Fv Annuity With Growth 2024: A Guide to Potential Gains offers a comprehensive look at fixed variable annuities, a financial instrument that combines guaranteed income with the potential for growth. This guide explores the intricacies of these annuities, delving into their advantages, disadvantages, and risks, and examining how they can be strategically incorporated into your financial planning.

Have questions about annuities? This article provides answers to common questions: Annuity Questions And Answers 2024.

Fixed variable annuities offer a unique blend of security and growth potential, making them a potentially attractive option for individuals seeking to diversify their investment portfolio. However, understanding the nuances of these annuities, including the interplay between their fixed and variable components, is crucial for making informed decisions.

Annuity drawdown is a way to access your retirement savings. This article explains the concept: Is Annuity Drawdown 2024.

This guide provides insights into the key factors influencing annuity growth, strategies for maximizing growth potential, and the role of these annuities in retirement planning.

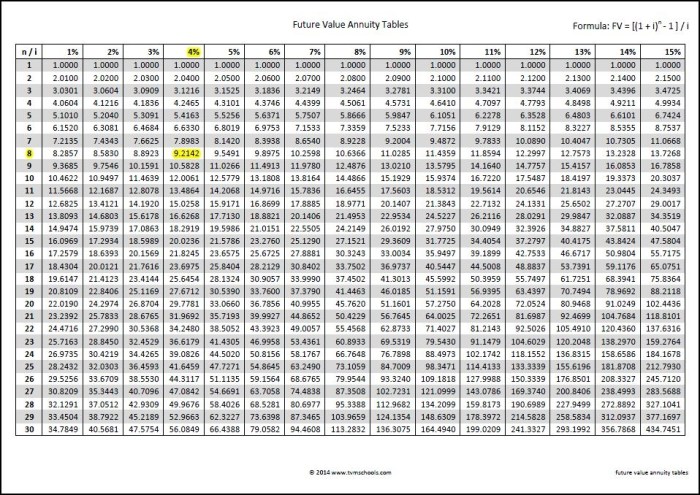

Want to know how annuities are calculated? This article explains the Formula For Calculating The Annuity 2024 , helping you understand the mechanics behind this financial tool.

Contents List

- 1 Understanding Fixed Variable Annuities with Growth Potential in 2024

- 2 Factors Influencing Annuity Growth in 2024

- 3 Key Considerations for Choosing a Fixed Variable Annuity in 2024

- 4 Strategies for Maximizing Growth Potential within a Fixed Variable Annuity: Fv Annuity With Growth 2024

- 5 Fixed Variable Annuities in Retirement Planning

- 6 End of Discussion

- 7 Essential Questionnaire

Understanding Fixed Variable Annuities with Growth Potential in 2024

Fixed variable annuities (FVAs) are financial products designed to provide a balance between guaranteed income and the potential for growth. They offer a unique combination of features that can be attractive to investors seeking to secure their retirement income while potentially enhancing their savings.

R is a powerful programming language for statistical analysis. Learn how to calculate annuities using R in this article: R Calculate Annuity 2024.

This article will delve into the intricacies of FVAs, exploring their core features, advantages, disadvantages, risks, and rewards. We’ll also discuss the factors influencing their growth in 2024, key considerations for choosing an FVA, strategies for maximizing growth potential, and their role in retirement planning.

Excel is a popular tool for financial planning. Learn how to calculate growing annuities using Excel in this article: Calculate Growing Annuity In Excel 2024.

Core Features of Fixed Variable Annuities

FVAs are structured with two distinct components: a fixed account and a variable account. The fixed account provides a guaranteed minimum rate of return, typically a modest interest rate, offering a stable and predictable income stream. The variable account, on the other hand, invests in a range of sub-accounts that track different market indices or mutual funds, aiming to generate higher returns but with the potential for greater volatility.

An annuity is essentially a stream of payments, often used for retirement income. Learn more about how annuities work in this article: Annuity Is Payment 2024.

Advantages and Disadvantages of Fixed Variable Annuities

FVAs offer several advantages over traditional investment options, including:

- Guaranteed Income:The fixed account provides a guaranteed minimum return, ensuring a steady income stream regardless of market performance.

- Growth Potential:The variable account offers the potential for higher returns through investments in various market segments.

- Tax Deferral:Gains within the annuity are not taxed until withdrawn, allowing for tax-deferred growth.

- Protection from Market Downturns:The fixed account acts as a safety net, providing a guaranteed return even if the variable account experiences losses.

However, FVAs also come with some disadvantages:

- Fees:FVAs typically have higher fees compared to other investment options, including management fees, surrender charges, and mortality and expense charges.

- Limited Liquidity:Accessing funds in the annuity before a certain age may result in penalties.

- Complexity:Understanding the intricacies of FVA structures and investment options can be challenging for some investors.

Risks and Rewards Associated with Fixed Variable Annuities

The interplay between the fixed and variable components of FVAs creates a unique risk-reward profile.

