Calculating The Annuity 2024: A Guide to Retirement Planning is your comprehensive resource for understanding and maximizing the potential of annuities in today’s economic landscape. Annuities, often considered a cornerstone of retirement planning, provide a steady stream of income during your golden years, but navigating their complexities can be daunting.

Want to know how to calculate an annuity? Calculating A Annuity 2024 provides a step-by-step guide, making the process easier to understand.

This guide demystifies annuities, exploring their different types, calculation methods, and real-world applications in 2024. We’ll delve into the current economic climate and its impact on annuity rates, highlighting the role of annuities in achieving your retirement goals.

For those interested in growing annuities, Growing Annuity Calculator Present Value 2024 offers a tool to help you determine the present value of your investment.

Whether you’re just starting to plan for retirement or seeking to optimize your existing strategy, understanding annuities is crucial. We’ll guide you through the process of calculating annuity values, comparing different options, and making informed decisions based on your individual financial needs and risk tolerance.

To grasp the concept of present value in annuities, Annuity Is Present Value 2024 explains the importance of this calculation and its implications.

By the end of this guide, you’ll be equipped with the knowledge to confidently incorporate annuities into your retirement plan and secure a comfortable future.

Contents List

Understanding Annuities

An annuity is a financial product that provides a stream of regular payments over a specified period. It’s a popular choice for individuals seeking guaranteed income, especially during retirement. Annuities are designed to help individuals manage their finances, particularly in retirement, by providing a predictable income stream.

Components of an Annuity

An annuity consists of two main components:

- Premium:This is the initial lump sum payment made to purchase the annuity. The premium can be paid in a single lump sum or in installments over time.

- Annuity Payments:These are the regular payments received by the annuitant, typically on a monthly or annual basis. The payment amount is determined by factors such as the premium amount, the interest rate, and the duration of the annuity.

Types of Annuities

Annuities come in various forms, each with its own features and benefits:

- Fixed Annuities:These provide a guaranteed rate of return, meaning the payment amount remains fixed throughout the annuity term. This offers stability and predictability, but the returns may not keep pace with inflation.

- Variable Annuities:These offer the potential for higher returns but also carry greater risk. The payment amount is tied to the performance of underlying investments, such as stocks or mutual funds. The value of the annuity can fluctuate with market conditions.

- Immediate Annuities:These start paying out immediately after the premium is paid. They are ideal for individuals who need immediate income.

- Deferred Annuities:These begin paying out at a later date, typically upon retirement. This allows for growth of the premium over time before payments begin.

Factors Influencing Annuity Payments

Several factors influence the amount of annuity payments:

- Premium Amount:A larger premium generally results in higher annuity payments.

- Interest Rate:Higher interest rates lead to larger payments.

- Annuity Term:The duration of the annuity affects the payment amount. Longer terms typically result in smaller payments.

- Age of the Annuitant:Older annuitants generally receive larger payments than younger ones, as they have a shorter life expectancy.

- Gender:Women tend to have longer life expectancies than men, which may result in smaller annuity payments.

Annuity Calculations

Understanding how annuities are calculated is crucial for making informed financial decisions. Here’s a breakdown of the key calculations:

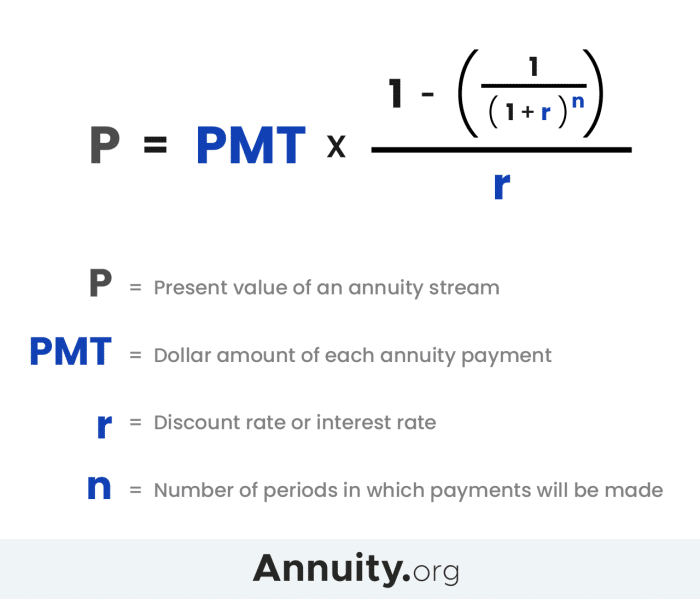

Present Value of an Annuity

The present value of an annuity is the current value of a series of future payments, discounted to reflect the time value of money. In simpler terms, it’s the amount of money you would need to invest today to receive a specific stream of payments in the future.

