How To Calculate Annuity Due On Ti-84 2024: Ever wondered how to calculate the present value of an annuity due using your trusty TI-84 calculator? This guide will walk you through the process, explaining the concepts behind annuities due, breaking down the formula, and providing step-by-step instructions for using your calculator.

A $300,000 annuity can provide a significant source of income for many years. Annuity 300k 2024 explores the potential benefits and considerations of a $300,000 annuity.

Annuity due, unlike ordinary annuities, involves payments made at the beginning of each period. Understanding the difference is crucial for accurate financial calculations, particularly when dealing with investments, loans, or retirement planning. This guide will help you master the process of calculating annuity due on your TI-84, equipping you with the knowledge to confidently tackle financial problems.

A deferred annuity is a type of annuity where payments are delayed until a future date. Annuity Is Deferred 2024 delves into the concept of deferred annuities and their potential applications.

Contents List

Understanding Annuities Due

An annuity due is a series of equal payments made at the beginning of each period. It is a common financial instrument used in various situations, including mortgages, leases, and retirement planning. Understanding the concept of an annuity due is crucial for making informed financial decisions.

The HP-12C calculator is a classic financial tool often used for annuity calculations. Calculate Annuity Hp12c 2024 provides guidance on using the HP-12C calculator to calculate annuity values.

Key Characteristics of Annuities Due

- Equal Payments:Each payment in an annuity due is the same amount.

- Regular Intervals:Payments are made at regular intervals, such as monthly, quarterly, or annually.

- Payment at the Beginning of the Period:This is the defining characteristic of an annuity due. Payments are made at the start of each period, rather than at the end.

Annuity Due vs. Ordinary Annuity

The key difference between an annuity due and an ordinary annuity lies in the timing of the payments. An ordinary annuity involves payments made at the end of each period, while an annuity due involves payments made at the beginning of each period.

Calculating annuity payments involves considering factors such as interest rates and the length of the payment period. Calculating Annuity Payments 2024 provides a detailed guide on calculating annuity payments.

Real-World Examples of Annuities Due

- Mortgages:Most mortgage payments are structured as annuities due, with the first payment due at the beginning of the loan term.

- Leases:Lease payments are often made at the beginning of each lease period, making them annuities due.

- Retirement Annuities:Some retirement annuities involve payments made at the beginning of each period, providing income immediately upon retirement.

The Formula for Annuity Due

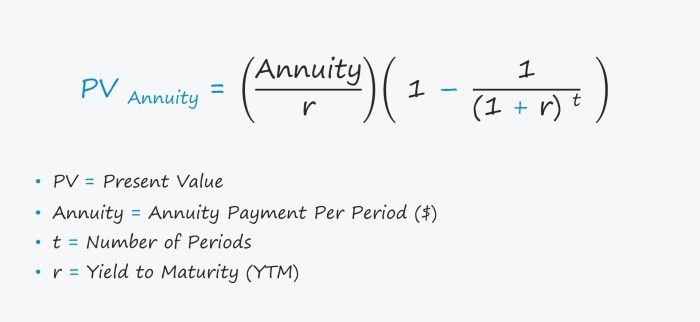

The present value (PV) of an annuity due can be calculated using the following formula:

PV = PMT

Lottery winners often have the option of receiving their winnings as an annuity. Calculating Lottery Annuity Payments 2024 explains how to calculate the payments received over time for a lottery annuity.

- [(1

- (1 + i)^-n) / i]

- (1 + i)

Where:

- PV:Present value of the annuity due

- PMT:Payment amount

- i:Interest rate per period

- n:Number of periods

Step-by-Step Calculation

- Calculate the present value of an ordinary annuity:This is the first part of the formula, PMT

- [(1

- (1 + i)^-n) / i].

- Multiply by (1 + i):This accounts for the fact that the first payment is made at the beginning of the period, earning an extra period’s worth of interest.

Using the TI-84 Calculator for Annuity Due Calculations

The TI-84 calculator has built-in functions that can simplify annuity due calculations. The key function to use is the “TVM Solver” (found under the “APPS” menu).

If you’re looking for a steady stream of income, an annuity could be a good option. Annuity Is Income 2024 explains how annuities can provide a reliable source of income, especially in retirement.

Using the TVM Solver

- Access the TVM Solver:Press “APPS” and select “Finance.” Then choose “TVM Solver.”

- Input the variables:Enter the values for N (number of periods), I% (interest rate per period), PV (present value), PMT (payment amount), FV (future value), and P/Y (payments per year).