- Fixed Account Risk:While the fixed account guarantees a minimum return, the rate may be lower than inflation, eroding the purchasing power of your income over time.

- Variable Account Risk:The variable account carries investment risk, meaning you could lose money if the market performs poorly. The performance of the variable account is tied to the underlying investments, and their value can fluctuate.

On the other hand, FVAs offer the potential for significant rewards:

- Growth Potential:The variable account offers the potential for substantial growth, especially in bull markets.

- Income Security:The fixed account provides a guaranteed income stream, ensuring a steady flow of funds during retirement.

Factors Influencing Annuity Growth in 2024

Annuity growth in 2024 will be influenced by a combination of macroeconomic factors, regulatory changes, and market volatility.

Choosing between an annuity and an IRA can be tough. This article helps you weigh the pros and cons of each option: Annuity Or Ira 2024.

Macroeconomic Factors

Key macroeconomic factors that could impact annuity growth in 2024 include:

- Interest Rate Trends:Rising interest rates generally benefit annuity providers, as they can offer higher guaranteed rates on fixed accounts. However, higher rates could also lead to increased competition for investors’ funds.

- Inflation:High inflation can erode the purchasing power of annuity payments, making them less attractive to investors. Annuity providers may need to adjust their rates to compensate for inflation.

- Economic Growth:Strong economic growth can boost investor confidence and lead to higher demand for annuities. However, economic uncertainty or recessionary pressures could dampen growth.

Regulatory Changes and Market Volatility

Regulatory changes and market volatility can significantly influence annuity performance.

Are annuities right for you? This article helps you determine if an annuity is a suitable option for your retirement planning: Is Annuity Right For Me 2024.

- Regulatory Changes:New regulations or changes in existing rules can impact annuity products, potentially affecting their features, fees, and investment options.

- Market Volatility:Market volatility can create uncertainty for investors, potentially affecting their investment decisions. Volatile markets can make it challenging to predict the performance of variable accounts.

Investment Strategies within Fixed Variable Annuities

Investment strategies within FVAs play a crucial role in maximizing growth potential.

Curious about how an annuity with a lump sum of 3 million would work? This article explores the potential of an Annuity 3 Million 2024.

- Asset Allocation:The allocation of funds between the fixed and variable accounts is a critical decision. Investors need to consider their risk tolerance, time horizon, and financial goals when determining the appropriate asset allocation.

- Investment Choices:Within the variable account, investors have a range of investment options, including sub-accounts tracking different market indices or mutual funds. Selecting the right investments based on their risk profile and investment objectives is essential for achieving growth potential.

Key Considerations for Choosing a Fixed Variable Annuity in 2024

Selecting the right FVA requires careful consideration of individual financial goals, risk tolerance, and time horizon.

Planning for retirement in Nigeria? You can use an Annuity Calculator Nigeria 2024 to estimate your future income. These calculators consider factors like your age and savings to give you a clearer picture of your financial future.

Financial Goals, Risk Tolerance, and Time Horizon

- Financial Goals:Define your specific financial objectives, such as retirement income, supplemental income, or long-term savings. These goals will guide your choice of an FVA that aligns with your needs.

- Risk Tolerance:Assess your willingness to accept risk. If you are risk-averse, you may prefer a higher allocation to the fixed account. Conversely, if you have a higher risk tolerance, you may allocate more funds to the variable account.

- Time Horizon:Consider your investment time horizon. Longer time horizons allow for greater potential for growth in the variable account, as market fluctuations have more time to average out.

Comparing Annuity Providers, Fv Annuity With Growth 2024

When comparing FVA providers, consider the following factors:

- Fees:Compare the fees charged by different providers, including management fees, surrender charges, and mortality and expense charges. These fees can significantly impact the overall returns on your investment.

- Surrender Charges:Understand the surrender charges associated with withdrawing funds before a certain age. These charges can be substantial and can reduce your potential returns.

- Investment Options:Evaluate the investment options available within the variable account. Choose a provider offering a diverse range of investment choices that align with your risk profile and investment objectives.

Table Comparing Popular Fixed Variable Annuity Products

| Product Name | Provider | Guaranteed Rate | Minimum Investment | Fees | Surrender Charges | Investment Options ||—|—|—|—|—|—|—|| [Product 1] | [Provider 1] | [Rate] | [Amount] | [Fees] | [Charges] | [Options] || [Product 2] | [Provider 2] | [Rate] | [Amount] | [Fees] | [Charges] | [Options] || [Product 3] | [Provider 3] | [Rate] | [Amount] | [Fees] | [Charges] | [Options] || [Product 4] | [Provider 4] | [Rate] | [Amount] | [Fees] | [Charges] | [Options] |

Annuities can be a valuable tool for retirement planning. Read this article to learn more about the benefits: Annuity Is Good 2024.

