How To Calculate Annuity Calculator 2024: A Comprehensive Guide: Planning for retirement can feel overwhelming, but understanding annuities and how to calculate their potential benefits can provide peace of mind. Annuities are financial products that offer a steady stream of income, often used for retirement planning, income generation, and legacy planning.

The internal rate of return (IRR) is a key metric used in annuity calculations. This resource provides information about IRR calculators and their application to annuities: Irr Calculator Annuity 2024.

This guide will equip you with the knowledge and tools to confidently navigate the world of annuities and make informed decisions about your financial future.

If you’re looking to understand the concept of an annuity in Hindi, there are resources available online that can help you learn more. This particular link provides a detailed explanation of the meaning of an annuity in Hindi: Annuity Meaning In Hindi 2024.

We’ll cover the basics of annuities, including their different types, key features, and how they work. You’ll learn how to use an annuity calculator to estimate your future income and explore the factors that can affect your calculations. By the end of this guide, you’ll be equipped to confidently choose the right annuity calculator and make informed decisions about your retirement planning.

Calculating an annuity can be done with a financial calculator, and there are tutorials available to guide you through the process. This resource can help you learn how to calculate an annuity using a financial calculator: How To Calculate Annuity In Financial Calculator 2024.

Contents List

Understanding Annuities

Annuity is a financial product that provides a stream of payments over a set period of time. It is often used for retirement planning, income generation, and legacy planning. Annuities can be purchased from insurance companies or financial institutions.

The HMRC (Her Majesty’s Revenue and Customs) provides an annuity calculator to help individuals understand the tax implications of annuities. You can find the HMRC annuity calculator here: Annuity Calculator Hmrc 2024.

Types of Annuities

There are several different types of annuities, each with its own features and benefits. The most common types include:

- Fixed Annuities: These annuities provide a guaranteed rate of return, meaning that the payments you receive will be fixed for the life of the annuity. This type of annuity is ideal for those who want predictable income streams and are risk-averse.

There are online calculators designed to help you estimate the lifetime payments you might receive from an annuity. This calculator can help you determine the potential lifetime payments from an annuity: Annuity Calculator Lifetime 2024.

- Variable Annuities: These annuities invest your money in a variety of sub-accounts, such as stocks, bonds, or mutual funds. The value of your annuity will fluctuate based on the performance of the underlying investments. Variable annuities offer the potential for higher returns but also carry greater risk.

A compound value annuity factor table is a useful tool for calculating the future value of an annuity. This resource provides information about compound value annuity factor tables: Compound Value Annuity Factor Table 2024.

- Indexed Annuities: These annuities link their returns to the performance of a specific index, such as the S&P 500. Indexed annuities offer a combination of potential growth and downside protection. They typically have a minimum guaranteed rate of return, but your returns can also exceed this rate based on the performance of the index.

Annuities are often used to provide a steady stream of income, especially during retirement. You can explore the primary uses of annuities in more detail by visiting this website: Annuity Is Primarily Used To Provide 2024.

Key Features of Annuities

Here are some key features of annuities:

- Payout Options: Annuities offer a variety of payout options, such as a lump sum payment, monthly payments for life, or a combination of both. You can choose the payout option that best suits your needs and financial goals.

- Tax Implications: The tax implications of annuities can vary depending on the type of annuity and how it is structured. It is important to consult with a financial advisor to understand the tax implications of an annuity before purchasing it.

- Risks: Annuities are not without risk. For example, variable annuities carry investment risk, while fixed annuities may not keep pace with inflation. It is important to carefully consider the risks involved before purchasing an annuity.

Real-World Examples of Annuities

Here are some real-world examples of how annuities are used:

- Retirement Planning: Annuities can provide a steady stream of income during retirement. For example, a retiree could purchase an annuity to supplement their Social Security benefits or to provide income for living expenses.

- Income Generation: Annuities can be used to generate income from a lump sum of money. For example, an individual who inherits a large sum of money could purchase an annuity to receive regular payments for life.

- Legacy Planning: Annuities can be used to provide financial security for loved ones after your death. For example, you could purchase an annuity that will pay out to your spouse or children after you pass away.

Annuity Calculator Basics

An annuity calculator is a helpful tool for understanding the potential benefits of an annuity. It allows you to estimate the future value of an annuity, the monthly payments you will receive, and the total interest earned.

An annuity is essentially a series of regular payments made over a specific period. This website offers more information about the definition and characteristics of an annuity: An Annuity Is A Series Of Equal Periodic Payments 2024.

Using an Annuity Calculator

To use an annuity calculator, you will need to input the following information:

- Age: Your current age, or the age at which you plan to start receiving annuity payments.

- Investment Amount: The amount of money you plan to invest in the annuity.

- Interest Rate: The expected rate of return on the annuity. This rate will vary depending on the type of annuity you choose.

Adjustable Variables in an Annuity Calculator

Annuity calculators often allow you to adjust several variables, such as:

- Payment Frequency: The frequency of annuity payments, such as monthly, quarterly, or annually.

- Growth Rate: The expected rate of growth on your investment. This rate can vary depending on the type of annuity and the market conditions.

- Withdrawal Amount: The amount of money you plan to withdraw from the annuity each year. This amount can be fixed or variable.

Key Outputs of an Annuity Calculator

An annuity calculator will typically provide the following outputs:

- Future Value: The estimated value of your annuity at a specific point in the future.

- Monthly Payments: The amount of money you will receive each month from the annuity.

- Total Interest Earned: The total amount of interest earned on your annuity investment.

