Annuity Calculator With Inflation 2024: Planning for retirement is essential, and understanding how inflation can impact your savings is crucial. An annuity calculator that considers inflation helps you make informed decisions about your financial future.

Health insurance can be combined with annuities to create comprehensive financial plans. Annuity Health Insurance 2024 explores the benefits and considerations of combining these two financial products, helping you make informed decisions about your health and financial security.

Annuities are financial products that provide a stream of regular payments for a specific period. While they can be a valuable tool for retirement planning, it’s essential to factor in inflation. Inflation erodes the purchasing power of your money over time, meaning your retirement income might not stretch as far as you anticipate.

The BA II Plus calculator is a popular tool for financial calculations. Calculate Annuity With Ba Ii Plus 2024 provides instructions on using the BA II Plus calculator to calculate annuities, making it easier for you to manage your finances.

An annuity calculator that accounts for inflation allows you to see how your payments will adjust to keep pace with rising costs.

If you’re comfortable working with spreadsheets, you can easily calculate annuities using Excel. Calculating Annuity In Excel 2024 offers a detailed guide on using Excel functions to perform annuity calculations, saving you time and effort.

Contents List

- 1 Introduction to Annuities and Inflation

- 2 Understanding Annuity Calculators

- 3 Factors Influencing Annuity Calculations

- 4 Using an Annuity Calculator with Inflation

- 5 Considerations for 2024

- 6 Benefits of Using an Annuity Calculator with Inflation

- 7 Resources and Tools: Annuity Calculator With Inflation 2024

- 8 Last Word

- 9 Frequently Asked Questions

Introduction to Annuities and Inflation

Annuities are financial products that provide a stream of regular payments, typically for a set period or for the lifetime of the annuitant. They are often used in retirement planning as a way to ensure a steady income stream during those years.

Planning for retirement can involve exploring different annuity options. Annuity 10000 Per Month 2024 examines the specifics of a particular annuity that pays out $10,000 per month, giving you insights into potential retirement income strategies.

However, inflation can significantly impact the purchasing power of annuity payments over time. Understanding how inflation affects annuities is crucial for making informed retirement planning decisions.

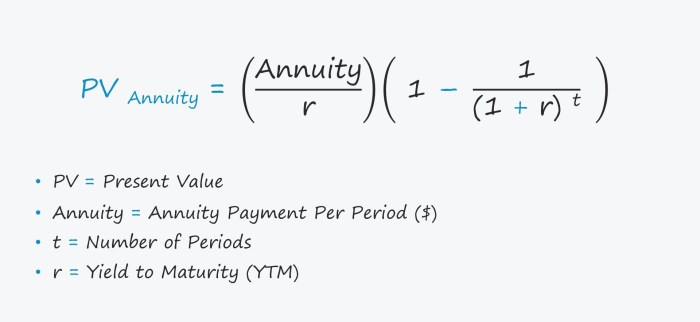

When it comes to annuities, knowing how to calculate them is essential. Calculating Annuity 2024 offers step-by-step instructions and formulas to help you understand the mechanics of annuity calculations.

Inflation is the rate at which the prices of goods and services rise over time. As inflation increases, the purchasing power of money decreases. This means that the same amount of money will buy fewer goods and services in the future than it does today.

For those studying for financial certifications, understanding annuity formulas is crucial. Annuity Formula Jaiib 2024 provides a breakdown of the formulas relevant to the Jaiib exam, making it easier for you to prepare for your studies.

When calculating annuity payments, it is essential to consider inflation to ensure that the payments keep pace with the rising cost of living. Failing to account for inflation could lead to a decline in the real value of annuity payments over time, potentially jeopardizing retirement security.

If you’re already receiving annuity payments, it’s important to understand the terms of your agreement. This article, K Is An Annuitant Currently Receiving Payments 2024 , delves into the details of annuitant rights and responsibilities, so you can be sure you’re getting the most out of your annuity.

Understanding Annuity Calculators

Annuity calculators are tools that help individuals estimate the potential payments and values of annuities. They take into account various factors, such as the initial investment amount, interest rates, and the duration of the annuity. Annuity calculators can be valuable for understanding the potential benefits and risks of different annuity options.

