Calculating Annuity Units 2024: A Guide to Retirement Planning is a comprehensive guide that delves into the intricacies of annuity units, a crucial element of retirement planning. This guide explores the concept of annuity units, explains how they are calculated, and Artikels their role in securing a comfortable retirement.

Whether you’re a seasoned investor or just starting to think about your financial future, understanding annuity units is essential for making informed decisions about your retirement savings.

Annuity units are a way to measure the value of your retirement savings within an annuity plan. They are often used in defined benefit pension schemes, where the amount of your pension is determined by the number of units you have accumulated.

Unlike traditional savings accounts, where your balance fluctuates based on market performance, annuity units are tied to the performance of a specific investment portfolio.

Contents List

- 1 Annuity Units: A Fundamental Concept

- 2 Factors Influencing Annuity Unit Calculations

- 3 Calculating Annuity Units: A Step-by-Step Guide

- 4 Annuity Units and Retirement Income

- 5 Annuity Units: Variations and Considerations

- 6 Annuity Units: A Comparative Analysis: Calculating Annuity Units 2024

- 7 Summary

- 8 Questions and Answers

Annuity Units: A Fundamental Concept

Annuity units are a crucial element in retirement planning, particularly for those who receive a defined benefit pension. They represent a unit of entitlement to a pension, acting as a measure of your future retirement income. Unlike traditional retirement savings, which involve accumulating funds that you can access later, annuity units are based on the promise of a future stream of income.

A 6-year guaranteed annuity can provide you with a steady stream of income for a specific period, offering peace of mind during retirement. To learn more about this type of annuity, you can visit this resource: Annuity 6 Guaranteed 2024.

Defining Annuity Units and Their Role in Retirement Planning

Annuity units represent your share in a pension fund. They are essentially units of entitlement to a pension, with each unit representing a specific amount of income. For instance, one annuity unit might correspond to $100 per month of pension income.

Annuity 65 is a type of annuity designed for individuals who are 65 years old or older. To learn more about this specific annuity, you can check out this article: Annuity 65 2024.

The number of annuity units you accumulate during your working years determines the amount of pension you receive in retirement.

Annuity retirement plans can be a great way to ensure you have a steady stream of income in your golden years. You can learn more about how annuities work for retirement by checking out this article: Is Annuity Retirement 2024.

Distinguishing Annuity Units from Traditional Retirement Savings

Traditional retirement savings, such as 401(k)s and IRAs, involve accumulating funds that you can withdraw in retirement. You control the investment decisions and bear the risk of market fluctuations. Annuity units, on the other hand, are based on a defined benefit pension plan, where the employer promises a specific level of income in retirement.

The employer assumes the investment risk and guarantees the pension payments.

Knowing how to calculate annuity interest is crucial for making informed decisions about your retirement savings. This article can help you understand the process: Calculating Annuity Interest 2024.

Analogy for Understanding Annuity Units

Imagine a pizza cut into slices. Each slice represents an annuity unit, and the entire pizza represents the total pension fund. The number of slices you own (annuity units) determines the amount of pizza (pension income) you receive. As you work longer, you accumulate more slices, increasing your share of the pizza and your future retirement income.

Factors Influencing Annuity Unit Calculations

Several factors influence the calculation of annuity units, ultimately determining the value of your future pension. Understanding these factors is essential for planning your retirement effectively.

Key Variables Affecting Annuity Unit Calculations

- Salary:Your salary during your working years directly impacts the number of annuity units you accumulate. Generally, a higher salary results in a larger contribution to the pension fund, leading to more annuity units.

- Years of Service:The longer you work, the more annuity units you accrue. Pension plans often have a formula that determines the number of units earned per year of service.

- Interest Rates:The interest earned on the pension fund assets influences the value of annuity units. Higher interest rates generally lead to a greater accumulation of assets, increasing the value of each unit.

- Mortality Tables:Pension plans use mortality tables to estimate the average lifespan of retirees. These tables factor into the calculation of annuity units, as they help determine the expected duration of pension payments.

- Investment Performance:The performance of the pension fund’s investments significantly affects the value of annuity units. Strong investment returns generally increase the value of each unit, while poor performance can reduce their value.

Impact of Interest Rates on Annuity Unit Values

Interest rates play a crucial role in annuity unit calculations. When interest rates rise, the pension fund earns more income on its investments, leading to a higher value for each annuity unit. Conversely, falling interest rates can reduce the value of annuity units.

This is because the pension fund earns less income, potentially impacting the amount of pension you receive in retirement.

Mortality Tables and Investment Performance: Their Contribution to Unit Calculations

Mortality tables are used to estimate the average lifespan of retirees. Pension plans use this information to calculate the expected duration of pension payments, which impacts the value of each annuity unit. Higher life expectancies generally lead to lower unit values, as pension payments are expected to continue for a longer period.Investment performance directly affects the value of annuity units.

Annuities can be a complex financial product, but they can also be a valuable tool for retirement planning. If you’re looking for information about annuities, you can check out this article: Annuity 9 2024.