Here’s a step-by-step guide to calculate the present value of an annuity:

- Determine the annuity payment amount (PMT):This is the regular payment received from the annuity.

- Identify the interest rate (r):This is the rate of return used to discount future payments.

- Determine the number of periods (n):This is the total number of payments over the annuity term.

- Apply the present value of annuity formula:

Present Value = PMT- [1 – (1 + r)^-n] / r

To understand the basis of annuities, Annuity Basis Is 2024 provides a clear explanation of the underlying principles and how they apply to annuity calculations.

Future Value of an Annuity

The future value of an annuity is the total value of a series of payments at a future point in time. It represents the accumulated value of the payments, compounded at a specific interest rate.

Here’s the formula for calculating the future value of an annuity:

Future Value = PMT- [(1 + r)^n – 1] / r

Calculating the annuity exclusion ratio is essential for tax purposes. Calculate Annuity Exclusion Ratio 2024 guides you through the process of determining this crucial factor.

Methods for Annuity Calculations

There are several methods available for calculating annuities:

- Financial Calculators:These calculators are specifically designed to perform financial calculations, including annuity calculations. They simplify the process by allowing you to input the necessary variables and obtain the desired result.

- Spreadsheets:Spreadsheets like Microsoft Excel provide powerful tools for annuity calculations. You can use formulas and functions to calculate present value, future value, and other relevant metrics.

- Online Annuity Calculators:Numerous online calculators are available that allow you to quickly calculate annuity values based on your specific parameters.

Annuity Applications in 2024

Annuities continue to play a significant role in financial planning, particularly in retirement. The current economic climate and evolving market conditions influence the relevance and application of annuities.

Annuity rates can vary, and understanding specific percentages is crucial. Annuity 8.5 Percent 2024 provides insights into the potential benefits and drawbacks of an 8.5% annuity.

Current Economic Climate and Annuity Rates

The current economic climate has a direct impact on annuity rates. Interest rates are a major factor determining the returns offered by fixed annuities. In an environment of rising interest rates, annuity rates may increase, providing higher payouts to annuitants.

Conversely, if interest rates decline, annuity rates may also fall. It’s crucial to monitor market trends and consult with a financial advisor to understand how current economic conditions may affect annuity options.

Annuities are essentially a series of payments. Annuity Is A Series Of 2024 breaks down the structure of these payments and how they function over time.

Role of Annuities in Retirement Planning

Annuities can be a valuable tool for retirement planning, providing a consistent income stream to supplement other retirement savings. In 2024, as individuals seek to secure their financial future, annuities can offer stability and predictability, especially in a volatile market environment.

Annuities can be used to generate guaranteed income, provide longevity protection, and address potential outliving one’s assets.

Benefits and Drawbacks of Investing in Annuities

Investing in annuities comes with both potential benefits and drawbacks. Here’s a breakdown:

- Benefits:

- Guaranteed Income:Fixed annuities offer guaranteed income for life, providing peace of mind and financial security.

- Longevity Protection:Annuities can help ensure that individuals don’t outlive their retirement savings.

- Tax Advantages:Some annuities offer tax-deferred growth, allowing earnings to accumulate tax-free until withdrawn.

- Drawbacks:

- Limited Liquidity:Annuities are generally illiquid, meaning it can be difficult to access funds before the annuity payout begins.

- Potential for Lower Returns:Fixed annuities may offer lower returns than other investment options, particularly during periods of market growth.

- Complexity:Annuity contracts can be complex, requiring careful review and understanding.

- Interest Rate:Higher interest rates generally result in larger annuity payments.

- Annuity Term:The duration of the annuity affects the payment amount. Longer terms typically result in smaller payments.

- Fees and Expenses:Annuities may have various fees, such as surrender charges, administrative fees, and mortality and expense charges. These fees can impact your overall returns.

- Death Benefit:Some annuities offer a death benefit, which provides a payout to beneficiaries upon the annuitant’s death.

- Withdrawal Options:Annuities may have different withdrawal options, such as lump sum withdrawals, partial withdrawals, or systematic withdrawals.

- Consult with a Financial Advisor:A financial advisor can help you understand your financial goals, risk tolerance, and the different annuity options available.

- Compare Quotes:Obtain quotes from multiple insurance companies to compare rates, fees, and features.

- Read the Contract Carefully:Thoroughly review the annuity contract before making a decision. Pay attention to the terms and conditions, fees, and other important details.