Annuity certain is a specific type of annuity with a guaranteed payment period. Formula Annuity Certain 2024 provides insights into the formulas and calculations involved in annuity certain, offering a deeper understanding of this type of annuity.

Annuity calculators typically require users to input key information, including:

- Initial investment amount (principal)

- Interest rate (expected return)

- Annuity period (number of years or lifetime)

- Payment frequency (monthly, quarterly, annually)

Based on these inputs, the calculator will generate outputs such as:

- Estimated annuity payments

- Present value (the current worth of future payments)

- Future value (the total value of the annuity at a specific point in time)

Annuity calculators come in various forms, including:

- Fixed annuities:These annuities provide a guaranteed rate of return and fixed payment amounts. They are typically less risky than variable annuities.

- Variable annuities:These annuities offer a variable rate of return based on the performance of underlying investments. They have the potential for higher returns but also carry more risk.

- Immediate annuities:These annuities begin making payments immediately after the initial investment is made.

- Deferred annuities:These annuities delay payments until a future date, often during retirement.

Factors Influencing Annuity Calculations

Several factors can influence annuity calculations and the amount of payments received. These factors include:

- Age:The age of the annuitant is a key factor, as it affects the expected lifespan and the duration of annuity payments. Younger individuals typically receive lower annuity payments than older individuals, as they are expected to live longer and receive payments for a longer period.

For those using financial calculators, understanding how to calculate annuities is essential. Calculate Annuity Hp10bii 2024 provides a step-by-step guide on using the HP10bii calculator for annuity calculations, simplifying the process.

- Interest rates:Interest rates play a crucial role in determining the growth of annuity investments and the amount of payments received. Higher interest rates generally lead to larger annuity payments.

- Expected lifespan:The expected lifespan of the annuitant is a significant factor, as it determines the number of payments received. A longer expected lifespan will result in a larger total amount of payments received over time.

- Inflation rate:As discussed earlier, inflation can significantly impact the purchasing power of annuity payments. A higher inflation rate will erode the real value of payments over time.

- Investment growth potential:For variable annuities, the potential for investment growth can influence the amount of payments received. Higher investment growth potential generally leads to larger annuity payments.

Each of these factors can impact the annuity payment amount in different ways. For example, a higher interest rate will generally lead to larger payments, while a higher inflation rate will erode the real value of payments.

Determining the right annuity amount for your specific needs is crucial. How Much Annuity For 80000 2024 explores how to calculate the appropriate annuity for a $80,000 investment, helping you make informed financial decisions.

Using an Annuity Calculator with Inflation

Most annuity calculators allow users to input an inflation rate to adjust calculations for the impact of rising prices. This feature is crucial for ensuring that annuity payments keep pace with the cost of living.

When dealing with loans, annuities play a significant role. Calculate Annuity Loan Excel 2024 guides you on calculating annuity loan payments using Excel, helping you manage your debt effectively.

When inflation is factored into the calculations, it affects the present value and future value of annuity payments. The present value represents the current worth of future payments, while the future value represents the total value of the annuity at a specific point in time.

The specifics of annuities can vary depending on the type. For example, Annuity 4 2024 explains a particular type of annuity and its features, providing you with valuable information if you’re considering this type of investment.

Here’s how inflation affects the present and future values of annuity payments:

- Present value:Inflation reduces the present value of future annuity payments. This is because the same amount of money will buy fewer goods and services in the future due to rising prices.

- Future value:Inflation also reduces the future value of annuity payments. This is because the purchasing power of the payments will decline over time due to rising prices.

It is important to adjust annuity calculations for inflation, especially in scenarios where:

- Long-term planning:For retirement planning, where payments may be received over many years, it is crucial to account for inflation to ensure adequate purchasing power in the future.

- High inflation:In periods of high inflation, the impact on annuity payments can be significant. Adjusting for inflation can help to mitigate the erosion of purchasing power.

- Variable annuities:For variable annuities, where returns are not guaranteed, adjusting for inflation can help to ensure that payments keep pace with the cost of living.