Strong investment returns generally increase the value of each unit, as the pension fund accumulates more assets. Conversely, poor investment performance can reduce the value of annuity units, potentially impacting the amount of pension you receive in retirement.

Calculating Annuity Units: A Step-by-Step Guide

Calculating annuity units can be a complex process, but understanding the steps involved can provide valuable insights into your future retirement income.

Steps Involved in Calculating Annuity Units

- Determine Your Salary:Your salary during your working years is a key factor in annuity unit calculations. The higher your salary, the more you contribute to the pension fund, resulting in more annuity units.

- Calculate Your Years of Service:The number of years you have worked for the company is another crucial factor. Pension plans often have a formula that determines the number of units earned per year of service.

- Apply the Pension Formula:Pension plans have a specific formula that determines the number of annuity units you accumulate based on your salary and years of service. The formula can vary depending on the plan, so it’s essential to consult your plan documents for specific details.

Understanding how annuities are taxed is essential for making informed financial decisions. You can learn more about the tax implications of annuities here: How Annuity Is Taxed 2024.

- Consider Interest Rates:The interest earned on the pension fund assets influences the value of annuity units. Higher interest rates generally lead to a greater accumulation of assets, increasing the value of each unit.

- Factor in Mortality Tables:Pension plans use mortality tables to estimate the average lifespan of retirees. These tables factor into the calculation of annuity units, as they help determine the expected duration of pension payments.

- Account for Investment Performance:The performance of the pension fund’s investments significantly affects the value of annuity units. Strong investment returns generally increase the value of each unit, while poor performance can reduce their value.

Numerical Example: Demonstrating the Calculation Process

Let’s assume a pension plan has a formula that awards one annuity unit for every $1,000 of salary earned per year of service. An employee earning $60,000 per year and working for 10 years would accumulate 60 annuity units (60,000 / 1,000

- 10). If each unit is currently worth $100 per month, the employee would be entitled to a monthly pension of $6,000 (60 units

- $100 per unit).

Formula for Calculating Annuity Units

The formula for calculating annuity units can vary depending on the pension plan. However, a common formula is:

Annuity Units = (Salary / Unit Value)

Years of Service

Annuity home loans can be a unique financing option for homeowners. You can learn more about how these loans work and their potential benefits by checking out this resource: Annuity Home Loan 2024.

Where:* Salary:Your annual salary during your working years

Calculating the annuity factor is an important step in determining the present value of an annuity. To understand how this is done, you can explore this resource: Calculating Annuity Factor 2024.

Unit Value

The value of one annuity unit, determined by the pension fund

Years of Service

The number of years you have worked for the company

Calculating annuity due on a BA II Plus calculator can be a bit tricky, but it’s essential for understanding the true cost of an annuity. If you’re looking for guidance on how to do this, check out this helpful article: Calculating Annuity Due On Ba Ii Plus 2024.

Annuity Units and Retirement Income

Annuity units are the building blocks of your future retirement income. Understanding how they translate into actual pension payments is crucial for financial planning.

A lifetime annuity can provide you with a guaranteed income stream for the rest of your life, which can be a valuable asset for retirement planning. If you’re interested in learning more about lifetime annuities, you can check out this resource: Is Annuity Lifetime 2024.

Translating Annuity Units into Retirement Income

The amount of pension you receive in retirement is directly proportional to the number of annuity units you have accumulated. Each unit represents a specific amount of monthly income, which is determined by the pension fund. For example, if one annuity unit corresponds to $100 per month, and you have accumulated 50 units, your monthly pension would be $5,000 (50 units

Shopping around for annuity quotes can help you find the best deal for your needs. To get started, you can check out this resource: Annuity Quotes 2024.

$100 per unit).

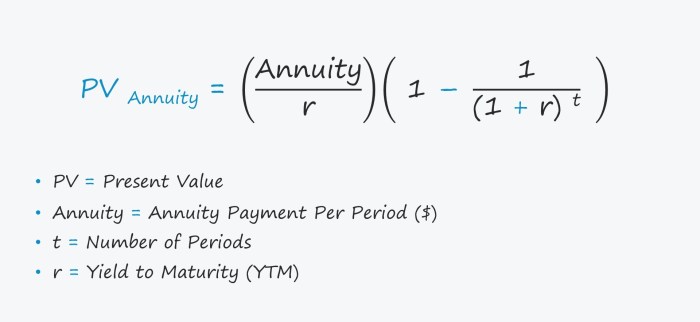

Understanding the present value of an annuity can be a valuable tool for financial planning. You can learn more about this concept here: Pv Annuity Of 1 Table 2024.

Relationship Between Annuity Units and Pension Amount

The more annuity units you have, the higher your pension income. This relationship is linear, meaning that a doubling of annuity units will result in a doubling of your pension. Therefore, maximizing your annuity unit accumulation during your working years is essential for securing a comfortable retirement income.

Impact of Inflation on Annuity Unit Values and Retirement Income

Inflation can erode the value of annuity units over time, potentially reducing your purchasing power in retirement. As prices rise, the value of each annuity unit may decline, leading to a lower real income. However, many pension plans have mechanisms to mitigate the impact of inflation, such as adjusting the value of annuity units periodically.

