Annuity Calculator Vs Lump Sum 2024: Navigating the world of financial planning can be daunting, especially when faced with significant decisions like choosing between an annuity and a lump sum payment. Both options offer distinct advantages and disadvantages, making it crucial to understand the nuances of each before making a choice.

Annuity payments are a form of income, but their tax implications can vary. Is Annuity Income 2024 clarifies the tax treatment of annuity payments.

This guide delves into the intricacies of annuity calculators and lump sum payments, equipping you with the knowledge to make informed decisions about your financial future.

Annuity due is a common financial concept, and Annuity Due Is 2024 explores its definition and significance in financial planning.

Annuity payments provide a steady stream of income over a predetermined period, offering financial security and predictability. On the other hand, a lump sum payment grants you immediate access to a large sum of money, allowing for flexibility and investment opportunities.

Excel can be a powerful tool for financial analysis, including annuity calculations. Calculate Annuity Value In Excel 2024 offers practical steps on how to use Excel for annuity calculations.

Understanding the pros and cons of each option, along with the factors influencing your decision, is essential for maximizing your financial well-being.

Calculating the right annuity rate is crucial for maximizing your returns. Calculating An Annuity Rate 2024 provides insights into the factors that influence annuity rates.

Contents List

- 1 Understanding Annuities and Lump Sum Payments

- 2 Annuity Calculator: Functionality and Features: Annuity Calculator Vs Lump Sum 2024

- 3 Factors to Consider When Choosing Between an Annuity and Lump Sum

- 4 Using an Annuity Calculator for Financial Planning

- 5 Real-World Applications of Annuity Calculators

- 6 Last Recap

- 7 Question & Answer Hub

Understanding Annuities and Lump Sum Payments

An annuity is a financial product that provides a stream of regular payments over a period of time, typically for a set number of years or for the rest of your life. It’s a popular choice for retirees, as it provides a consistent income stream.

A lump sum payment, on the other hand, is a single, one-time payment. This can be received from a variety of sources, such as a retirement account, an inheritance, or a lottery win.

If you’re considering a lump-sum investment for a secure future, you might be interested in a single premium annuity. G Purchased A $50 000 Single Premium 2024 explores this type of annuity, offering insights into its potential benefits and considerations.

Annuity vs. Lump Sum

The choice between an annuity and a lump sum payment depends on several factors, including your age, financial goals, and risk tolerance. Here are some situations where an annuity might be a better option than a lump sum, and vice versa:

- Annuity: If you’re concerned about outliving your savings, an annuity can provide you with a guaranteed income stream for the rest of your life. This can be particularly helpful if you’re not comfortable managing your own investments.

- Lump Sum: If you’re a younger investor with a longer time horizon, you might prefer a lump sum payment. This gives you the flexibility to invest the money in a way that aligns with your individual risk tolerance and financial goals.

For a comprehensive understanding of annuities, An Annuity Is Quizlet 2024 provides a concise and interactive overview of key annuity concepts.

Tax Implications

The tax implications of receiving an annuity versus a lump sum payment can vary depending on the specific circumstances. In general, the payments from an annuity are taxed as ordinary income, while a lump sum payment is taxed as capital gains.

Annuity calculations are a key aspect of accounting. Calculating Annuity In Accounting 2024 explores the accounting principles and methods used in annuity calculations.

Annuity Calculator: Functionality and Features: Annuity Calculator Vs Lump Sum 2024

An annuity calculator is a tool that helps you estimate the future value of an annuity based on various factors, such as the initial investment amount, interest rate, and payment period. These calculators can be valuable for making informed decisions about your retirement planning, estate planning, and long-term financial security.

Understanding the intricacies of retirement planning can be daunting, but Calculating Tsp Annuity 2024 provides a clear guide on how to calculate your potential annuity payments from your TSP contributions.

Key Features and Functionalities

Annuity calculators typically have the following features:

- Inputting annuity details: You can enter information about the annuity, such as the initial investment amount, interest rate, payment period, and payment frequency.

- Calculating future value: The calculator will use the inputted data to estimate the future value of the annuity at a specific point in time.