Considerations for 2024

The economic outlook for 2024 is uncertain, with various factors potentially influencing inflation rates. The current global economic situation, geopolitical events, and monetary policy decisions can all impact inflation levels. It is essential to stay informed about economic trends and projections to make informed decisions about annuity planning.

Excel is a powerful tool for managing finances, including annuity calculations. Annuity Is Excel 2024 explores how to use Excel to calculate and analyze annuities, making it easier for you to track your financial progress.

Projected inflation rates for 2024 vary depending on the source and methodology used. Some experts predict that inflation will remain elevated, while others anticipate a moderation in price increases. It is important to consider a range of forecasts and consult with financial professionals for personalized guidance.

Wondering where your annuity fits in the financial world? It’s helpful to understand the different types of accounts available. Annuity Is Which Account 2024 provides a clear explanation of annuities and how they differ from other investment options, making it easier for you to make informed decisions about your finances.

To adjust annuity strategies based on inflation forecasts, individuals may consider:

- Increasing initial investment:A larger initial investment can help to offset the impact of inflation on future payments.

- Choosing variable annuities:Variable annuities offer the potential for higher returns, which can help to outpace inflation.

- Adjusting payment frequency:Receiving payments more frequently can help to mitigate the impact of inflation on purchasing power.

Benefits of Using an Annuity Calculator with Inflation

Incorporating inflation into annuity calculations offers several benefits for retirement planning:

- Protecting purchasing power:By adjusting payments for inflation, individuals can ensure that their annuity income keeps pace with the rising cost of living. This helps to preserve their purchasing power over time.

- Ensuring adequate retirement income:Accounting for inflation helps to ensure that annuity payments provide adequate income to cover essential expenses during retirement.

- Avoiding financial strain:By adjusting payments for inflation, individuals can avoid the financial strain of declining purchasing power and ensure a more comfortable retirement.

Using an annuity calculator with inflation adjustments can provide a more realistic and accurate assessment of annuity payments and their potential value over time.

Annuity calculations can be a bit tricky, but there are plenty of resources available to help you out. For instance, if you’re looking for a comprehensive guide on calculating an annuity in 2024, check out this article: Calculating A Annuity 2024.

It covers everything from the basics to more advanced concepts, and it’s easy to understand even if you’re not a financial expert.

Resources and Tools: Annuity Calculator With Inflation 2024

Several reputable online annuity calculators are available to help individuals assess their annuity options. Some popular calculators include:

- Bankrate:This website offers a variety of financial calculators, including an annuity calculator that allows users to input inflation rates.

- Investopedia:Investopedia provides a comprehensive annuity calculator that includes features to adjust for inflation and other factors.

- AARP:The AARP offers a simple and user-friendly annuity calculator that can be helpful for basic calculations.

When selecting an annuity calculator, consider:

- Features:Ensure that the calculator offers the necessary features, such as inflation adjustment, to meet your specific needs.

- Accuracy:Choose a calculator from a reputable source and verify its accuracy by comparing results with other calculators.

- Ease of use:Select a calculator that is user-friendly and easy to navigate.

Reliable sources of inflation data include:

- Bureau of Labor Statistics (BLS):The BLS provides official inflation data for the United States, including the Consumer Price Index (CPI).

- Federal Reserve:The Federal Reserve publishes inflation projections and economic forecasts.

- Financial websites:Many financial websites, such as Yahoo Finance and Bloomberg, provide inflation data and analysis.

Last Word

By using an annuity calculator with inflation, you can gain a clearer picture of your retirement income needs and make informed decisions about your financial future. Remember, consulting with a financial advisor can provide personalized guidance tailored to your specific circumstances.

Frequently Asked Questions

What is the difference between a fixed and a variable annuity?

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s return is tied to the performance of underlying investments. Fixed annuities offer more predictable income, while variable annuities have the potential for higher returns but also carry more risk.

How often should I adjust my annuity calculations for inflation?

It’s generally recommended to adjust your annuity calculations for inflation annually to reflect changes in the cost of living.

Can I use an annuity calculator for other financial planning purposes?

Yes, annuity calculators can be used for other purposes, such as estimating the future value of investments or planning for college savings.