Annuity Calculator With Monthly Contributions 2024 is your guide to a secure financial future. This powerful tool helps you visualize the growth of your savings over time, making retirement planning more accessible and achievable. Whether you’re just starting your savings journey or looking to optimize your existing retirement plan, an annuity calculator can provide valuable insights and help you make informed decisions about your financial future.

While winning the lottery might seem like a dream, the reality is often complex. Learn more about the implications of Annuity Lottery 2024 before making any decisions.

Imagine a tool that can project your future retirement income based on your current savings, monthly contributions, and anticipated interest rates. That’s exactly what an annuity calculator with monthly contributions does. It’s a user-friendly resource that allows you to experiment with different scenarios, adjusting variables like your monthly contribution amount or investment period to see how these changes impact your projected retirement income.

Hargreaves Lansdown offers a variety of financial tools, including annuity calculators. Discover the features and benefits of the Annuity Calculator Hargreaves Lansdown 2024.

Contents List

Understanding Annuities

Annuity is a financial product that provides a stream of regular payments over a specified period of time. It is often used for retirement planning, as it provides a guaranteed income stream for individuals in their later years. An annuity is essentially a contract between you and an insurance company, where you make a lump-sum payment or a series of payments in exchange for a guaranteed stream of income in the future.

Annuities can be a valuable tool for retirement planning, but understanding how they work is essential. Explore the methods for Calculating Annuities 2024 to make the most of your retirement savings.

Key Characteristics of an Annuity

Annuity contracts typically have the following key characteristics:

- Regular Payments:Annuities provide a consistent stream of income payments, either monthly, quarterly, or annually, depending on the terms of the contract.

- Guaranteed Period:The payment period is defined in the contract, ensuring a predictable income stream for a specific duration. This duration can be for a fixed period, such as 10 or 20 years, or for the lifetime of the annuitant.

- Interest Rate:Annuities often accrue interest on the invested principal, which contributes to the growth of the annuity’s value over time.

- Tax Implications:The income received from an annuity is generally taxable, but the specific tax treatment can vary depending on the type of annuity and the individual’s tax situation.

Types of Annuities

Annuities are categorized into different types based on their features and payment structures. Here are some common types:

- Fixed Annuities:These offer a guaranteed fixed interest rate and fixed payment amount. They provide stability and predictability, but may not keep pace with inflation.

- Variable Annuities:These invest in a portfolio of securities, such as stocks or bonds, offering the potential for higher returns but also exposing the annuitant to market risk.

- Immediate Annuities:Payments begin immediately after the purchase of the annuity. They are often used for income replacement or to supplement existing retirement income.

- Deferred Annuities:Payments begin at a future date, allowing the annuity to accumulate value over time before income payments start. They are typically used for long-term retirement planning.

Benefits of Annuities for Retirement Planning

Annuities offer several advantages for retirement planning:

- Guaranteed Income:Annuities provide a steady and predictable income stream, reducing the risk of outliving your savings.

- Longevity Protection:Some annuities offer lifetime income payments, ensuring that you receive income for as long as you live, regardless of how long you live.

- Tax Advantages:Certain annuities offer tax-deferred growth, allowing the investment to grow tax-free until withdrawals are made.

- Investment Protection:Fixed annuities protect the principal investment from market fluctuations, providing peace of mind for risk-averse individuals.

Annuity Calculator with Monthly Contributions: Annuity Calculator With Monthly Contributions 2024

An annuity calculator is a valuable tool that helps individuals estimate the future value of their annuity based on monthly contributions. It allows you to input various parameters and see how your annuity will grow over time. This can be especially helpful for retirement planning, as it provides a clear picture of how your savings will accumulate and how much income you can expect to receive in retirement.

Planning for retirement often involves considering annuities. If you’re approaching 65, you might want to know about Annuity 65 2024 and its potential benefits.

Functionality of an Annuity Calculator

An annuity calculator typically incorporates the following functionality:

- Input Variables:It allows you to input key parameters such as the initial investment amount, monthly contribution amount, interest rate, and investment period.