- Generating reports: Many calculators can generate reports that summarize the projected annuity value and provide other relevant financial information.

Types of Annuity Calculators

There are different types of annuity calculators available online, each with its own unique features and functionalities. Some popular types include:

- Simple annuity calculators: These calculators provide basic estimates of annuity value based on a few input variables.

- Advanced annuity calculators: These calculators offer more sophisticated features, such as the ability to adjust for inflation, taxes, and other financial factors.

- Personalized annuity calculators: These calculators allow you to input your specific financial information, such as your age, income, and expenses, to generate personalized estimates of annuity value.

Importance of Considering Key Factors

When using an annuity calculator, it’s important to consider factors such as:

- Interest rates: The interest rate used in the calculator will significantly impact the projected annuity value.

- Investment growth: The calculator should consider the potential for investment growth over time.

- Longevity: The calculator should take into account your life expectancy and the potential for receiving annuity payments for a longer period.

Factors to Consider When Choosing Between an Annuity and Lump Sum

The decision of whether to choose an annuity or a lump sum payment depends on your individual circumstances and financial planning objectives. Here are some key factors to consider:

Pros and Cons

Here’s a comparison of the pros and cons of each option:

| Annuity | Lump Sum | |

|---|---|---|

| Pros | Guaranteed income stream, protection against outliving savings, potential for tax benefits | Flexibility to invest as desired, potential for higher returns, control over your money |

| Cons | Limited flexibility, potential for lower returns, may not keep up with inflation | Risk of losing money, need to manage investments, potential for higher taxes |

Key Factors

- Age: Younger investors with a longer time horizon may prefer a lump sum payment, while older investors may prefer the guaranteed income stream of an annuity.

- Financial goals: Your financial goals will also influence your decision. If you’re saving for retirement, an annuity can provide a consistent income stream. If you’re saving for a down payment on a house, a lump sum payment may be more suitable.

Excel can be a valuable tool for managing your finances, including calculating annuity cash flows. Calculating Annuity Cash Flows Excel 2024 provides practical guidance on using Excel to calculate annuity cash flows.

- Risk tolerance: Your risk tolerance will also play a role. If you’re risk-averse, an annuity may be a more comfortable option. If you’re willing to take on more risk, a lump sum payment may be a better choice.

- Health: Your health status can also be a factor. If you have a serious health condition, you may want to consider an annuity to ensure a guaranteed income stream.

Using an Annuity Calculator for Financial Planning

An annuity calculator can be a valuable tool for making informed decisions about your financial future. It can help you project future income streams, analyze different scenarios, and make informed decisions about retirement planning, estate planning, and long-term financial security.

Annuity is a versatile financial instrument, and Annuity Is 2024 provides an overview of its different types and uses in financial planning.

Projecting Future Income Streams, Annuity Calculator Vs Lump Sum 2024

By inputting your financial information into an annuity calculator, you can estimate the future value of an annuity based on different assumptions. This can help you understand how your investment choices will impact your financial future.

Annuity is a valuable tool for financial planning, particularly for retirement income. An Annuity Is Primarily Used To Provide 2024 discusses the primary uses of annuities in retirement planning.

Analyzing Different Scenarios

An annuity calculator can help you analyze different scenarios, such as the impact of different interest rates, payment periods, or investment growth rates. This can help you identify the best option for your individual circumstances.

Informed Decision Making

An annuity calculator can help you make informed decisions about your financial future. By using the calculator to project future income streams and analyze different scenarios, you can gain a better understanding of your financial options and make choices that align with your financial goals.

Understanding the nuances of annuity due is essential for accurate financial planning. Calculating Annuity Due 2024 delves into the specifics of calculating annuity due payments.

Tips and Strategies

Here are some tips for using an annuity calculator effectively:

- Use a reputable calculator: Choose a calculator from a trusted source, such as a financial institution or a reputable website.

- Input accurate information: Make sure to enter your financial information accurately, as this will impact the calculator’s projections.

- Consider all factors: Don’t just focus on the projected annuity value. Consider other factors, such as taxes, inflation, and investment growth, when making your decision.

- Seek professional advice: If you’re unsure about which annuity option is right for you, consult with a financial advisor.