Strategies for Maximizing Growth Potential within a Fixed Variable Annuity: Fv Annuity With Growth 2024

To maximize growth potential within an FVA, consider the following strategies:

Asset Allocation, Investment Diversification, and Risk Management

- Asset Allocation:Regularly review and adjust your asset allocation between the fixed and variable accounts based on market conditions and your financial goals. A well-balanced allocation can help mitigate risk and maximize returns.

- Investment Diversification:Diversify your investments within the variable account by allocating funds to different asset classes, such as stocks, bonds, and real estate. Diversification helps reduce risk and enhance potential returns.

- Risk Management:Implement risk management strategies, such as stop-loss orders, to limit potential losses in the variable account. This can help protect your principal and preserve your gains.

Periodic Rebalancing and Portfolio Adjustments

- Periodic Rebalancing:Regularly rebalance your portfolio to maintain your desired asset allocation. This involves adjusting the proportions of your investments to bring them back in line with your original plan. Rebalancing helps ensure that your portfolio remains aligned with your risk tolerance and investment objectives.

The Annuity 2000 Mortality Table 2024 provides insights into life expectancy and helps insurance companies calculate annuity payments. It’s a crucial tool for understanding annuity pricing.

- Portfolio Adjustments:Make adjustments to your portfolio based on changes in market conditions, your financial goals, or your risk tolerance. This may involve buying or selling specific investments to optimize your portfolio’s performance.

Leveraging Investment Options

- Growth-Oriented Investments:Consider investing in growth-oriented investments within the variable account, such as stocks or mutual funds with a higher growth potential. These investments can help generate significant returns over the long term.

- Income-Generating Investments:Include income-generating investments, such as bonds or dividend-paying stocks, in your portfolio. These investments can provide a steady stream of income, supplementing the guaranteed income from the fixed account.

- Tax-Efficient Strategies:Utilize tax-efficient strategies, such as tax-loss harvesting, to minimize your tax liability. This can help preserve your investment gains and maximize your overall returns.

Fixed Variable Annuities in Retirement Planning

FVAs can play a significant role in retirement income planning, providing both guaranteed income and growth potential.

Understanding how annuity pensions are calculated is essential for retirement planning. This article explains the process: Calculating Annuity Pension 2024.

Retirement Income Planning

- Guaranteed Income Stream:The fixed account provides a guaranteed income stream, ensuring a steady flow of funds during retirement, regardless of market performance.

- Growth Potential:The variable account offers the potential for growth, enhancing your retirement savings and providing additional income options.

- Flexibility:FVAs provide flexibility in how you access your funds during retirement. You can choose to withdraw from the fixed account for a guaranteed income stream or from the variable account for potential growth.

Creating a Sustainable Retirement Income Stream

- Income Annuities:Consider using income annuities within your FVA. Income annuities provide a guaranteed stream of payments for life, offering a secure and predictable source of income during retirement.

- Withdrawal Strategies:Develop a withdrawal strategy that balances your need for income with your desire to preserve your principal. A well-defined withdrawal strategy can help ensure that your retirement savings last throughout your golden years.

- Inflation Protection:Look for FVAs that offer inflation protection features. These features can help preserve the purchasing power of your retirement income over time.

Checklist for Integrating Fixed Variable Annuities into a Retirement Plan

- Assess your financial goals:Determine your retirement income needs and savings goals.

- Evaluate your risk tolerance:Consider your willingness to accept risk and your investment time horizon.

- Compare annuity providers:Research different FVA providers and compare their features, fees, and investment options.

- Choose the right product:Select an FVA that aligns with your financial goals, risk tolerance, and time horizon.

- Develop a withdrawal strategy:Plan how you will access your funds during retirement to meet your income needs.

- Monitor your portfolio:Regularly review and adjust your portfolio based on market conditions and your financial goals.

End of Discussion

As you navigate the complex world of fixed variable annuities, remember that informed decision-making is paramount. By understanding the intricacies of these instruments, you can make choices that align with your financial goals and risk tolerance. This guide has provided a roadmap to help you explore the potential benefits and risks of fixed variable annuities, equipping you with the knowledge to make informed decisions for your financial future.

Essential Questionnaire

What is the difference between a fixed and variable annuity?

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s returns fluctuate based on the performance of the underlying investments.

Are fixed variable annuities suitable for everyone?

No, fixed variable annuities are not suitable for everyone. They are best suited for individuals with a moderate to high risk tolerance and a long-term investment horizon.

What are the potential risks associated with fixed variable annuities?

While annuities and pensions both provide regular income in retirement, they are not the same. To understand the differences, check out this article: Is Annuity The Same As Pension 2024.

The primary risk associated with variable annuities is the potential for loss of principal due to market fluctuations. However, the fixed component provides a layer of protection against losses.

It’s never too early to start planning for your retirement. You can use an Annuity Calculator By Age 2024 to get a personalized estimate based on your age and financial goals.