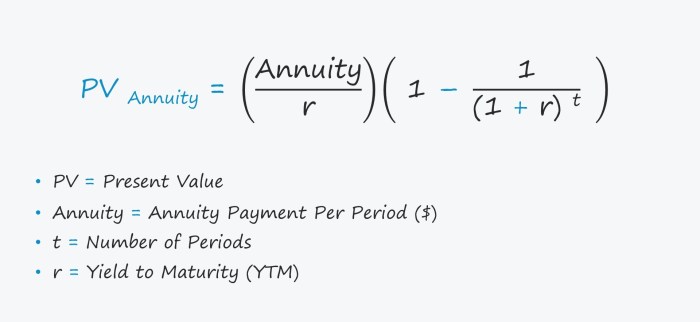

- Future Value Calculation:The calculator uses a formula to calculate the future value of the annuity based on the input variables. This formula considers the time value of money, taking into account the compounding effect of interest over time.

- Visualization:Many calculators provide graphical representations of the annuity’s growth over time, allowing you to visually track the progress of your savings.

- Scenario Analysis:Some calculators allow you to explore different scenarios by changing the input variables, such as increasing or decreasing monthly contributions or adjusting the interest rate. This helps you understand the impact of various factors on your annuity’s growth.

Key Input Variables

The key input variables used in an annuity calculator are:

- Initial Investment:This is the starting amount you invest in the annuity.

- Monthly Contribution:This is the regular amount you contribute to the annuity each month.

- Interest Rate:This is the annual interest rate earned on your annuity investment.

- Investment Period:This is the length of time you plan to invest in the annuity.

Factors Affecting Annuity Growth

The growth of an annuity is influenced by several factors. Understanding these factors can help you optimize your annuity strategy for maximum growth.

Impact of Interest Rates

Interest rates play a significant role in annuity growth. Higher interest rates generally lead to faster growth, as your investment earns more interest over time. However, interest rates can fluctuate, so it’s important to consider the potential for interest rate changes when planning your annuity strategy.

Effect of Monthly Contribution Amount, Annuity Calculator With Monthly Contributions 2024

The amount you contribute each month has a direct impact on the future value of your annuity. Larger contributions will lead to faster growth, as you are investing more money over time. Even small increases in your monthly contributions can make a significant difference in the long run.

Understanding the tax implications of annuities is essential for financial planning. Learn about the Annuity Exclusion Ratio 2024 to make informed decisions.

Investment Period

The longer you invest in an annuity, the more time your money has to grow through compounding interest. A longer investment period generally leads to higher returns. This emphasizes the importance of starting early and investing consistently over the long term.

Understanding the concept of future value is crucial when evaluating annuities. Explore the relationship between Annuity Is Future Value 2024 to make informed financial choices.

Tips for Maximizing Annuity Growth

Here are some tips for maximizing annuity growth:

- Contribute Regularly:Make regular monthly contributions to your annuity, even if they are small amounts. Consistency is key to maximizing growth over time.

- Invest Early:Start investing as early as possible to benefit from the power of compounding interest. The earlier you start, the more time your money has to grow.

- Consider a Variable Annuity:If you are comfortable with market risk, a variable annuity can offer the potential for higher returns, but it also comes with the risk of losing money.

- Seek Professional Advice:Consult with a financial advisor to develop a personalized annuity strategy that aligns with your financial goals and risk tolerance.

Using an Annuity Calculator for Retirement Planning

An annuity calculator can be a valuable tool for estimating your retirement income and determining how much you need to save to achieve your goals. It can help you visualize the growth of your annuity over time and make informed decisions about your retirement planning.

Annuity plans offer a steady stream of income, but it’s crucial to understand the basics. Read more about An Annuity Is Best Defined As 2024 to gain clarity on this financial tool.

Estimating Retirement Income

To estimate your retirement income, you can use an annuity calculator to project the future value of your annuity based on your current savings, monthly contributions, and expected interest rates. This can give you a realistic estimate of how much income you can expect to receive in retirement.