Factors Affecting Annuity Calculations

Several factors can influence annuity calculations, including:

Interest Rates

Interest rates play a significant role in annuity calculations. Higher interest rates generally result in higher annuity payouts. The table below shows the impact of different interest rate scenarios on annuity payouts:

| Interest Rate | Annual Payout |

|---|---|

| 2% | $5,000 |

| 3% | $6,000 |

| 4% | $7,000 |

Inflation

Inflation can erode the purchasing power of your annuity payments over time. If inflation is high, your annuity payments may not be able to keep up with the rising cost of living.

Annuity options are available in the UK, and there are resources that provide information about annuities in the UK market. To learn more about annuities in the UK, you can visit this website: Annuity Uk 2024.

Life Expectancy

Your life expectancy is also a factor in annuity calculations. If you live longer than expected, your annuity payments will continue for a longer period of time. However, if you die sooner than expected, you will receive fewer payments.

Calculating the return on an annuity is important for assessing its performance. This website provides guidance on how to calculate the return on an annuity: Calculate Annuity Return 2024.

Investment Strategies

Annuity payouts can be compared to the projected payouts of other investment strategies, such as stocks and bonds. It is important to consider the risks and potential returns of each investment option before making a decision.

The BA II Plus financial calculator is a popular tool for calculating annuities. This resource can guide you through the process of calculating an annuity using the BA II Plus: Calculate Annuity Using Ba Ii Plus 2024.

Annuity Calculator Tools and Resources

There are several reputable online annuity calculators available in

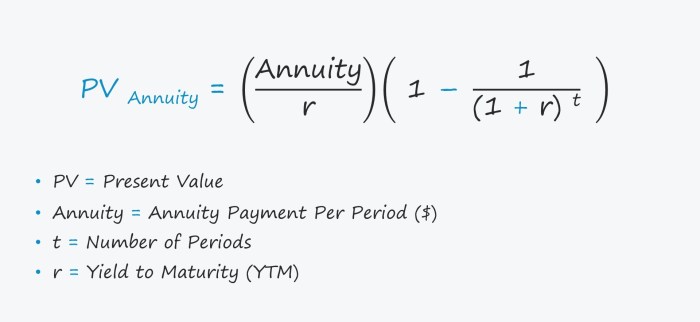

The “R” annuity formula is a mathematical formula used to calculate the present value of an annuity. You can find more information about the “R” annuity formula here: R Annuity Formula 2024.

2024. Here is a list of some of the most popular tools

Understanding the meaning of an annuity is crucial for making informed financial decisions. This website offers a clear explanation of the meaning of an annuity: Annuity Is Meaning 2024.

Online Annuity Calculators

Here is a table comparing the features and functionalities of different annuity calculators:

| Annuity Calculator | Features | Ease of Use | Accuracy | Data Privacy Policy |

|---|---|---|---|---|

| Calculator 1 | [List features] | [Easy/Moderate/Difficult] | [High/Moderate/Low] | [Link to policy] |

| Calculator 2 | [List features] | [Easy/Moderate/Difficult] | [High/Moderate/Low] | [Link to policy] |

| Calculator 3 | [List features] | [Easy/Moderate/Difficult] | [High/Moderate/Low] | [Link to policy] |

Relevant Resources

Here are some links to resources that offer further insights into annuities and annuity calculations:

- [Link to resource 1]

- [Link to resource 2]

- [Link to resource 3]

Choosing the Right Annuity Calculator

Selecting the right annuity calculator is essential for getting accurate and useful results. Here are some key considerations:

Factors to Evaluate

When choosing an annuity calculator, consider the following factors:

- Reputation: Choose a calculator from a reputable source, such as a financial institution or a well-known financial website.

- Accuracy: Look for a calculator that uses reliable data and provides accurate calculations. You can check the calculator’s methodology or compare its results to other calculators.

- User Interface: Choose a calculator that is easy to use and understand. The calculator should have a clear layout and provide helpful explanations of the input variables and output results.

Tips for Maximizing Accuracy, How To Calculate Annuity Calculator 2024

Here are some tips for maximizing the accuracy and usefulness of annuity calculator results:

- Use realistic assumptions: When inputting information into the calculator, use realistic assumptions for interest rates, growth rates, and other variables.

- Consider inflation: Take inflation into account when calculating your annuity payouts. You can use an inflation calculator to estimate the impact of inflation on your future income.

- Seek professional advice: If you are unsure about which annuity calculator to use or how to interpret the results, seek professional advice from a financial advisor.

Last Word

Understanding annuities and how to calculate their potential benefits is an important step in planning for a secure financial future. With the right tools and resources, you can confidently navigate the world of annuities and make informed decisions about your financial goals.

By utilizing an annuity calculator, you can gain valuable insights into your potential income stream and make informed choices about your retirement planning strategy.

Key Questions Answered: How To Calculate Annuity Calculator 2024

What are the different types of annuities?

Annuities come in various forms, including fixed, variable, and indexed annuities, each with its own characteristics and risk-reward profile.

Annuity is a financial product that provides regular payments for a set period of time, and it’s often used for retirement planning. You can find out more about annuities in 2024, including how they work and the different types available, by checking out this resource: Annuity 7 Letters 2024.

How do I choose the right annuity calculator?

Consider the type of annuity you’re interested in, your financial goals, and the level of detail you need when selecting an annuity calculator.

What factors affect annuity calculations?

Annuity can be a helpful tool for retirement planning, and it can sometimes be considered a form of pension. You can explore the relationship between annuities and pensions in more detail here: Annuity Is Pension 2024.

Interest rates, inflation, and life expectancy are key factors that influence annuity calculations.

Are there any risks associated with annuities?

Like any financial product, annuities have certain risks, such as the potential for market volatility or the possibility of outliving your annuity payments.