity 2024 provides a breakdown of the formula and how to use it.

Contents List

Understanding Annuities

An annuity is a series of equal payments made over a specified period of time. Annuities are commonly used in financial planning for retirement savings, loan repayment, and other financial goals. Understanding the different types of annuities and their components is crucial for effective financial decision-making.

If you’re looking for a way to guarantee a stream of income for yourself or your loved ones, an annuity may be a good option for you. G Purchased A $50 000 Single Premium 2024 is a great example of how an annuity can provide financial security.

Components of an Annuity, Calculate Annuity Using Ba Ii Plus 2024

The key components of an annuity are:

- Present Value (PV):The current value of a future stream of payments.

- Future Value (FV):The value of an annuity at a future point in time.

- Payment Amount (PMT):The amount of each equal payment made in the annuity.

- Interest Rate (I/Y):The annual interest rate earned on the annuity.

- Time Period (N):The total number of payment periods in the annuity.

Types of Annuities

Annuities can be categorized into two main types:

- Ordinary Annuity:Payments are made at the end of each period. This is the most common type of annuity.

- Annuity Due:Payments are made at the beginning of each period. This type of annuity generally yields a higher future value than an ordinary annuity.

Applications of Annuities in Financial Planning

Annuities have a wide range of applications in financial planning, including:

- Retirement Savings:Annuities can be used to provide a steady stream of income during retirement.

- Loan Repayment:Annuities are commonly used to structure loan payments, such as mortgages and auto loans.

- Investment Planning:Annuities can be used to accumulate wealth over time.

- Insurance Products:Annuities are often incorporated into insurance products, such as variable annuities.

The BA II Plus Calculator

The BA II Plus calculator is a powerful financial calculator widely used by professionals and students for various financial calculations, including annuity computations. Its intuitive interface and comprehensive features make it an ideal tool for handling complex annuity problems.

Features Relevant to Annuity Calculations

The BA II Plus calculator offers several features specifically designed for annuity calculations, such as:

- Time Value of Money (TVM) Functions:These functions allow you to calculate present value, future value, payment amount, interest rate, and time period for annuities.

- Cash Flow Worksheet:This feature enables you to input and analyze cash flows for irregular annuity payments.

- Amortization Schedule:The calculator can generate an amortization schedule that shows the breakdown of principal and interest payments for each period.

Accessing Annuity Functions

To access the annuity functions on the BA II Plus calculator, follow these steps:

- Press the “2nd” key, followed by the “PMT” key.This will access the TVM menu.

- Input the known variables:Enter the values for PV, FV, PMT, I/Y, and N, depending on the specific annuity calculation you are performing.

- Solve for the unknown variable:Press the “CPT” key followed by the key corresponding to the variable you want to calculate (e.g., PV, FV, PMT, I/Y, or N).

Key Input Variables and Calculator Keys

Here is a table outlining the key input variables and their corresponding calculator keys:

| Variable | Calculator Key |

|---|---|

| Present Value (PV) | PV |

| Future Value (FV) | FV |

| Payment Amount (PMT) | PMT |

| Interest Rate (I/Y) | I/Y |

| Time Period (N) | N |

Calculating Present Value of an Annuity

The present value (PV) of an annuity represents the current value of a series of future payments. This calculation is crucial for determining the fair price of an annuity or for evaluating investment opportunities.

An annuity is a financial product that provides a stream of payments over a set period of time. You can find more information about annuities in this article: An Annuity Is Best Defined As 2024. Annuities can be a useful tool for retirement planning, as they can provide a steady income stream in your later years.

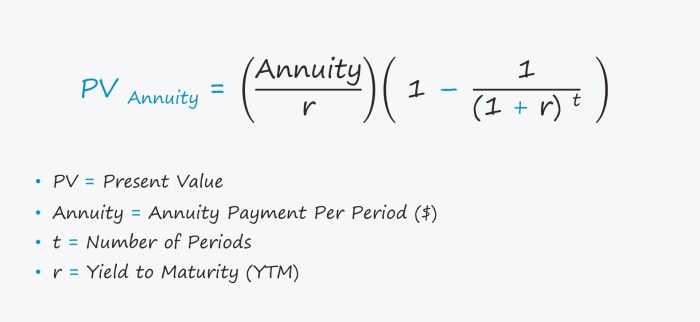

Formula for Calculating Present Value

The formula for calculating the present value of an ordinary annuity is:

PV = PMT

- [1

- (1 + I/Y)^-N] / (I/Y)

Where:

- PV = Present Value

- PMT = Payment Amount

- I/Y = Interest Rate

- N = Time Period

Calculating Present Value Using the BA II Plus Calculator

To calculate the present value of an annuity using the BA II Plus calculator, follow these steps:

- Press the “2nd” key, followed by the “PMT” key.This will access the TVM menu.