Annuity King Sarasota is a company specializing in annuities, providing advice and guidance to individuals looking for retirement planning solutions. You can find more information about them here: Annuity King Sarasota 2024.

Annuity Units: Variations and Considerations

Annuity units can vary in structure and features, influencing their value and the level of protection they offer. Understanding these variations is essential for making informed retirement planning decisions.

Different Types of Annuity Units

- Guaranteed Annuity Units:These units offer a guaranteed level of income, regardless of the performance of the pension fund’s investments. The value of guaranteed units is typically fixed, providing a degree of certainty about future pension payments.

- Non-Guaranteed Annuity Units:The value of these units is tied to the performance of the pension fund’s investments. If the fund performs well, the value of non-guaranteed units may increase, potentially leading to higher pension payments. However, if the fund underperforms, the value of these units may decline, reducing your retirement income.

Advantages and Disadvantages of Different Annuity Unit Structures

Guaranteed Annuity Units

Advantages

- Provides a guaranteed level of income, offering certainty about future pension payments.

- Protects against investment losses, ensuring a stable retirement income.

Disadvantages

- May offer lower potential returns compared to non-guaranteed units, as the value is fixed.

- May not keep pace with inflation, potentially reducing the purchasing power of your pension over time.

Non-Guaranteed Annuity Units

Advantages

- Potential for higher returns if the pension fund performs well, leading to a larger pension income.

- May offer greater flexibility in investment choices, allowing for potential growth.

Disadvantages

Role of Investment Risk and Return in Annuity Unit Calculations

The investment risk and return associated with the pension fund’s assets directly impact the value of annuity units. Higher investment risk generally offers the potential for higher returns, but it also carries a greater chance of losses. Pension plans must carefully balance risk and return to ensure the long-term sustainability of the fund and the security of retirees’ pensions.

Annuity Units: A Comparative Analysis: Calculating Annuity Units 2024

Annuity units are just one of many retirement savings options available. Comparing them to other choices can help you make informed decisions about your financial future.

An annuity calculator can be a helpful tool for estimating your future retirement income. CNN provides a helpful calculator that you can access here: Annuity Calculator Cnn 2024.

Comparing Annuity Units to Other Retirement Savings Options, Calculating Annuity Units 2024

- Traditional Retirement Accounts (401(k)s, IRAs):These accounts offer flexibility in investment choices and control over your savings. However, you bear the investment risk and are responsible for managing your funds. Annuity units, on the other hand, offer a guaranteed level of income and are managed by the employer, but you have less control over investments.

- Defined Contribution Plans:These plans, such as 401(k)s, involve contributions from both the employer and the employee. You typically have a choice of investment options, but the final amount of your pension is dependent on the performance of your investments. Annuity units offer a guaranteed income stream, but you have less control over investment choices.

Whether an annuity is a good or bad investment for you depends on your individual financial situation and goals. To help you decide, you can explore this resource: Annuity Is Good Or Bad 2024.

- Individual Annuities:These are insurance contracts that provide a stream of income in retirement. They offer a guaranteed income stream, but you may have to pay higher fees compared to pension plans.

Pros and Cons of Investing in Annuity Units versus Traditional Retirement Accounts

Annuity Units

Pros

- Guaranteed income stream, providing certainty about future pension payments.

- Employer manages the investments, reducing your responsibility for financial planning.

- Potential for tax advantages, as pension contributions are often tax-deductible.

Cons

Traditional Retirement Accounts

Pros

- Greater control over investment choices, allowing you to tailor your portfolio to your risk tolerance and goals.

- Potential for higher returns if your investments perform well.

- More flexibility in terms of withdrawal options, allowing you to access your savings as needed.

Cons

Suitability of Annuity Units for Different Retirement Goals

Annuity units can be a suitable retirement savings option for those seeking a guaranteed income stream and who prefer a more passive approach to financial planning. However, if you prioritize control over your investments and have a higher risk tolerance, traditional retirement accounts may be a better fit.

Ultimately, the best choice depends on your individual circumstances, retirement goals, and financial situation.

Summary

In conclusion, understanding annuity units is paramount for those planning for retirement. This guide has provided a comprehensive overview of the concept, including factors influencing their calculation, how they translate into retirement income, and their advantages and disadvantages. By carefully considering these aspects, individuals can make informed decisions about their retirement savings and ensure a secure financial future.

Questions and Answers

How do annuity units differ from traditional retirement savings accounts?

Annuity units are typically tied to a specific investment portfolio within an annuity plan, whereas traditional retirement savings accounts allow you to invest in a wider range of assets.

What are the advantages and disadvantages of annuity units?

Advantages include potential for higher returns due to professional management and guaranteed income in retirement. Disadvantages include limited investment options and potential for lower returns if the underlying investment portfolio performs poorly.

Are annuity units suitable for everyone?

Annuity units can be suitable for individuals seeking guaranteed income in retirement and those who prefer a hands-off approach to investment management. However, they may not be the best choice for those seeking greater flexibility or control over their investments.