- Set the “Begin” option:This is crucial for annuity due calculations. Make sure the “Begin” option is selected (it should be highlighted).

- Solve for the desired variable:In most cases, you’ll want to solve for PV (present value). To do this, move the cursor to the “PV” line and press “ALPHA” followed by “ENTER.”

Example Calculation, How To Calculate Annuity Due On Ti-84 2024

Let’s say you want to calculate the present value of an annuity due with the following parameters: PMT = $100, i = 5%, n = 10.

Calculating annuity payments can be complex, but financial calculators can simplify the process. Calculating Annuity Ba Ii Plus 2024 provides a guide on using the BA II Plus calculator to determine annuity values.

- Input the variables:N = 10, I% = 5, PMT = 100, FV = 0, P/Y = 1, Begin = YES.

- Solve for PV:Press “ALPHA” followed by “ENTER” to solve for PV. The calculator will display the present value of the annuity due, which is approximately $863.84.

Examples and Applications of Annuity Due Calculations

| Scenario | Interest Rate (i) | Payment Amount (PMT) | Number of Periods (n) | Present Value (PV) |

|---|---|---|---|---|

| Scenario 1 | 5% | $1,000 | 10 | $8,638.40 |

| Scenario 2 | 7% | $500 | 15 | $5,695.09 |

| Scenario 3 | 3% | $200 | 20 | $3,523.84 |

As you can see, the present value of an annuity due is affected by the interest rate, payment amount, and number of periods. Higher interest rates and payment amounts result in a higher present value, while a longer time period also leads to a higher present value.

A 5-year annuity offers a shorter term investment option compared to longer-term annuities. Annuity 5 2024 explores the features and considerations of a 5-year annuity.

Common Mistakes and Tips for Success

- Incorrectly setting the “Begin” option:Remember to set the “Begin” option to “YES” when calculating annuities due.

- Confusing annuity due with ordinary annuity:Make sure you understand the difference between these two types of annuities and use the correct formula or calculator settings.

- Misinterpreting the present value:The present value represents the lump sum amount that would be equivalent to the stream of payments in an annuity due.

To avoid mistakes, carefully review the formula and the calculator instructions. Practice with different examples to gain confidence in your understanding and ability to calculate annuities due.

A deferred annuity allows you to delay receiving payments until a later date. Calculating A Deferred Annuity 2024 explains how to calculate the value of a deferred annuity and its potential benefits.

Closing Summary

Mastering annuity due calculations on your TI-84 opens a world of possibilities for financial planning and analysis. By understanding the concepts, formula, and calculator functions, you can confidently determine the present value of annuities due in various scenarios. Remember, practice makes perfect, so don’t hesitate to apply these techniques to real-world examples and explore different financial scenarios.

An annuity with an 8% interest rate can provide substantial growth over time. Annuity 8 Percent 2024 explores the potential benefits of an annuity with a higher interest rate, helping you understand its long-term impact.

The power of financial knowledge is at your fingertips, ready to help you make informed decisions and achieve your financial goals.

Understanding the relationship between annuity payments and initial investment is crucial. How Much Annuity For 40 000 2024 helps you determine the potential annuity payments for a specific initial investment amount.

Common Queries: How To Calculate Annuity Due On Ti-84 2024

What is the difference between an ordinary annuity and an annuity due?

An ordinary annuity involves payments made at the end of each period, while an annuity due involves payments made at the beginning of each period. This difference in timing affects the present value calculation.

The TI-84 calculator is a versatile tool for financial calculations, including annuities. Calculate Annuity On Ti 84 2024 provides step-by-step instructions on using the TI-84 to calculate annuity values.

Can I use the TI-84 calculator for other types of financial calculations?

An annuity is a financial product that provides a guaranteed stream of income for a specified period. An Annuity Is Known 2024 dives deeper into the different types of annuities and their characteristics, offering a comprehensive overview.

Yes, the TI-84 calculator is a versatile tool that can be used for various financial calculations, including future value, present value, amortization, and loan payments.

Tax implications are a crucial factor when considering an annuity. Is Annuity From Lic Taxable 2024 provides clarity on the taxability of annuities, helping you make informed financial decisions.

What are some real-world applications of annuity due calculations?

Deciding between an annuity or a lump sum lottery payout can be a tough choice. Annuity Or Lump Sum Lottery 2024 offers a detailed breakdown of the pros and cons of each option, helping you understand which might be best for your individual needs.

Annuity due calculations are used in various real-world situations, such as calculating the present value of a lease payment, the cost of a mortgage with upfront payments, or the value of a retirement annuity with payments made at the beginning of each year.