- Input the known variables:Enter the values for PMT, I/Y, and N.

- Set the FV to 0.This is because we are calculating the present value of the annuity, so the future value is assumed to be zero.

- Press the “CPT” key followed by the “PV” key.This will calculate the present value of the annuity.

Real-World Scenarios

Here are some real-world scenarios where calculating the present value of an annuity is useful:

- Purchasing an Annuity:To determine the fair price of an annuity, you need to calculate its present value based on the promised payments, interest rate, and time period.

- Evaluating Investment Opportunities:When comparing different investment options, you can use the present value calculation to assess their relative value and choose the most favorable one.

- Loan Repayment:Calculating the present value of a loan’s future payments can help you determine the effective cost of borrowing.

Calculating Future Value of an Annuity: Calculate Annuity Using Ba Ii Plus 2024

The future value (FV) of an annuity represents the value of a series of payments at a future point in time. This calculation is helpful for estimating the accumulated wealth from regular savings or for understanding the future value of a loan or investment.

An annuity can be a valuable tool for retirement planning, but it’s important to do your research and choose one that’s right for you. You can find more information about annuities on Annuity Gator 2024.

Formula for Calculating Future Value

The formula for calculating the future value of an ordinary annuity is:

FV = PMT

You can use an online calculator to help you estimate the potential savings of an annuity. This tool will take into account factors such as the annuity’s interest rate, the length of the payout period, and the amount of money you’ve invested.

Calculator Annuity Savings 2024 is a great resource for this.

- [(1 + I/Y)^N

- 1] / (I/Y)

Where:

- FV = Future Value

- PMT = Payment Amount

- I/Y = Interest Rate

- N = Time Period

Calculating Future Value Using the BA II Plus Calculator

To calculate the future value of an annuity using the BA II Plus calculator, follow these steps:

- Press the “2nd” key, followed by the “PMT” key.This will access the TVM menu.

- Input the known variables:Enter the values for PMT, I/Y, and N.

- Set the PV to 0.This is because we are calculating the future value of the annuity, so the present value is assumed to be zero.

- Press the “CPT” key followed by the “FV” key.This will calculate the future value of the annuity.

Real-World Scenarios

Here are some real-world scenarios where calculating the future value of an annuity is helpful:

- Retirement Planning:Estimating the future value of your retirement savings can help you determine if you will have enough funds to meet your financial needs.

- Investment Growth:Calculating the future value of an investment can help you assess its potential growth over time.

- Loan Repayment:Understanding the future value of a loan can help you determine the total amount you will repay, including interest.

Solving for Annuity Payment

The payment amount (PMT) of an annuity is the fixed amount paid or received in each period. Determining the payment amount is essential for budgeting, loan repayment, and investment planning.

Using the BA II Plus Calculator to Determine Payment Amount

To calculate the payment amount for an annuity using the BA II Plus calculator, follow these steps:

- Press the “2nd” key, followed by the “PMT” key.This will access the TVM menu.

- Input the known variables:Enter the values for PV, FV, I/Y, and N, depending on the specific annuity scenario.

- Press the “CPT” key followed by the “PMT” key.This will calculate the payment amount for the annuity.

Examples of Calculating Payment Amount

Here are some examples of how to calculate the payment amount for different annuity scenarios:

- Loan Repayment:If you borrow $100,000 at an interest rate of 5% for a 30-year mortgage, the monthly payment amount can be calculated using the BA II Plus calculator.

- Retirement Savings:If you want to accumulate $1 million in retirement savings over 25 years, you can use the BA II Plus calculator to determine the monthly contribution needed, assuming a certain interest rate.

Implications of Varying Interest Rates and Time Periods

The payment amount for an annuity is directly affected by the interest rate and time period. Higher interest rates generally result in higher payment amounts, while longer time periods lead to lower payment amounts.

An annuity can be a good investment, but it’s important to carefully consider your financial goals and risk tolerance before making a decision. You should also compare different annuity options and choose one that best meets your needs. Annuity Is It A Good Investment 2024 provides more information about the pros and cons of investing in an annuity.