Tax implications are a significant factor when considering annuities. Learn whether Is Annuity Payments Taxable 2024 to understand the potential tax implications.

Hypothetical Scenario

For example, let’s say you are 40 years old and have $50,000 in savings. You plan to retire at age 65 and want to contribute $500 per month to an annuity with an expected interest rate of 5%. Using an annuity calculator, you can project that your annuity will be worth approximately $450,000 at retirement, assuming a consistent contribution and interest rate.

When considering an annuity, it’s helpful to use a calculator to estimate potential returns. Learn more about the Annuity Calculator Nsdl 2024 and its features.

Adjusting Monthly Contributions

The annuity calculator can also help you determine how much you need to contribute each month to achieve your desired retirement income. If you want to receive a higher income in retirement, you may need to increase your monthly contributions.

Understanding how your 401k works is essential, especially when considering an annuity. Learn about the latest information on Annuity 401k 2024 and make informed decisions about your retirement savings.

Conversely, if you are comfortable with a lower retirement income, you may be able to contribute less each month.

Annuities can provide a steady stream of income, but understanding the intricacies of growth is crucial. Explore the process of Calculating Growing Annuity Payment 2024 to optimize your financial strategy.

Regular Reviews and Adjustments

It’s important to regularly review your annuity plan and make adjustments as needed. As retirement approaches, you may need to increase your contributions or adjust your investment strategy to ensure that you are on track to meet your goals.

Generating leads for annuity products can be a challenge. Explore strategies and insights for Annuity Leads 2024 to enhance your sales efforts.

Annuity Calculator Resources

There are numerous online annuity calculators available to individuals. These calculators can provide valuable insights into the potential growth of your annuity and help you make informed decisions about your retirement planning.

Retirement planning involves various options. If you’re considering an annuity, you might wonder about its comparison to an IRA. Learn about Annuity Or Ira 2024 to make an informed decision.

Reputable Online Annuity Calculators

Here are some reputable online annuity calculators that you can use:

- Bankrate: https://www.bankrate.com/retirement/annuities/

- Investopedia: https://www.investopedia.com/retirement/annuity-calculator/

- NerdWallet: https://www.nerdwallet.com/annuity-calculator

Resources for Annuity and Retirement Planning

In addition to annuity calculators, there are many resources available to provide you with detailed information on annuities and retirement planning.

- The Securities and Exchange Commission (SEC): https://www.sec.gov/

- The Financial Industry Regulatory Authority (FINRA): https://www.finra.org/

- The National Endowment for Financial Education (NEFE): https://www.nefe.org/

Financial Advisors

For personalized guidance on annuity investments, consider consulting with a qualified financial advisor. A financial advisor can help you develop a comprehensive retirement plan that includes annuities and other investment strategies.

When planning for retirement, you might wonder if an annuity or a lump sum is better. A Annuity Calculator Vs Lump Sum 2024 can help you compare the options and make the right choice.

Closure

By understanding the principles behind annuities and using an annuity calculator effectively, you can take control of your financial future. With careful planning and regular adjustments, you can build a solid retirement nest egg and enjoy financial peace of mind for years to come.

Don’t wait any longer to start planning for your future. Embrace the power of an annuity calculator and begin building your path towards a comfortable and secure retirement.

Essential FAQs

What is the difference between a fixed and variable annuity?

Many individuals have questions about the nature of annuity funds. Find out if an Annuity Fund Is Unrestricted Fund 2024 to understand how these funds operate.

A fixed annuity provides a guaranteed rate of return, while a variable annuity’s returns fluctuate based on the performance of the underlying investments.

How often should I review my annuity plan?

It’s recommended to review your annuity plan at least annually, or more frequently if your financial circumstances or goals change.

Can I withdraw money from my annuity before retirement?

You may be able to withdraw money from your annuity before retirement, but there may be penalties or restrictions depending on the terms of your contract.