- Consider Your Long-Term Needs:Choose an annuity that aligns with your long-term financial goals and lifestyle.

Annuity Examples

Fixed Annuity Calculation

Consider a fixed annuity with the following parameters:

| Parameter | Value |

|---|---|

| Premium | $100,000 |

| Interest Rate | 3% |

| Annuity Term | 20 years |

Using the present value of annuity formula, the annual payment amount can be calculated as follows:

Present Value = PMT- [1 – (1 + r)^-n] / r

$100,000 = PMT – [1 – (1 + 0.03)^-20] / 0.03

If you’re based in the UK and looking for annuity quotes, Annuity Quotes Uk 2024 offers a guide to finding the best options available to you.

PMT = $100,000 – 0.03 / [1 – (1 + 0.03)^-20]

If you’re curious about Kathy’s specific annuity situation, you might find the article Kathy’s Annuity Is Currently Experiencing 2024 informative. It discusses the current state of her annuity and potential implications.

PMT = $7,417.76

The relationship between annuities and loans can be confusing. Annuity Is Loan 2024 explores this connection and helps you understand the differences.

Therefore, the annual payment for this fixed annuity would be $7,417.76.

If you need assistance calculating your annuity in the UK, Annuity Calculator Hmrc 2024 provides a useful tool that complies with HMRC regulations.

Comparison of Present Values

The following table compares the present value of different types of annuities, assuming a premium of $100,000, an interest rate of 3%, and an annuity term of 20 years.

An annuity is often known as a reliable income stream. An Annuity Is Known 2024 explores the reasons behind this reputation and its potential benefits.

| Annuity Type | Present Value |

|---|---|

| Fixed Annuity | $100,000 |

| Variable Annuity (projected growth of 5%) | $125,778 |

| Immediate Annuity | $100,000 |

| Deferred Annuity (deferred for 5 years) | $86,384 |

Annuity Supplementing Retirement Income

Imagine a retiree who has accumulated $500,000 in retirement savings. They want to use a portion of their savings to generate a guaranteed income stream. They decide to purchase a fixed annuity with a premium of $200,000, which provides an annual payment of $10,000 for life.

For those familiar with Excel, Annuity Is Excel 2024 demonstrates how to use the program to perform annuity calculations efficiently.

This annuity provides a stable and predictable source of income, supplementing their other retirement assets and helping them meet their living expenses.

Considerations for Annuity Selection: Calculating The Annuity 2024

Choosing the right annuity is crucial for achieving your financial goals. Here are key considerations to guide your decision:

Individual Financial Goals and Risk Tolerance, Calculating The Annuity 2024

Your individual financial goals and risk tolerance play a significant role in annuity selection. If you prioritize guaranteed income and stability, a fixed annuity might be suitable. If you’re comfortable with potential market fluctuations and seeking higher returns, a variable annuity could be a better fit.

Tax implications are an important consideration when it comes to annuities. Is A Single Life Annuity Taxable 2024 provides clarity on the taxability of single-life annuities.

Key Factors to Evaluate

When comparing different annuity options, consider these factors:

Tips for Selecting the Right Annuity

Here are some tips for selecting the most suitable annuity for your situation:

Final Thoughts

In conclusion, annuities can be a powerful tool for retirement planning, offering a reliable stream of income and the potential for growth. However, it’s crucial to approach them with a thorough understanding of their complexities, considering your individual financial goals and risk tolerance.

By carefully evaluating different annuity options, seeking professional advice, and staying informed about market trends, you can make informed decisions that align with your retirement aspirations. Remember, the key to a successful retirement lies in planning ahead, understanding your options, and making choices that support your long-term financial well-being.

FAQ Compilation

What are the risks associated with annuities?

Annuities can involve certain risks, such as the potential for lower-than-expected returns, the possibility of losing principal in variable annuities, and the risk of outliving your annuity payments. It’s essential to carefully consider these risks before investing in an annuity.

How do I choose the right annuity for my needs?

Choosing the right annuity depends on your individual financial goals, risk tolerance, and time horizon. It’s crucial to consult with a financial advisor to determine the best annuity option for your specific circumstances.

Are annuities a suitable investment for everyone?

Annuities are not suitable for everyone. They can be complex and may not be the best option for individuals with short-term financial needs or a high risk tolerance. It’s important to carefully consider your financial situation and goals before investing in an annuity.

Understanding annuities can be a bit complex, but the good news is that there are resources available to help. For instance, you can check out Annuity Health 2024 for a comprehensive overview of the latest trends and information.