Troubleshooting Common Errors

While the BA II Plus calculator is a powerful tool, users may encounter errors during annuity calculations. Understanding common errors and their causes can help you troubleshoot and resolve them effectively.

The annuity basis is the amount of money you’ve invested in an annuity. This amount is used to calculate the annuity’s payouts. Annuity Basis Is 2024 explains the importance of understanding the annuity basis.

Common Errors Encountered

Here are some common errors encountered when using the BA II Plus calculator for annuity calculations:

- “Error 5” or “Error 7”:These errors indicate that the calculator is unable to find a solution that meets the specified input variables. This can occur if the inputs are inconsistent or if the calculation is impossible.

- “Error 1”:This error suggests that the calculator is trying to divide by zero, which is mathematically impossible. This can happen if the interest rate or time period is set to zero.

- “Error 2”:This error indicates that the calculator is trying to take the square root of a negative number, which is also mathematically impossible. This can occur if the input variables are not entered correctly.

Causes and Solutions

The causes of these errors can vary, but here are some common solutions:

- Double-check your input variables:Ensure that all input variables are entered correctly and that they are consistent with the specific annuity scenario you are trying to calculate.

- Check the interest rate and time period:Make sure that the interest rate and time period are not set to zero. If they are, adjust them to appropriate values.

- Reset the calculator:If you are still encountering errors, try resetting the calculator by pressing the “2nd” key followed by the “CLR” key and selecting “TVM.” This will clear the calculator’s memory and reset the input variables.

Table of Common Error Messages

| Error Message | Cause | Solution |

|---|---|---|

| Error 5 or Error 7 | Inconsistent or impossible input variables | Double-check input variables and ensure they are consistent. |

| Error 1 | Dividing by zero | Check interest rate and time period; ensure they are not set to zero. |

| Error 2 | Taking the square root of a negative number | Verify input variables and ensure they are entered correctly. |

Last Word

Understanding annuities and mastering their calculation using the BA II Plus calculator is essential for individuals seeking to make informed financial decisions. Whether you’re planning for retirement, saving for a major purchase, or managing debt, the concepts and techniques presented in this guide provide a solid foundation for financial success.

By leveraging the power of the BA II Plus calculator, you can confidently analyze annuity scenarios, optimize your financial strategies, and achieve your financial goals.

FAQ

Can I use the BA II Plus for other financial calculations besides annuities?

An annuity due is an annuity where payments are made at the beginning of each period. To calculate the present value of an annuity due, you can use a spreadsheet program like Excel. Calculating Annuity Due In Excel 2024 provides a step-by-step guide to calculating annuity due in Excel.

Yes, the BA II Plus is a versatile financial calculator that can be used for a wide range of calculations, including time value of money, bond valuation, amortization, and more.

To calculate the potential payouts of an annuity, you can use an annuity withdrawal calculator. This tool will take into account factors such as the annuity’s interest rate, the length of the payout period, and the amount of money you’ve invested.

You can find a great calculator on Annuity Withdrawal Calculator 2024.

Where can I find a manual for the BA II Plus calculator?

An index annuity is a type of annuity that links its returns to the performance of a specific stock market index. This can provide the potential for higher returns than traditional fixed annuities, but it also comes with more risk.

Index Annuity Is What 2024 provides a detailed explanation of how index annuities work.

You can find the BA II Plus user manual online on the Texas Instruments website or by contacting their customer support.

Annuity payments can be used to supplement your retirement income, or they can be used to provide a guaranteed income stream for a loved one. In some cases, annuities can even be used to help pay for long-term care expenses.

Annuity Is Pension 2024 provides more information about how annuities can be used to plan for the future.

Is there a difference between the BA II Plus and the BA II Plus Professional?

The BA II Plus Professional offers additional features and functionality compared to the standard BA II Plus, such as advanced bond calculations and a larger display.

Before deciding if an annuity is right for you, it’s important to carefully consider your financial goals and risk tolerance. You should also compare different annuity options and choose one that best meets your needs. To learn more about the benefits of annuities, you can read Annuity Is Good 2024.

Are there any online resources or tutorials for learning about annuities and the BA II Plus calculator?

Yes, numerous online resources and tutorials are available, including videos, articles, and interactive exercises, to help you understand annuities and master the BA II Plus calculator.

There are many different types of annuities available, each with its own features and benefits. For example, you can choose an annuity that guarantees a certain rate of return, or one that is linked to the performance of the stock market.

1 An Annuity Is 2024 is a great resource for learning more about the various annuity options.