Real-World Applications of Annuity Calculators

An annuity calculator can be used to evaluate different investment options and make informed decisions about your financial future. Here’s a hypothetical scenario where an annuity calculator is used to compare the potential outcomes of choosing an annuity versus a lump sum investment.

Annuity calculations can seem complex, but Annuity Calculator Math 2024 simplifies the process, explaining the mathematical principles behind annuity calculations.

Hypothetical Scenario

Imagine you have received a $100,000 lump sum payment from a retirement account. You are 65 years old and are considering whether to invest the money in an annuity or a diversified portfolio of stocks and bonds.

Inheriting an annuity can be a complex situation, particularly regarding tax implications. I Inherited An Annuity Is It Taxable 2024 provides guidance on the taxability of inherited annuities.

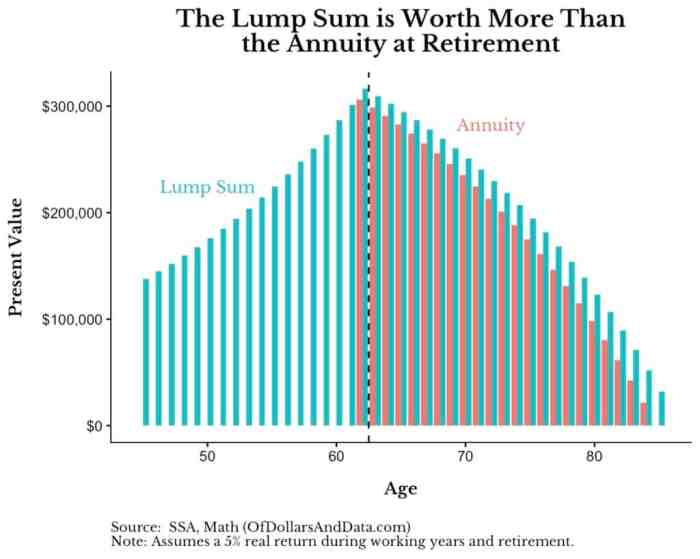

Comparing Outcomes

| Annuity | Lump Sum | |

|---|---|---|

| Investment Type | Fixed annuity with a guaranteed interest rate of 3% per year | Diversified portfolio of stocks and bonds with an estimated annual return of 7% |

| Projected Value After 10 Years | $134,392 | $196,715 |

| Projected Value After 20 Years | $180,611 | $386,968 |

Benefits and Drawbacks

Based on these projections, the lump sum investment is projected to generate significantly higher returns over time. However, it’s important to note that this is just a hypothetical scenario and actual outcomes may vary.

- Annuity Benefits: Guaranteed income stream, protection against outliving savings, lower risk.

- Annuity Drawbacks: Lower potential returns, limited flexibility, potential for higher taxes.

- Lump Sum Benefits: Higher potential returns, flexibility to invest as desired, control over your money.

- Lump Sum Drawbacks: Risk of losing money, need to manage investments, potential for higher taxes.

Last Recap

Ultimately, the choice between an annuity and a lump sum payment depends on your individual circumstances, financial goals, and risk tolerance. By carefully considering your options, utilizing an annuity calculator, and seeking professional financial advice, you can make an informed decision that aligns with your long-term financial aspirations.

Planning for a substantial retirement income? Annuity 300k 2024 delves into the specifics of generating a $300,000 annuity, outlining potential strategies and considerations.

Question & Answer Hub

What are the different types of annuities?

Annuities can be categorized into several types, including fixed annuities, variable annuities, and indexed annuities, each offering unique features and risk profiles.

Can I withdraw from an annuity before the payout period?

Depending on the type of annuity, early withdrawals may be possible, but they may incur penalties or affect future payments.

How do taxes affect annuity payments and lump sum withdrawals?

Tax implications vary depending on the type of annuity and the specific tax laws in your jurisdiction. It’s essential to consult with a tax advisor to understand the tax consequences.

Are annuity calculators accurate?

Annuity calculators provide estimates based on specific assumptions and may not always reflect actual outcomes. It’s important to use them as a tool for comparison and to consult with a financial advisor for personalized guidance.